Are you using spreadsheets to manage your patent portfolio?

The utility, supply, and demand of IP have seen a significant shift in the last decade, and so has the way leading companies view IP. A decade ago, companies wielded IP more as a way to gain competitive advantage by excluding others, but today, the best IP strategy is to collaborate rather than confront.

IP owners still demand royalties, assert claims, and seek restraining orders. But today’s playbook is increasingly oriented by the belief that companies stand to benefit the most by working with other companies to ensure that they have the freedom to operate in specific technology domains.

Legislation in the US makes weaponizing patents for companies with big portfolios (supply-side) tough. Alternatively, digital disruption is creating a much wider market for IP (demand-side). This makes IP owners look at these companies less as competition and more as a market. These shifts are creating new opportunities for companies “big” on IP to cooperate with traditional companies that may be “short.”

Classic, exclusionary IP strategy is not dead, but companies need to master a more sophisticated and nuanced playbook for creating competitive advantage through IP. Moreover, as economic and technological developments accelerate, the shelf life of patents and many other IP assets shorten. Companies needing to renew their IP portfolios more frequently are becoming more judicious in choosing where to invest. These developments collectively reduce IP risks to companies — and decrease the attractiveness of strategies with a sole focus on creating value through patent assertion.

This shift in fundamentals of IP strategies demands an ever-alert IP group led by visionary heads of IP teams. This shift also demands using the huge amount of data available to help innovators shape and pursue their strategies. This, in turn, demands access to advanced IP analytics that can help CTOs and IP heads follow the IP current. To all these decision-makers, the information below may be helpful in leaving the old ways of assessing IP and creating a new system that is robust enough to handle the IP strategy challenges of today’s world.

Are you responsible for managing and growing your company’s patent portfolio? Yes?

Okay, if you said yes, I believe you must have been asked the questions below. And if not yet, the C-suite or leadership is going to throw these questions your way:

- How is our patent portfolio distributed among various technologies within your industry?

- Is the portfolio aligned with the business goals?

- Can you align our patent portfolio with business strategies that are constantly monitored?

- Which are our highly valued patents?

- Which patents are overhead costs?

- Can you suggest steps to fetch dollars from the patent portfolio?

Now before we move ahead, I have another question to ask: Are you using Excel spreadsheets to manage your patent portfolio?

I may appear a bit straightforward here, but spreadsheets are not a good resource for managing patent portfolios and making business decisions.

Even Microsoft agrees that it shouldn’t be used as a business tool to make critical decisions as it comes with its own perils – formula errors, integration issues, data control access issues, etc.

F1F9, a financial modeling firm, conducted research with the help of 1200 senior managers from the UK in 2015. The key findings of the study were:

- 17% of large businesses have suffered financial loss due to poor spreadsheets.

- 57% of large businesses say bad spreadsheets have caused wasted time.

- 33% of large businesses report poor decision-making due to spreadsheet problems.

You heard the problem. Now, here’s A Solution!

If your portfolio has a few dozen patents, answering the above questions might be easy. But when we are talking about hundreds of patents, without having all the information in one place, it becomes tricky.

What I mean by “all the information in one place” is a centralized platform that not only gives you a 15,000-foot view of your portfolio but also helps you navigate and explore each aspect of it.

