Recently, we noticed that many companies, especially with big patent portfolios, may not be aware that some of the patents in their portfolio are getting delayed in being officially listed as Standard Essential.

As standard-essential patents are worth a good amount of money, delaying or missing to declare these patents to ETSI might result in lost opportunity for companies to make millions.

For example, we gathered data from major 3GPP standard contributors and found two certain relevant instances.

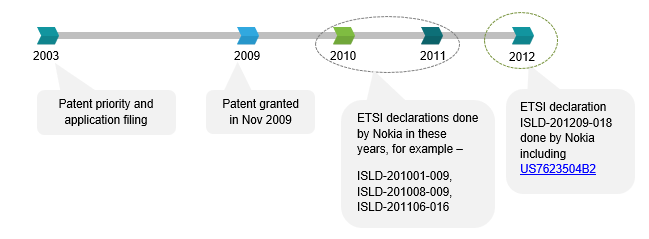

The first would be Nokia’s patent US7623504B2 whose timeline goes like –

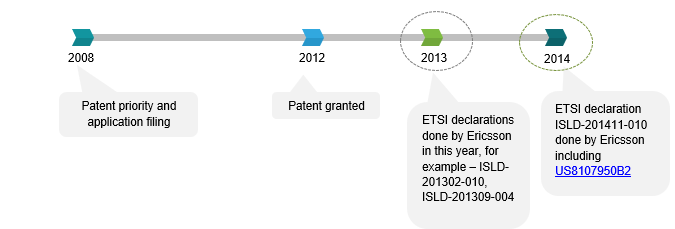

For the second case, we can look at Ericsson’s patent US8107950B2 –

What do these timelines indicate?

In both Nokia and Ericsson’s case, the patents were not included in ETSI declarations as soon as they got granted.

Nokia got US’504 granted in 2009 but included it in IPR Information Statement and Licensing Declaration (ISLD) only in 2012, even though Nokia was active in submitting ISLDs regularly including years 2010-11.

Similarly, Ericsson didn’t include US’950 in the ISLDs submitted after its grant. It was submitted after a gap of almost 2years.

There are more examples where the patents were delayed to be declared as SEPs. For instance –

- US7764773B2 was granted in 2010 and US8145195B2 was granted in 2012 but declared in 2014 (ISLD-201405-005)

- US7088996B1 was granted in 2006 but declared in 2013 ISLD-201306-001

- US6684082B1 was granted in 2004 but declared in 2011 ISLD-201104-013

One of the reasons this happens is because there are very large portfolios to review and there is a probability that some patents get missed being declared as SEPs. They are submitted after the next review cycle. Sometimes, in the process, even useful patents get completely missed and are not declared as SEPs.

The Impact of Delay/Miss in declaring your SEPs to ETSI

If we evaluate the impact of this miss or delay, I believe it is quite high. Considering that a SEP is worth a couple of millions, the company is losing thousands in licensing fees every year which that patent could fetch. The impact is multiplied when a potential SEP is missed and is never declared to ETSI.

Similar was the case for one of the telecom companies I introduced at the beginning of this article. They were missing 10-20% of their patents in ETSI declaration which led to a loss in licensing revenues from SEPs. While working on such cases, we realized the reason why it is difficult to locate every SEP in a big portfolio.

Based on our experience in such studies, we identified that major reasons for missing out SEPs while reviewing patent portfolios are –

- For a patent to be a SEP, its each and every clause must overlap the information given in the standard specification. Since the technical specifications are very vast and descriptive, there is a possibility to miss overlapping information. This could ultimately lead to a miss in identifying complete overlap and considering the patent as SEP.

- The standard protocols keep updating. It is necessary to keep up with the latest technological update; else there is a probability to miss valuable SEPs.

What measures can be taken to avoid this?

You can take the following measures to avoid similar instances happening to you –

- Keep the portfolio review dynamic, for example, review as soon as the patent gets granted or published.

- There must be multiple cycles of review to ensure no potential SEPs are missed.

- Keep the shortest possible time between the patent grant and declaring to ETSI, to gain max benefits.

Need more information on SEPs and how GreyB can help you in the process? Fill the short form below and we will get in touch with you in no time.

Authored by: Vincy Khandpur, Team Lead, Patent Infringement.