The global medical devices market will reportedly reach $799.67 billion by 2030. Medical device inventions are witnessing widespread adoption and saving lives every year. Studies show that 10% of people who use wearable health monitoring devices have improved their lifestyle due to the available data.

Post-pandemic consumers are more health-conscious and willing to spend more on healthcare devices and services. Statista forecasts that by 2027, over 332.8 million people will own a fitness-tracking device. Additionally, 28% of China’s population uses connected health devices, marking it the most active wearable market in the world.

Earlier, GreyB’s experts discussed mergers and acquisitions in the medical device domain and the role of patents in the process in an article published on IAM. This report details the top medical device companies and their recent activities to gain the upper hand in the industry.

These medical device companies are picked based on research and patent filing trends, narrowing the search to the 7 Medical device companies which are discussed below:

Top Medical Device Companies

1. Medtronic

Medtronic perhaps can be regarded as the top medical device company of the current times as the company revenue grew 2% in 2019 with $30.6 billion. Further, the company has been making many acquisitions to keep the upper hand in the medical device industry.

From its humble origins as a repair shop to a global medical technology leader, Medtronic is a global healthcare solutions company committed to improving people’s lives through its medical technologies, services, and solutions.

New Devices / Technology

Solitaire X

On May 1, 2019, Medtronic launched Solitaire X, a revascularization device intended to treat patients with acute ischemic stroke in the US. It is used to mechanically remove blood clots from blocked vessels in the brain, which helps restore blood flow in acute ischemic stroke patients with large vessel occlusion. Solitaire X is the company’s fourth-generation device. It is equipped with an optimized delivery system to enhance efficiency along with the technical features of its predecessor revascularisation devices.

TYRX envelope

As of October 28, 2019, according to the Cleveland Clinic, the TYRX envelope – a Medtronic product that stabilizes the implantable device placed in patients and reduces the infection rate in patients – is among the top medical innovations for 2020.

MARVEL 2

On November 11, 2019, Medtronic announced results from the MARVEL 2 (Micra Atrial Tracking Using A Ventricular Accelerometer) study showing that an investigational set of algorithms in the Micra™ Transcatheter Pacing System (TPS) significantly improves synchrony and cardiac function in patients with impaired electrical conduction between the chambers of the heart, called the atrioventricular (AV) block.

SonarMed™ Airway Monitoring System

In 2021, Medtronic launched the SonarMed™ airway monitoring system in the U.S. The system was the first to utilize acoustic technology to look for endotracheal tube (ETT) obstruction and verify position in real time. This technology enables clinicians to understand the crucial details to make more informed, life-saving patient decisions.

SmartGuard™ Technology

In 2023, Medtronic stated that the U.S. Food and Drug Administration (FDA) approved its MiniMed™ 780G system with the Guardian™ 4 monitor, requiring no finger sticks while using SmartGuard™ technology. The system uses the most advanced SmartGuard™ technology from the company to automatically give people with diabetes basal insulin and correction boluses every five minutes. Doing so makes it easier for them to stay healthy and avoid blood sugar highs and lows. (Source)(Source)

Infusion Set for Insulin Pumps

Medtronic launched the Medtronic Extended Infusion Set in the United States in 2022. This set is the first and only infusion set approved for up to seven days. A set change is usually needed every two to three days for an infusion set, the tube that brings insulin from an insulin pump to the body. Modern materials in the Medtronic Extended infusion set help keep insulin flowing and stable while reducing the loss of insulin stabilizer.

These materials also make the infusion set last twice as long. The Medtronic Extended infusion set has a unique design that uses its own technology. It has a new tubing connector that makes the insulin more stable physically and chemically, increases the trustworthiness of the infusion site’s performance, and lowers the risk of the infusion set becoming blocked. (Source)

NuVent™ Eustachian Tube Dilation Balloon

In 2022, Medtronic released the NuVent™ Eustachian tube dilation balloon. FDA has approved it to treat chronic, blocked Eustachian Tube Dysfunction. With the help of the NuVent™ balloon, surgeons can provide therapy in an outpatient or office setting. It has a flexible balloon section that enables customized implantation depending on the patient’s anatomy. (Source)

Mergers And Acquisitions

VisionSense

On April 10, 2018, Medtronic acquired VisionSense, an Israeli company that develops imaging and visualization tech for minimally invasive surgery. The deal was closed in $75 million, with $50 million in cash and a further $25 million in milestone payments. VisionSense is known for developing a 3D-HD camera that optically maps the surgical field.

Mazor

On September 21, 2018, Medtronic officially announced the acquisition of Mazor. Medtronic, back in May 2016, had made a big move by inking a major multi-phased strategic and equity investment agreement with Mazor Robotics. The cash deal is valued at about $1.64 billion, or $1.34 billion net of Medtronic’s existing stake in Mazor and cash acquired.

Considering Mazor’s revenue took a big hit in the second quarter due to lower pricing under its agreement with Medtronic, the acquisition is easily a win-win for both companies. It’s also no coincidence that the deal was unveiled just days before the annual North American Spine Society (NASS) meeting in Los Angeles.

AV Medical

On October 10, 2019, Medtronic acquired Israeli medical technology company AV Medical for 30 million USD. AV Medical said the acquisition will help our products reach more patients worldwide and improve the quality of the patient’s life during treatment and the physician’s work.

EPIX Therapeutics

On January 28, 2019, Medtronic got into a definitive agreement to buy EPIX Therapeutics, a medical device manufacturer of cardiac ablation systems that treats patients with cardiac arrhythmias, for an undisclosed amount. Following the completion of the acquisition, EPIX, apart from its flagship technology – DiamondTemp ablation system, will widen the Medtronic cardiac ablation portfolio with a range of tools to treat patients with cardiac arrhythmias.

Titan Spine

On May 10, 2019, Medtronic signed an agreement to acquire the US-based surface technology company Titan Spine, which designs and manufactures interbody fusion devices for the spine. Titan Spine’s product portfolio comprises a complete range of Endoskeleton interbody fusion devices featuring its nanoLOCK or surface technologies. The acquisition deal’s amount is undisclosed.

Klue

On December 18, 2019, Medtronic acquired Klue, a US-based digital health startup focused on behavior tracking and change. Medtronic did not disclose financial details of the transaction but said the deal would have no impact on its earnings per share in the fiscal year 2020. Medtronic plans to integrate Klue’s technology into its Personalized Closed Loop (PCL) insulin pump system.

EOFlow Co. Ltd.

In 2023, Medtronic announced its agreement with EOFlow Co. Ltd. Through this acquisition, Medtronic sought to bolster its presence in the healthcare technology sector, specifically diabetes management. The company acquired EOFlow, the manufacturer of the EOPatch® device, a tubeless, wearable, and fully disposable insulin delivery device. This strategic collaboration combined EOFlow’s innovative insulin delivery technology with Medtronic’s Meal Detection Technology™ algorithm and next-generation continuous glucose monitor (CGM). (Source)

Affera, Inc.

In 2022, Medtronic announced the acquisition of Affera, Inc. This strategic collaboration is congruent with Medtronic’s aim to enhance its position in the medical device industry, particularly in cardiac care. The acquisition expanded Medtronic’s cardiac ablation portfolio to include cutting-edge cardiac mapping and navigation technology, diagnostic catheters, and ablation solutions.

