The UK’s proposed higher tax on beverages containing more than 10 grams of sugar per 100 milliliters directly targets iconic brands like Coca-Cola. Meanwhile, the HFSS regulations ban advertisements of products high in fat, sugar, or salt, forcing brands to rethink their entire marketing playbook.

The regulatory squeeze doesn’t stop there. By 2026, the FDA will phase out petroleum-based synthetic dyes in the US, removing the artificial colors that have defined the visual identity of beverages for decades.

Such regulations are redefining the landscape of the beverage industry. Brands are using AI-powered hydration systems, sugar reduction strategies, and ingredient innovations to navigate these changes.

The next challenge for beverage R&D teams is clear: understanding how industry leaders are tackling emerging trends and which innovations will shape the future. What strategies are disruptors using to stay ahead, and which innovations should you prioritize? Let’s explore the key growth opportunities for your product development strategy.

Trend 1: Alcohol is fading, but premiumization is on the rise

Alcohol consumption among Gen Z has declined by 25% over the past four years. A growing focus on health, mindfulness, and lifestyle balance drives this trend.

As a result, non-alcoholic alternatives have become one of the fastest-growing beverage segments worldwide. Waitrose reported a 20% rise in no/low-alcohol beverage sales, underscoring the market’s rapid expansion. Major brands like AB InBev, Heineken, and Carlsberg have expanded their non-alcoholic (NA) portfolios to meet this demand.

However, maintaining the taste and aroma of these beverages has been a challenge for the manufacturers. NA drinks have thin bodies, lack flavor, and often have undesirable off-flavors, such as those caused by oxidation.

Innovators worldwide are creating formulations to overcome these industry challenges. Notably, many of these innovations are emerging from China and Japan.

Kirin Holdings and Sapporo Breweries are eliminating off-flavors in NA beers using special compounds

Kirin is eliminating the boiled barley-like smell in NA beers by using special compounds like 2,5-dimethylpyrazine, isoamyl acetate, and succinic acid.

Adjusting isoamyl acetate and succinic acid also enhances the depth and balance of the taste, creating a more enjoyable drinking experience. The beverage has an ethanol concentration of less than 0.01%, ensuring it remains a non-alcoholic beer.

Meanwhile, Sapporo Breweries is enhancing the taste and smell of its NA beers with isobutyl isobutyrate and Terpinen-4-ol. Isobutyl isobutyrate reduces the strong raw-grain odors from barley and malt. Terpinen-4-ol removes unwanted flavors caused by acidity and sweetness in NA beers.

Author’s Note: Social stigma and consumer mindset are still hurdles in the non-alcohol segment. A Heineken and Oxford study found that 21% of Gen Z hide their preferences for low or no-alcohol drinks due to social pressure. Some drinkers also question the point of drinking alcoholic beverages with no buzz. Changing these perceptions takes marketing strategies. For example, Heineken launched the “0.0 Reasons Needed” campaign to show that you don’t need an excuse, like eating healthy or being the designated driver, to choose a 0.0 beer.

Although total alcohol consumption is declining, the value of sales is rising because people are choosing top-shelf options. Surveys indicate that 54% of individuals aged 18 to 34 prefer premium beverages.

Consumers are showing a willingness to pay more for drinks perceived as higher quality, more authentic, or offering a unique experience. Social media and influencers are another driver of premiumization in the alcohol category. A premium, beautifully packaged drink is more “Instagrammable,” like a limited-release bourbon.

Brands are producing these premium spirits using advanced maturation technology that can chemically age rum or whiskey 20 years in about a week.

New Caledonia Enterprises LLC accelerates aging by recirculating alcohol through an ultrasonic bed of wood and biomass

The traditional aging process involves storing alcohol in oak barrels for years. This process is both time-consuming and expensive.

New Caledonia Enterprises’ patented technology speeds up the aging process by rapidly recirculating the alcohol through a bed of size-reduced wood and biomass above atmospheric pressure. The system applies ultrasonic waves, mechanical vibration, and heat to agitate the biomass. Furthermore, it introduces oxygen in a controlled manner to facilitate the oxidative reactions necessary for aging.

This innovative method significantly reduces the traditional aging time from years to mere hours or days while offering producers greater control over flavor profiles and product consistency. It increases speed to market. Producers can innovate faster with a variety of flavors and respond to market trends in a timely manner.

