Xiaomi has been surprising the consumer electronics industry with its innovative and affordable products since its inception.

Founded in 2010, the startup quickly became a smartphone leader in the Chinese market. Its success was attributed to its innovative e-commerce tactics, which gave it a first-mover advantage and resulted in a rise in smartphone demand. The success party, however, didn’t last long as others started using the same tactics and rolled products with similar features and price ranges.

As a result, it lost its Chinese market share in smartphones to companies like Oppo, Vivo, and Huawei. Xiaomi soon realized that the Chinese smartphone market had saturated and to continue growing, it needs to expand globally into other markets.

Thus, Xiaomi kicked off its global expansion plan. Xiaomi’s journey over the years was filled with challenges and wasn’t smooth by any measure. But the company persevered and implemented new business strategies along the way. In this article, we have tried to narrate an account of all of these happenings, along with the ups and downs.

This is a long report (5000+ words). If you’d like to have a copy for future reference, you can get a PDF copy of this report delivered in your inbox by filling the form below:

The Global Expansion Plans of Xiaomi

Founded in 2010, Xiaomi – a privately owned electronics company – ventured into the smartphone market with the launch of Xiaomi 1S (released in August of 2011), selling over 300,000 pieces in that fiscal year.

In 2012, the sales numbers increased by 2400%, with the launch of Xiaomi 2S and 2A models, which were a significant improvement over its predecessors. With the addition of flagship models with improved features at stunningly low costs, the sales soared exponentially and by the end of 2013, Xiaomi was valued at $10 billion.

In 2014, Xiaomi took the smartphone world by storm by introducing flash online sales and a sleek marketing strategy. In India alone, they claimed to have sold 1 million smartphones by partnering with Indian e-commerce giant Flipkart.

These marketing tactics were a huge success, as Xiaomi sold over 61 million phones in 2014, whilst earning the third spot on the list of biggest smartphone makers on a global scale. By the end of 2014, Xiaomi was valued at 45 billion dollars making it the most valuable startup in the world.

And then the fall

Sales figures in 2015 took a hit as Xiaomi sold merely 70 million phones that year, which though was an improvement over the previous year’s numbers, fell short of their speculated sales target by 10 million.

The table for Xiaomi started turning further in the second quarter of 2015 when Huawei toppled it as a top smartphone vendor in the Chinese market. Looking back at the global sales data from the first quarter of 2015, the situation was imminent.

Let’s win back move

The then most valuable startup in the world knew well that global expansion was the key to achieving the top spot. If they wanted to soar higher in the consumer electronics market, they needed to expand beyond China, especially in the USA.

Before reaching its Zenith, Xiaomi had already forayed into other Asian markets including Singapore, Malaysia, Philippines, Indonesia, Hong Kong, Taiwan, and India, with plans to expand to other international markets as well.

On June 30th of 2015, Xiaomi made its first foray into the international market by expanding its operations to Brazil, with the launch of Redmi2.

Soon after, the second quarter reports of 2015 emerged, and in an attempt to chase the #1 spot, Xiaomi’s co-founder Bin Li went vocal about its global expansion plans encompassing the US as well.

Earlier, the company had slowed down its expansion plans in order to learn more about each market it entered. But that was no longer the case. Xiaomi entered the swift expansion mode. In November 2015, they expanded sales to the African continent: specifically Kenya, Nigeria, and South Africa.

Xiaomi even succeeded in penetrating the US and European markets via its online MI store albeit limiting sales to smartphone accessories and activity trackers. The move (limiting sales of handsets in the US market), though marketed as a precursor to gauge the reaction of consumers, had a big reason beneath it: The lack of patents.

Biggest Hurdle in Xiaomi’s Global Expansion Plan: Patent Lawsuits

In India, Xiaomi faced its first setback when the Delhi High Court issued a temporary order and blocked Xiaomi and its distributor Flipkart from importing, marketing, and selling smartphones that were infringing Ericsson’s eight patents. It was one of the biggest lawsuits that Xiaomi faced by a big company.