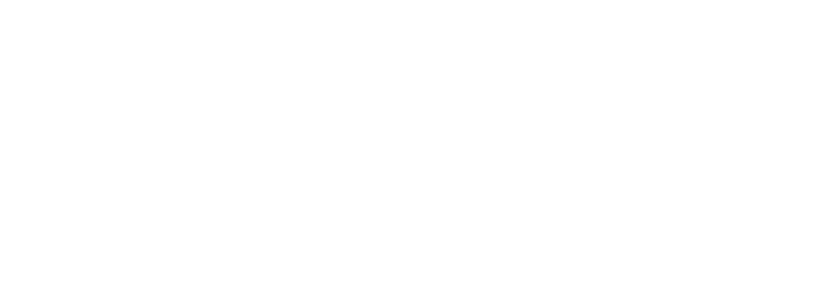

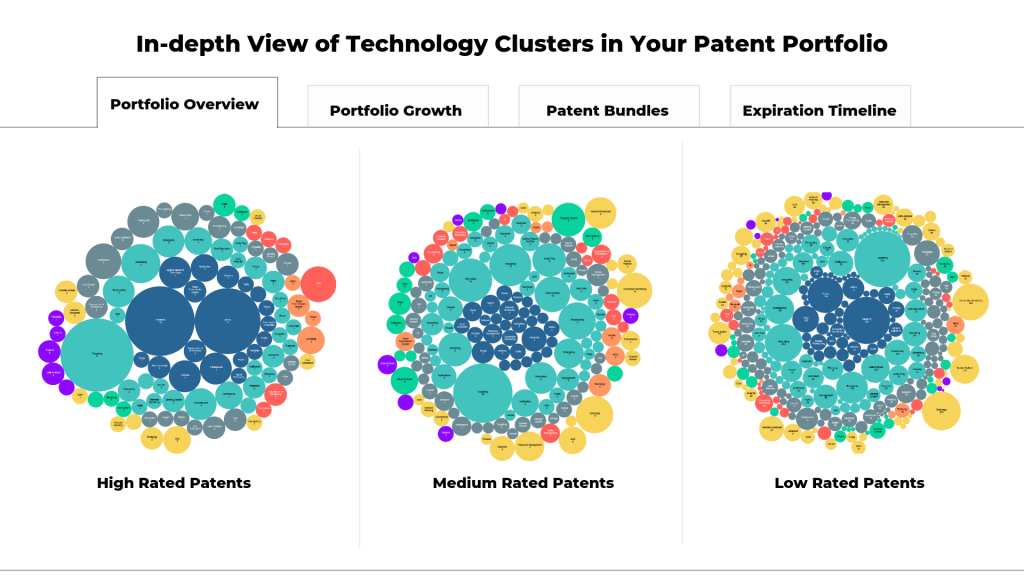

This is what such a platform could look like —

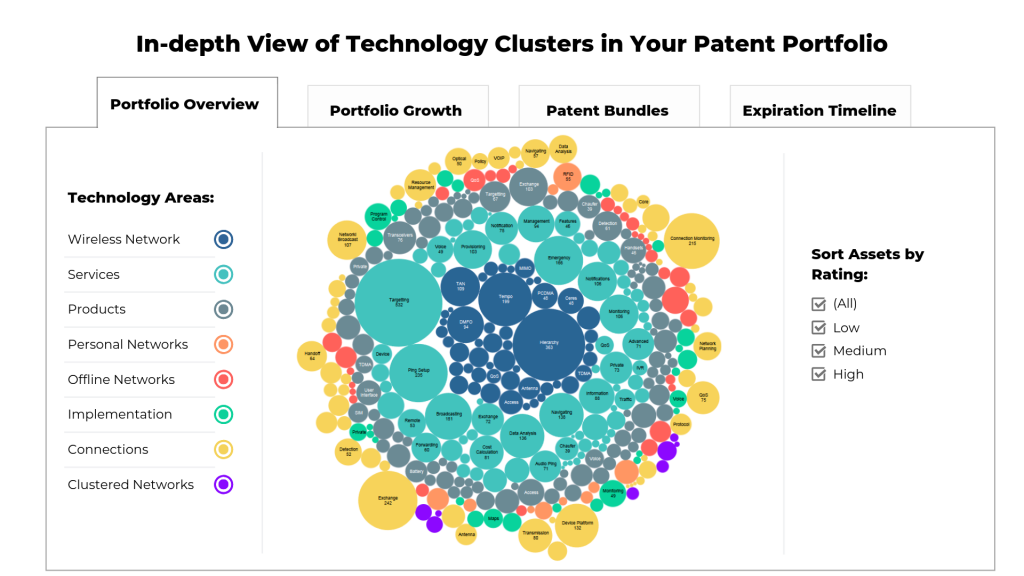

Here’s another view of how such a platform can allow you to browse through and compare different technology areas in your portfolio:

An ideal system should allow you to give you a holistic view of your entire portfolio, navigate and dive deeper into it through simple clicks, and reach the relevant information in no more than a few minutes.

Give me a moment to explain it with an example. I believe pruning patents from the portfolio must be your vital tactic to save budget. Let’s see how an ideal system can help you here and then some more aspects.

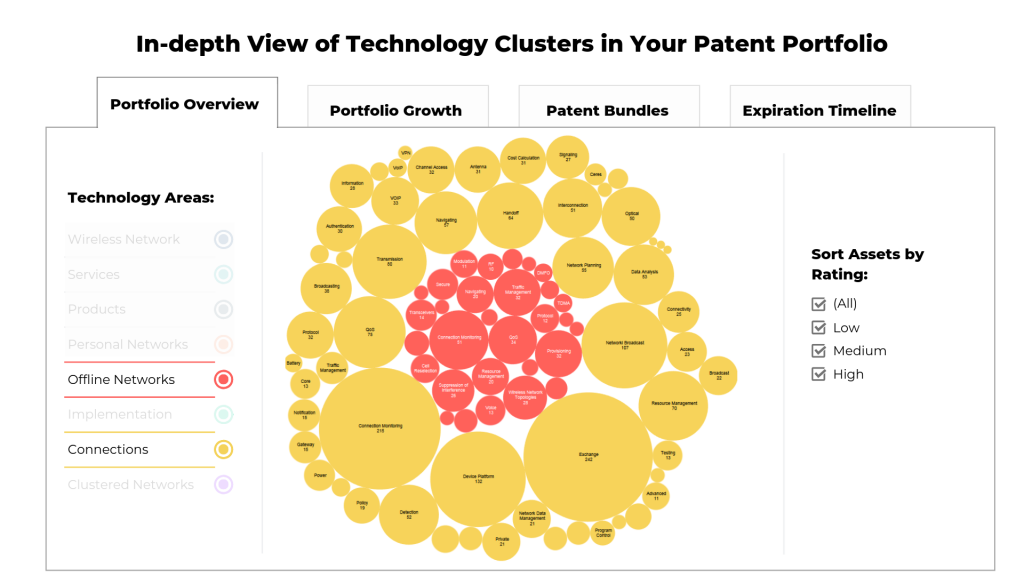

You Can Find Patents to Prune Within Minutes

Imagine a situation where you need to prune your patent portfolio by eliminating patents no longer relevant to your organization. This is a common practice and is important for businesses as it helps them save a lot of money on maintenance and increase the overall value of their portfolio.