The process is applicable to many alcoholic beverages, including whisky, wine, and beer. The composition of the beverage can range from 1% to 95% alcohol by volume.

New Caledonia Enterprises operates on a B2B licensing model. Therefore, manufacturer can integrate the technology into their own production systems instead of buying the aging equipment. This expands the technology’s reach and scalability across various producers without requiring significant capital investment.

Trend 2: Brands are tracking hydration levels in real-time to offer personalized drinks

Instacart’s 2024 data reveals a 36% surge in electrolyte drink powder purchases, reflecting a growing trend towards hydration.

What used to be niche “sports drinks” for athletes has now transformed into everyday wellness beverages for the masses. For example, Liquid I.V., which was originally positioned as a sports drink, was acquired by Unilever and rebranded as a daily wellness drink.

Health-conscious consumers understand that drinking more water not only promotes overall well-being but also contributes to clearer skin and weight loss.

Despite its rapid growth, the category faces several challenges. Many traditional sports drinks are high in sugar and artificial ingredients, which health-conscious consumers now shy away from. Discover how some beverage brands are cutting sugar upto 100%.

Apart from new electrolyte formulas, the industry is also seeing cross-category concepts to differentiate its offerings. One of the most exciting frontiers is using technology to personalize and monitor hydration.

Coca-Cola’s smart beverage dispensing system personalizes drinks for hydration

Coca-Cola invented a smart beverage system that creates and dispenses personalized hydration drinks for individuals based on how much fluid and electrolytes they’ve lost through sweating. It uses activity data, wearable sensors, and user preferences to tailor the drink recipe, helping users rehydrate effectively.

This system can also integrate with a smart bottle that tracks daily fluid intake and activity-related losses. It sends reminders to the user’s device, notifying them when it’s time to hydrate and meet their recommended intake.

