If you lead a business and are responsible for its growth, you might always think: What’s next?

For more than 80% of businesses, this ‘what’s next?’ is primarily about futuristic technologies and is often preceded by the decision to make a shift.

But finding the answer to this three-word question is not a piece of cake.

With technology’s ever-changing nature, businesses have become much more dynamic. It is paramount to make calculated decisions at the right time to gain an advantage.

So, how does one make calculated decisions before making the transit? It is believed that the decision to transit to a particular technology could be a cakewalk if two questions could be accurately answered.

- When is the right time to shift to the next technology?

- Will this shift help in business growth?

To get answers to these questions, first, one needs to evaluate at what growth stage a technology is, and its impact on business.

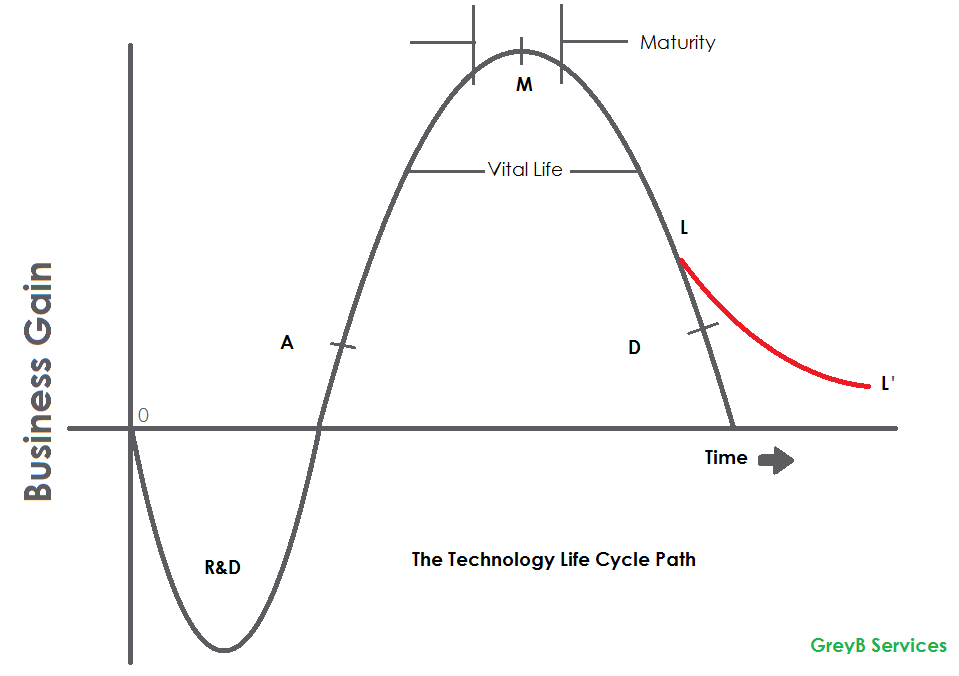

The Technology Life Cycle

How do you evaluate at what growth stage a technology is in?

The answer is simple if you know the technology’s lifecycle and the determining factors associated with each phase. Normally, there are four important stages in a technology’s lifecycle.

They are as follows:

- The research and development (R&D) phase (sometimes called the “bleeding edge”) is when input incomes are negative and the prospects of failure are high.

- The ascent phase is when out-of-pocket costs have been recovered, and the technology begins to gather strength by going beyond some Point A on the TLC (sometimes called the “leading edge”)

- The maturity phase is when the gain is high and stable, the region goes into saturation, marked by M, and

- After Point D, the decline (or decay phase) of reducing the technology’s fortunes and utility.

Understanding each phase and taking a decision accordingly could be the stepping stone to success. Instead of going into theory, let us show you how the shift could be done with the help of an example.

A note from the author: In one of my previous articles, I discussed how an R&D team could figure out many complex questions like what to develop next, which technology of yours is in the growth/declining phase, etc. You must read that article here for better understanding: Click here to read.

Apple – An Example of Exploiting the Technological Shift

Many companies have already taken advantage of rightly identifying the time to shift, and with their openness to upcoming/developing markets they were able to open new revenue streams.

Let’s take the example of a well-known tech giant Apple. It entered into the music player industry by identifying the need to shift. No need to mention how we see an iPod today and how much market is captured. Not only this, they entered into the watch domain to further expand the business.