Similarly, in the US, it received a not-so-warm welcome with a patent lawsuit by Blue Spike over its upcoming devices MI 5 and MI 5 plus.

Even in its home country, China, Xiaomi couldn’t avoid patent lawsuits. On 26 January 2018, Yulong Computer Communications Technology (Shenzhen) Co. Ltd, owned by Coolpad Group, filed a lawsuit against Xiaomi for infringing Coolpad’s 3 patents related to smartphone app icon management and other UI elements.

Though Xiaomi yearned for global expansion, it lacked a strong patent portfolio. And to top it all, most of its products resembled other existing products. For instance, in 2014, Mashable called out MIUI (Xiaomi’s customized version of android) a blatant iOS ripoff.

These factors, in unison, made it imperative for Xiaomi to boost its patent portfolio by acquiring third-party patents—which was long anticipated. Broadcom, a semiconductor company based in the US, for instance, transferred 19 patents to Xiaomi, according to an assignment of the USPTO.

With all these factors in mind, and to find answers to few questions we had, we accessed the patent portfolio of Xiaomi, which has been filing patents since 2009, to see what the Chinese company is up to in terms of innovation.

A side note from the author: Just like this analysis of Xiaomi’s patent portfolio to understand their innovation trend, we also analyzed the patent portfolio of Twitter. If you’re curious about what insights Twitter’s portfolio holds, this article can help answer your questions.

How Many Patents Does Xiaomi Have?

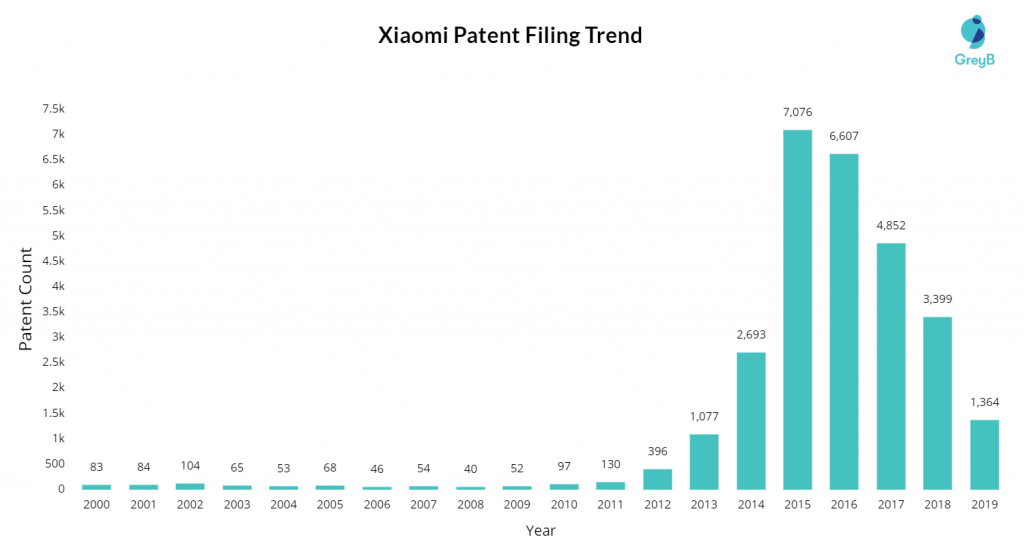

Xiaomi now has more than 28,000 patents in its portfolio globally (14,000+ unique patents per family) with more than 60% Chinese patents. 2015 and 2016 were the best years for Xiaomi in terms of patent filings, as the company saw the biggest growth in its portfolio in those two years. After that, the filing activity went down but the company’s numbers reflect it full well knows the value of patents.

Here’s a chart showing how Xiaomi’s patent filing grew over the course of the past few years:

Even though the earliest patent in Xiaomi’s portfolio dates back to 1995, Xiaomi filed its first patent in 2010.

Even though the earliest patent in Xiaomi’s portfolio dates back to 1995, Xiaomi filed its first patent in 2010.

All of the patents appearing in its portfolio before 2010, were the result of patent acquisitions and were mostly of US origin. We got curious and decided to dig deep to see the origin of these patents. Our analysis revealed that out of these 652 patents, Intel Corporation was the original owner of the 321 patents.