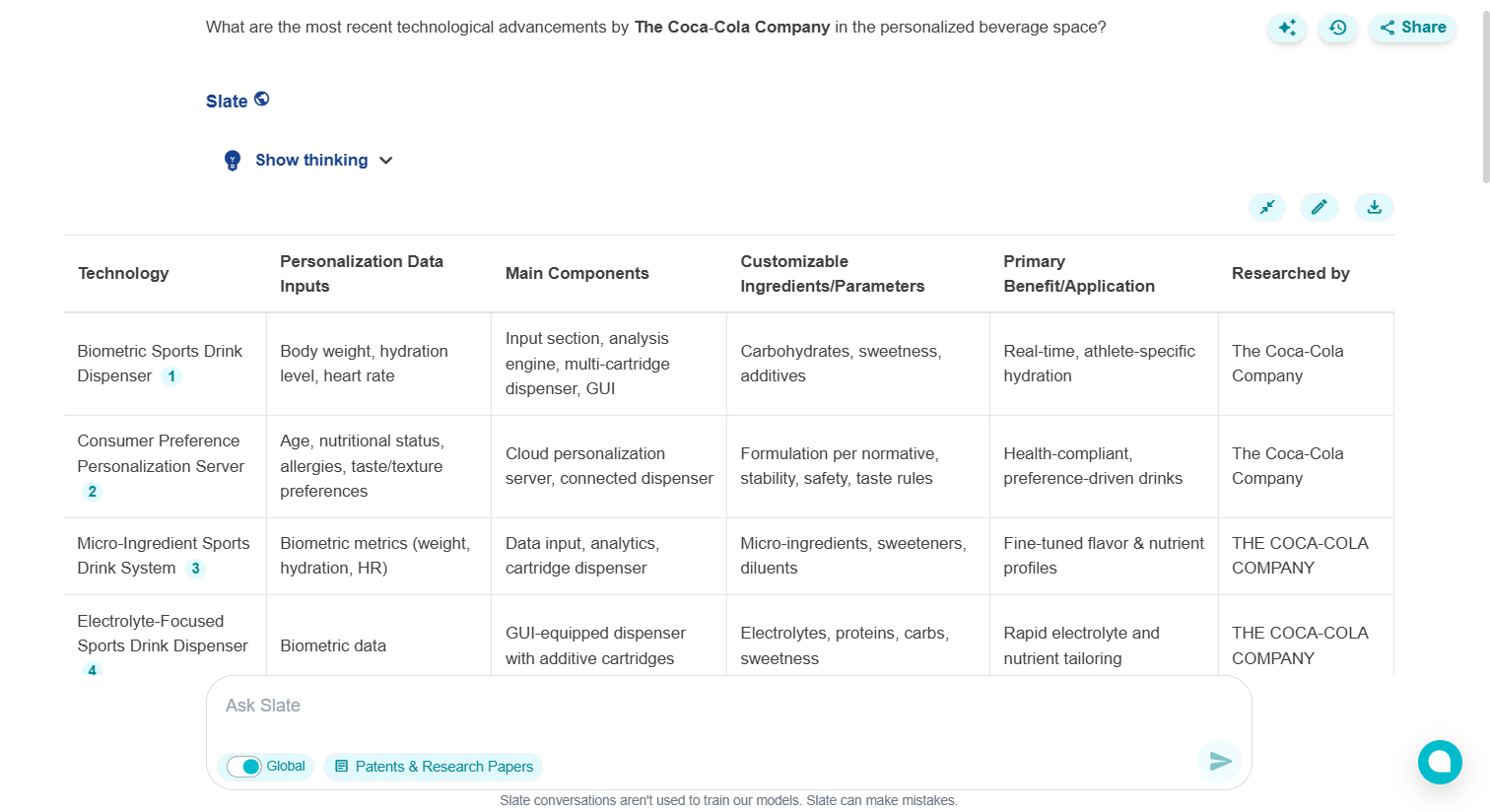

This innovation is just one part of Coca-Cola’s broader strategy to enter the personalized drinks space. The beverage giant is also exploring portion-adaptive ingredient matrices and user-recipe dispensers. Keeping up with such R&D activities is key to maintaining the competitive edge. Stay one step ahead with proactive competitive research on our AI-based research tool, Slate. Just ask, “What are the most recent technological advancements by The Coca‑Cola Company in the personalized beverage space?”

What are the most recent technological advancements by The Coca‑Cola Company in the personalized beverage space?

Garmin’s smartwatches can measure hydration using pulse spectroscopy

Although smartwatches try to estimate hydration levels through sweat loss, this is usually a rough estimate and not entirely reliable. Other options, like skin patches, tend to be messy, uncomfortable, and typically single-use.

Garmin’s newly patented technology introduces a smartwatch that uses pulse spectroscopy to monitor hydration levels in real-time. The device shines light at different wavelengths into the user’s skin and analyzes how that light scatters or gets absorbed. The system adjusts both the wavelength and intensity of the light dynamically based on the user’s skin tone, wrist thickness, and movement. The system then analyzes the light absorption patterns to determine the presence and concentration of different molecules. This opens the door to tracking metrics like hematocrit and hydration levels non-invasively.

Although this feature hasn’t made its way into Garmin’s current devices, the technology is a promising solution for accurate, real-time hydration monitoring.

Author’s Note: Beverage brands should explore collaboration opportunities with wearable technology companies to create a more personalized consumer experience. While smartwatches monitor hydration levels, brands can leverage this data to recommend appropriate beverages from their portfolio or deliver custom-formulated drinks directly to consumers via a dedicated app.

Trend 3: Health and Functional Beverages: Consumers want wellness in every sip

Beverages today are expected to do more than simply hydrate. They’re being tasked with healing, calming, energizing, and even boosting immunity, all without sacrificing flavor.

Initially, HFSS compliance fueled reformulation to reduce sugar, salt, and fat in beverages. However, growing interest in functional wellness among health-savvy Gen Z has pushed brands to rethink their portfolios entirely.

Google searches for “prebiotic soda” and “fiber soda” spiked by 79% and 42% between 2023 and 2024. Sodas aren’t just bubbly and fun drinks anymore. They’re becoming the go-to choice for a growing base of non-alcoholic drinkers seeking inclusivity without sacrificing health.

Earlier niche brands like Shark Tank’s famous Poppi and Olipop were trending in the prebiotic drinks segment. Now, this niche interest is quickly going mainstream with industry giants like Coca-Cola launching Simply Pop, a new line of fiber sodas in early 2025.

However, capitalizing on this trend isn’t that simple.

“If you are in the food industry, you know how tricky reformulation is. It becomes a more expensive product. You have issues with texture and with taste.”

— Sara de Pelsmaeker, health & wellbeing director at Puratos

Even the most health-forward drink won’t make it past a single purchase if the flavor, mouthfeel, or appearance misses the mark. For brands, the challenge lies in delivering functional benefits without compromising on sensory appeal. While challenges remain, the steady rise of health-conscious consumers confirms that this trend is here to stay.

