At first glance, the connection between GLP-1 and ice cream is not obvious. High-protein ice cream itself is still an emerging category, and GLP-1 for ice cream is even newer. Many brands are now asking critical questions: How exactly is demand for ice creams changing? What does satiety-driven indulgence look like? And how are competitors responding?

Well, most players are taking the straightforward route: boosting protein content to deliver a stronger feeling of fullness. Meiji, however, took a different bet. The Japanese food company engineered an ice cream that naturally stimulates GLP-1 secretion, directly aligning with consumers’ weight-management goals.

Reviews of GLP-1 boosters consistently highlight that consumers love products that help them reduce appetite. And this sentiment is now driving innovation in the frozen dessert aisle. Industry leaders like TMICC have introduced bite-sized ice cream, Magnum Bon Bons, to entice shoppers who want to indulge while maintaining portion control.

Gut-friendly, sugar-free, and probiotic-rich—ice cream is shedding its guilty-pleasure labels to secure a place in the better-for-you category. This presents an opportunity for ice cream producers to start exploring functional ingredients in their R&D to resonate with future consumers.

Brands now cut sugar without the hassle of sourcing sugar alternatives

Around the world, over one in five people are actively choosing foods with less salt, sugar, and fat, and this trend is growing stronger in higher age groups. The push is equally severe from regulations too; the UK Food Standards Agency has imposed a ban on TV and online ads for foods high in fat, sugar, or salt (HFSS).

In the EU, front-of-pack labeling systems like Nutri-Score are becoming popular. Seven countries—Belgium, France, Spain, Switzerland, Germany, and the Netherlands—already use the Nutri-Score system. The color-coded labeling system ranks products from A (green, healthiest) to E (red, least healthy).

Although various FDA-approved sugar reduction alternatives exist in the market, reformulation with these solutions comes with its own set of challenges.

“If you are in the food industry, you know how tricky reformulation is. It becomes a more expensive product. You have issues with texture and with taste.”

— Sara de Pelsmaeker, health & wellbeing director at Puratos

Additionally, global regulations around additives, substitutes, and allergens create complexity for manufacturers, especially when launching products across multiple markets. Therefore, brands seek solutions to reduce sugar without the hassle of sourcing new ingredients or worrying about their regulatory approvals.

Buza Ice Cream cut 35% sugar in its ice cream using O’Taste’s micromilling technology, without relying on substitutes

O’taste’s patented technology micromills sugar to a microscopic size and suspends it in oil to cut sugar by upto 35% in ice cream.

The technology reduces the particle size to less than 15 μm, increasing the surface area exposed to taste receptors. This intensifies flavor even though the actual amount of sugar stays the same.

This process keeps the sugar inside fat globules to prevent it from dissolving into water. This helps avoid an icy texture when the ice cream melts and refreezes during transportation or in home freezers.

Together, these elements produce ice cream that stays smooth, creamy, and sweet with fewer calories and better stability.

The tech enabled Barely to market its Hazelnut & Cocoa Spread using claims “80% less sugar” and “no artificial sweeteners.”

Brands can also use this tech for salt reduction. It helps manufacturers to offer clean-label products, avoiding complex INS numbers that make the product unappealing.