By integrating Affera’s innovative technologies, such as the Affera Prism-1™ cardiac mapping with navigation platform and Sphere-9™ cardiac diagnostic and ablation catheter, Medtronic provides advanced solutions for cardiac arrhythmias, addressing critical healthcare needs in this specialized medical domain. (Source)

Intersect ENT

In 2022, Medtronic acquired Intersect ENT, which bolstered its medical device portfolio in ear, nose, and throat care. This acquisition included innovative sinus procedure products such as PROPEL™ and SINUVA™ implants. Medtronic addressed chronic rhinosinusitis, a typical healthcare issue affecting millions annually, by enhancing patient outcomes and treatments using advanced medical devices. (Source)

Companion Medical

In 2020, Medtronic acquired Companion Medical to bolster its diabetic business. Companion Medical manufactures InPen, an FDA-cleared innovative insulin pen system. This acquisition has been a part of Medtronic’s strategy to enhance its diabetic device portfolio, focusing on optimizing multiple daily injection therapies and leveraging AI and data science. It provided diabetic patients with a device that helps improve dosing decisions, irrespective of insulin delivery methods. (Source)

Collaborations

Novo Nordisk

On September 17, 2019, Medtronic partnered with Novo Nordisk to offer digital solutions combining their respective technologies to help diabetic patients better manage their condition. Under this collaboration, Medtronic’s continuous glucose monitoring (CGM) devices, including the Guardian Connect system, will integrate insulin dosing data from smart insulin pens currently developed with Novo Nordisk.

Cydar Medical

In 2023, Medtronic entered a strategic collaboration with Cydar Medical to leverage Medtronic’s expertise in aortic care and Cydar’s cutting-edge artificial intelligence (AI) technology. Through this collaboration, Medtronic enhanced patient care and support for physicians in aortic treatments by utilizing Cydar’s AI-powered Maps technology. The program involved up to 40 global sites and demonstrates Medtronic’s commitment to advancing aortic care through innovative digital solutions for medical devices, ultimately improving patient treatment decisions and outcomes. (Source)

Cosmo Pharmaceuticals & NVIDIA

In 2023, Medtronic partnered with Cosmo Pharmaceuticals and NVIDIA to advance healthcare technology. They integrated NVIDIA’s AI into the GI Genius™ colonoscopy tool, enhancing polyp detection. This collaboration also introduced an Innovation Center for third-party developers to create and validate AI models, elevating the capabilities of the medical device. The goal was to improve colonoscopy accuracy and effectiveness in detecting colorectal cancer. (Source)

BMJ

In 2023, Medtronic partnered with BMJ to sponsor Copenhagen’s International Forum on Quality and Safety. This collaboration connected healthcare decision-makers and industry leaders to share expertise and innovation. Medtronic’s involvement demonstrated its commitment to advancing healthcare quality and safety, particularly in the medical device sector.

BioIntelliSense

In 2022, Medtronic partnered with BioIntelliSense, a leader in health monitoring tech. They gained exclusive U.S. distribution rights for the BioButton® wearable. This collaboration provided medical-grade continuous monitoring for general care patients in the hospital and post-discharge. It streamlined care delivery and automated workflows and enabled proactive clinical intervention, addressing staffing shortages in healthcare. (Source)

Patent Insights

Medtronic, being the top 3rd patent filer in the medical devices domain, has filed most of the patents in the sub-areas of Assistive Care Domain, Treatment Equipment, followed by Prosthetic Devices, Measuring Devices, and Telehealth.

Medtronic is advancing mainly in surgical treatment equipment. The company is also among the top three patent filers in the sub-area of Diagnosis and Imaging, Monitoring, and Tracking devices preceding Philips.

As for drug delivery devices, Medtronic comes at the second position in the overall tech area. However, it tops the patent filings in two sub-areas, i.e., Implantable Drug Delivery Devices and Infusion Pumps.

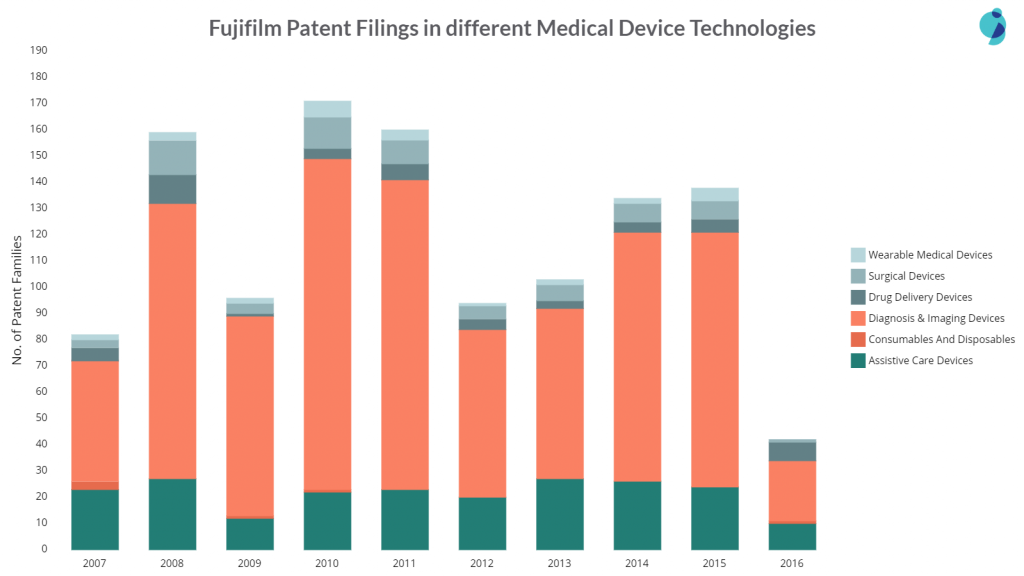

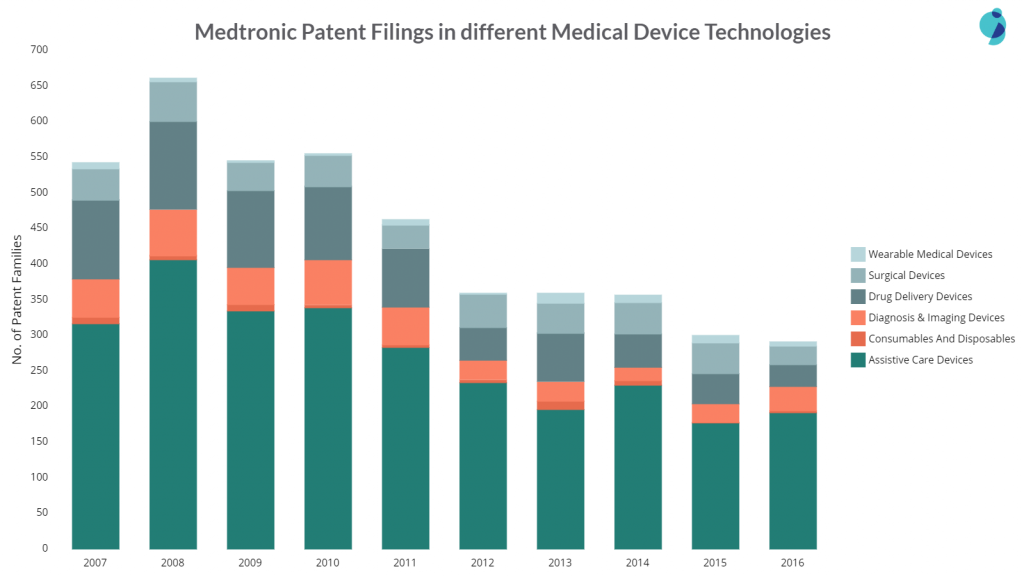

Below are the patent filings of the company in different tech clusters:

As the company actively utilizes acquisitions to grow its medical empire, its patent filing has decreased since 2010. In June 2014, Medtronic acquired Covidien, which stands in the 2nd position in the patent filing. Covidien’s acquisition has so far helped Medtronic accelerate therapy innovation, globalization, economic value, and, consequently, the growth of the company.

The company has already witnessed its first acquisition in 2020. And it’s been anticipated that the acquisition activity will increase further shortly.

2. Olympus Corporation

Olympus is mainly known for its endoscopic devices and can be regarded as the top medical device company of endoscopic devices. The company is committed to making people’s lives healthier, safer, and more fulfilling every day by crafting innovative optical and digital solutions in medical technologies, life sciences, industrial solutions, and cameras and audio products.