EXBERRY’s FDA-approved blue beverage solution is enriched with bioactive LPS

Spirulina, a blue-green microalgae, is known for its nutritional and therapeutic properties. However, including whole spirulina in food and beverage products presents some limitations. It has a strong, often unpleasant taste and odor. Additionally, only a small portion of bioactive components in spirulina actually gets absorbed into the bloodstream.

GNT Group, the creator of EXBERRY® natural colors, has developed a patented formulation that overcomes these challenges by using an aqueous extract of spirulina enriched with bioactive lipopolysaccharides (LPS). This innovative process selectively removes unwanted fractions while preserving beneficial compounds. The resulting product is a water-soluble powder containing at least 20% spirulina protein. It is odorless, temperature-stable, and acid-stable, making it ideal for use in food and beverage manufacturing.

In 2022, the FDA approved the use of spirulina extract in beverages. This regulatory nod expanded its permitted usage to cover all non-alcoholic drinks and alcoholic beverages with an alcohol content below 20% ABV. The approval also includes applications in products like yogurt, ice cream, and confectionery.

Since the powder is made from edible, plant-based raw materials using only traditional physical processing methods, the EU and many other regions consider it a food ingredient rather than an additive.

With the FDA’s plan to phase out petroleum-based synthetic dyes by 2026, this breakthrough allows brands to produce beverages with vibrant blue hues while supporting clean label claims.

Firmenich’s amide-based modifiers reduce the need for sugar and salt in bitter beverages

Bitterness and astringency are major barriers in the development of health-focused beverages, especially those involving plant-based, high-protein, or botanical ingredients.

DSM-Firmenich is overcoming this industry challenge with its new class of amide compounds. These compounds are cinnamic acid amides, such as C103, C106, and C107. They are not flavoring agents themselves, but modify how flavors are perceived by inhibiting the activity of taste receptors that detect bitterness. Manufacturers can add these compounds to food and beverage compositions at very low concentrations, ranging from 0.1 to 1000 ppm.

The brand can improve consumer acceptance of better-for-you products without relying on sugar, salt, or masking agents to enhance taste. The innovation also enables manufacturers to avoid sugar taxes and comply with HFSS regulations.

This innovation isn’t limited to beverages. As the use of GLP-1 drugs grows, consumers are increasingly seeking high-protein, low-sugar, low-salt alternatives across snacks and sweets, too. Dive into our Food Trends 2026 report to explore which other emerging trends, like GLP-1, will reshape the future of food.

Recommended Read

Trend 4: Eco-minded consumers are willing to pay more for sustainable sips

According to the 2024 survey, consumers are willing to pay 9.7% more for sustainably produced or sourced goods. This increasing environmental awareness among consumers is driving both global brands and local startups to adopt sustainable technologies throughout their processes.

For example, a startup called Prefer Coffee is addressing the water- and energy-intensive process of growing coffee beans by utilizing fermented agricultural byproducts, such as soy pulp, to recreate coffee-like aromas. Another startup, Origin by Ocean, is turning harmful seaweed into biodegradable materials. These are used in cosmetics, textiles, and packaging to replace petroleum-based ingredients.

Frank Welle and Roland Franz’s SiOx coating helps alcohol brands comply with PPWR

The popularity of glass bottles is gradually declining due to their energy-intensive production and the increased carbon emissions from their heavy transportation. Moreover, the European Union’s Packaging and Packaging Waste Regulation (PPWR) requires all packaging to be recyclable by 2030.

Polyethylene terephthalate (PET) refillable bottles have emerged as a PPWR-compliant solution. However, enhancing the barrier properties of these bottles is crucial for preserving the quality of premium spirits.

A study by Frank Welle and Roland Franz suggests that applying silicon oxide (SiOx) coatings to the interior surfaces of PET containers can be an effective solution. These micro-thin, glass-like layers significantly reduce the permeability of oxygen and carbon dioxide. Research indicates that SiOx coatings can improve the oxygen barrier performance of PET bottles by 37 times, effectively extending the shelf life of the beverage.

Author’s Note: Brands that use refill solutions can strengthen their sustainability image and communicate their environmental benefits to enhance consumer engagement. For example, Broken Heart Spirits started the “Bottle for Life” initiative to show that its fully recyclable refill pouches reduce CO₂ emissions by 95%. Meanwhile, they also show cost-saving incentives to boost sales.

