The dairy sector remains determined in its commitment to environmental consciousness and sustainability. As a result, over the past 15 years, greenhouse gas emissions have decreased by 17%, water usage by 10%, land utilization by 26%, and feed consumption by 15%.

Furthermore, driven by shifting consumer preferences and expectations, dairy companies are rising to the challenge of prioritizing health and digitalization.

Like every year, GreyB also thoroughly investigated the direction of the dairy industry and the trends that will impact in 2025. After reviewing research papers, forums, white papers, and market analysis, we pinpointed eight groundbreaking trends that will redefine the sector.

This report summarizes recent dairy advancements and the transformative trends driving them.

Access the complete analysis of the trends shaping the future of the Dairy Industry.

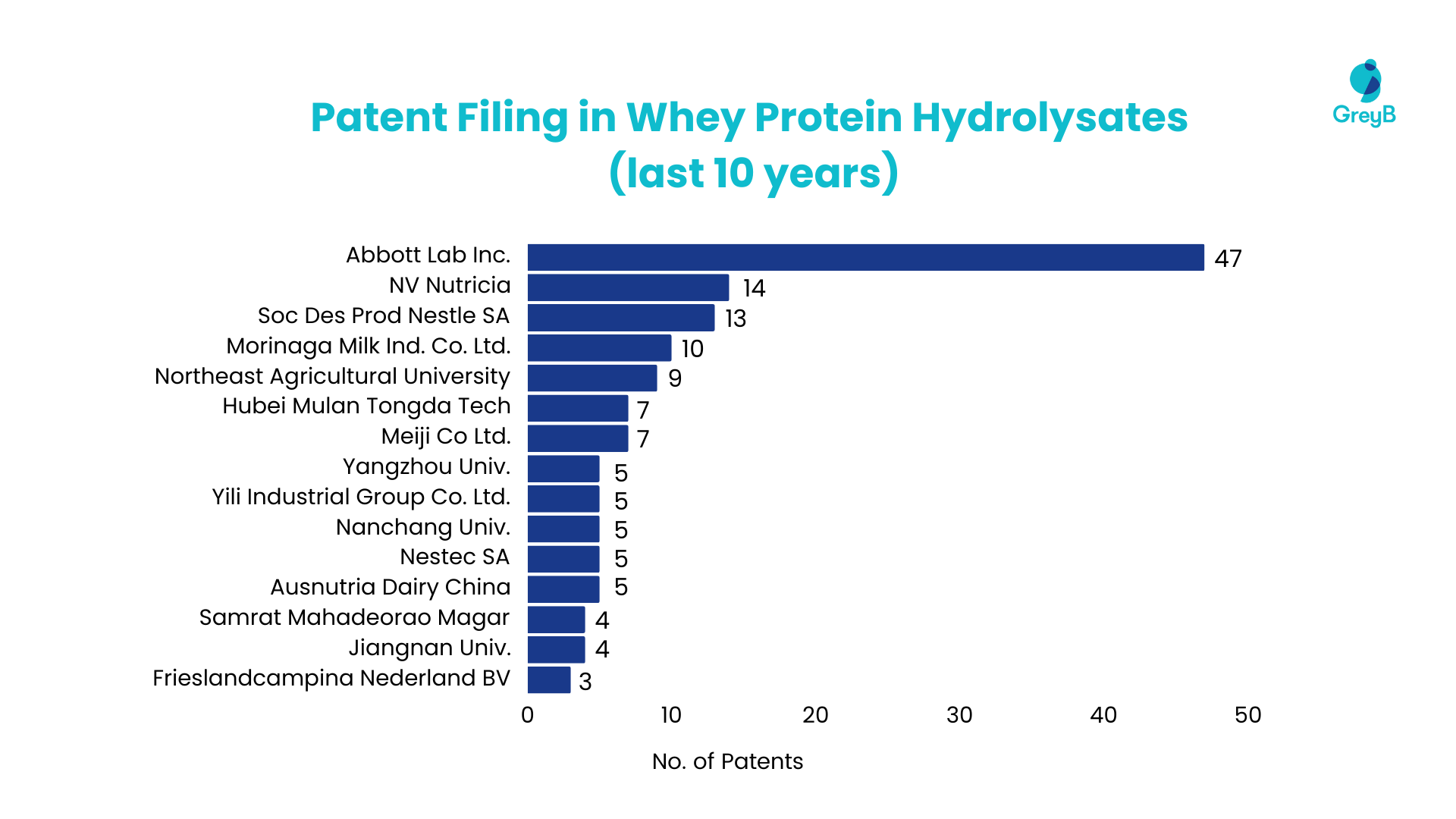

Trend 1 – Whey Protein Hydrolysates

The increasing demand for functional foods and beverages has driven the growth of the whey protein hydrolysate market. Further, whey protein hydrolysates are gaining popularity in the dairy industry as a natural alternative to artificial supplements due to their enhanced nutrient absorption and wider health benefits. However, companies must overcome various challenges, such as potential allergic reactions, loss of nutritional value, and bitter taste.

Recent patent filing trends highlight the industry’s interest in bringing about innovations and solving these domain challenges.

Key developments in this area include –

- Arla Foods’ innovative approach to reducing allergenicity while preserving immune benefits through modifications to hydrolysis processing conditions.

- Feihe Dairy introduced techniques to stabilize whey protein hydrolysates and the development of a hydrolyzed whey formula tailored for individuals with reduced renal function.

- The collaboration between Shandong Jiejing Biotechnology Co. Ltd and Jiangnan University resulted in a method to enhance glutamine levels in whey protein, thereby improving both digestibility and taste.

- Morinaga’s ongoing efforts to create a nutritional blend aim to maintain emulsion stability in whey protein-based beverages, ultimately enhancing their shelf life.