New Devices / Technology

PowerSpiral

On March 29, 2019, Olympus announced the launch of the Small Intestine Endoscopy System “PowerSpiral” in Europe and parts of Asia. It is the world’s first Endoscope with a Motorized Rotation System.

DSX1000 Microscope

On June 3, 2019, Olympus launched the DSX1000 digital microscope, which significantly improves users’ inspection workflow and enables the analysis speed. The Microscope Boasts a 20–7,000X Magnification range and the ability to switch between 6 observation methods instantly.

Ultra-thin lenses

On June 4, 2019, with the launch of its next-generation X Line objectives, Olympus delivered a breakthrough to life science microscopy – Ultra-thin lenses. Manufactured by a revolutionary polishing technique that enabled the objectives to boost numerical aperture, flatness, and chromatic correction simultaneously – it provides exceptional image quality for researchers and clinicians alike.

New rhino laryngoscopes

On September 13, 2019, Olympus Medical Systems Group introduced two new rhino laryngoscopes, ENF-VH2 and V4, with video capability to ensure better visualization during ENT procedures. ENT specialists can use laryngoscopes to identify lesions, while the devices can help speech-language pathologists examine the physiology of swallowing.

A new endoscopic surgery system

On October 25, 2019, Olympus announced it’s developing the “Digital transformation for surgery: advanced information-assisted endoscopic surgery system.” The system provides information that helps to ensure the safe and consistent quality of the surgery by translating the tacit knowledge of skilled physicians in the endoscopic surgery field into data through AI analysis. This developmental theme was selected as a subsidized project by the Japan Agency for Medical Research and Development (AMED). It aims for its practical application from 2024 onward.

OmniScan® X3

On October 30, 2019, Olympus launched the OmniScan® X3 Flaw Detector to redefine the Standard for Phased Array. The OmniScan X3 flaw detector elevates the standard with innovations that improve the inspection workflow.

SLIDEVIEW VS200

On October 31, 2019, Olympus launched the new SLIDEVIEW VS200 Research Slide Scanner, which offers easy-to-operate high-resolution data acquisition. This scanner improves the quality and efficiency of life science research and drug discovery.

NoviSight 3D Cell

On September 10, 2018, Olympus announced the US-only launch of a new 3D cell analysis technology, NoviSight 3D Cell Analysis Software, with the ability to accurately analyze 3D cell cultures down to the nuclei, improving the reliability and accuracy of the entire drug discovery process from compound selection to animal experimentation and clinical trials in humans.

EZ Shot 3 Plus

On September 14, 2018, Olympus introduced the EZ Shot 3 Plus 25 G EUS Needle with enhanced maneuverability for uncompromised access to any lesion and consistent performance to potentially reduce procedural costs and procedure time.

SpinSR10

On November 1, 2018, Olympus launched a high-sensitivity model of the SpinSR10 Super-Resolution Imaging System that delivers clearer images and three times the brightness of the standard model.

New Endoscopy System and Compatible Endoscopes

Olympus’ new EVIS X1 endoscopy system and two compatible gastrointestinal endoscopes- the GIF-1100 gastrointestinal videoscope and the CF-HQ1100DL/I colonovideoscope, got FDA clearance in 2023. The CF-HQ1100DL/I colonovideoscope is used for the lower digestive tract, including the anus, rectum, sigmoid colon, colon, and ileocecal valve.

The GIF-1100 gastrointestinal videoscope is used in the upper digestive tract, containing the esophagus, stomach, and duodenum. (Source)

THUNDERBEAT Energy Device for Open Surgery

In 2022, Olympus launched the THUNDERBEAT™ Open Fine Jaw Type X, a surgical energy device for open surgery. The THUNDERBEAT device has a new thermal shield to make treatments safer. They planned to sell the product in October 2022 in Europe, the United States, and South Korea but moved it to other countries and regions.

This device is part of Olympus’ THUNDERBEAT line of hybrid energy devices that use both ultrasonic and bipolar energy simultaneously to handle tissue and perform cutting and dissecting without bleeding during open and laparoscopic surgery. (Source)

POWERSEAL Advanced Bipolar Surgical Energy Devices

In 2021, Olympus Corporation launched the first devices in the new POWERSEAL™ family of advanced bipolar surgical energy solutions. For advanced bipolar surgical energy devices, the POWERSEAL 5mm Curved Jaw Tissue Sealer and Divider Double-Action devices match the highest clinical performance standards.

Olympus released the POWERSEAL devices, a line of advanced bipolar surgical energy devices with various uses. They are part of a large and unique surgical energy suite, including the SONICBEAT™ ultrasonic dissectors and the THUNDERBEAT™ hybrid energy devices. (Source)

SIF-H190

In 2021, Olympus Corporation released the SIF-H190 single balloon enteroscope in Japan on February 17, 2021, and at the end of February 2021 in Europe. This enteroscope has functionalities that allow the user to move farther into the small intestine while maintaining a smoother flow.

This product is a single balloon enteroscope that can help diagnose and treat illnesses of the small intestine, such as cryptic gastrointestinal bleeding. Its primary application is in the diagnosis of gastrointestinal bleeding. (Source)

Mergers And Acquisitions

Cybersonics

On April 10, 2018, Olympus inked a deal to acquire lithotripsy system design and production technology from Cybersonics for an undisclosed amount. With the acquisition, Olympus’ dual-action lithotripsy systems ShockPulse-SE and CyberWand, which Cybersonics previously manufactured, will now be serviced and manufactured by the Olympus Surgical Technologies America subsidiary.

Taewoong Medical Co. Ltd.

In 2023, Olympus Corporation acquired Taewoong Medical Co. Ltd., a Korean medical device manufacturer specializing in gastrointestinal (GI) metallic stents. This acquisition bolstered Olympus’s GI EndoTherapy product portfolio and improved its ability to provide comprehensive solutions for improved patient outcomes in the medical device field. (Source)

Odin Vision

In 2022, Olympus Corporation collaborated with London-based Odin Vision, a cloud-AI endoscopy company, to strengthen its medical device portfolio, specifically in endoscopy. Odin Vision brought advanced CAD solutions and cloud-enabled applications to enhance healthcare quality, patient outcomes, and provider efficiency.

This partnership aligns with Olympus’s goal of innovation in endoscopy, driven by Odin Vision’s AI and cloud-based expertise developed in collaboration with clinicians from UCL. It showcases Olympus’s commitment to cutting-edge technology in healthcare. (Source)

Medi-Tate Ltd.

In 2021, Olympus Corporation announced its acquisition of the Israeli medical device company Medi-Tate Ltd. Olympus strengthened its presence in medical devices through this strategic collaboration, specifically in delivering in-office treatment for benign prostatic hyperplasia (BPH). Through this acquisition, Olympus expanded its business portfolio and solidified its position as a leader in urological devices. This move allows Olympus to enhance its capabilities in providing innovative medical solutions and further contribute to advancements in urology and medical device technology. (Source)

Veran Medical Technologies, Inc.

In 2020, Olympus Corporation finalized the acquisition of Veran Medical Technologies, Inc. (VMT). This strategic collaboration bolstered Olympus’ presence in medical devices, particularly in interventional pulmonology. By acquiring VMT, Olympus gained access to its global sales network, marketing capabilities, manufacturing expertise, research and development resources, and other functions. This acquisition is part of Olympus’ broader strategy to expand and enhance its respiratory product portfolio, emphasizing its commitment to advancing medical device technology for respiratory care and interventional pulmonology procedures. (Source)

Collaborations

University of Southern California

On January 9, 2019, The University of Southern California and Olympus announced their first-ever co-development partnership. The USC-Olympus Innovation Partnership in Multiscale Bioimaging has the goal of advancing multiscale research into cancer prevention, diagnosis, and treatment through precision medicine.

