Julija Kaminskaite, as a part of her business school program, submitted her thesis on reducing the failure rate of SMEs. What astounded me when I was reading through the paper was this particular statement, which I have paraphrased here – “In the past few years, the failure rate of SMEs fluctuated from 70 to 90%, dependently on the country and industry.” 70-90% is a large number, irrespective of the location and this needs to change for obvious reasons.

Reading through the paper, I began to ponder – What could these enterprises do to hamper the negative effects, reduce the chances of failure, and if possible get an edge in their respective domains?

Julija suggested implementing innovation in the very early stages in the business strategy, as one way of reducing the chances of failure among other options. Though notable, it ought to be mentioned that innovation alone won’t do much to hamper the negative effects, let alone get an edge in the market.

Innovation, however, when coupled with IP protection can work wonders for an organization. There have been various instances in the past where upstarts and SMEs have competed with large and established players in the domain merely with the help of their Intellectual property, especially patents. Patents, as we know them, can serve as a shield, protecting the innovations of an organization from being copied by others, giving the company an edge in the domain.

In addition, the IP held by these entities – be it startups or SMEs – have often made their founders rich and helped these companies grow leap and bounds. Patent portfolios of these SMEs have often proved to be a key reason behind their acquisitions, other than brand value and growth projections.

As an SME, what can you do to reduce your chance of failure? The answer is simple – Build a sturdy patent portfolio.

Now, when I say build a sturdy patent portfolio, I do not solely mean getting patents over the innovations developed by your organization. Rather, the emphasis is on building a patent strategy such that the resultant patents in your portfolio are in synergy with your business strategy. To become a significant player in the domain, it is important that you, as an organization, design your innovation strategy in a way that keeps the market trends of your domain in mind, which, when coupled with efficient patent protection, would ensure your place as a significant player in the domain.

I might have delved a bit deep so let me put it this way. Instead of just focusing on getting patents covering your innovations, try to grasp the trends in your domain, and innovate and patent accordingly. This would not only ensure a sturdy patent portfolio, but also help establish a significant hold over the domain and give you the freedom to explore additional application areas.

Other than these reasons, let me give you a key reason why you as a startup or an SME need to have a good patent strategy. Patents, accrued without being given a thought on patent strategy, though would cost your organization thousands of dollars but might not give a good Return on Investment. You might not be able to leverage your IP properly, or maybe not be able to leverage it at all from a monetization perspective. Hence, it is very important to have a proper IP strategy in place.