Overall, while innovations in whey protein hydrolysates are at an infancy stage, they show significant promise for transforming infant food nutrition, with increased adoption expected shortly by key dairy players.

Trend 2 – HMObiotics for gut health

Compared to formula-fed infants, exclusively breastfed infants have fewer infections, a distinct microbiota and modestly improved cognitive outcomes. There are many factors associated with breastfeeding — scientists look toward components found in human milk that are lacking or inadequate in infant formula to help explain these differences and hopefully help to close the gap between breastfed and formula-fed infants.

Dr. Marta Miks, senior regulatory and scientific affairs manager at dsm-firmenich.

HMObiotics, a blend of human milk oligosaccharides (HMOs) and probiotics is a solid solution for boosting gut health in both infants and adults. This partnership gains strength from key factors driving this trend forward. The increasing global preference for HMO-based infant formula, alongside the growing demand for health-conscious food and drinks, is fueling the rise of HMObiotics.

In the HMO market, the Asia Pacific region, including countries like China, India, Japan, and Australia, holds a dominant position. This is due to technological advancements and a growing population seeking healthier food options.

Companies such as DSM, BASF SE, Chr. Hansen Holding A/S, DUPONT, and Royal FrieslandCampina N.V. are leading the charge in developing and expanding these products, making HMObiotics more accessible and beneficial for consumers.

Key developments in this area include –

- As per Danone’s formulation, Nutricia has enhanced prebiotic and anti-pathogenic properties, fostering a thriving gut environment.

- Meanwhile, Yili Group and Nestle use this blend to alleviate infant intestinal discomfort and address allergies.

- Feihe Dairy’s recent blend development demonstrates improvements in immune system development and offspring intestinal flora enhancement when incorporated into the maternal diet.

- Health and Nutrition leader Abbott, has introduced a composite comprising dual HMOs and Bifidobacterium and Streptococcus species, aimed at alleviating infant gas discomfort.

