A farmer in western Victoria ploughed thousands of dollars’ worth of broccoli back into the field, suffering losses of around $40,000 to $50,000 per crop. The lack of soil moisture had made the broccoli too bitter to eat. “We’ve had crop after crop fail on us this year, especially over summer,” he said, echoing a crisis rippling through global food supply chains.

Major Agtech companies like Pairwise and Syngenta are using CRISPR gene editing and sucrose-enhancement technologies for enhancing flavor profiles of the crops. The industry is also seeing emerging technologies from cross-industry players like Sony and Fuji. These tech giants are repurposing their advanced imaging systems and AI algorithms to analyze crops in real-time, modifying tastes, detecting stress levels, and boosting yields.

For agricultural companies, this is the perfect moment to track these emerging technologies closely. The potential for collaboration with tech giants could drive new, innovative solutions, transforming both the industry and food production as a whole.

Get the Report in your Inbox

Fill the form to get access to the report

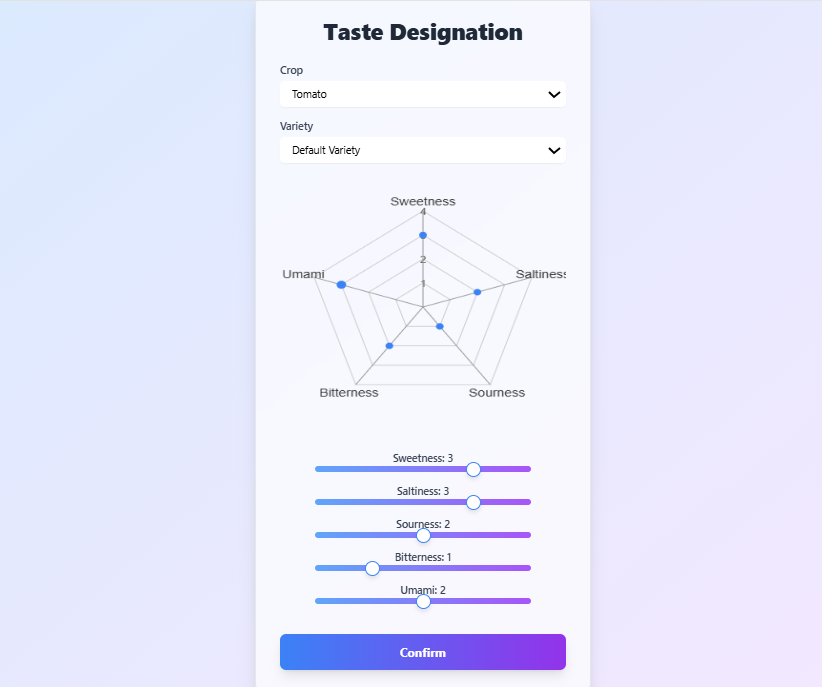

Sony’s smart farm tech lets you control the flavor of the crop

This smart farming system lets farmers customize the taste of crops by adjusting factors such as fertilizer, light, carbon dioxide, and water levels.

A user inputs the desired flavor strength of five basic tastes (umami, saltiness, sweetness, sourness, bitterness) through a taste specification screen app on a smartphone or tablet.

Based on this input, the system calculates the ideal cultivation environment data that will yield the desired taste and makes adjustments. For example:

- Nitrogen fertilizers (e.g., ammonium nitrate) influence umami taste

- Adjusting light and carbon dioxide to enhance photosynthesis helps in controlling sweetness

- Modifying potassium levels in the soil or culture medium may adjust sourness

- Controlling the levels of magnesium and calcium helps regulate bitterness

The system uses light and moisture sensors to monitor the environment and adjust these factors in real-time continuously. With increasing consumer interest in customized food products, this technology allows producers to grow crops with specific taste profiles, making them more appealing to targeted markets.

