What is the Automotive Industry doing about 5G? A sneak peek at their Patent and 3GPP contributions

A year ago, in 2020, we published our take on the state of 5G and why automotive industries should be investing in 5G unless they want to find themselves in hot water.

Gladly, a year later, things have changed for the better. Automobile companies are actively working on 5G technology and are defining the industry’s trends.

In our brief time today, we will have a quick overview of the activity of industry giants and the different strategies they are adapting to behold their dominance in the market in the new 5G world. We will also be trying to find answers to questions like:

- What’s the take of automotive industry giants (like Tesla, Volkswagen, Toyota, Hyundai) on 5G to survive in the market?

- Are they shifting their R&D focus in this direction?

- Have they already shifted it?

- Which technologies are driving the innovation space?

- Which players are driving this transformation?

For this article, we have focused on analyzing the contributions (3GPP and patents) of companies like Toyota, Volkswagen, General Motors, and Ford since these are some of the biggest names in the automobile industry and might as well be primarily defining the industry trends. We will later also be looking into the market share of these players to get a reality check – whether the one who is leading in R&D and innovation is also leading the market or not.

But first, a quick overview of 5G standard developing bodies

3GPP is majorly responsible for developing the 5G standards and has all the information related to 5G. It isn’t very easy to get all the information related to 5G unless you are aware of the 3GPP/ETSI processes.

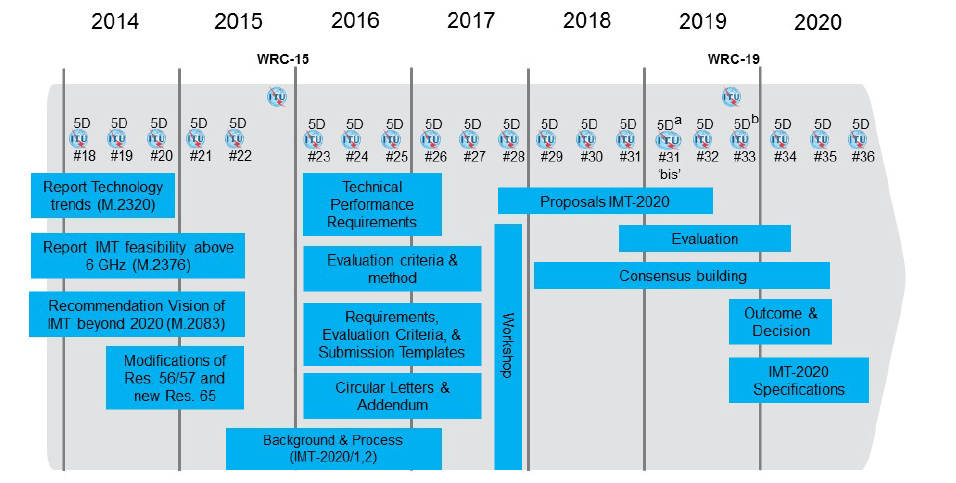

For the next generation of mobile communication networks, ITU-R had set up a project called IMT-2020 to set the plan for these networks, with the following timelines:

Talking of specifications, the ETSI has a number of component technologies that will be integrated into finalized 5G systems: Network Functions Virtualization (NFV), Multi-access Edge Computing (MEC), Millimetre Wave Transmission (mWT), and Next Generation Protocols (NGP). The list of all 5G-related specs (including core network and system aspects) is provided in 3GPP TR 21.205. One can also refer to the 3GPP website to get a comprehensive list of all the TRs and TSs.

As a race is going on amongst the automobile industry leaders for establishing their dominance in 5G, it reflects in the 3GPP’s work proposals for 5G. We can see changes being made now and then in the plan, in order to introduce intermediate timelines, so that the whole thing is kept under control.

Digging deeper into 3GPP Contributions inV2X Communication Technology

While analyzing the patents in the 5G SEP study, which is one of the most exhaustive studies on 5G done till now, we observed V2X as one of the major development areas in the standard which signifies the focus of the industry and its use in the automobile domain. To get an idea of the activity of automakers, let’s try and find more about the kind of submissions they made on V2X.

Uncovering these insights is not easy though. Searching through 3GPP submissions can be a pain due to road breakers like running synonyms and flexible search logic.

The good news is we have a solution for this. We used our in-house search and analysis tool – NPLSE – and extracted all the 3GPP submissions (including TRs, Tdocs, Change requests, Specifications) on our servers and made them searchable.