Dairy Industry Competitive Anaysis

Trend 3 – Shelf-stable yogurt with active probiotics

Consumers increasingly seek convenient and flexible products that can be easily stored and consumed without refrigeration. Shelf-stable yogurt with active probiotics addresses this demand by providing a product that can be stored at room temperature for extended periods. Yogurt demand is witnessing a surge in the Chinese market, which projects a CAGR of 8.52%, with the ambient yogurt market projecting a CAGR of 3.6%. As a result, dairy companies in China are developing methods to produce room-temperature stable yogurt while preserving the health benefits of the probiotics.

In India, the yogurt market is projected to grow at a CAGR of 8.97% between 2024 and 2029, reaching a market volume of US$50.45 billion in 2029. Like China, India is also witnessing a rise in demand for probiotic and ambient yogurt products due to increased health awareness and the need for convenient options. Key dairy players such as Danone, and Nestlé are investing in developing shelf-stable yogurt to cater to these evolving consumer preferences.

Key developments in this area –

Bright Dairy & Food and Mengniu Dairy are innovating by adding live probiotics after sterilization and fermentation, respectively, ensuring bacterial viability, taste, and texture. Interestingly, Yili Dairy intends to use lactose-negative bacteria with L. rhamnosus to control fermentation and acidity, thereby prolonging shelf life.

Such innovations indicate active participation within the ambient yogurt sector, driven by projected growth and competitive positioning in the market.

Author’s note – Do you want to know more about extending the shelf life of food products? Here are some innovative solutions from the industry.

Trend 4 – Enhancing the meltability of vegan cheese

The rise of veganism has increased the demand for vegan cheese, challenging traditional dairy alternatives. Existing plant-based cheeses often lack texture due to substituting casein with plant proteins, despite advancements improving firmness and springiness. Melting properties remain problematic, prompting companies to innovate and enhance vegan cheese meltability.