First, you have to spot the relevant patents in your portfolio. You can either filter out the patents based on technology areas where your organization is no longer working in or the patents that have little to no monetization value in the market. There could be dozens of ways to find those patents. Each strategy will result in you digging deeper into your patent portfolio through different perspectives, taking you longer than expected.

Ideally, all this information should be available right at your mouse click instead of hidden behind filters and numbers of traditional tools. An ideal system should give you a holistic view of your entire portfolio, navigate and dive deeper into it through simple clicks, and reach the relevant information in no more than a few minutes.

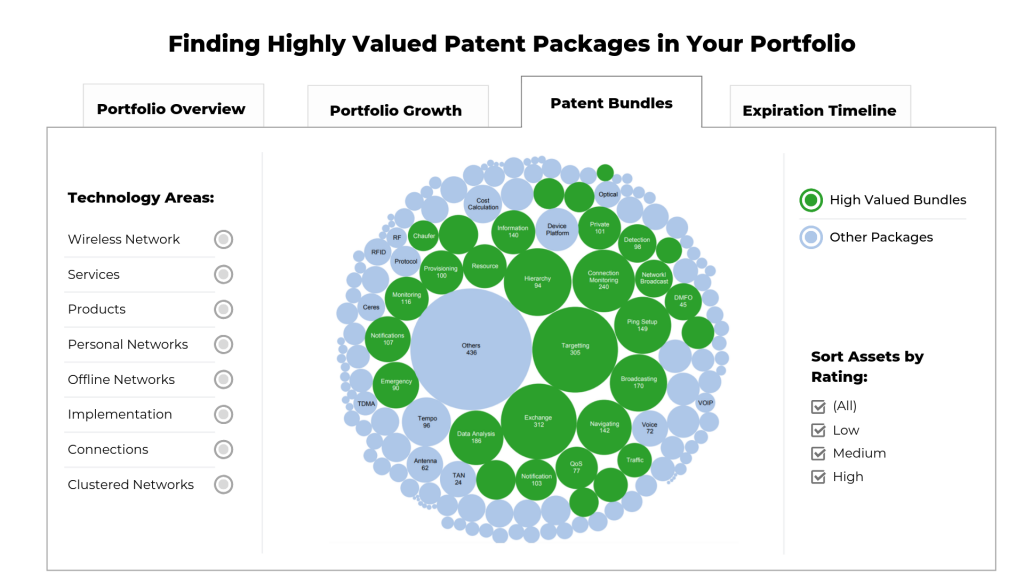

Or, here’s another way to look at it:

And Use the Saved Time to Craft Patent Monetization Strategies

The time you save can be spent exploring these patents further and crafting a monetization strategy. Even if they are no longer relevant to your business, they could be really useful for someone else in the market.

One strategy you can craft here is pairing them with other similar but highly valued patents in bundles and monetizing them altogether. That way, you’ll get maximum return on your investment from assets no longer valuable to you.

These tasks on spreadsheets are simply inefficient and time-consuming. You may have to use multiple layers of filters, and chances are you might still not find the information you’re looking for.

Tools Are Not Meant to Restrict but Empower

Hundreds of factors are considered when deciding whether to keep a patent, monetize it, or abandon it. When working with sheets, you have to translate these factors into filters.

This whole process looks like you’re searching for something in a dark room using a narrow-focused flashlight. It can help you navigate but can’t show you the whole picture, limiting your ability to explore.

Not just another challenge that you might face with these tools is – that their data gets outdated too soon.

Patent portfolios are dynamic and change as a company grows. New patents are filed, old patents expire, and some are abandoned.

Keeping track of those changes while working with these tools requires a lot of manual work and deprives you and your team of time that you could spend crafting million-dollar IP strategies.

Not having all the information in one place in an easily accessible manner not only keeps you from the complete picture but also restricts your true potential. Essentially, your tools should amplify your powers, not restrict them.

What’s Next?

In the coming days, I will talk about how having such a centralized dynamic platform can help you monetize, prune, and improve the overall quality of your patent portfolio.

Such a centralized dynamic platform can:

- Show you the growth and expiration of your patent portfolio

- Showcase various technology areas where your organization is strong and weak

- Identify areas with good monetization potential or can bring maximum return on your investment.

Do you want me to inform you whenever the next article on building an ideal system for managing a patent portfolio goes live? If so, you can join my list of VIP members here.

About Author:

Vikas Jha is AVP, Solutions, at GreyB. In the last four years, he has witnessed GreyB’s clients, blue-chip companies, using unproductive methods to manage patent portfolios, and he has vowed to save others from the same fate by harnessing the power of software.