PulPac AB’s dry molded fiber bottle is water-saving and cuts CO₂ emissions by 80%

Traditionally, manufacturing sustainable paper-based packaging, such as cartons and bottles, involved mixing cellulose fibers with a large amount of water to form a pulp slurry. This slurry was poured into molds, and the water was dried out. This was a slow and resource-heavy process.

PulPac AB overcame this industry challenge with its Dry Molded Fiber technology, in which fibers are air-laid and then pressed in a mold using heat and pressure. Because DMF avoids the soaking/drying cycle, it uses almost no water in molding and far less energy for drying. This speeds up production up to ten times, making it a viable alternative to single-use plastics in terms of scalability and cost.

DMF technology cuts CO₂ emissions by an estimated 80% compared to both traditional plastic bottle manufacturing and conventional wet fiber molding. The innovation also has the potential to replace traditional glass bottles for alcohol, helping alcohol brands comply with the PPWR regulation.

In 2022, PA Consulting and PulPac partnered with global companies like Diageo, Haleon, and Sanofi to launch the Bottle Collective, a sustainability initiative aimed at commercializing DMF technology. The bottle was first launched at the Time Out Food & Drink Festival (2024) through Diageo’s Bailey’s brand. 2,000 Baileys Minis (80 mL) were distributed among attendees for trial. The survey reported positive reactions.

- 86% felt that the fact it was made predominantly of paper was important and a positive move by the brand

- Comments on the quality and the look of the bottle were strong (scoring 8.1 out of 10).

Made of 90% paper, the Baileys bottle had a thin PET liner that acted as a moisture barrier to contain the liquid. The users did not need to separate the PET liner before disposing of it. It could be easily recycled in standard paper streams. The bottle was sealed with a foil lid that was heat-sealed onto it, instead of using a regular plastic cap.

To open the bottle, people simply peeled off or poked through the foil.

The Baileys DMF bottle has not yet been rolled out broadly to retail shelves. It is still in a pilot/feasibility stage, moving toward broader commercialization in the near future.