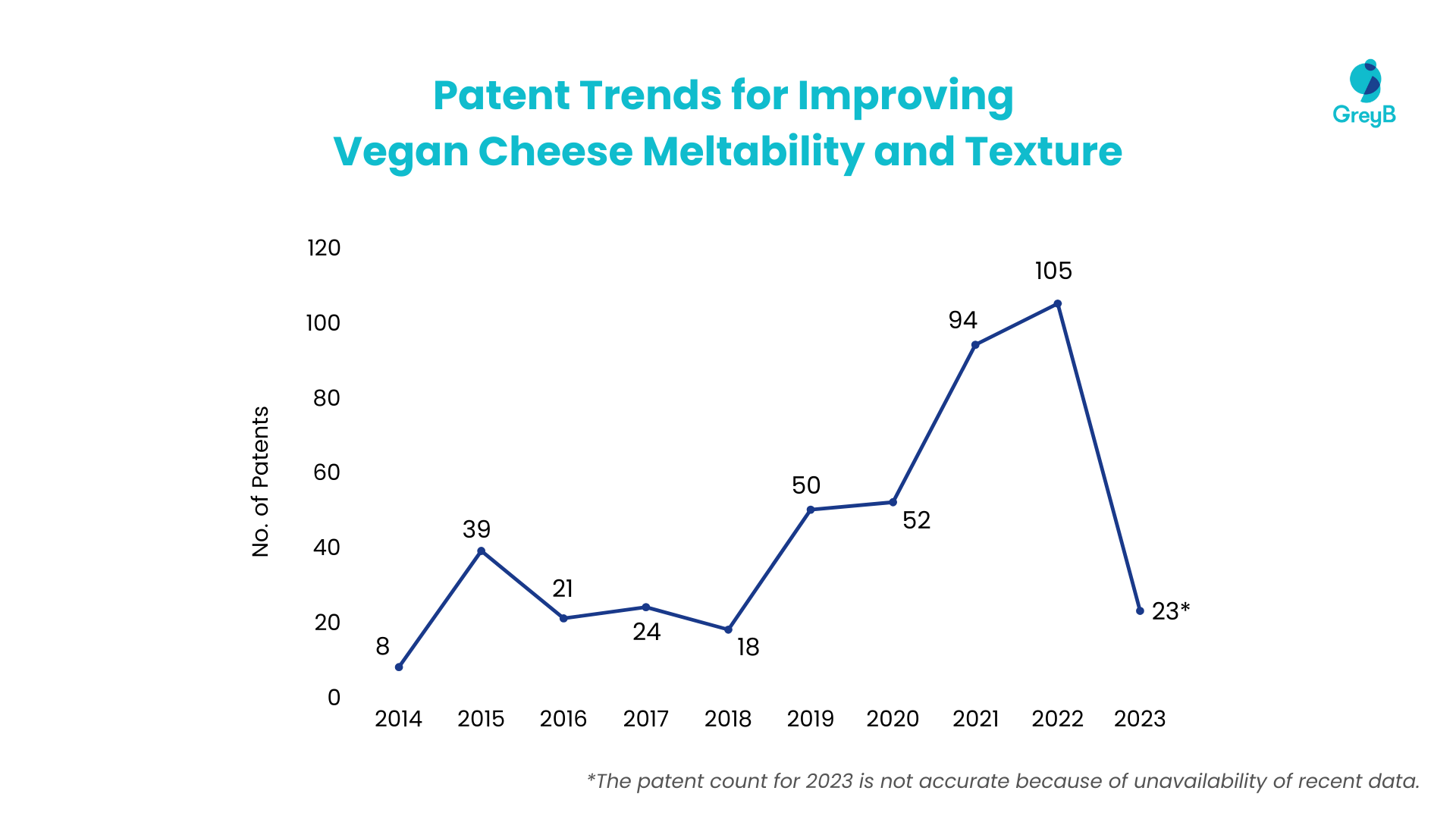

To solve these issues, multiple companies are seen filing patents in this domain, with 2022 seeing the highest number of patent filings i.e. 105 –

Key developments in this area –

Companies like Kraft Foods and Bunge SA are refining their processing methodology by tweaking the starch type and content to produce vegan cheese with desirable melting characteristics.

On the other hand, Ajinomoto intends to use protease enzymes to prevent gelling and enhance meltability.

Nestle also looks forward to modulating vegan cheese composition to provide smooth melting characteristics.

As the domain for vegan cheese evolves, it would be interesting to see how companies innovate to tackle the challenge associated with meltability.

Access the complete analysis of the trends shaping the future of the Dairy Industry.

Trend 5 – Tackling precipitation in plant-based beverages

According to a 2022 report, the revenue of the global plant-based milk market is projected to reach $51.87 billion by 2032.

Vegconomist

Particle aggregation and precipitation often occur in plant-based beverages, causing alterations in their texture, flavor, and overall appeal. These issues can be especially problematic in soy-based drinks, which are becoming more popular. The resulting precipitation can greatly impact the quality and longevity of plant-based beverages, developing unpleasant tastes, odors, and sedimentation that can reduce consumer satisfaction and product safety.

Companies capable of successfully managing precipitation problems in plant-based beverages stand to gain a competitive edge in the market. This becomes especially crucial as consumers grow more discerning about product quality and consistency. As a result, dairy industry leaders are introducing alternative dairy products and enhancing the quality and stability of plant-based milk.

Key developments in this area –

- Mengniu Dairy Group and Jiagnan University are innovating separately on an enzymatic process to improve stability, nutritional benefits, and flavor without stabilizers.

- Yili Group’s innovation involves dual grinding processes to improve consistency and texture.

Growing demand for plant-based milk, driven by lactose intolerance and changing consumer preferences, pushes dairy companies to expand their offerings. Innovations to improve the taste and stability of plant-based drinks can make them more appealing to consumers and drive industry growth.

