Walmart Case study – How to find monetization opportunities using data instead of hunches?

When you are managing a portfolio of 100 patents or less, you probably are aware of all the gem patents. You may be selecting the gems based on vapours reasons like –

- they protect your products

- they overlap on competitors products

- they are part of the future product plan

- they can generate licensing revenue in future

- they can potentially become part of the industry standard

- if you have other reasons we would love to hear them out.

When it is right time and you wish to generate licensing income from your IP, you know that it is not going to take long. All because of these gems you have harvested over years.

However, what if you are managing a portfolio of 500+ patents? How do you manage the portfolio? How do you find the gem patents?

As the portfolio grows, a lot of other urgent things take priority and important things (like tracking gems) take a back seat. When we are such a situation, and there is a pressure of generating an income from IP assets, the process of figuring out gem patents, the potential licensee and the worth of these gem assets is a hefty, costly, and time-consuming process.

When you are catering to a large portfolio which is a mixture of essential to business patents (can be licensed) and the non-essential patents (can be sold), you need an easy way to filter out gem patents and potential business opportunities. Imagine having all the gem patents, overlapping products, respective potential buyers/licensees, and market size always available with you at all time.

Now imagine having all this data at the click of a button!

We developed a system internally to automate this process and make it easier for you to manage and monetize your patents.

This developed system can give you answers to questions like:

- Which patents have the most monetization potential?

- Which companies are potential clients corresponding to each asset?

- Which of your patents are blocking your competitor’s applications?

- If you have US patents, which of your patents pose 102 rejections for your competitor’s applications?

- Which competitors could not overcome rejections?

And more. In fact, to better illustrate it, let’s pick the example of Walmart and dissect its portfolio to identify Walmart’s best patents, competitors, and their patent filing strategy.

Dissecting Walmart’s Patent Portfolio for Insights into its patent strategy

Walmart started building its patent portfolio aggressively after 2014 and emerged as one of the strongest players in the market with its innovation-centric approach.

Given their portfolio’s rapid growth, we figured it would form a good example to see what gems are hidden in their patent chest.

I’m going to next take you through Walmart’s best patents, competitors, and patent filing strategy. Before we part ways, I’ll let you on the path to help identify such insights about your own portfolio. Let’s get started.

Which patents have the most monetization potential?

Evaluating a patent’s value has a lot to do with the end objective. Some factors would weigh more when you want to launch a product compared to when it’s non-core to your business and you’d want to monetize or license it in some way, perhaps without aggressively suing.

For example, say you have a patent on ‘sensors for a house security system’. Let’s say you have discontinued this product for some reason or that this particular patent does not directly contribute to your business anymore. If you want to monetize it without being involved in litigation, the obvious step is to sell/license it.

We developed a system to automate this process and make it easy to figure out which of the patents are creating trouble for other application holders (by blocking their applications). Having this information about your patents can then help you in deciding whether to sell/license them.

You select the technology area and the chart like below would show (some) applications from the Walmart’s portfolio which are blocking its competitor’s patents. A darker color indicates more number of applications being blocked.

To make things easier, we encased Walmart’s patent portfolio in a dynamic interface. The dashboard is interactive and you can hover over each application to see the number of patent applications from competitors it is blocking. We would repeat, by blocking we mean examiner using your patent to reject the competitor’s patents.

In an instant, the chart above reflected the most interesting applications in Walmart’s portfolio that have caused a lot of rejections for other applicants.

If you’re a counsel from Walmart reading this, you now have a list of patents from your portfolio which have potential. Patents that have probability of being used in the products of other companies. And unlike many times when counsels have to rely on hunches to make monetization decisions, the insights derived from these dashboards could provide a data pointer to take the action.

Who will be interested in licensing or buying them?

Once you have figured out which applications are essential for your business and the ones which can be licensed or sold, you can also see which companies can be prioritized over the others.

You’ll find not only your competitors but also companies which may use the technology but operate in other industry.