Between Xiaomi’s dream to penetrate the US and other global markets, the biggest roadblock was a thin patent portfolio. In-house patent filing alone was not a viable option as it might have taken another decade to build a considerable patent portfolio. Xiaomi’s strategy hence included patent acquisitions alongside in-house patent filing.

Xiaomi filed its first two patents on 27th Dec 2010. The third patent of 2010 in Xiaomi’s portfolio was originally filed by the China Academy of Telecommunication Technology. Other than 3 Chinese patents, Xiaomi also has 8 US patents dating back to 2010, which originally belonged to LSI Corporation (which was acquired by Avago Technologies in 2013, which later merged with Broadcom Corp).

In 2011, Xiaomi added 59 patents to its portfolio. Out of these 59, 14 patents belonged to Broadcom Corp (more details in a later section), and the rest were filed by Xiaomi itself.

With 396 patents, Xiaomi’s patent filing almost skyrocketed in 2012. Out of these 396, most of the patents are the result of their patent acquisition deals. Three of these patents were acquired from Broadcom Corp, and a few of them were filed by Xiaomi in China.

In 2013, Xiaomi’s patent filing kept a rising trend. The Chinese company filed 1077 patents that year. In 2014, Xiaomi beefed up its patent arsenal by adding 2693 patents, hundreds of which were a result of various patent acquisition deals (more details below in the acquisition section)

“We’re building our own portfolio of patents for defensive purposes, because you kind of have to have that. Think of it as a war chest of sorts. We’ve filed over 2,000 patents, which is actually a lot, and we’re acquiring patents”, Hugo Barra in one of his interviews with Bloomberg.

Which Countries, other than China, Xiaomi is has patents in?

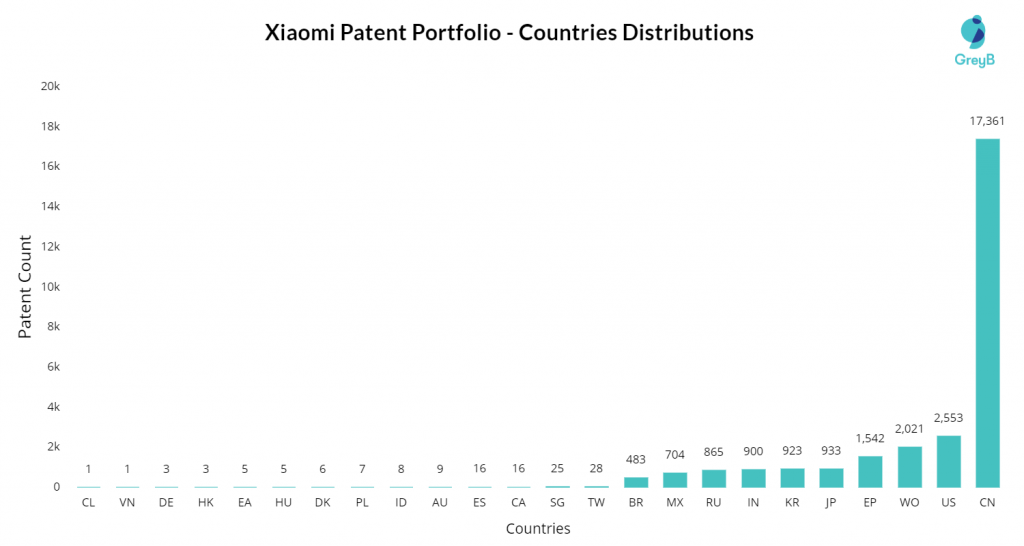

The chart below represents the geographical distribution of Xiaomi’s patent portfolio. These are the countries where Xiaomi has filed patents.

Xiaomi has a majority of its patents, 17361 of them, in China.

Xiaomi has a majority of its patents, 17361 of them, in China.

USA: After China, the USA is the top second country where Xiaomi has 2553 patents in its portfolio. The increase in the number of US patents is an indication of Xiaomi’s increased efforts to enter the US market.