How You Can Predict and Adapt to Technological Shifts

If you are thinking – it all makes sense but how to do it? I will end your quest and show it to you using the example of the smartwatch domain itself. How top watch companies could have identified the need to shift to smartwatch? Let’s see how patent-based insights help here –

Info graph-

![The great growling engine of change – Technology Shift [Image-2]](https://www.greyb.com/wp-content/uploads/2016/11/The-great-growling-engine-of-change-–-Technology-Shift-Image-2.png)

How Traditional Watch Manufacturers Failed to Identify Technological Shift

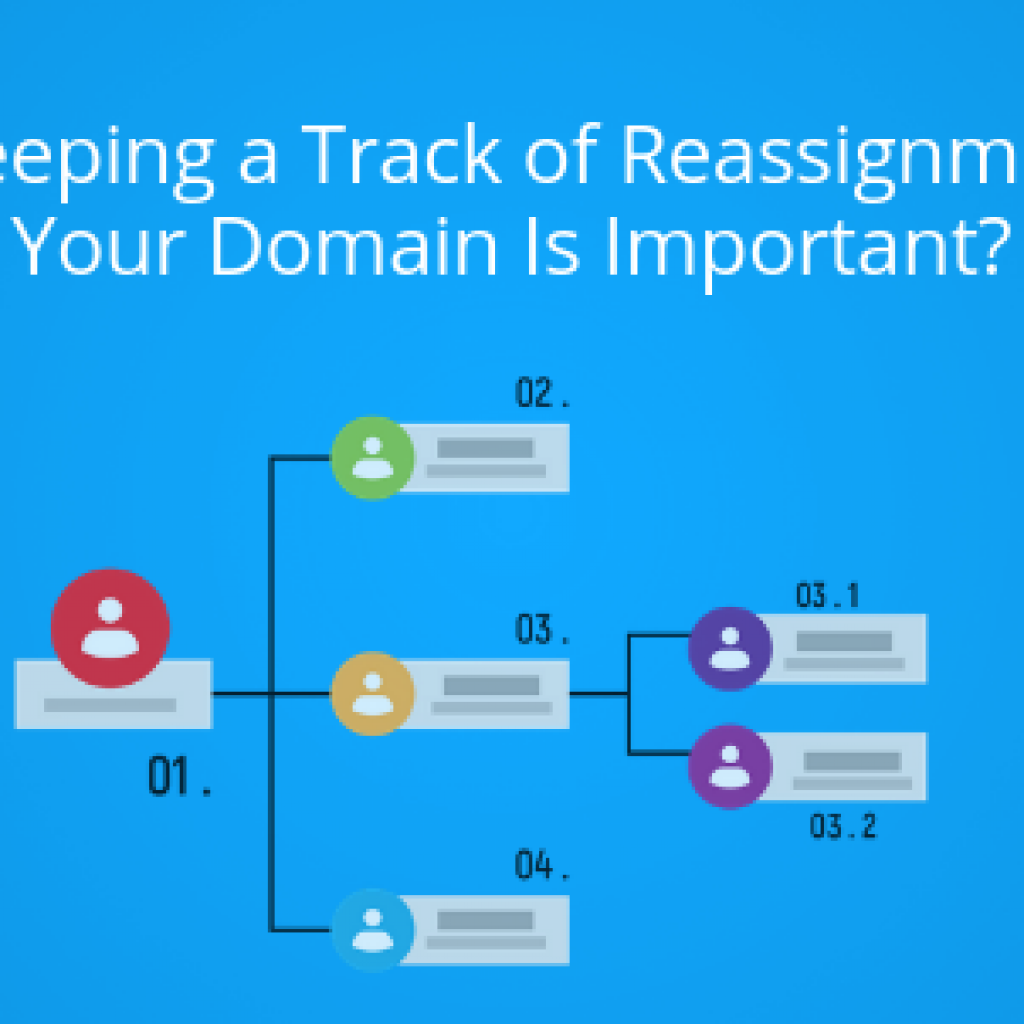

Patent filing in the watch domain is stagnant whereas in smartwatches the interest picked up around 2008 and research activity increased thereafter. This was the first clue that something is happening in the industry. Now let’s take a deeper look at it and identify which type of companies were giving early fire to it.

![The great growling engine of change – Technology Shift [Image-3]](https://www.greyb.com/wp-content/uploads/2016/11/The-great-growling-engine-of-change-–-Technology-Shift-Image-3.png)

Before 2012, the innovations in smartwatches were led by watch manufacturers like (Seiko, Casio, and Citizen). Post-2012, the companies of mobile phone domain such as LG, Oppo Mobile, etc. contributed to a great extent in the industry. Also, the big players of the mobile phone world such as Apple, Samsung, Motorola, have a presence in the SmartWatch market, but their patent activity is less.

It seems big names like Swatch, Tissot, Tag Heuer, etc. started late and are not having much presence in this area. Fossil, for example, started late and collaborated with Intel to penetrate the market. Had the shift been seen and explored by traditional watchmakers, they would have captured the market and had the pie eaten by non-watch makers.

What more could have solidified the indication to move towards the smartwatch market –

The huge potential of domain attracted many new companies to enter in the last 5 years. The contribution from these companies has risen exponentially. Keeping a watch on such an activity helps take decisions to enter into an unexplored domain. In smartwatch domain, an average of 30% rise is observed in the patent filings of new entrants. This is indicative of their rising interest.