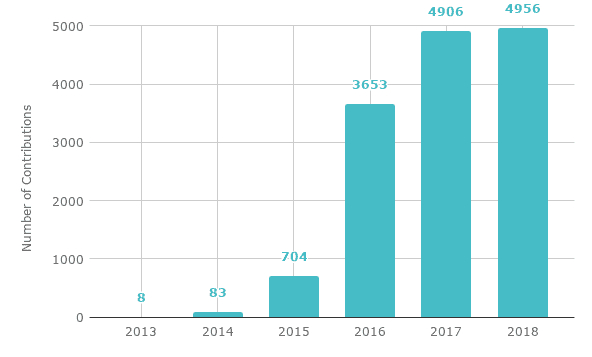

With the pain point sorted, let’s now look at what happens when we search for all the 3GPP RAN WG contributions mentioning terms related to “V2X” –

What do these numbers look like if we tracked the number of contributions company-wise for major automobile companies?

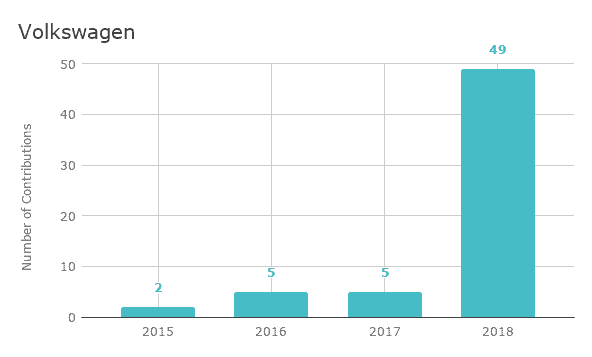

Volkswagen

Total contributions – 61

From multiple 3GPP meeting documents like RP-181467 submitted by Volkswagen, it seems like they are working on ‘5G Link budget with 2 RX vehicular UE’ along with Telecom giants – Samsung & LG.

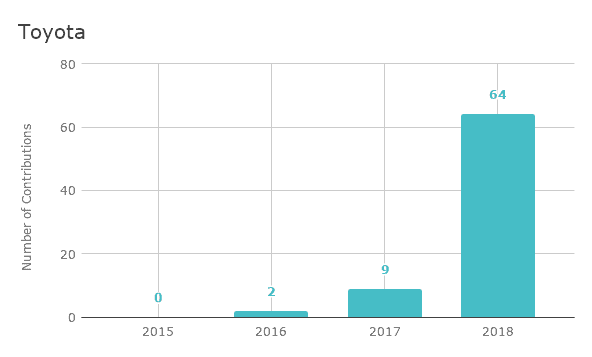

Toyota

Total contributions – 75

Toyota seems to be closely working on the concept of ‘Adding a new event in Namf_EventExposure for Network Performance Analysis’ and also submitted a CR (change request) in S2-1906087 for this concept.

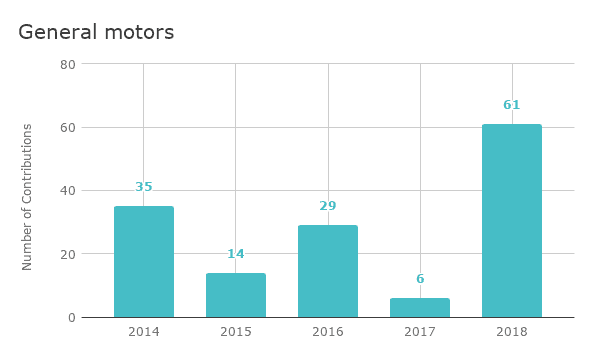

General Motors

Total contributions – 145

General Motors – along with Volkswagen AG and telecom giants: LG Electronics, Samsung, and Qualcomm – has submitted a CR in RP-180782 for ‘REFSENS requirements for NR vehicular UE at FR1’.

(Disclaimer: These numbers will be used as being broadly indicative of the number of contributions made by these companies or the number of documents talking about any contributions made by these companies as ‘References’. GreyB hasn’t analyzed each of these contributions in detail to confirm this)

From the data, General Motors seem to be leading the spot while the others are not so far behind. However, it is surprising to see Ford having no contributions at all in 3gpp.

The above graphs might act as a witness showcasing how actively these companies are participating and contributing to the 3GPP standard development which requires high-quality R&D and innovation practice.

But that’s not it.

A good indicator of innovation effort and how companies want to benefit from the R&D and monopolize on their innovations can be figured by looking at their patent filings. Let’s look at what trends patent filings showcase for automobile companies in the technology.