Of course, we intend to gain space in those major markets, U.S. and Europe, but we’ll only try it when we feel stronger and more mature. – Hugo Barra

Europe with 1542 patents is the third country where Xiaomi holds the maximum of its patents, followed by Japan at the fourth spot with 933 patents. Interestingly, in our previous update of this article, Xiaomi only had 408 patents in Europe with no news about when they were planning to enter the market.

Xiaomi earlier was only selling accessories like headphones, fitness bands, and power banks since May 2015 in Europe using their retail stores. One could say that it was an attempt to build the market interest until they could get their hands on a stronger patent portfolio to finally make a big splash using their smartphones.

After 2 years of waiting, their portfolio grew stronger, and Xiaomi felt enough confidence to enter Europe’s market by placing their first step in Madrid, Spain. The company launched Mi Mix 2 and Mi A1 smartphones in November 2017 at an event held in Madrid.

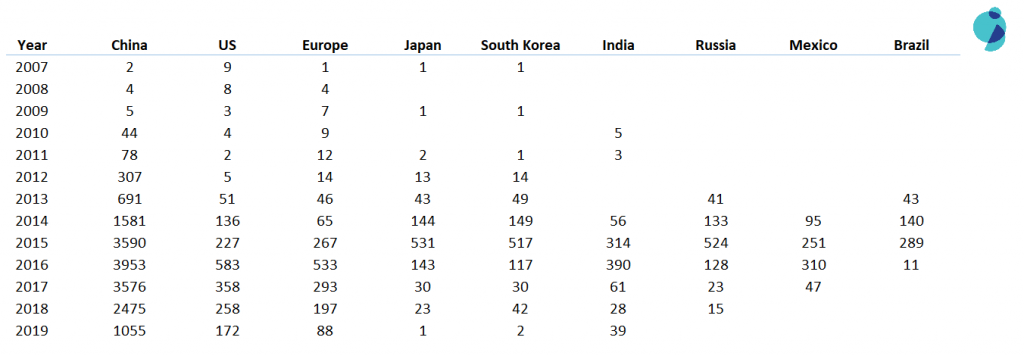

In December 2019, Xiaomi made its foray into the Japanese markets, by launching the Mi Note 10 series of smartphones. The company had pumped up its patent arsenal well in the last few years before entering the market. Back in 2016, Xiaomi had only 172 Japanese patents, while they have over 1000 patents now. Being a neighboring country, it makes sense for Xiaomi to secure its inventions there as Japan could prove a valuable market especially when Sony is struggling in its smartphone business.

Next on the list is South Korea, where consumers have an appetite for high-end smartphones at cheaper prices, which was vital for Xiaomi’s sales expansion outside the home country.

Interestingly, in an attempt to enter Korean markets, with 144 patents in its arsenal at that time, Xiaomi launched its first smartphone in South Korea on 4 January 2015 through mobile carrier KT Corporation. A couple of days later, on January 6, Xiaomi pulled back its smartphones from the Korean Market due to some legal matters, according to a report by the Korean Times. Speculations were that lack of Korean patents might be a strong reason beneath the matter.

Xiaomi took the lesson and further strengthened its Korean portfolio to make a foray into the market. Less than 6 months later, Xiaomi made a re-entry in South Korea by opening its first offline store in Seoul. At the moment, the company has 923 Korean patents in its arsenal.

India with 900 patents sits at the sixth spot followed by Russia at seventh with 785 patents. Xiaomi’s progress in India has been tremendous after the pullback that occurred with Ericsson’s lawsuit against them.

Since then, India has proved as an interesting market for Xiaomi. Xiaomi overtook Samsung in 2017 and became the top smartphone player in India. In the 2nd quarter of 2018 alone, they sold more than 10 Million devices, a number that was never achieved by any smartphone company before. Even in 2019, the company had the biggest market share in India followed by Samsung.

Following Xiaomi, other Chinese smartphones also made an entry to the Indian market and now Xiaomi has many competitors in India.

