Fujifilm — A noteworthy competitor in skincare industry!

Did we tell you about that one photographic film company that made an annual sale of over 10 billion yen in 2010 by selling skincare products? One, which can be very easily overlooked by major skincare companies?

No? Okay then, listen up.

The year was 1934, Fujifilm had established itself as a domestic producer of positive films in Japan.

But the arrival of the new decade (the year 2000) brought with it the rise of digital photography and the fall of photographic film.

Fujifilm then decided to shift its focus from being a photo-film centric business and ventured into another market, the skin-care Industry.

Fujifilm’s Entry to Skincare Domain

One might wonder what is common between the worlds of photographic film and skincare, but in the case of Fujifilm, there was not one but two strings that created a link between the two. Collagen and nanoparticle.

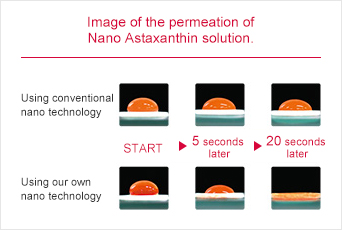

Collagen is a crucial substance in both photographic film and human skin. It gives skin resilience, healthy, and hydrated appearance. Nanoparticles on the other hand easily penetrate the dermal layer when mixed with a carrier.

Years of experience in photography gave them a leg up for their beauty research.

Even in the year 2004, there was a lot of competition in the beauty market. They knew that to propel their way in, they will have to offer something unprecedented. They also realized that ingredients are key to success in skincare.

With these two things in mind, their R&D team got to work and went through their database of antioxidants which comprised some 4,000 different compounds. This large database was accumulated through decades of photographic R&D.

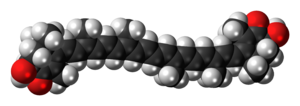

During their search, one particular compound caught their eye. Astaxanthin. Astaxanthin is a red compound naturally found in salmon, shrimp, crab, and lobster and gives them their red color. Astaxanthin possesses 1,000 times the antioxidant power of coenzyme Q10, which is one of the most popular antioxidants for skincare use.

3,3′-dihydroxy-β,β-carotene-4,4′-dione- chemical structure of Astaxanthin (Source)

Now you must be wondering if this compound was so powerful, why wasn’t anyone using it? Well, it came with its own set of problems. You see, Astaxanthin is sensitive to light and heat and gets oxidized easily. Further, it’s difficult to maintain it in the form of fine particles, and even dissolving it thoroughly and evenly in water was no easy task.

So you can imagine how even storing Astaxanthin was a cumbersome task, let alone stabilizing it enough to use in skincare products.

Fujifilm took up the challenge of producing nano-level Astaxanthin particles and maintaining them in a stable form. Their prior experience in antioxidants and nanotechnology helped them a great deal. What made Astaxanthin just so familiar and ideal among the ingredients was its usage as an antioxidant for film and skincare — because the same oxidation from ultraviolet rays that causes color photographs to fade also leads to the aging of a person’s skin

The biggest challenge they faced was related to the particles’ surface area to volume ratio – the smaller the particle size that they created, the greater was the particle’s surface area to volume ratio. And this would make them more susceptible to oxidizing and hence degrading.

But Fujifilm had a trick up their sleeve. They optimized the formula’s emulsifying agents, which helped compounds mix smoothly and completely. They also discovered additives that could help prevent oxidation of the Astaxanthin particles.

The Birth of ASTALIFT

Fujifilm ended up doing the seemingly impossible – development of a formula that preserves Astaxanthin nanoparticles in a stable state while protecting them from both light and heat.

And that led to the birth of ASTALIFT. (You see? Mastering Astaxanthin lead to → ASTALIFT)

While they had the option to create a separate line, Fujifilm decided to use their name with the tagline- photogenic beauty. Many in their own company wondered if that would be a good idea as people might question – “Why is this photo film company producing beauty products?” and “Will it be any good?”

But Fujifilm stayed firm and decided to use people’s doubt into a plus point. The public’s doubt led to curiosity, and Fujifilm responded by demonstrating how advanced technology born of the photographic film could make a difference.

And guess what? It worked! Recently, a stat came up which indicated that Astalift contributes US$3.4 billion to the revenue of Fujifilm.