![The great growling engine of change – Technology Shift [Image-4]](https://www.greyb.com/wp-content/uploads/2016/11/The-great-growling-engine-of-change-–-Technology-Shift-Image-4.png)

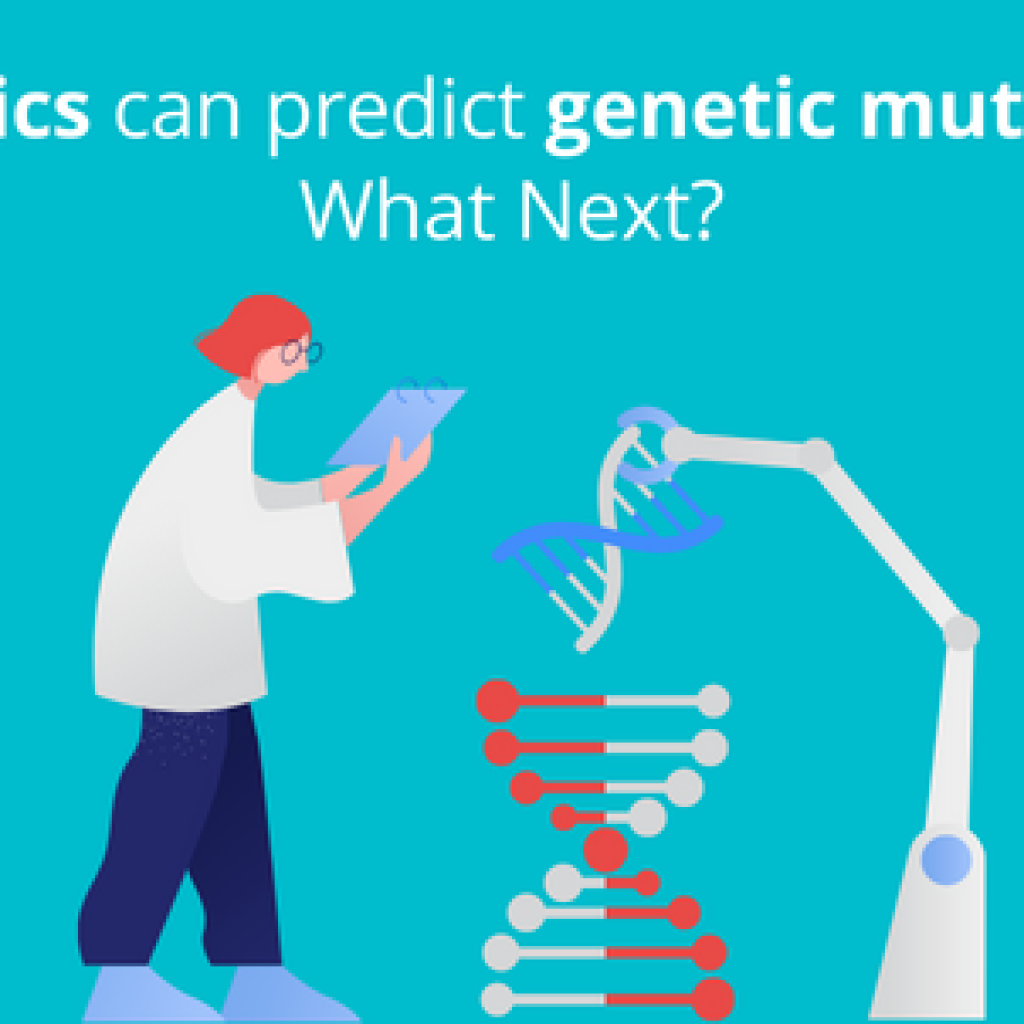

You might be thinking about what more can strengthen your decision about making the shift. It hints about business potential in this direction. One clear indication would be the expansion possibilities. In the smartwatch domain, it was observed from the research interest where different applications were covering a smartwatch.

See it yourself –

Most of the inventions focus on the integration of smartwatch with other devices. Some of the most important ones include health monitoring features, navigation, and automobile control. Also, the activity gives hints that smartwatch may emerge as an important pillar for smart homes for controlling various consumer electronic devices.

Also, you will find a handful of traditional watchmakers in the top 100 entrants of the smartwatch market.

![The great growling engine of change – Technology Shift [Image-6]](https://www.greyb.com/wp-content/uploads/2016/11/The-great-growling-engine-of-change-–-Technology-Shift-Image-6.png)

Apple alone sold 12 million to 13 million watches in one year. Now you can imagine where this number could go if I consider the sales figure for every smartwatch maker. Imagine what Swatch, Tissot, Tag Heuer Fossil could have earned had they been the early movers.

This is not the only case where companies lost a big bet, there are many. Ebooks, for example, affected the traditional book market. There are many technological areas where it still is time to take action. Smart switches, for example, holds the potential to disrupt the traditional switch industry, 3D printing, and many others.

Want to spot the next technological shift in your business? We are just one click away.

Authored by: Shikhar Sahni, AVP, Operations

P.S. We recently conducted a patent landscape analysis on nano photovoltaic cells. The study reveals disruptive innovations, leading countries and universities, future prospects and challenges, market coverage and more. You can download a copy of the study here.

![The great growling engine of change – Technology Shift [Image-5]](https://www.greyb.com/wp-content/uploads/2016/11/The-great-growling-engine-of-change-–-Technology-Shift-Image-5.png)