Trend 6 – Bovine immunoglobulin-fortified milk products

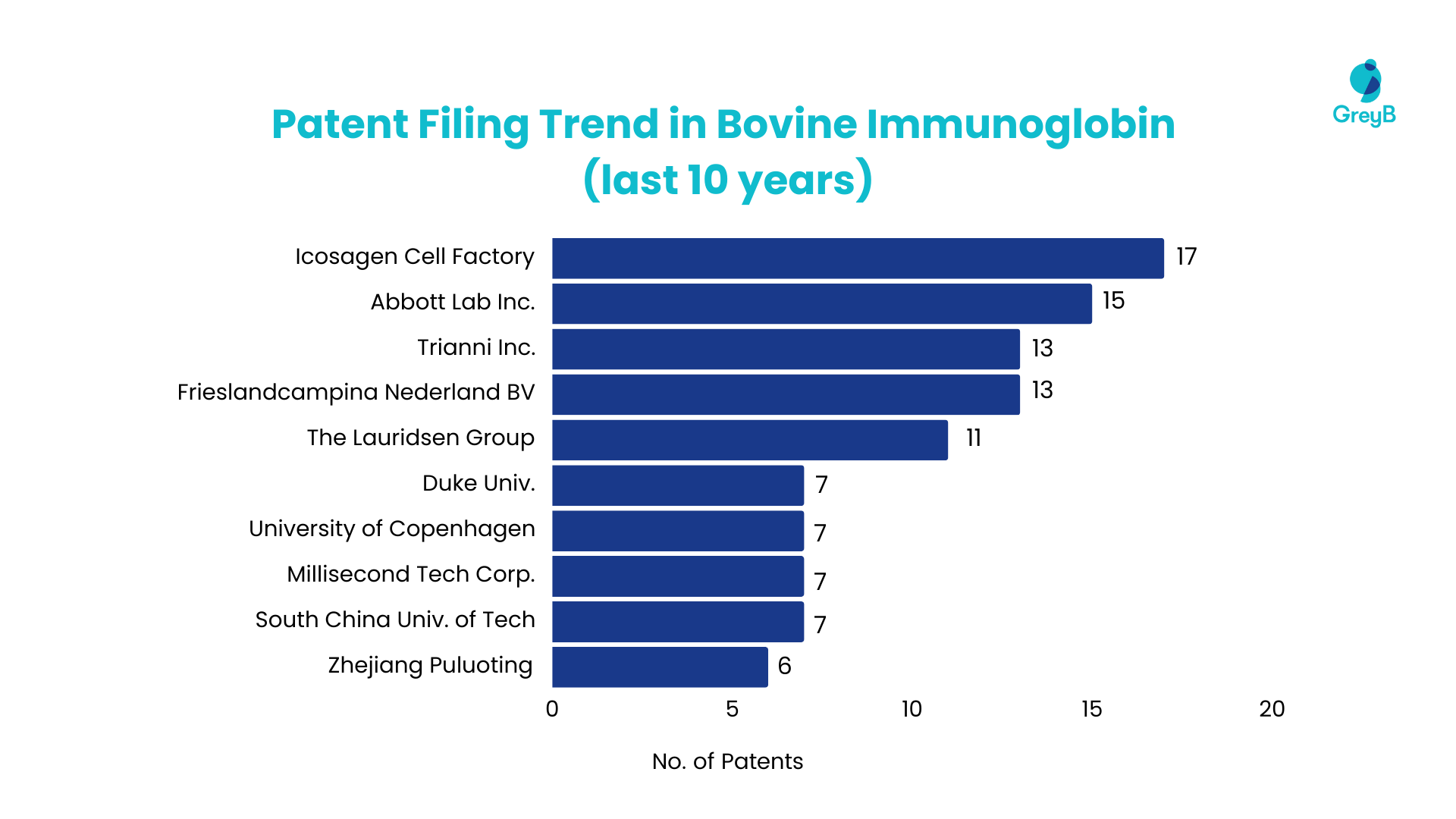

Consumers’ worries about immunity and staying healthy fuel the increasing need for immune support products. Bovine immunoglobulin-based items offer a natural and efficient way to enhance immune functions. While there’s growing interest in adding immunoglobulins to dairy products for their immunity-boosting advantages, challenges arise from heat treatments and the expensive nature of cow colostrum. Major players in the industry are constantly innovating to maintain immunoglobulin effectiveness and improve nutritional value. Various companies’ patent filings on bovine immunoglobulin reflect this trend in the field.