We have talked about how their portfolio has grown at a different pace in different countries. Now here’s a table to show you a full timeline of Xiaomi’s patent portfolio growth globally.

These are the top countries along with the patent count that the company received each year either by filing or acquisition.

Acquisitions – The Solution that helped Xiaomi Expand Beyond China

Acquisitions – The Solution that helped Xiaomi Expand Beyond China

Xiaomi wanted to establish a global presence by entering into multiple markets. But the foray was not easy. Most of the markets welcomed the company with patent infringement suits. Ericsson in India and Blue Spike in the US are a couple of examples.

Xiaomi realized that having an IP strategy in place would be the only way to establish a presence in foreign markets.

From 4702 patents in January 2016 to more than 28,000 patents currently (as of 20 March 2020), mostly by filing and partly by acquisitions, Xiaomi had significantly beefed up its portfolio. The company made some sizable patent acquisitions that would remove some thorns from its path towards global expansion.

Now let’s see have a look at the acquisitions that Xiaomi did to beef up its patent arsenal.

Technology Transfer Agreement with Leadcore Technologies

As Qualcomm was facing some inevitable complications in China, the technology transfer was a major negotiation to the situation for Xiaomi. This led Xiaomi to Leadcore Technologies, a subsidiary of Datang Telecom and a renowned smartphone chip manufacturer in China.

In November 2014, Leadcore Technologies entered into a $US16.8 Million deal with Beijing Sunggao Electronics, which according to TechWeb is a company controlled by Xiaomi. The purpose behind the deal was the acquisition of Leadcore’s core technology patents, according to a report by QQ.

The extracted patent portfolio of Xiaomi revealed the acquisition of 30 patents. These patents cover 4G and other chip-related technologies.

Ninebot acquired Segway with help of Xiaomi

In April 2015, Ninebot Inc., which claims itself as the first smart short transportation equipment operator in China, acquired Segway. As per a report by Bloomberg, the purchase also added 400 patents of Segway into the portfolio of Ninebot, parts of which are owned by Xiaomi.

In October 2015, Ninebot launched its first self-balancing scooter with which Xiaomi embarked on the field of transportation gadgets.

At the time of this acquisition, Ninebot was facing patent lawsuits filed by Segway and Inventist. Being an emerging startup in the self-balancing vehicle industry, their patent portfolio was just as weak as Xiaomi had in its early days.

This acquisition was an exceptional strategic move by Ninebot; with the financial help of Xiaomi, they acquired Segway and freed themselves from the lawsuit. Another benefit was, they now had enough patents in their arsenal to counter sue Inventist (The Company with the first patent of Hoverboard). You can read the entire patent battle of the Hoverboard industry and how a single patent just turned it upside down, from here.

Patent Assignment with Broadcom Corporation

In October 2015, Broadcom Corporation assigned 20 patents to Xiaomi. Most of the patents covered in the deal were of the wireless communication domain. Oblon was the law firm involved in this assignment.

Patent Licensing Deal with Qualcomm

Qualcomm, in December 2015, announced signing a patent licensing agreement with Xiaomi under which the latter will be paying royalties for its 3G and 4G smartphones. The deal helped Xiaomi include one out of two types of patents – related to wireless communication – in its arsenal. The other types of patents Xiaomi seeking are smartphone designs and features.

Qualcomm’s patent licensing business is intriguing. It earns more than $6 billion every year from its licensing revenue. What’s the secret? We have conducted a deeper analysis of Qualcomm’s patent portfolio as well which you can find from here.

Patent collaboration with Guangzhou Feimi Electronic Technology

In 2014, an investment subsidiary of Xiaomi, Tianjin Jinxing Investment, invested 4 million Yuan in Guangzhou Femini Electronic Technology which later filed 27 patents in collaboration with Xiaomi.

These patents also appeared in our extracted patent sets. From further analysis, we found the patent set disclosing technologies related to aircraft shock absorbers, remote control, design structures, and the like.

This patent collaboration adds weight to Xiaomi’s announcement of launching its first camera drone in 2016.

Patent Assignment deal with Foshan Gales Electrical Appliance Technology Co., Ltd.