Jikei University School of Medicine

On March 8, 2019, Olympus collaborated with Jikei University School of Medicine to develop AI-assisted sperm selection to reduce the workload in IntraCytoplasmic Sperm Injection (ICSI). This research will make it easier for embryologists to select good sperm.

RIKEN Brain Science Institute

On January 17, 2018, Olympus announced the joint development with the RIKEN Brain Science Institute of the FV30-AC25W and FV30-AC10SV objectives for multiphoton laser microscopes featuring automatic spherical aberration compensation for Neuroscience Research.

EndoClot® Plus, Inc.

In 2022, Olympus Corporation formed an exclusive distribution agreement with EndoClot® Plus, Inc. (EPI) to expand their partnership to cover the Middle East, Europe, and Africa (EMEA). This collaboration leveraged EPI’s hemostasis technologies to enhance Olympus’ offerings in gastrointestinal endoscopy. It also strengthened their support for endoscopic procedures like polyp and early-stage cancer removal. (Source)

AIG & Indian academic societies

In 2020, Olympus collaborated with AIG and Indian academic societies to support endoscopy training in India, conducting over 150 training sessions annually and offering quick medical equipment repair services. This partnership advanced endoscopist development and enhanced regional healthcare, showcasing Olympus’ commitment to medical device technology and healthcare support in India. (Source)

Patent Insights

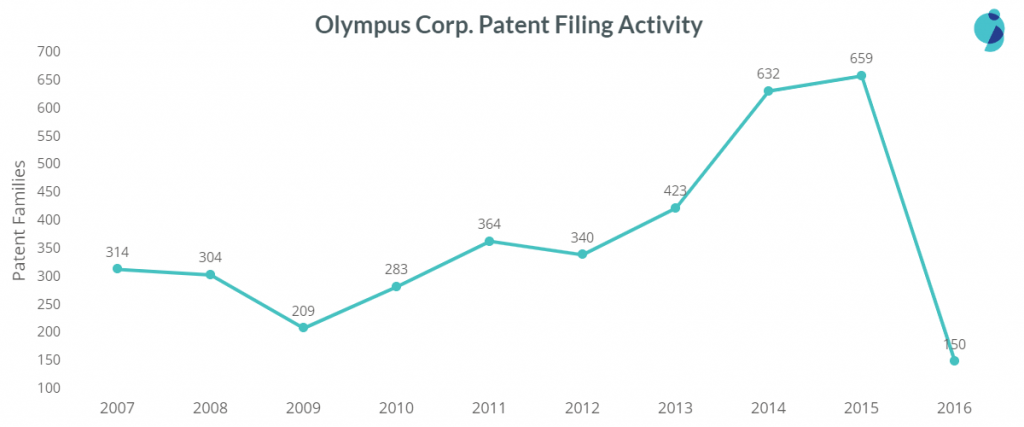

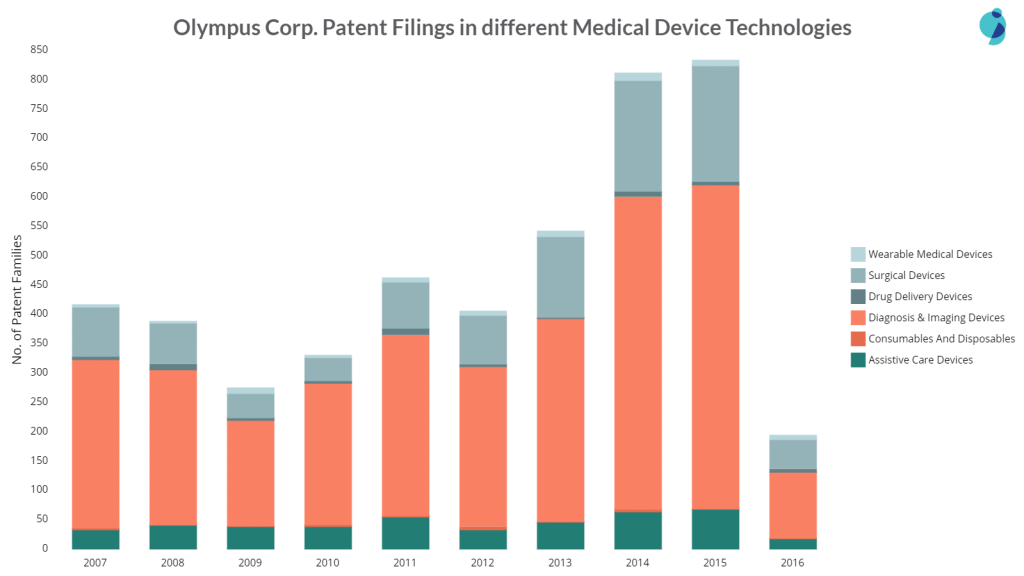

Olympus is the leader in patent filings in the entire Medical Devices domain. The company is entirely focused on Endoscopic Devices i.e., almost all of its patent filings in the Medical Devices space are concentrated in this cluster only. Moreover, it has almost 4.5 times the number of patents when compared to second-placed Fujifilm (in this space). Interestingly, in 2014 & 2015, Olympus filed twice as many patents as it had filed in 2007.

In the year 2014-15, Olympus not just filed patents in its area of expertise i.e. Diagnosis & Imaging Devices but all of medical device technology clusters.

The chart below will help you understand the company’s patent filings in different technology clusters over the years.

3. Philips

Besides its core business, Philips also has a vast presence in the medical device industry. Philips Healthcare provides healthcare solutions for diagnostics, treatment, and preventive care. The company has now focused its research and development efforts on developing new approaches in radiology, cardiology, oncology, decision support, home health, respiratory, and other critical areas.

New Devices / Technology

IntelliSpace Discovery 3.0

On November 22, 2018, Royal Philips introduced a comprehensive and open platform called IntelliSpace Discovery 3.0 to enable the development of artificial intelligence assets and their deployment in radiology to help teams conduct clinical and translational research. Launched ahead of the 2018 Radiological Society of North America (RSNA), the open platform, powered by Philips HealthSuite, enables radiologists to have thorough data analytics in medical imaging.

Zenition imaging platform

On February 19, 2019, Royal Philips unveiled its new Zenition mobile C-arm imaging platform, which provides live image guidance during surgical procedures. Based on X-ray technology, Zenition features image capture and processing capabilities similar to the company’s image-guided therapy platform, Azurion, introduced in 2017. In addition, the Zenition mobile C-arm can be moved easily between operating rooms. It is simple to position around the patient and allows intuitive operability.

Philips IntelliSite Pathology Solution

The Philips IntelliSite Pathology Solution is the first. Currently, it is the only digital pathology solution marketed for primary diagnostic use in the U.S. It aids pathologists in the review and interpretation of digital images of surgical pathology slides through an automated digital pathology image creation, viewing, and management system.

AI-powered Integrated Diagnostic

At the ECR (European Congress of Radiology) meeting 2023, Philips showed off its radiology range of intelligent connected imaging systems and vendor-neutral integrated radiology workflow solutions. Phillips showed off its newest MR, CT, diagnostic X-ray, and ultrasound innovations that connect radiology, cardiology, pathology, and oncology. One is MR SmartSpeed, a next-generation imaging technology that uses Philips’ cutting-edge speed engine and AI reconstruction technology to improve speed and image quality. (Source)

NightBalance

On September 11, 2019, Philips launched NightBalance, a therapy option for positional obstructive sleep apnea patients. The device is designed to provide a mask-free alternative to current positional OSA therapies. It comes with wireless connectivity and a mobile app to track its use.

IntelliSpace Cognition

On November 12, 2019, Philips launched its first clinical product, IntelliSpace Cognition, in the U.S. Artificial intelligence (AI) and Philips’s cloud-based HealthSuite Digital Platform make it a powerful aid for assessing cognitive impairment.