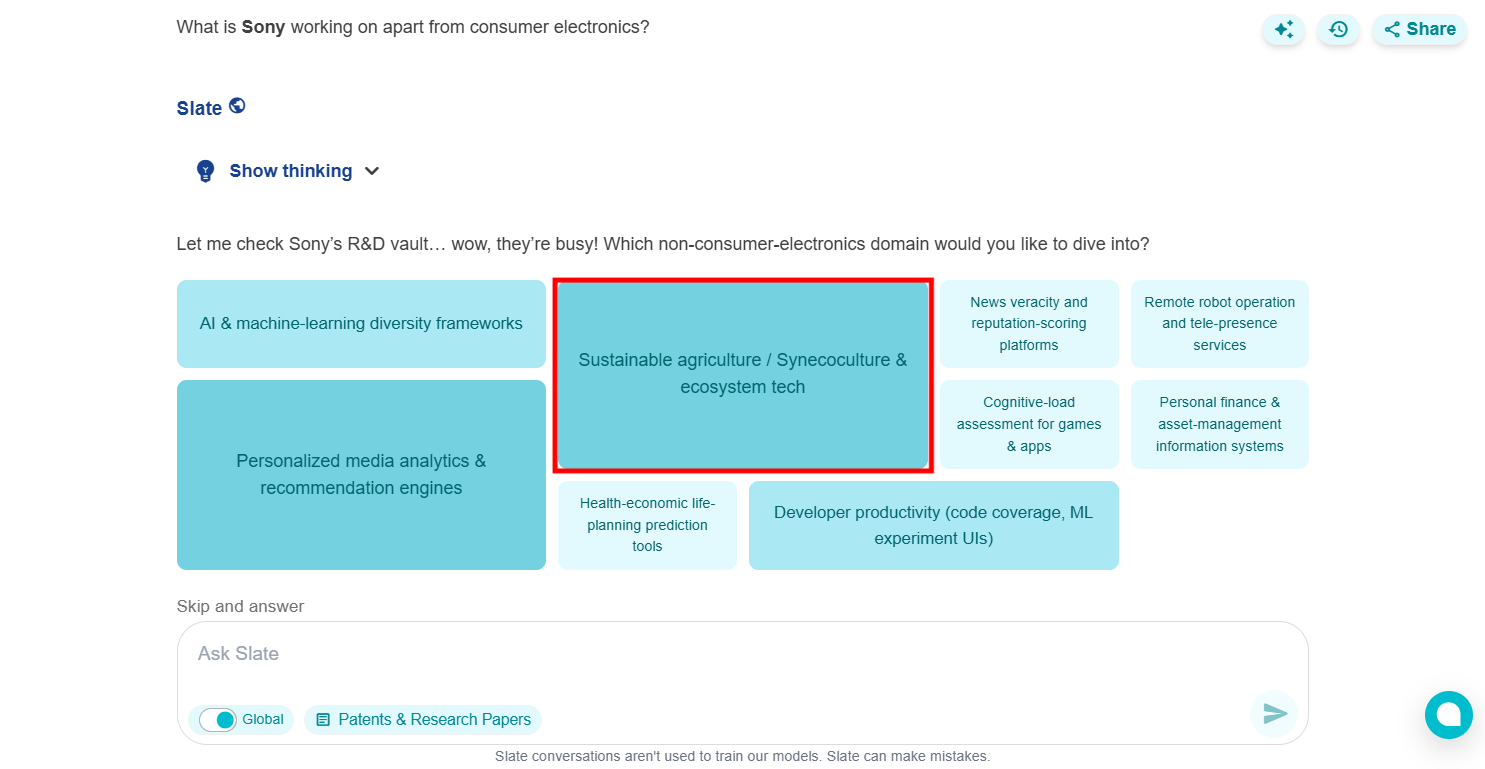

Sony is reinventing itself as a multifaceted tech company, whether that’s making gaming more immersive or making crops more flavorful.

Sony has been steadily expanding its patent activity in agriculture and smart farming. From soil-moisture mapping and predictive analytics for livestock to aerial crop monitoring, its innovations signal a strategic push into this space. With Slate, you can easily track such cross-industry patent filings, R&D activity, and product moves by competitors. Just ask: “What is Sony working on apart from consumer electronics?”

For Sony’s flavor-customization system to work, key nutrients like the nitrogen fertilizer that enhances umami taste must be effectively absorbed by the crop. Tracking this absorption has long been a challenge in farming. However, Fuji’s breakthrough innovation is making it visible and measurable in real time.

Fuji’s glowing fertilizer makes plant health visible

Traditional methods for assessing plant health rely heavily on manual inspection. This approach is labor-intensive and time-consuming. It often lacks the precision needed to detect early signs of stress, disease, or nutrient deficiencies across large crop fields.

Another issue is that soil bacteria must first break down commercial fertilizers for plants to absorb them. If not, fertilizers risk being washed away by rain or evaporating into the air. Studies suggest that more than half of the applied fertilizer is wasted due to runoff, evaporation, or inefficient absorption.