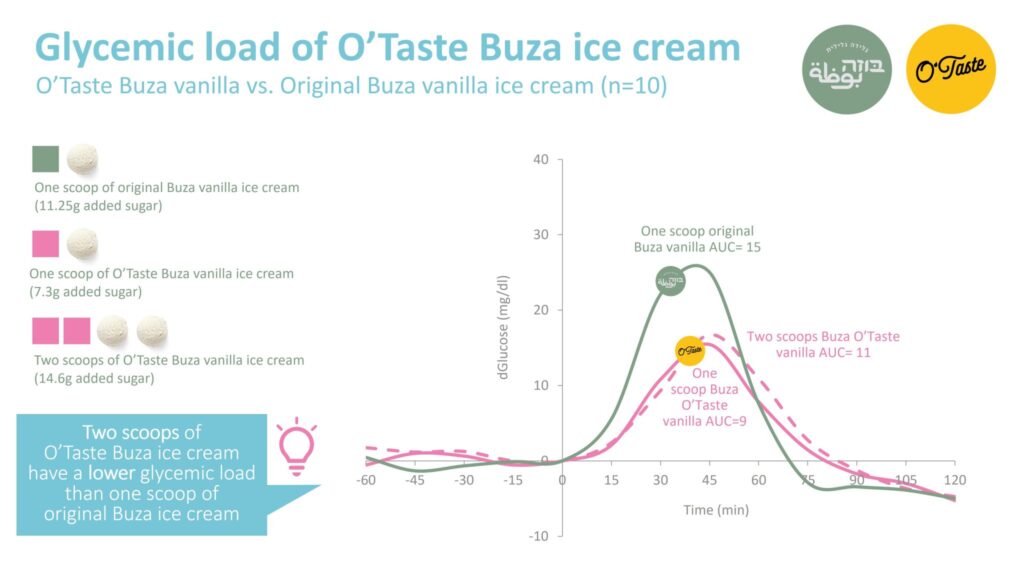

O’Taste is a subsidiary of Israeli company Omega 3 Galilee, known for its R&D in fatty acids and lipids. In 2024, Buza Ice Cream partnered with O’Taste to introduce a new vanilla variant developed using advanced micromilling technology. This collaboration enabled a 35% reduction in sugar while maintaining Buza’s signature taste and texture.

A comparative glycemic load study showed that one scoop of the O’Taste-enhanced vanilla ice cream triggers a significantly lower glycemic response than the original formulation. This means that the customer could enjoy a guilt-free indulgence without compromising the consumer experience.

Keeping up with such R&D activities is the key to placing timely bets, whether through internal innovation, partnerships, or acquisitions. Track them with our AI R&D intelligence platform Slate. Just ask, “What are the latest emerging trends and innovations in the ice cream sector?”

What are the latest emerging trends and innovations in the ice cream sector?

High-protein ice cream launches multiply as brands target growing GLP-1 users

The number of users taking GLP-1 medicines for weight management and diabetes increased from 21,000 in 2019 to 174,000 in 2023, marking a 700% rise. This signals that protein will remain one of the leading trends in food and beverage in 2026.

Various dairy-derived ingredients like micellar casein, beta-lactoglobulin, and milk oligosaccharides are being explored for creating GLP-1-friendly food. Users are lapping up protein-packed dairy products to support muscle retention during weight loss, with high-protein frozen desserts among the fastest-growing segments in the industry.

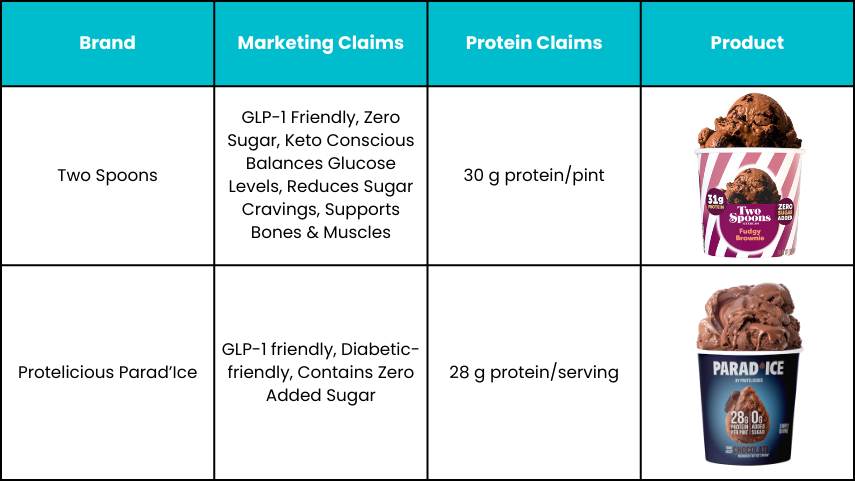

Researchers in Pakistan are exploring Okara, a low-cost by-product from tofu and soy milk production, to create scalable, high-protein functional ice creams. Commercial first-movers in this category include Two Spoons and Protelicious Parad’Ice.

Meiji’s high-protein ice cream composition promotes GLP-1 secretion

Meiji’s patent describes a nutritional composition designed to promote the secretion of GLP-1. The composition includes fermented milk, dietary fiber, and oligosaccharides. It may also optionally contain propionic acid bacteria, honey, and n-3 fatty acids.

In an animal study using Sprague-Dawley rats, the results showed that rats consuming the nutritional composition had significantly higher levels of GLP-1 in their plasma compared to the control group. This confirms the composition’s effectiveness in promoting GLP-1 secretion.

This nutritional composition can be used to manufacture a variety of products, including jelly, gel, mousse, ice cream, and milkshakes.

Brands that collaborate with Meiji or license this patent to produce high-protein ice cream can make marketing claims such as “promotes GLP-1 secretion,” “suppresses appetite,” and “improves blood sugar control.”