Xiaomi already has a strong presence in providing smart home products, like air & water purifiers, smart webcams, and routers. In order to expand its intellectual property in this domain, Xiaomi has bought 104 patents from Foshan Gales Electrical Appliances. The company is a major manufacturer of home products like juicers, water dispensers, etc.

Patent acquisition deal of Xiaomi with Intel

In December 2016, News surfaced about a new deal between Xiaomi and Intel. Intel, which is highly active among US companies to penetrate Chinese Semiconductor markets earlier entered into a strategic partnership with Chinese semiconductor company Rockfit, while having a significant stake in Tsinghua Unigroup – the company that owns domestic chipmakers Spreadtrum and RDA.

The deal with Xiaomi was two-fold. According to a report by Digitimes, in December 2015, on the quest to land Xiaomi as a major client, Intel introduced a free chip deal. For every notebook processor Xiaomi purchased, Intel gave away a free tablet processor. This move was speculated to be an attempt to convince Xiaomi to consider ordering Intel-based smartphone solutions too.

Further to sweeten the relations between the two companies, the semiconductor giant transferred the ownership of 332 patents to Xiaomi. Most of these patents were originally assigned to Intel whereas some of these were owned by LSI, another semiconductor company, whose networking business was acquired by Intel from Avago(a Broadcom Corp company), who originally acquired LSI in 2013.

The Microsoft – Xiaomi Patent deal

To sell its handsets in the US market, Xiaomi signed a big deal with Microsoft to remove some obstacles from its US invasion plan in 2017.

The cross-licensing and patent transfer deal among the companies involved the acquisition of 1500 of Microsoft’s patents from its global portfolio, for which Xiaomi is believed to have paid $40 million.

Though the deal is official, Microsoft has yet not assigned the patents to Xiaomi yet. According to a report by Reuters, the patents belong to domains including voice communications, multimedia, and cloud computing.

The Absorption of Ruichuan IPR funds

In September 2016, News surfaced that Xiaomi quietly absorbed Ruichuan IPR funds, a government-backed Chinese patent-holding company.

The two-year-old government-sponsored company was known to be seeded with $50 billion to acquire patents that could be used in action against US competitors. Xiaomi was known to have a sizable stake in the company, which was attempting to build a massive arsenal for use in harassment litigation.

Though it remains unknown the kind or number of patents the company has, it would be an interesting addition to Xiaomi’s portfolio knowing its interest in global markets.

Xiaomi Bought Patents From Nokia

Since the inception of Xiaomi’s global expansion plan, it has entered into a lot of patent deals which helped it to build a strong patent war chest. Its patent portfolio, however, is still incomparable to competitors like Samsung. To bridge the gap, Xiaomi’s efforts are on and the patent deal with Nokia is an effort in that direction.

On July 5, 2017, Xiaomi entered into business cooperation and patent agreement deal with Nokia. The number of patents involved in the agreement or the price tag of the deal is still classified.

The below statement by Nokia gives the gist of the agreement:

“Under the business cooperation agreement, Nokia will provide network infrastructure equipment designed to deliver the high capacity, low power requirements expected by large web providers and data center operators. Nokia and Xiaomi will work together on optical transport solutions for datacenter interconnect, IP Routing based on Nokia’s newly announced FP4 network processor, and a data center fabric solution. In addition, the companies have agreed to explore opportunities for further cooperation, in areas such as Internet of Things, augmented and virtual reality, and artificial intelligence.”

Besides the patent acquisition deal, Nokia also revealed that the company has signed a cross-license deal with Xiaomi for cellular standard-essential patents.

Patent deal with Casio

On July 6, 2016, Xiaomi bought patents from Casio, one of the most famous Japanese consumer and commercial electronics manufacturers that has been in the industry for more than 60 years. Casio has a wide range of products from calculators to musical instruments. They were the first company to build an all-electric calculator.

The patent assignment deal consisted of 59 US patents the majority of which were covering camera and image processing technologies. This acquisition will surely add fuel to Xiaomi’s pursuit to enter the US smartphone market.

