If you are working in the automotive domain and not taking 5G seriously, you might find yourself in troubled waters a few years down the line.

You know all about V2X Communication. You also know that 5G will make V2X easier, faster, and reliable.

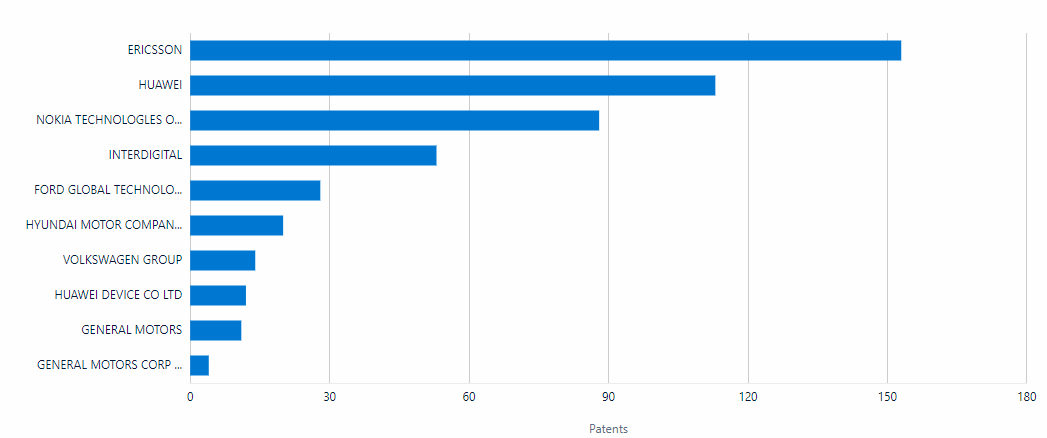

However, what you need to know is that the technology that is so important to V2X is not being actively developed by automobile companies. In fact, automakers are neither the leaders nor primary patent filers for V2X.

Who is? Check our exclusive report on 5G SEP to find out – https://info.greyb.com/5g-standard-essential-patents-who-owns-the-5g-patents.]

An analysis of the patenting activity in V2X revealed that it is predominantly dominated by telecom players. As the technology progresses, factors like licensing and litigation will come into play. This means a lot of challenges lie ahead for automobile players.

Future Challenges Automotive Companies might have to face

FRAND licensing terms outside the telecom industry

As an automobile player, you would want to know how much you might have to pay for using 5G patents. Traditionally, telecom companies are actively impacted by FRAND. Patent owners claim licensing revenues from the sale of each phone.

However, as discussed in our previous articles, automakers operate in a fixed price model. With the use of 5G impacting the growth in the Auto industry, FRAND licensing models will need to be re-evaluated or at least need to be fine-tuned. We have covered the topic in detail in another article. Click here to read.

|

Increase in litigations in the Automotive sector

Patent litigations are routine in the telecom sector. Most telecom companies have budgets allocated for frequent litigations. Patent teams in the sector also continuously review their patents and locate the ones they can use for counter sue situations.

The automobile industry, however, operates differently. They don’t expect frequent litigations from ‘other’ automobile players. But now telecom companies would want a share from the growing use of the 5G in automobiles. We can thus expect frequent litigations.

A quick analysis of the number of patents involved in litigation by some top companies shows the stark difference between how telecom and automotive sectors approach litigation.

As a matter of fact, 80% of the core Standard Essential Patents of the 5G standard are owned by the top 6 ICT companies including Ericsson, Nokia, and Huawei. These companies would want licensing revenues outside the traditional telecom space.

On the other hand, though the Auto sector has thus far avoided some major court battles that characterized the early years of the smartphone industry, litigation has broken out, and it started with Nokia vs. Daimler or Broadcom vs. Volkswagen. It is evident what lies ahead, and we are about to see long debates when it comes to paying for and realizing technical value.

All-in-all, this much is clear, when we talk about these very different cultures collaborating (or should I say colliding), the answer becomes obvious – Automotive companies will have to step up their game. Something beyond collaborative bodies like 5GAA.

What should be the next step for automotive companies?

Auto companies will need to ramp up R&D in ICT. If they pay whatever licensing fee the ICT companies will claim, they will start losing money.

Given the history of the ICT companies, we find it will be unwise for the automakers to rely on them. Undoubtedly, this is a tech where auto companies should not just sit by and watch; but they should take part in actively developing it. But to what extent?

Our take is that auto industries should participate full-fledged in building the V2X standard (not 5G directly though, as that is not their area of expertise) and ramp up patent filing there.

For now, from the patent filing by the automakers, and their propensity to collaborate with technology companies (like the formation of 5GAA), it is very clear that they are relying on the telcos for developing V2X, and the telcos are responding.

They are aggressively filing patents, developing the standard, and then are declaring their patents as SEPs. Creating the possibility of a bottomless pit in license money – a pit that will force the automotive companies to be overburdened with all the licensing fees while keeping their own product’s cost buyer friendly.

|

The automakers need to shift this landscape. Years of expertise, and billions of dollars spent in R&D later, Telcos gained the necessary expertise in 5G development and deployment to the level it is today. Competing with them even for a small chunk of it like V2X will require courage and planning. Nonetheless, it is the need of the hour, because it is a question of survival.

Particularly for standard development, immediate attention from the automakers is warranted. In the communications world, standards rule the technology game, due to its foundation of interoperability. This has not been the case in the automotive sector before.

Automakers can take inspiration here from the cloud tech companies. Cloud has previously been a separate industry, but 5G is now merging it with traditional communication via Multi-access Edge Computing (MEC). And, cloud companies are participating actively in developing the 3GPP standard.

Another way will be to file patents regularly and collaborate in patent pools. Even though those have not been very effective in the past to save companies from litigation sharks that are out there for blood, but at least they can form a primary safeguard.

Such strategies will give automotive companies an edge when it comes to negotiations and gain the upper hand for cross-licensing negotiations.

Net-net, investing in core ICT R&D from a V2X perspective seems not only like a good idea, but a fool-proof one too over many other solutions one may present in this case (like collaborating with ICT companies or signing up in patent pools).

Times may take a turn where the influence of ICT’s culture will force everyone to adopt similar strategies to survive. When those times arrive, a strong technical backing will most definitely help. Over that, being one of the standard-setters or developers of the tech in V2X might even be among the competitively sane decisions when thinking long term, like when autonomous vehicles arrive.

Parting Notes

A simple way to look at the current scenario would be to relate to the Godfather movies. You have many families ruling different segments, but the families on the high table jointly take the most crucial decisions in the mafia business. If you don’t run by their game, then chances are you are not going to survive independently without some sort of upper hand. The high table here being the 3GPP, and families being top ICT corporations today.

Hence, a short answer to the dilemma may be that in the short term – it may not matter. But in long term, companies need to understand that the value added by ICT will only increase significantly in the coming years, and might end up becoming one of the key consumer decision points when they decide to purchase a vehicle. With the pace technology is developing in today’s time, companies have to think 10 years from now to truly make decisions that will benefit them in the long term.

Authored by: Sparsh Gupta, Patent Infringement.