Key developments in this area –

- Abbott has filed patents on using bovine immunoglobulin and human milk oligosaccharides for respiratory infections.

- Interestingly, FrieslandCampina has developed dairy products with higher immunoglobulin content by using gentle heat treatment and selecting milk from specific lactation cycles.

- Cass Dairy has innovated an immunoglobulin-rich yogurt by using low-temperature treatments.

- Also, Mengniu Dairy patented a yogurt preparation method that preserves immunoglobulins through centrifugal sterilization and double ultrafiltration.

With the growing interest in replicating the immunological qualities of human milk, future innovations are focused on altering bovine immunoglobulin levels to more closely match those in human milk. Additionally, the synergistic effect of bovine immunoglobulin with other functional ingredients may become a key area of innovation.

Dairy Packaging Trends

Trend 7 – Altering feed composition to reduce enteric methane emissions

To reduce GHG emissions and meet sustainability targets, fodder and dairy companies are actively developing innovative, antibiotic-free feed compositions to diminish enteric methane production by incorporating propionic acid-producing microorganisms and plant-based polyphenols.

Key developments in this area –

- Fonterra has developed a method to reduce methane emissions in livestock using probiotics. At the same time, DSM has innovated a composition comprising a combination of limonene and propanediol mononitrate, which claims to reduce enteric methane production by 30%.

- On the other hand, Inner Mongolia Agricultural University plans to use Schizochytrium powder in cow feed to lower enteric methane through fermentation changes in the rumen.

- The National Agriculture and Food Research Organization intends to use Prevotella lacticifex to produce acids that suppress methane-producing organisms.

- Northeast Agricultural University employs silybin to inhibit methane-producing microorganisms and regulate metabolic pathways.

The rise of feed additives to reduce methane emissions presents a growing trend, yet balancing methane reduction with milk nutrition and yield remains a key challenge. Future innovations aim to address this balance. The dairy industry is also exploring technologies across the production chain to reduce its carbon footprint.