350 Patent Assignment From Phillips

In August 2018, Xiaomi acquired about 350 patents from Philips. IAM media reported on this assignment first mentioning the lack of Chinese patents in the deal. The assignment contained about 130 US patents and dozens of patents from other countries including Japan, India, South Korea, Russia, and Turkey.

We analyzed the patents involved in this transaction and almost all of the assets are related to displaying technologies, especially OLEDs. Analyzing their entire portfolio could reveal more insights about how this transaction will add value to their product line, other than strengthening their patent portfolio.

Want us to dig deeper? Reach out to us to get the full analysis conducted.

Licensing agreement with NTT Docomo for 5G Standard Essentials

In September 2018, Xiaomi entered into an agreement with Japanese Telecom giant NTT Docomo for a global license of their 5G standard-essential patents. This agreement helped Xiaomi in building a 5G compatible device, which most of the market leaders like Samsung, Apple were already working on.

Which telecom players are leading 5G research? Read our detailed coverage here to find out – 5G Research: What are the top companies up to?

Taking Over Meitu Hardware Business for Selfie-focused Smartphones

In November 2018, Xiaomi found itself in another deal, and perhaps it made things easier for both of the parties. Xiaomi took over the hardware business of Meitu, a smartphone company that also has expertise in the software field and particularly in image editing.

As per the deal, the future smartphone will have the Meitu brand but Xiaomi will be responsible for the whole production such as research and development, design, and sales. Meitu technology will help Xiaomi to make more selfie-focused smartphones and the Xiaomi brand will help Meitu to enter the bigger market.

MI CC9 Meitu Edition is the first smartphone developed from their collaboration.

The Innovation Game

Xiaomi, as a smartphone company, has seen both ups and downs. From selling 300,000 handsets a year to being the most valuable startup, to faltering sales – Xiaomi has seen it all.

Considering the tough competition other players like Huawei, Vivo, and Lenovo poses, Xiaomi realized that Global expansion is the only way to stay ahead. In order to achieve its goals, Xiaomi has an actionable IP strategy that might open doors to opportunities in the global market.

However, it is worth noting that despite having a sizable portfolio; Xiaomi has not made it to the top position. Why?

The problem with Xiaomi

Xiaomi’s rise was based on one simple advantage: It offered premium hardware and features at a fraction of the cost offered by Apple or Samsung. But as soon as other Chinese manufacturers entered the market offering premium specifications at low prices, the danger was imminent.

Further, the competitors didn’t just manufacture premium devices at low costs but added features that gave them an edge. For instance, Vivo offered curved screens, LeEco offered Exclusive content and Huawei offered dual-lens camera and fingerprint sensors in its handsets.

Xiaomi, on the other hand, despite having a sizable portfolio failed to take advantage and that serves as one reason beneath its small market share.

A strong portfolio, a huge fan base, hold over some pretty strong markets, what should Xiaomi do next to emerge as a leader?

Leverage its IP and Innovate. That is how Xiaomi could up its game.

Key takeaways from the analysis

Xiaomi’s expansion plan would be incomplete if it fails to get a hold over the US and European markets. The US, being an IP-intensive economy, would require some strong patents from Xiaomi to allow invasion in its markets.

Though Xiaomi had been taking steps toward reaching its goal, the road ahead isn’t really easy. Xiaomi might lose the low-cost advantage it offers if it has to start manufacturing its products in the US once it enters the market.

No matter what the case, US Expansion or not, Xiaomi won’t become a market leader if it continues to play on its low-cost advantage. Rather, it should take advantage of its beefed-up portfolio and bring innovative products to market that would ensure its success.

Innovation is the key.

Authored By: Nitin Balodi, Team Lead – Market Research and Shabaz Khan, Sr. Research Analyst – Market Research

Wondering what to read next? We love to perform portfolio analysis of companies to understand how they are innovating internally and how their IP strategy is changing over the years. Here’s one of our old cross-company analysis of the patent portfolio of Salesforce compared against Google, Microsoft, SAP, and Oracle. Click here to read.