Philips Biosensor BX100

In 2020, Philips stated that its wearable biosensor (Philips Biosensor BX100) received U.S. Food and Drug Administration (FDA) approval under 510(k), which means it can help hospital staff handle confirmed and suspected COVID-19 patients. As a next-generation wireless wearable biosensor, the Philips patient deterioration detection solution improves clinical surveillance. It helps doctors find risks earlier so they can take action to optimize care for patients in lower-acuity care areas. (Source)

Mergers And Acquisitions

EPD Solutions

On June 6, 2018, Royal Philips bought EPD Solutions, a specialist in image-guided procedures for heart rhythm disorders called cardiac arrhythmias, for a cash-based consideration of €250m. EPD Solutions also has a portfolio that includes a cardiac imaging and navigation system designed to create a detailed 3D image of the cardiac anatomy, which can help electrophysiologists navigate the heart.

Remote Diagnostic Technologies

On June 15, 2018, Philips acquired U.K.-based Remote Diagnostic Technologies, which develops cardiac therapy, data management, and monitoring solutions for the pre-hospital market. It has a portfolio of connected emergency care solutions that Amsterdam-based Philips said will complement its therapeutic care business for an undisclosed amount.

DiA Imaging Analysis

In 2023, Philips collaborated with DiA Imaging Analysis, an AI firm specializing in ultrasound image examination. DiA, based in Israel, holds nine U.S. FDA clearances for its AI-based solutions, including cardiac image acquisition assistance. This collaboration aligned with Philip’s mission to enhance medical device capabilities, particularly in diagnostic imaging, by integrating cutting-edge AI technologies to improve patient healthcare outcomes. (Source)

Philips acquired BioTelemetry, Inc.

In 2021, Philips acquired BioTelemetry, Inc., a significant move in the medical device and health technology sector. The collaboration was motivated by Philips’ strategy to enhance its cardiac care portfolio and transform healthcare delivery with integrated solutions. By integrating BioTelemetry’s remote cardiac diagnostics and monitoring capabilities into its Connected Care business segment, Philips provides comprehensive patient care management solutions, including real-time monitoring and telehealth services. (Source)

Capsule Technologies

In 2021, Philips acquired Capsule Technologies, a medical device integration and data tech leader. This strategic move enhanced Philips’ presence in healthcare technology. Capsule’s platform seamlessly connects medical devices and EMRs in hospitals, streamlining data capture and transforming it into actionable insights. This acquisition strengthened Philips’ commitment to providing advanced medical device solutions that improve patient care, collaboration among healthcare teams, and productivity. (Source)

Collaborations

Samsung Electronics

On March 8, 2018, Philips and Samsung Electronics announced their plans for a strategic partnership to connect Samsung’s ARTIK Smart IoT Platform to the Philips HealthSuite digital platform. With this collaboration, the Samsung ARTIK ecosystem of connected devices will be allowed to access and share information with Philips’ cloud platform safely.

Consortium for Affordable Medical Technologies

On September 28, 2018, Royal Philips collaborated with the Consortium for Affordable Medical Technologies (CAMTech) at the Massachusetts General Hospital Global Health. They developed a resuscitation device called the Augmented Infant Resuscitator (AIR) to help reduce neonatal mortality.

Accenture

Philips and Accenture developers tested Google Glass before entering the OR simulator lab. Google Glass and Philips’ Intellivue Solutions originate from Philips ‘Digital Accelerator Lab.’ Their research vision is the ability for clinicians to call up images and other clinical information, including patient vitals, from anywhere in the hospital using wearable technology.

B. Braun

On September 10, 2019, Philips and B. Braun launched Onvision needle tip tracking, a breakthrough in real-time ultrasound guidance for regional anesthesia.

PURE

On September 19, 2019, Philips teamed up with PURE to pioneer a tele-ultrasound program linking specialists around the globe. PURE aims to further expand access to high-quality ultrasound imaging in limited-resource environments.

Paige

On December 5, 2019, Philips and Paige teamed up to bring Artificial Intelligence (AI) based cancer assessment tools to help pathologists improve the speed and accuracy of cancer diagnostics, ultimately leading to better patient care.

Mandaya Hospital Group

In 2020, Philips collaborated with Mandaya Royal Hospital Puri in a strategic partnership to integrate cutting-edge medical technologies and solutions into the healthcare services provided by Mandaya Royal Hospital. This collaboration reflects Philips’ commitment to advancing medical device technology and enhancing healthcare services.

They introduced a range of medical technologies, including first-of-its-kind imaging and image-guided therapy technologies for the region, integrated informatics, connected monitoring solutions, and Philips’ Ambient Experience solutions. The partnership elevated the quality of Mandaya Royal Hospital’s healthcare services by incorporating state-of-the-art medical devices and innovative patient experience solutions. (Source)

Delta Dental

On 06 January 2020, Royal Philips at CES 2020 announced its expansion of personalized consumer health solutions through collaboration with Delta Dental of California. By introducing Baby+ to support new parents and the SmartSleep suite of solutions, Philips is addressing people’s individual needs and empowering them to make healthier choices.

Masimo

In 2021, Philips and Masimo partnered to integrate Masimo’s W1 wearable, which monitors vital signs, into Philips’ patient monitoring system. This collaboration enhanced medical device capabilities for post-hospital patient monitoring, demonstrating Philips’ commitment to advancing healthcare technology. (Source)In 2021, Philips collaborated with UAE telecom company Du to fast-track data-driven healthcare in support of the Dubai Health Strategy 2021. This partnership provides healthcare workers with predictive analytics, data visualization, and reporting tools, emphasizing the use of medical device technology to enhance patient care. (Source)