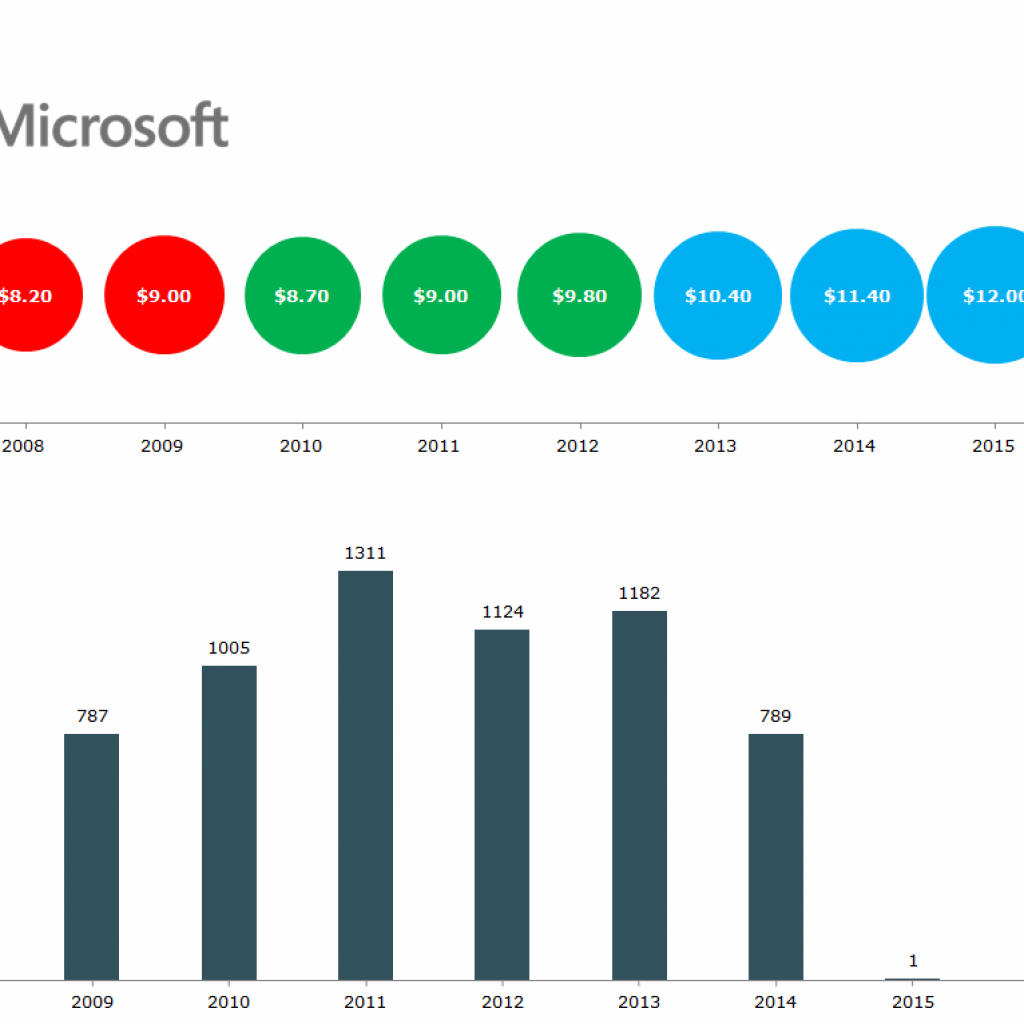

We have witnessed a lot of SMEs who have attained huge success by having a good IP strategy in place and competently utilizing their patents. Below we have listed 8 such SMEs for your reference who turned unique aspects of their patents into financial gains.

Here is the list of the companies:

InVisage

InVisage Technologies Inc. – a California-based startup founded in the year 2005 – is a fabless semiconductor company that produces quantum dot-based image sensors. The company’s products enable images from handheld devices, such as camera phones and PDAs. Their key product, QuantumFilm, is better at taking high-quality pictures in a variety of non-optimal lighting conditions.

Apple acquired them in 2017, which granted the tech giant the power over 71 patents of InVisage in the field. This led to an array of reports on the lines that the subject acquisition would help Apple overtake the Japanese giant, Sony in the segment of imaging in mobile phone cameras and webcams and related devices where this cutting-edge technology is used; which includes but is not limited to security and surveillance, automotive imaging, military, and medical imaging applications.

Mobli

Mobli, an Israeli startup found in the year 2010, was a social mobile photo and video-sharing website, which posed as a competitor for Vine, Instagram, and other social media platforms which were used primarily for photo and video sharing. The company, however, couldn’t strive for long given the stringent competition, and shut down in 2016, citing bankruptcy as the reason.

Thanks to their patent, Mobli isn’t a failure story. They had patented the idea of Geo-filters in 2012, which was a critical feature of the product. When Snapchat introduced the geo-filters feature – which is a leading source of income for the company – the parent company, Snap, jumped on the opportunity to acquire the patent for a whopping USD 7.7 Million. Snapchat has been using this patent since then to ensure that no other competitor can sell photo filters based on location to advertisers.

M Squared Lasers

M Squared Lasers is a UK based photonics technology company, which designs, manufactures and distributes lasers and photonics systems to its customers globally. It has a wide range of products namely: SolsTis, Sprite XT, Firefly IR, Firefly THz, Firefly Imager and Aurora, and an extensive portfolio covering them.

The company, owing to its innovation and strong IP has earned an investment from BGF (formerly, Business Growth Fund) – a UK investment company formed by Barclays, HSBC, Lloyds Bank, Royal Bank of Scotland and Standard Chartered bank – of a whopping Euro 5.5 Million till date, among other investments.

ObjectVideo

ObjectVideo Inc. formerly known as DiamondBack Vision, Inc., found in 1998, is well known for its intelligent video analytics software for security, public safety, business intelligence gathering, and process improvement applications.

In the year 2014, Avigilon Corporation – a leading global provider of end-to-end security solutions, acquired ObjectVideo’s entire patent portfolio of video analytics, and licensed ObjectVideo’s 76 US and international patents and over 50 US and international patent applications, for a cash amount of USD 80.3 million.

This is not it. Later, in the year 2017, the remaining piece-meal business of ObjectVideo comprising of remaining products, patent portfolio, and personnel was acquired by Alarm.com for an undisclosed amount. It goes on to show how a well-planned patent strategy coupled with a good innovation strategy could help companies achieve their growth objectives.