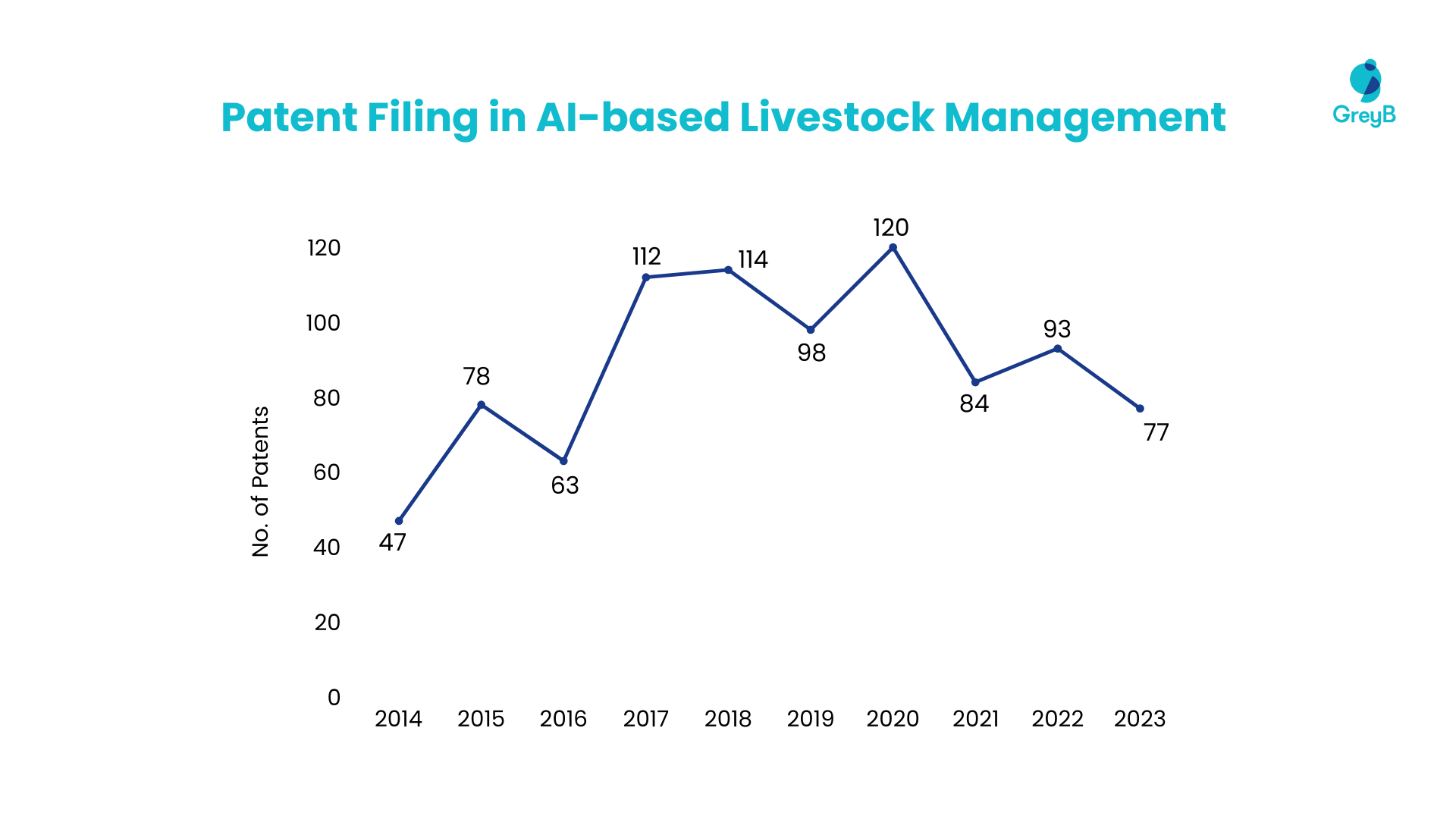

Trend 8 – AI-based livestock management

Dairy farming relies on livestock management, but manual data collection is labor-intensive and error-prone. While RFID tags aid in health assessment, decision-making is still inefficient. Startups and universities are now using AI/ML technology to streamline decisions for timely interventions.

Key developments in this area –

- Substrate AI has developed an ML system to evaluate milk quality and recommend optimal feed compositions, streamlining livestock management and improving resource use.

- Scotland Rural College and EIO Diagnostics have developed technologies using infrared spectra analysis, image analysis and ML for early disease detection in livestock.

- Taking a step ahead, Performance Livestock Analytics Inc. employs ML models to monitor and predict animal health in feedlots, enabling timely interventions and providing optimal resource allocation.

- Similarly, Finchinai Pty Ltd has developed a system with sensors for real-time health predictions, optimizing animal monitoring and grazing efficiency.

Emerging companies like Quantified AG, EIO diagnostics, Bovcontrol, etc., predominantly occupy the domain of AI-driven livestock management. This sector is expected to grow at a 26.0% CAGR from 2023 to 2031, creating favorable conditions for major dairy industry players to pursue partnerships. Moreover, as the sector continues to grow, personalized recommendations for feed intake could significantly enhance existing innovations.

Path Forward

Looking ahead, we expect the dairy industry to develop specialized products tailored to the aging population, alongside a focus on maternal health. This future outlook promises exciting innovations that align with evolving consumer preferences while embracing sustainability and technological progress. Companies that can swiftly adapt their product portfolios, processes, and business models to these emerging trends will lead the dynamic dairy landscape.

Align your product portfolio, processes, and business model with emerging consumer preferences and technological advancements to stay ahead of the industry and empower your team!

Talk to our experts today and request a detailed landscape tailored to your domain and requirements.

How Can We Help You?

We support industry-leading R&D and Innovation professionals through complex problems. Describe your challenge, and let us bring clarity and expertise.