Thereon, it continued its innovation and developed many original formulations that bring out the full potential of ingredients, such as human-type nano-ceramide, nano-lycopene, nano-AMA, nano-oryzanol, and nano-vitamin A.

Collagen and nanoparticles weren’t the only two links between the spheres that are photography and skincare. They also found 3 more connections namely- Anti-oxidation technology, Optical Analysis, and Control Technology. While initially, it may have seemed peculiar for a photo film company to enter the skincare market, these technologies made them an ideal business match.

The company has built an extremely strong skincare business by offering consumers products that are backed by careful and deep scientific research. Initially focusing on the Japanese market, Fujifilm has since expanded to several other countries in the Asian region and has created a brand that is global in scope.

And the rest, as they say, is history…

Notable Acquisitions

In 2010, Fujifilm entered into a partnership with Japan Tissue Engineering (J-TEC). In 2014, Fujifilm acquired a majority of shares of Japan Tissue Engineering and made it a consolidated subsidiary.

The company, then, acquired Cellular Dynamic in 2015 for $307 million as it wanted to enter into the area of iPS cell-based drug discovery support services such as regenerative medicines and cell therapy.

CDI’s portfolio includes 12 different iPSC based cell such as iCell Cardomyocytes, iCell Hepatocytes, iCell Neurons, etc.

With this acquisition, Fujifilm could work on the production of iPS cells on an industrial scale.

In 2018, the company also acquired Irvine Scientific and IS Japan, both researching in cell therapy and regenerative medicine, for $800 million.

What can skincare companies miss?

Fujifilm was able to stabilize Astaxanthin and convert it into a product — which can easily be considered a disruption in the cosmetics industry. And if this is not enough, Fujifilm’s products also feature in the top anti-aging products range, thus indicating that Fujifilm’s innovation is worth noting.

However, if we consider the top companies in the cosmetics industry, Fujifilm might not appear on the list. This can be a big miss for companies monitoring and analyzing innovation across the cosmetics industry, specifically for identifying disruptions.

But this can be prevented by combining patent landscape with market research. In fact, having a patent landscape done can keep you steps ahead of what the future market holds.

Patent cum market landscapes can easily help; there can be more such budding or emerging competitors that can be captured via performing this analysis. [And this is not once in a blue moon case, did you know about a tobacco and a food company heavily innovating in the skincare space, read here.]

So, how does it work, well to put it in layman words, companies (specifically those which can cause disruption) go for patent filing before entering into a particular space, and this is where landscape analysis can help generate signals of potential disruptors in near future.

If we talk about Fujifilm, the company does not only have products in the skincare space, but also quite a few patents protecting its innovations in this very industry.

For example — a patent filed in 2016 describes a cosmetic composition that contains collagen peptide with an average molecular weight of 300-5000 as the active ingredient. It helps in preventing/improving symptoms of photo-aging such as wrinkles by modulating and enhancing Endo180 gene expression. So far, it has been reported that in photo-aged skin the expression of Endo180 is decreased, and with this decrease, collagen fragments accumulate outside the dermal fibroblasts. This suggests that Endo180 expression is important for the normal collagen metabolic cycle.

Can this or any other patent recently filed by Fujifilm indicate one of its upcoming products — definitely! It can be another one of those products that can bring disruption to the skincare market and sooner or later feature in the top skincare products list.

With skincare industry booming and set for a good CAGR over the next few years, one can say that more companies would try to enter this space and it is suggested that the major players should watch out for such companies (specifically the ones that can take their market share away)

Conclusion

Fujifilm is a great example of how other domain players can affect the sales of skincare companies. But the company is not the only one; there could be players of different industries that might be trying to enter the skincare domain.

As most companies tend to go for securing innovations nowadays before entering the market or making an acquisition to achieve the same purpose, the skincare companies can utilize the landscape analysis to find such companies and make a strategy to tackle them.

A lot of research is being done in almost all the areas of the skincare industry and we’ll be publishing numerous insights in our upcoming articles.

In our next article, we’ll be talking about ITC and Nestle activities in the skincare domain.

Furthermore, if you are interested in finding out how technology landscape analysis in the skincare industry can help in making an attacking or defensive strategy, reach out us by filling the form below:

Authored by: Rajesh Agarwal, Patent Landscape, and Oorja Pandya, Market Research.