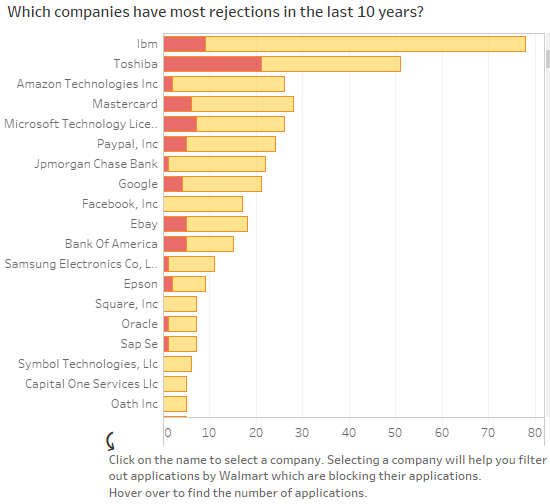

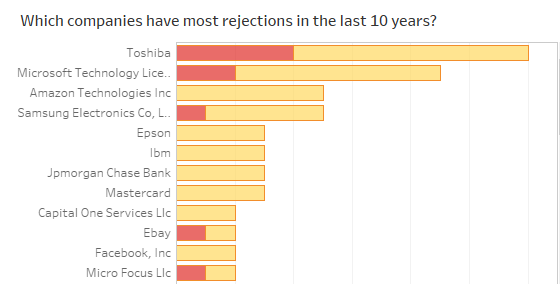

For example, here is a list of companies whose applications are being blocked by Walmart’s patents sorted based on number of patents being blocked –

(Color Legend)

IBM, Toshiba, Amazon, and Mastercard comes at the top of the list of companies whose applications are being blocked by Walmart’s patents. The red color here indicates the number of applications that were abandoned after the rejection.

If their patent applications were rejected due to your patent, they may be interested in acquiring the same technology from you.

Similarly, an application that still got granted after a few rejections shows that the assignee is actively working in a similar tech area and may be interested in acquiring a broader patent from you.

It all comes down to having as much information as you can so that if you approach them for a license, they consider it as an opportunity.

For example, you can know which competitors had a tough time overcoming objections posed by your patents. Thus, providing you a proof of your edge over them. This implies knowing the type of rejection is also helpful.

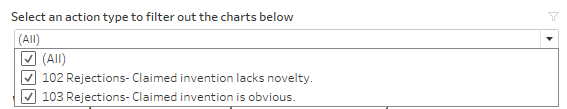

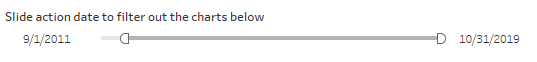

Using this system, you can filter out patents based on the type of rejection too – 102 or 103. If you want to be super strong, you can opt to show only those companies that have faced 102 rejections.

Having this level of insight drastically reduces the time and effort you would require otherwise. This can help you shortlist the potential buyers (who have high chances of licensing/buying) based on rejection data, within a few minutes.

We understand this is not a replacement of deep analysis of patents. Companies hire us for it all the time. However, we felt that sometimes our client just required a quick broad set of patents that they can say have a great potential. Such things should not require spending a lot of time or cost.

Want this system to analyze high potential patents in your portfolio?

In this article, I used Walmart as an example and the charts and screenshots you saw above are derived from a dashboard I created by extracting the data from our custom-developed system. I quickly created dashboard to showcase the capability and not to portray an accurate analysis.

If you also want to have a preview of the dashboard, click here to view.

I have tried to showcase how you can take the first steps towards monetizing your portfolio with much less effort. From figuring out patents that have great monetization potential to the names of the companies which might be interested in licensing them. This entire analysis can be done for anybody’s portfolio.

Keeping in mind your business goals and budgets, the dashboard and analysis can be customized. Interested in seeing what this analysis tells you about your own patent portfolio? Fill out this form and let’s get in touch get a free sample analysis of your portfolio.

Authored by: Krati Pandya, Solutions