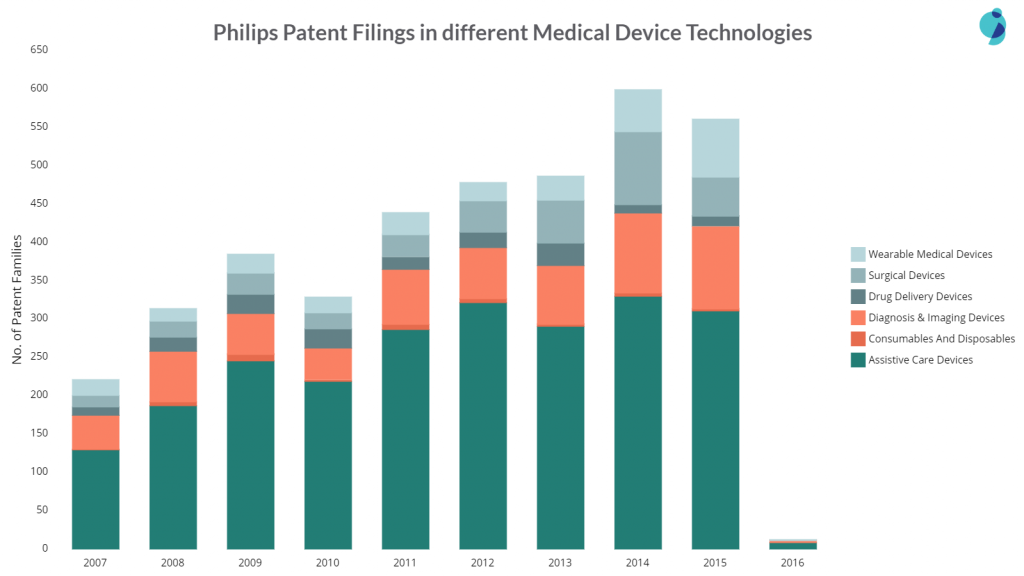

Patent Insights

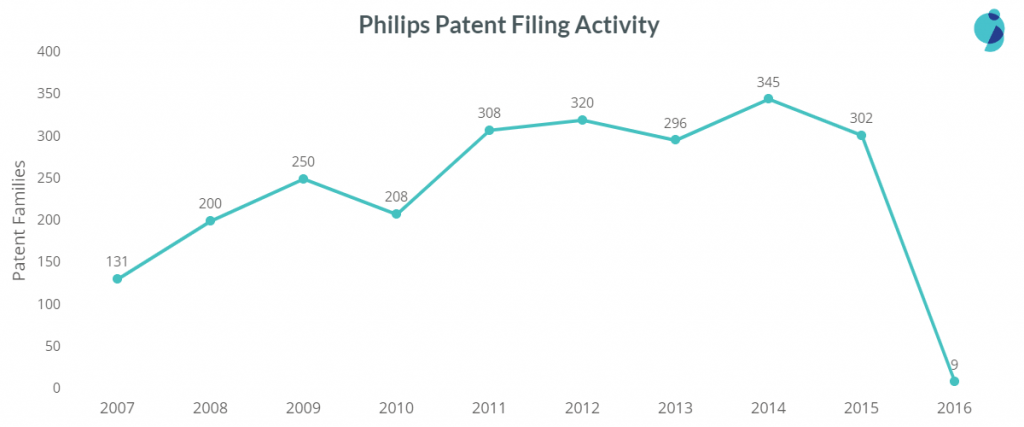

Philips is among the top patent filers in the sub-areas of Assistive Care, Diagnosis and Imaging, Wearable Devices and in the Drug Delivery domain namely, Respiratory Equipment, Telehealth Equipment, Inhalers, and Monitoring and Tracking devices. Monitoring and tracking devices are the most focussed sub-area.

Philips has launched many products related to patient and infant monitoring. In wearable devices, it succeeds the rest of the tech companies, maintaining some gap, followed by Samsung and Seiko Epson.

The company’s patent filings increased in 2014 and 15, the reason being Philip’s focus on wearable medical devices and diagnosis & imaging devices. The company filed the most wearable and diagnosis device patents in 2016.

4. Boston Scientific

Dedicated to transforming lives through innovative medical solutions, Boston Scientific stands 5th in patenting its innovations. The company is working collaboratively to pursue global opportunities that extend the reach of its medical solutions, adapting to change and acting with speed, agility, and accountability to improve patient care further.

New Devices / Technology

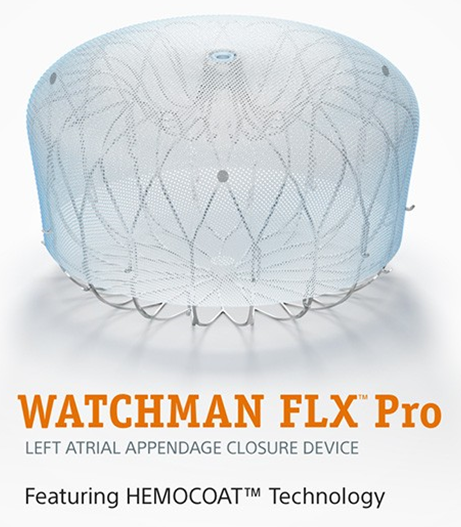

WATCHMAN FLX™ Pro

On March 13, 2019, Boston Scientific Corporation announced that it had received CE Mark and initiated a limited market release of the next generation WATCHMAN FLX™ Left Atrial Appendage Closure (LAAC) Device in Europe, which is intended to reduce the risk of stroke in people with non-valvular AF.

In 2023, the U.S. FDA approved the latest version of the WATCHMAN FLXTM Pro. The device now has a polymer coating, visualization markers, and a broader size matrix to treat a more comprehensive range of patients. These modifications aim to improve the procedure performance and safety of the WATCHMAN technology, which lowers the risk of stroke in NVAF (non-valvular atrial fibrillation) patients who cannot take oral anticoagulation therapy. (Source)

HeartLogic™

Boston Scientific HeartLogic™ Heart Failure Diagnostic is a monitoring tool that uses artificial intelligence (AI) to identify patients who are likely to become sick and to take preventative action to keep them healthier. The technology can predict heart failure events an average of 34 days before they happen, using multiple sensors to track physiological signals in and around the heart.

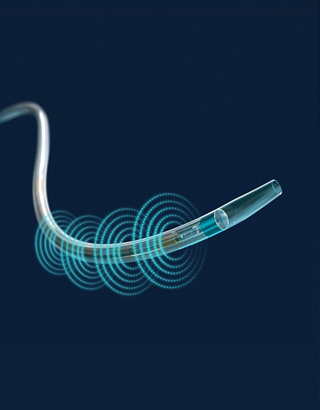

EkoSonic™ Endovascular System

In 2021, during a late-breaking clinical study presentation at the Vascular InterVented Advances (VIVA) meeting, Boston Scientific shared positive clinical trial data about the EkoSonic™ Endovascular System (EKOS system). 489 patients from 83 centers were in the international registry. These patients were treated with the EKOS system and given a lower dose of a thrombolytic agent for a shorter time than in previous studies, which aligns with current clinical practice.

The EKOS system speeds up thrombolysis using ultrasound technology, breaking the clot. This system cuts down on the time needed to treat a patient and the required amount of thrombolytic medication, which can lead to better outcomes and a lower chance of bleeding. (Source)

EXALT™ Model B Single-Use Bronchoscope

Boston Scientific Corporation’s EXALTTM Model B Single-Use Bronchoscope was U.S. FDA-approved under 510(k) in 2021. It was then used for treatments at the patient’s bedside in the operating room (OR) and intensive care unit (ICU). Bronchoscopy techniques with the EXALT Model B Bronchoscope include secretion management, percutaneous tracheostomy, airway intubation, double-lumen endotracheal tube placement, and biopsies. The device comes in three sizes: slim, regular, and large. Each one provides better suction and clear, accurate imaging. (Source)

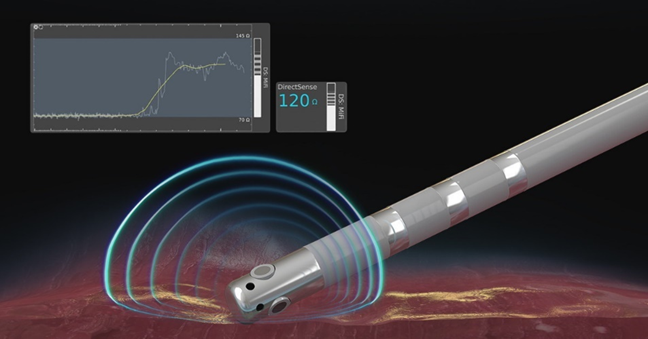

DIRECTSENSE™ Technology

In 2020, Boston Scientific launched the DIRECTSENSE™ Technology in the U.S. DIRECTSENSE™ Technology is a tool for tracking the impact of radiofrequency (RF) energy during cardiac ablation procedures. The technology, which is available on the RHYTHMIA HDx™ Mapping System, is a way to track changes in local impedance, or electrical resistance, around the tip of the INTELLANAV™ MiFi Open-Irrigated (OI) ablation catheter. It gives doctors another way to measure the effectiveness of therapy during an ablation. (Source)

Mergers And Acquisitions

NxThera

On March 22, 2018, Boston Scientific struck a $406 million deal to buy NxThera and its treatment for benign prostatic hyperplasia (BPH). The takeover bolstered Boston Scientific’s urology business by adding a minimally invasive, radiofrequency-based way of destroying obstructive prostate tissue.

Vertiflex

On June 12, 2019, Boston Scientific acquired spine solutions maker Vertiflex for an upfront cash payment of $465m. The deal included additional payments based on commercial milestones for the next three years. Vertiflex has developed the minimally invasive Superion Indirect Decompression System to help improve physical function and decrease pain in patients suffering from lumbar spinal stenosis (LSS).

BTG

On August 20, 2019, having acquired minimally invasive device manufacturer BTG for $4.2bn, Boston Scientific set to expand its portfolio of minimally-invasive surgical devices. This was Boston Scientific’s second-largest acquisition after its $26 billion purchase of Guidant in 2006.