Formulators are exploring new ingredients to optimize the texture and stability of dairy-free, plant-based ice creams

Plant-based ice creams are an evolving market opportunity in Asia, where 32% of consumers in China say they are reducing their dairy intake.

“Consumers have moved from seeing plant-based foods as a niche ‘better-for-you’ substitute to viewing them as a full-fledged source of indulgence — expecting the same rich taste and creamy texture they once associated only with dairy.”

— Felipe Lino, co-founder of the Berlin-based food tech startup Nosh.bio

However, dairy milk and cream have a highly unique composition: the emulsification of butterfat, milk proteins, sugars, and water in just the right ratios gives traditional ice cream its luscious texture. Therefore, making a plant-based ice cream that rivals dairy in creaminess, taste, and behavior is a formidable challenge for the formulators.

Brands like Nestlé, Mengniu Dairy, and Nosh.bio are exploring faba beans, coconut milk, and fungi protein to develop vegan, dairy-free ice cream formulations. Such advancements in plant proteins are delivering better texture, reduced off-notes, and improved creaminess, making plant-based ice creams far closer to traditional dairy products.

Pulmuone’s formulation achieves 49% higher overrun in plant-based ice cream

Traditional dairy ice cream achieves good overrun because milk proteins and fats naturally support air bubbles. Plant-based ice creams often struggle with this, leading to rough textures, faster melting, and lower consumer acceptance.

Pulmuone overcomes this challenge with a specific blend of stabilizers and a carefully controlled multi-step process. For 100 parts coconut milk:

- 0.15–0.25 parts glycerin fatty acid ester

- 0.15–0.25 parts sodium CMC

- 0.14–0.22 parts guar gum

- 0.05–0.08 parts carrageenan

- 0.02–0.14 parts locust bean gum

This precise blend controls viscosity, elasticity, emulsification, ice crystal formation, and air bubble stability.

A two-stage homogenization and cooling the mixture for 8–12 hours at 0–5°C allows stabilizers to hydrate and form an air-holding matrix. Then, the mixture is placed in an overrun freezer for 15–20 minutes. During this process, air is injected until the overrun reaches up to 49%, which is unusually high for plant-based ice cream.

The result is a product that closely mimics dairy ice cream in smoothness, mouthfeel, melting behavior, and structural stability. It appeals to vegan and lactose-intolerant consumers.

In spring 2024, Pulmuone launched two flavors, chocolate brownie and strawberry raspberry, using its patent-pending air softening formulation.

Food scientists must eliminate the cold-chain vulnerability with clean-label stabilisers and emulsifiers

Recent studies show that common emulsifiers like carrageenan and sodium citrate may contribute to type 2 diabetes, obesity, and gut health issues. This raises urgent questions for manufacturers about ingredient choices and transparency, as consumers grow more aware of what they are eating. Soon, regulatory bodies may also face calls for tighter oversight on the use of these emulsifiers. Yet, eliminating them isn’t easy.

Ice cream formulations depend on emulsifiers and stabilizers to withstand temperature fluctuations. Any disruption in the cold chain can lead to ice crystal formation, freezer burn, and spoilage, damaging both texture and shelf life. Current substitutes like agar or gelatin often fail to replicate creaminess, leaving the product rigid and unappealing.

Formulators are exploring various clean-label stabilizers, such as arrowroot, chia, tara, and carrageenan hydrolysates, to improve melt resistance while meeting natural ingredient requirements.

| Stabiliser | Optimal dose | Overrun | Melting time | Key benefit | Clean-label notes |

| Arrowroot starch | 20–30 % repl | 87 % | 37 min | High overrun, low viscosity | Recognised kitchen ingredient |

| Tara gum | 0.2 % | ~50 % | ~30 min | Creamy, non-gummy texture | EU additive E417, but a consumer-friendly name |

| Chia mucilage | 0.5–1.0 % | ~60 % | ~25 min | Vegan nutrition plus stability | Whole-seed recognition |

| Carrageenan hydrolysate | 0.1–0.3 % (in blend) | <32 % | 27 min | Small ice crystals, freeze–thaw | Hydrolysed = “natural” claim potential |

Arrowroot and tara deliver mainstream creaminess, chia adds vegan nutrition, and carrageenan hydrolysates offer high-performance freeze–thaw stability.