World of Medicine GmbH

World of Medicine (WOM), a German company – found in 1974 as Wiest + Fuchs – is considered to be a leader in Minimally Invasive Surgery and is a leading supplier to original equipment manufacturers (“OEMs”) of regulatory controlled equipment for the minimally invasive surgical market.

In the year 2017, WOM and its 50+ patents were acquired by Novanta – a leading global supplier of core technology solutions to the healthcare sector – for 115 Million Euro. The aim of the acquisition for Novanta was cited as “to increase its presence in medical end markets”, where WOM had a strong foothold given its strong IP in the area.

Aerogen

Aerogen – A leading medical device and drug delivery company – started its journey as Cerus Medical in 1997, and merged with Aerogen Inc. in 2000 and kept the latter’s name.

The company was acquired by Nektar Therapeutics, a leading biopharmaceutical drug discovery company in 2005 for its extensive patent portfolio and was followed by a management buyout in the year 2007.

Want to know the key reason beneath the acquisition? It was Aerogen’s patented technology of vibrating mesh for the development of nebulizers, which was expected to strengthen Nektar’s leadership position in pulmonary technology.

The acquisition will broaden Nektar’s pulmonary technology base by adding capabilities in aerosolized liquid drugs to Nektar’s leadership position with inhaleable powdered drugs. Initially, Nektar will incorporate Aerogen technology into its proprietary inhaled ICU antibiotics product, which is in clinical trials for the prevention of pneumonia in mechanically-ventilated patients. The addition of Aerogen’s technologies, people, products, and intellectual property, including a patent portfolio of more than 35 patents, will strengthen Nektar’s pulmonary leadership position.

Tralin/ Quanlin Paper

Up till this point, we have discussed how a company could benefit from having a sturdy patent portfolio from a commercialization and monetization perspective. However, these are not the only ways you could use your patents.

Tralin (Quanlin in Chinese) Paper, for instance, obtained a loan of RMB 8 Billion, with its IP as collateral in 2014. The Chinese company secured the loan against its portfolio of 110 patents and 34 trademark rights from a lending consortium led by the China Development Bank. This is the largest IP-backed loan in the history of IP financing and CDB is not the only player in the patent-based lending market.

IP backed financing has a long history and multiple businesses throughout the world – irrespective of their size – have used it to raise money when other sources of capital have dried up. If you have good IP in hand and have a cash crunch, you know where to look.

Masai Group International GmbH

IP backed financing has helped Masai a great deal, but that part is going to come into the picture a bit later. First, let me give you a brief background of the company.

Found in 1998 in Switzerland, Masai group is a designer and distributor of footwear. In 2008, the company patented the technology for physiological footwear known as ‘Masai Barefoot Technology (MBT)’, which creates a natural instability underfoot that stimulates and exercises the body’s supporting muscle system. These shoes became pretty famous, and like every other famous brand out there, copycats of the shoe brand began to appear in the market.

Owing to the tough competition, the company filed for bankruptcy and was consecutively acquired by Singaporean shoe distributor and retailer, Star 360 Holdings. There were a lot of counterfeit products in the market, which highly affected the sales of Masai group. However, after the takeover, Mr. Andy Chaw, the new CEO of the acquired company turned the table by getting a loan from DBS Bank, keeping its IP as collateral.

The seven-figure IP backed loan, approved after taking the valuation of Masai’s patents into account, was mostly dedicated to keeping the infringers out and further enhance the IP around its products.

Take a loan to protect your IP and get more IP keeping your IP as collateral. This is definitely going to my little black book of patent strategies.

Conclusion

Many a time SMEs seek funding to grow and expand. A Patent portfolio could help attract notable investors. Additionally, having good patents:

- Can enhance the valuation

- Can help in self-funding by finding potential infringers

- Can open new windows for collaboration, and M&A like opportunities

In case of losses, or in worst case scenario like bankruptcy, it can help recover losses.

A smart patent strategy has multiple benefits. The problem, however, is that a lot of SMEs miss these opportunities by not getting creative with their patent portfolio.

We have seen even industry giants leaving patent revenue on the table. My question to you is – do you think you may have patents in your portfolio that could become what Ginnie is for Aladdin?

Do let us know if you are interested to find these hidden gems. We are only a message away. Let’s put your patents to make money.