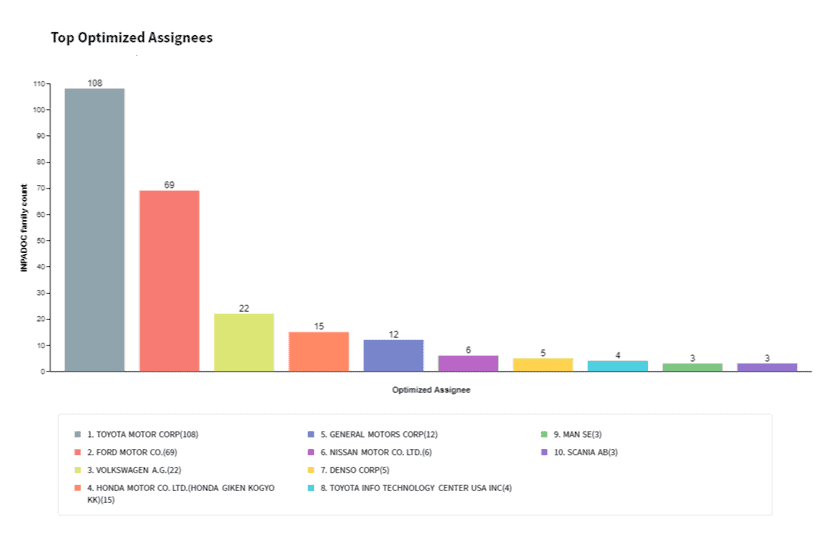

What are the Patent Filing Trends for Automobile Players in V2X?

The below chart showcases the patent filing numbers on V2X communication using 5G by the above-mentioned automobile giants.

(Chart source: Derwent Innovation)

Note: These are the INPADOC family counts.

Toyota seems to be the clear leader here, being significantly ahead of its competitors. But, do these numbers seem on the much lesser side to you else too?

We had gauged that already. It’s way less.

Even the top contributor to 3GPP – General motors is thrown to the fifth position regarding patent filings. This indicates that Toyota is actively participating in standard development and showing an active interest in patent filing.

This might also be alarming for another top player like Honda, which is way behind the others. Executives at Honda reading this, here’s a thought – Better late than never.

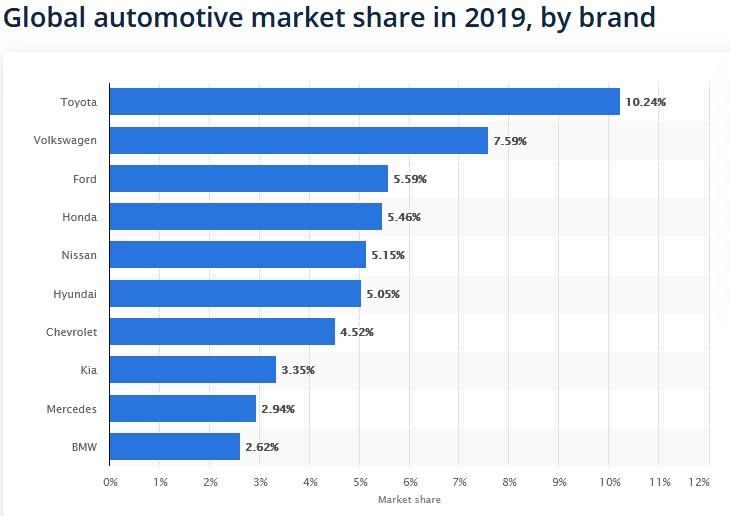

What does the Automotive Market Share look like for the top players?

Let’s now see whether the strategy of contributing to standard development and patent filing is actually beneficial to attain the market or not as it requires huge capital investment. Below are stats from the Market share report published by the renowned firm – Statista, which studies the market and actively publishes reports for the same.

Toyota seems to be the undisputed winner of this race and it indicates that the strategy of contributing to standard development and patent filing is actually beneficial to attain a majority share in the market. Patents and 3GPP submissions reflect your vision of innovation and can definitely help you capture more market in the time to come.

Concluding Thoughts

While the involvement of big players in the 5G affairs seems obvious, there is less information on the involvement of companies like Tesla, Suzuki, and Tata Motors in 5G developments at such platforms.

Even the big players need to focus more on increasing their IP activities. Only then can they ensure their dominance in the coming 20 years. They need to be aware of answers to questions like –

- What are their competitors doing?

- What technologies are they trying to bring into these vehicles?

- What collaborations are they undergoing with telecom companies to further speed up their pace of innovation?

These and more. Also, another angle that I wanted to address – These vehicles are going to get costlier because now you’ll have to start paying a licensing fee for using 5G tech. But is there someone who can answer how much the licensing fee is to be paid and to whom?

Authored by: Nripdeep Singh and Ankush Sharma, Search team.