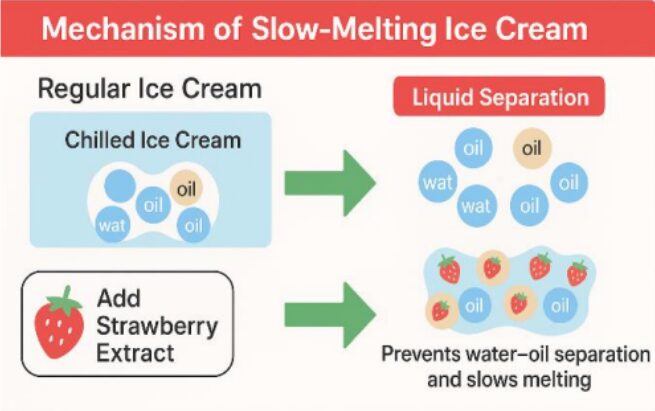

FullLife’s no-melt ice creams can withstand dripping for 2 hours at 25°C using strawberry extract

FullLife has solved this problem by adding strawberry polyphenols to the formulation. This suppresses syneresis and avoids fat-water separation in cream.

Adding strawberry extract also increases the elasticity of the tiny air bubbles in the ice cream, making it less likely to crumble. This means that ice cream that would generally begin to melt quickly can now maintain its shape for a while. Unlike agar or gelatin, strawberry extract does affect the texture of the ice cream. It also acted as a 100% natural stabilizer, potentially replacing synthetic gums.

With this approach, FullLife creates 360-degree 3D figures in ambient ice cream. In an experiment, an ice cream bar maintained its shape without dripping for 2 hours at 25°C.

What’s next in ice cream?

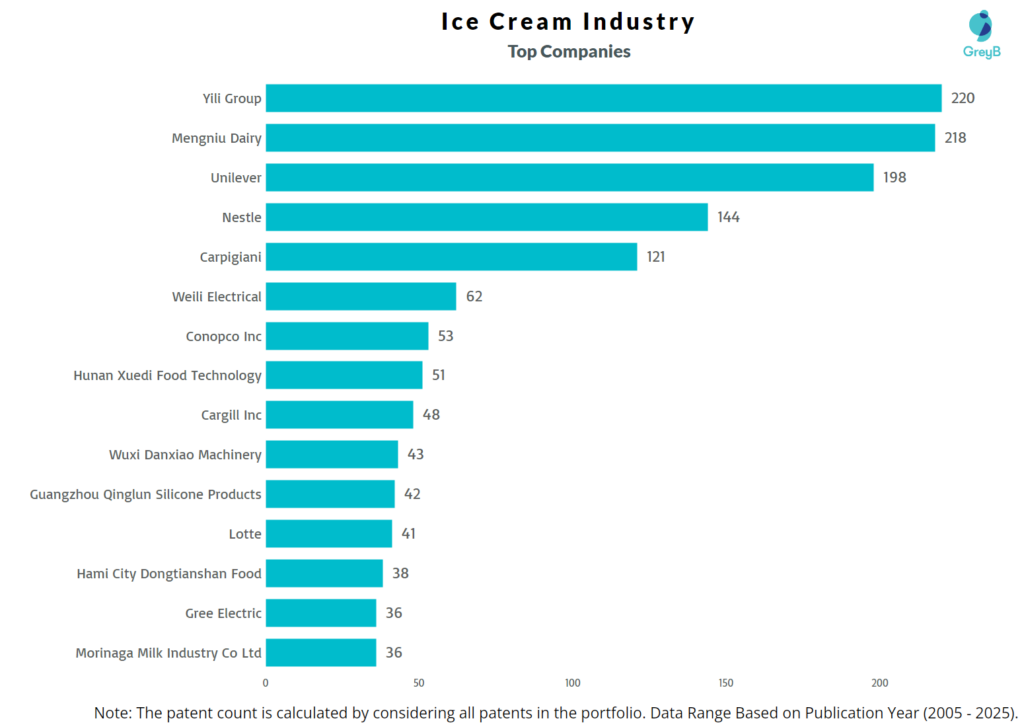

Geographical analysis reveals China holds over 40% of active global ice cream patents, with strong dominance by companies such as Yili and Mengniu. These companies are innovating in dairy processing, frozen dessert technology, and alternative formulations. Meanwhile, Western leaders such as Unilever and Nestlé focus on sustainability and automation. Europe and Japan lead in equipment and quality control.

Alcohol-infused ice cream is a small but high-growth segment. As cell-based dairy moves closer to market with the Opalia-Hoogwegt partnership, the animal-free ice cream category may see exponential growth. Fill out the form below to get a comprehensive view of these latest developments in the ice cream industry.