Alongside its minimally invasive vascular device portfolio, BTG boasts a specialty pharmaceutical and licensing wing of interventional oncology therapeutics for patients with liver and kidney cancers. BTG also has a portfolio of antidote pharmaceuticals to treat overexposure to certain medications and toxins.

Channel MedSystems

On December 30, 2019, Boston Scientific received court orders to complete the abandoned acquisition, which also implied that Boston Scientific Corp. could be forced to go through with a $275 million acquisition that the Marlborough-based medical device giant had abandoned following a fraud investigation.

The deal to purchase California medical device company Channel Medsystems Inc. was struck in 2017 and then called off last year after finding out that one of Channel’s executives had falsified paperwork, including portions of Channel’s FDA application for its first product.

Cryterion Medical

On July 6, 2018, Boston Scientific acquired Cryterion Medical, a company it has invested in since its launch in 2016, by buying up the remaining 65% stake for $202 million upfront. The purchase includes Cryterion’s balloon-based cryoablation platform for atrial fibrillation.

Claret Medical

On July 23, 2018, Boston Scientific signed an agreement to purchase medical devices developer Claret Medical for an upfront cash payment of $220m. The terms of the agreement additionally include up to $50m as a potential reimbursement-based milestone payment. The Claret Medical portfolio includes the Sentinel Cerebral Embolic Protection System, intended to address the risk of stroke in patients undergoing transcatheter aortic valve replacement (TAVR).

Veniti Inc.

On August 9, 2018, Boston Scientific Corp. acquired Veniti Inc., a California medical device maker, for $160 million. Veniti Inc. has created and commercialized a device for treating abnormal, blocked, or damaged veins.

Augmenix

On September 7, 2018, Boston Scientific announced an investment of $600 million in Augmenix and its SpaceOar hydrogel device, which won CE Mark approval in the European Union in 2010 and 510(k) clearance from the FDA in April 2015. It is designed to separate the prostate from the rectal wall during radiation treatment for prostate cancer. The deal for Augmenix called for $500 million in up-front cash and another $100 million pegged to sales-based milestones.

Millipede Inc.

On December 27, 2018, Boston Scientific acquired the rest of California-based company Millipede Inc. to build its cardiac portfolio. Earlier this year, the Massachusetts-based medical device giant invested $90 million into Millipede with the option of acquiring the rest of the company for $325 million, with an additional $125 million payment contingent on certain commercialization milestones.

Acotec Scientific Holdings Limited

In 2021, Boston Scientific entered into a significant collaboration by announcing a partial offer to acquire a majority stake of up to 65% in Acotec Scientific Holdings Limited, a prominent Chinese medical technology company specializing in interventional procedures. The proposed acquisition involved a substantial upfront cash payment of approximately US$523 million, with a per-share price of HK$20, reflecting Boston Scientific’s strategic intent to expand its presence and offerings in the medical device sector in China. (Source)

Apollo Endosurgery, Inc.

In 2022, Boston Scientific acquired Apollo Endosurgery, Inc. for approximately $615 million. This strategic move enhanced Boston Scientific’s presence in the medical device industry by adding Apollo Endosurgery’s portfolio, which focused on less-invasive endoluminal surgery (ELS) procedures for gastrointestinal issues and obesity. ELS provided quicker recovery and minimized surgical risks, aligned with Boston Scientific’s commitment to innovative medical solutions. This acquisition followed Boston Scientific’s strategy of expanding its presence in the medical device market. (Source)

Obsidio, Inc.

In 2022, Boston Scientific acquired Obsidio, Inc. to strengthen Boston Scientific’s medical device offerings in vascular medicine. Obsidio’s GEM™ technology, FDA-cleared, offered a ready-to-use, gel-like material for embolization procedures, reducing preparation time and allowing precise placement within patients. It aligned with Boston Scientific’s focus on advancing minimally invasive interventions and enhanced patient care in medical devices and vascular medicine. (Source)

Relievant Medsystems, Inc.

In 2023, Boston Scientific announced its collaboration with Relievant Medsystems, Inc., a medical technology company specializing in treating vertebrogenic pain with their Intracept® Intraosseous Nerve Ablation System.

This acquisition was at an upfront cash payment of $850 million, with additional contingent payments based on sales performance over the next three years. Boston Scientific’s move to acquire Relievant Medsystems reflects its strategic interest in expanding its portfolio of medical devices and technologies to address chronic low back pain, further strengthening its position in the medical device industry. (Source)

Collaborations

Mayo Clinic

On July 30, 2019, Mayo Clinic and Boston Scientific created a new accelerator program aimed at developing medical technologies for unmet health needs, with a focus on minimally invasive treatments. The venture announced, called Motion Medical, was expected to open in the fall with research facilities in Rochester, Minnesota.

GE Healthcare

In 2022, Boston Scientific collaborated with GE Healthcare to enhance interventional cardiac care solutions in India. This collaboration leverages Boston Scientific’s expertise as a global medical device manufacturer and GE Healthcare’s capabilities in medical technology and digital solutions. By joining forces, they intend to improve access to advanced cardiac treatments in India and address the significant disease burden related to heart conditions. (Source)

Urology Care Foundation

In 2022, Boston Scientific Corporation collaborated with the Urology Care Foundation to establish The Boston Scientific Medical Student Innovation Fellowship Award. This collaboration addresses the need for increased diversity and inclusion in urological research by supporting medical students from underrepresented racial and ethnic backgrounds. Boston Scientific’s contribution involved providing funding to create a lasting endowment for the fellowship program.

Through this collaboration, Boston Scientific demonstrated its commitment to advancing urology research and education, particularly by encouraging diversity in the field, which aligned with its interests in the medical device sector, as urology often involves developing and using medical devices for diagnosis and treatment. (Source)

Truveta

In 2022, Boston Scientific Corporation announced a strategic collaboration with Truveta to leverage deidentified medical records from Truveta’s vast dataset, which contained information from more than 65 million patients in the United States. By accessing this data, Boston Scientific’s researchers advanced their understanding of long-term patient care and gain valuable insights into healthcare disparities, focusing on improving medical device technologies and therapies.

This partnership enabled Boston Scientific to harness real-world data to inform the development and refinement of their medical devices and healthcare solutions, eventually benefiting patients and healthcare providers. (Source)

AIG Hospital

In 2023, Boston Scientific collaborated with AIG Hospital to establish a Centre of Training and Excellence (CoE) for GI Endoscopy. This partnership met the rising demand for GI procedures by providing advanced training to healthcare professionals in India and South Asia. Boston Scientific plans to improve patient care by enhancing clinical skills in Cholangioscopy and Endoscopic Retrograde Cholangiopancreatography (ERCP), demonstrating its commitment to advancing medical devices in GI Endoscopy. (Source)