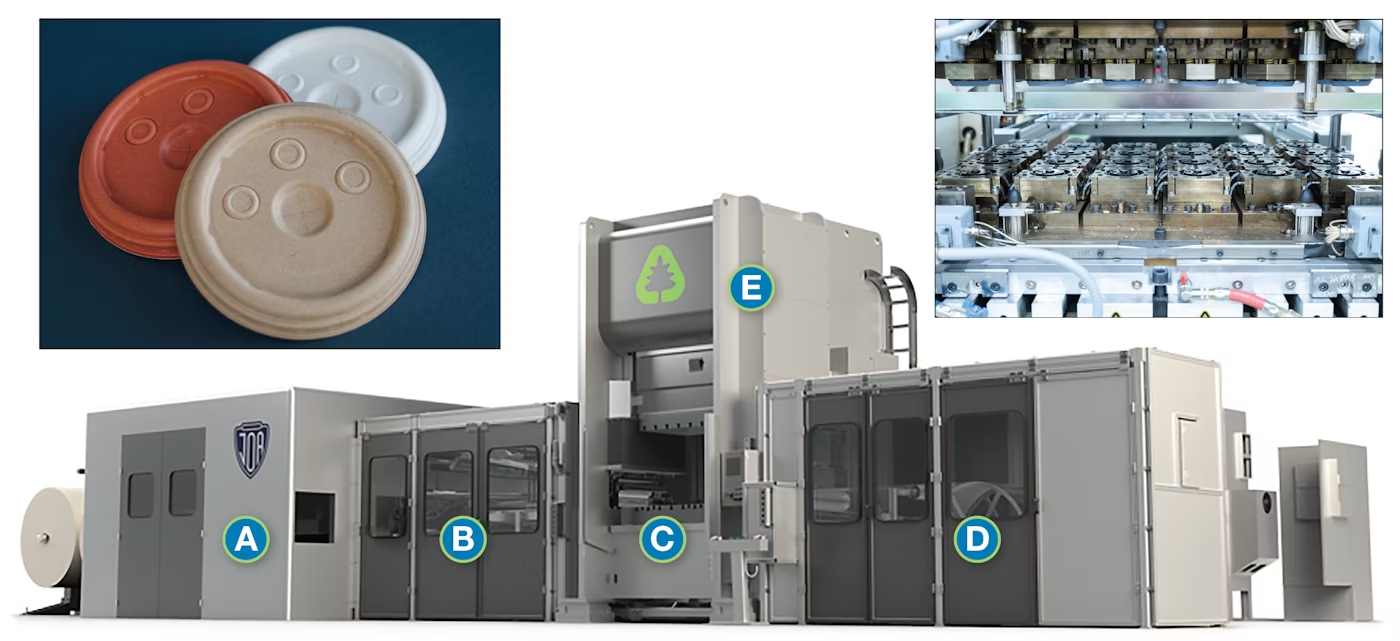

PulPac owns the intellectual property for DMF technology but does not manufacture the container-making machines itself. Instead, it licenses this technology to converters and earns a per-part royalty fee. These converters purchase machinery from manufacturers that PulPac designates as turnkey providers. One such provider is JOA. The first company to acquire a DMF system from JOA was Matrix Pack, a leading manufacturer of sustainable packaging solutions with production facilities in Greece, Bulgaria, the U.K., and Thailand.

Recommended Read

Trend 5: AI is tasting drinks and reading the facial expressions of consumers to understand preferences

Artificial Intelligence is reshaping how drinks are developed, produced, marketed, and delivered. AI is enhancing personalization by analyzing consumer data to identify emerging flavor trends and create tailored drink recipes for specific target demographics. Machine learning models can simulate and evaluate recipe variations much faster than physical lab tests. This enables R&D teams to accelerate their speed to market.

Recently, Japan’s Coedo Brewery partnered with IT company NEC to use AI to develop four unique craft beers. These beers targeted the characteristics and preferences of people in specific age groups: 20s, 30s, 40s, and 50s. The AI analyzed generational traits and preferences, translating them into beer characteristics such as taste, aroma, color, and bitterness. For instance, the 20s beer was designed to be pink with a fruity aroma and low bitterness. Meanwhile, the 50s beer featured a deep red color with malt and caramel notes.

Northeast Electric Power University taught machines to perceive beer flavors like humans

Northeast Electric Power University in China has developed a neurodynamic system model that enables machines to understand and visualize flavors in a manner similar to humans.

It uses a network with 12 channels that act like smell and taste sensors. The system operates in stages to simulate the way humans perceive flavors. First, it detects smell, then smell and taste together, and finally, the lingering taste. Two types of advanced sensors are used in the process, SA-402B (electronic tongue) and PEN3 (electronic nose).

AI analyzes collected data using machine learning techniques to identify key flavor characteristics. This helps create an accurate beer profile by focusing on the most relevant taste and aroma data. The refined data is then processed using a neurodynamic system model (KIII).

The approach reduces trial and error in product development by giving feedback that closely matches human perception.

Beijing Yanjing Brewery’s AI reads facial expressions to understand preferences

Traditional beer preference tests depended on people answering surveys, which can be subjective and biased. People may not always express their true feelings. The responses can vary based on mood, social setting, and external factors.

Therefore, Beijing Yanjing Brewery developed a technology that analyzes facial microexpressions using AI to understand consumer preferences. The deep learning system records nine types of expressions and compares them with surveys to identify patterns.

The AI model analyzes a 27-dimensional data matrix to ensure high accuracy and better quantify consumer preferences. This method eliminates the need for large in-person taste panels, making it cost-effective and remote-friendly.

Conclusion

One of the most promising areas of innovation is the wellness and moderation space. Brands are using functional ingredients such as cannabis, adaptogenic mushrooms, and proteins in beverages to enhance mood and support the nutritional needs of consumers. However, legalities come into play in this case. In Canada, where cannabis beverages are legal, brands like Molson Coors have already launched THC-infused drinks. The beverage giant is also exploring the U.S. market through its joint venture, Truss CBD USA. The venture has expanded its reach by offering CBD beverages in 17 states through direct-to-consumer online sales.

Although the category remains limited by regulatory uncertainty in the U.S., it is experiencing growing consumer demand. This indicates that if regulations liberalize, this could become the next big trend to capitalize on. Additionally, multicultural mindsets and adventurous palates of Gen Z are driving flavor fusions in the ready-to-drink segment.

You have already spotted the trends: NA drinks, personalized hydration, and AI-driven taste modeling. However, implementing them at scale is the real challenge. If you’re assessing which of these techs are worth the investment, we can help you dig into feasibility, IP coverage, and competitor activity to reduce the guesswork. Fill out the form below and talk to our experts today.

Talk To Our Experts Today

Fill out the form below