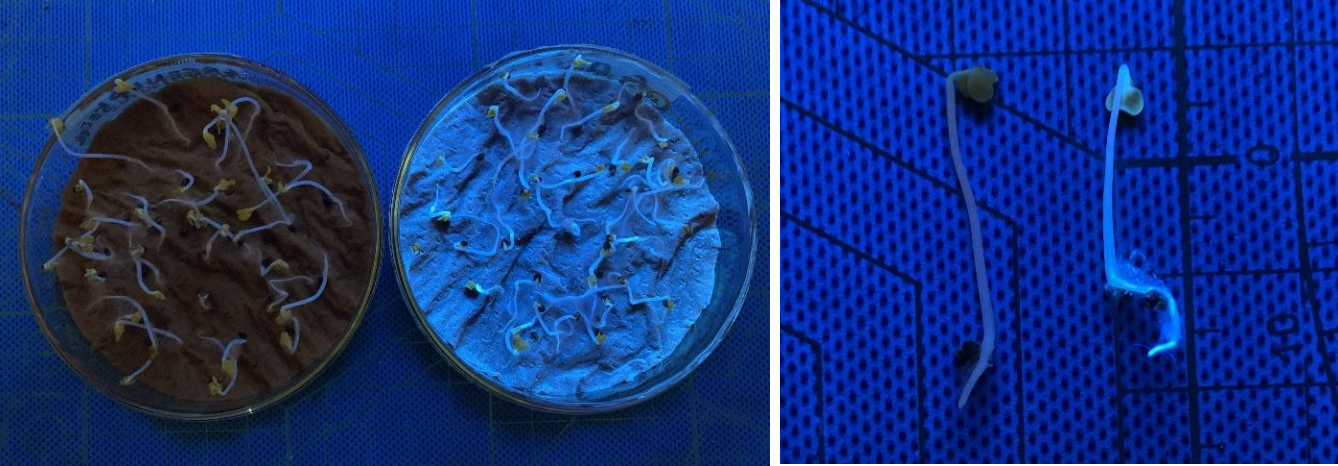

Fuji Pigment addresses these challenges with its fluorescent Quantum Dot Nano Fertilizer (QDNF). This fertilizer allows farmers to monitor plant health by observing fluorescent light emission from the plants under UV light. It comprises nitrogen-functionalized carbon quantum dots (CQDs), phosphorus compounds, and potassium salts. Once the plant absorbs the fertilizer through its roots or leaves, farmers can shine UV light through the plant. This allows for real-time, non-invasive health and nutrient checks.

The fluorescence behavior depends on two key factors:

- The type of nitrogen-containing CQDs used

- The health condition of the plant that absorbed them

For example, when a plant is under stress due to poor nutrition, sudden temperature fluctuations, or high humidity, it starts producing certain compounds like hydrogen peroxide and nitric oxide. These compounds bind with the CQDs and weaken their fluorescent glow. Such changes in the emitted light indicate stress or poor health in the plant. Farmers can take adequate measures at the early stage of stress to save agricultural crops.

Unlike traditional fertilizers, QDNFs are small enough to be absorbed without bacterial decomposition. It also serves as a sensor for pesticides, herbicides, and antibacterial residues. Its fluorescence fades upon reacting with harmful substances like diazinon, glyphosate, semicarbazide, and heavy metals. This makes it useful for detecting environmental and health hazards.

Commercial fertilizers in soil provide nutrition for both target crops and weeds. Since QNDF can be absorbed through leaves, farmers can spray it directly on crops. This ensures targeted fertilization while minimizing the risk of feeding weeds.

Gene mutation procedures, such as the particle gun method, may damage the plant. However, QDNF has the potential to deliver the required recombinant gene into plants without harming them. The illumination helps in tracking these recombinant genes.

In lab trials, Fuji’s R&D arm Green Science Alliance demonstrated that QDNF-fed Japanese Mustard Green plants grew the same as those given regular fertilizer. The treated plants emitted a visible glow under the UV light, confirming that the fluorescent nanoparticles were absorbed into the plant cells.

Analyst Comment:

GS Alliance is moving toward the commercialization of this innovation. In January 2025, GS Alliance president Ryohei Mori announced a collaboration with Tohoku University to study how quantum dots move and spread within plant tissues. The company has listed the Quantum Dot Nano Fertilizer on its product roster along with a brochure for interested buyers. This indicates Fuji’s intention to market the fertilizer, most likely in a B2B or pilot-project capacity.

Conclusion

While tech giants battle for market share in increasingly saturated consumer markets, a massive opportunity lies in the fields—literally. Farming has increasingly become data-driven through precision agriculture, drones, and IoT devices. In fact, 60% of agricultural companies are adopting AI technologies for farm management. Both Agtech companies and cross-industry players are identifying white spaces in the agriculture sector and creating innovative solutions to capitalize on this growth.

Disruptive agtech innovations include biopesticide nanoformulations for pest control, SNP mutation in the Pub17 gene for pathogen resistance, and a lightweight autonomous vehicle for large-scale harvesting. R&D and innovation heads in this sector must closely track these developments to identify potential collaboration and acquisition opportunities. Fill out the form to get a detailed breakdown of these techs.

Get the Report in your Inbox

Fill the form to get access to the report