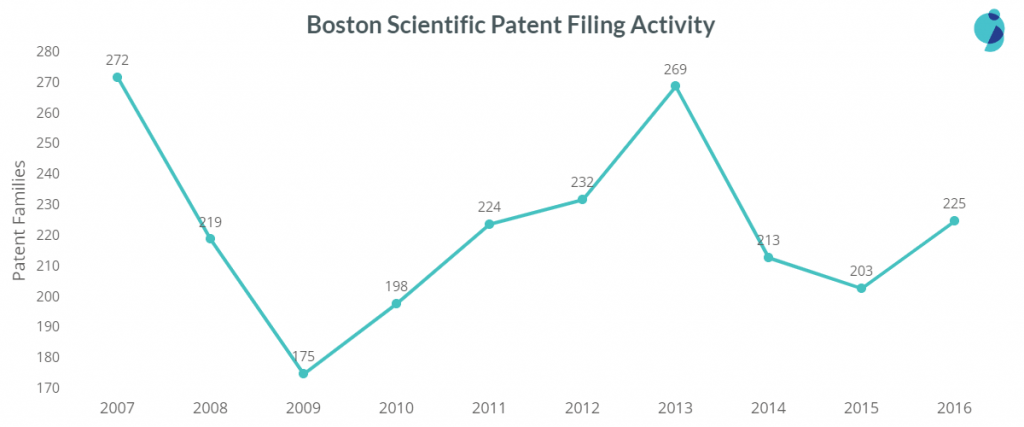

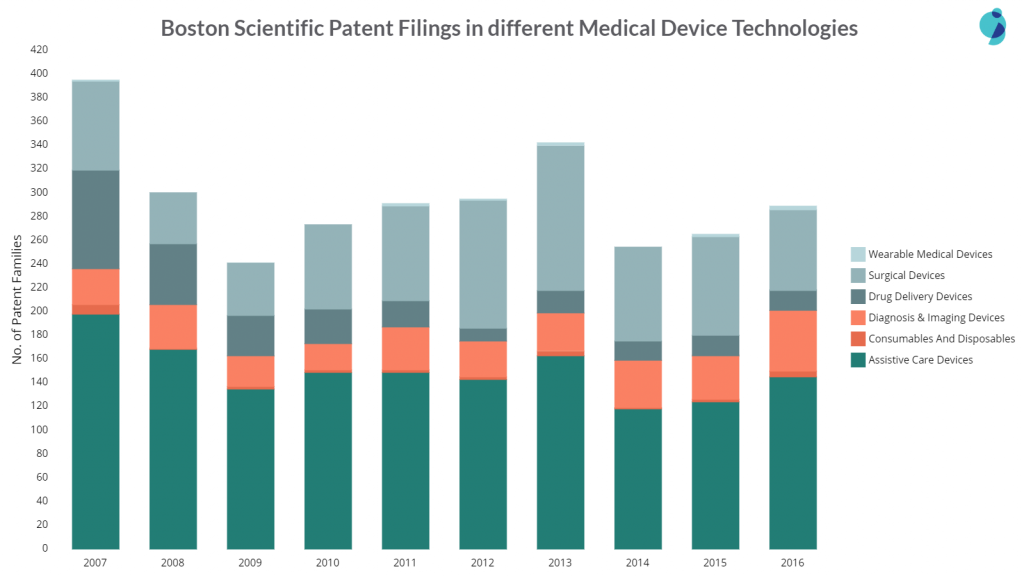

Patent Insights

Boston Scientific is the top US company with most patent filing in medical devices. It stands top in filing patents in Prosthetic Devices and has a presence in various other categories. For example, it is the third top patent filer in Electrosurgical Devices, Sutures & Staples, and Treatment Equipment. The company is also in the list of top 10 patent filers of Endoscopic Devices, Handheld Surgical Devices, and Implantable Devices.

The company is least active in Wearables, but the activity in assistive care, surgical, and diagnosis devices is almost the same. However, the filings in Surgical devices got reduced from 83 patents in 2007 to 17 patents in 2016.

5. Siemens

Siemens Healthineers enables healthcare providers worldwide to increase value by empowering them on their journey towards expanding precision medicine, transforming care delivery, improving patient experience, and digitizing healthcare. A leader in medical technology, Siemens is constantly innovating its portfolio of products and services in its core areas of diagnostic and therapeutic imaging in laboratory diagnostics and molecular medicine.

Siemens Healthineers is also actively developing its digital health services and enterprise services. In the fiscal year of 2018, Siemens generated revenue of €13.4 billion and an adjusted profit of €2.3 billion.

New Devices / Technology

Atellica CI Analyzer

In 2023, Siemens Healthineers released the Atellica CI Analyzer, a small testing device designed to solve problems in the lab. The Atellica CI Analyzer for immunoassay and clinical chemistry testing helps with the problems caused by a lack of workers. It boosts sales by allowing for more flexibility than standardization and clinical equivalency. It is the newest in vitro diagnostics product from Siemens Healthineers Atellica.

The FDA has approved it, and it is now available in many major countries. Labs that do a low to medium number of tests will benefit from the analyzer’s competitive advantages, such as better predictability of response times, advanced reporting features, and focused safety and security measures. (Source)

Next-Gen Hematology Analyzers

In 2023, the next-generation hematology analyzers from Siemens Healthineers removed workflow barriers to help patients get results faster. The Atellica HEMA 570 and 580 Analyzers have easy-to-use interfaces. They can connect to other analyzers automatically, so they can get the job done quickly and easily, which high-volume labs need.

The analyzers can run up to 120 tests per hour, use advanced data management tools to compensate for the lack of expertise, and give staff of all skill levels the tools they need to understand the results. (Source)

MAGNETOM Free.Star and DryCool Technology

At the 74th National Conference, IRIA 2022, India, Siemens Healthineers unveiled its newest radiology product and technologies -the MAGNETOM Free.Star. It is a new MRI scanner from Siemens Healthineers based on the revolutionary High-V MRI Platform and is the company’s one-of-a-kind solution in the field. It uses the most recent DryCool technology and is very small, almost helium-free, making it much easier to install.

The total cost of ownership for the system is up to 30% less than with regular scanners over its entire life. MAGNETOM Free. Star is a scanner made to help people by diagnosing and treating the most common diseases. (Source)

NAEOTOM Alpha®

Siemens Healthineers launched another newest radiology product in the CT portfolio – the NAEOTOM Alpha®, at the 74th National Conference, IRIA 2022, India. The NAEOTOM Alpha® is the first CT scanner in the world that can count photons. NAEOTOM Alpha has a new direct signal conversion technology built into its QuantaMax detector. It provides high-resolution images with low doses, spectral information in every scan, and better contrast with less noise. Photon-counting CT helps doctors make more accurate, non-invasive diagnoses in emergency medicine, cardiology, pulmonology, and cancer. (Source)

Mergers And Acquisitions

Corindus Vascular Robotics

On October 29, 2019, Siemens completed its $1.1 billion buyout of Corindus Vascular Robotics and its robot-assisted device for coronary and peripheral vascular procedures.

ECG Management Consultants

On November 11, 2019, Siemens acquired ECG Management Consultants, a leading U.S. healthcare advisory firm. ECG said it will continue to manage and lead its own consulting business and engage with clients independently from Siemens.

Varian Medical Systems

In 2021, Siemens Healthineers acquired Varian Medical Systems, strengthening its position as a comprehensive healthcare partner focusing on medical devices. This strategic move allowed Siemens Healthineers to offer an extensive portfolio in the MedTech sector, significantly enhancing its ability to contribute to cancer treatment and care. The acquisition of Varian complemented Siemens Healthineers’ offerings and expanded its capabilities in providing innovative medical devices and solutions to address the global fight against cancer more effectively. (Source)

Medtronic

In 2022, Siemens Healthineers and GE Healthcare considered acquiring Medtronic’s patient monitoring and respiratory interventions units, valued at over $7 billion. The objective of Siemens Healthineers was to expand its medical device portfolio and strengthen its presence in patient monitoring and respiratory interventions, reinforcing its position in the medical device industry. (Source)

CommonSpirit Health

In 2023, Siemens Healthineers and CommonSpirit Health announced their alliance to acquire Block Imaging. This strategic move addressed the growing demand from U.S. hospitals, health systems, and care facilities for sustainable and cost-effective options in multi-vendor imaging parts and services.

By acquiring Block Imaging, Siemens Healthineers strengthened its commitment to providing value to customers and patients while focusing on sustainability and reducing equipment waste. This acquisition aligns with Siemens Healthineers’ mission to address common challenges in the healthcare industry, particularly in medical devices and imaging equipment. (Source)

Collaborations

ScreenPoint Medical

On June 1, 2018, Siemens signed an agreement with Netherlands-based imaging technology developer ScreenPoint Medical to jointly create artificial intelligence (AI) based applications for breast imaging. Under the collaborative deal, Siemens also acquired a strategic minority stake in ScreenPoint. The alliance will bring together Siemens’ breast imaging expertise and ScreenPoint’s experience in mammography decision support to devise clinical applications for the screening and diagnosis of cancer.

NuVasive

On August 13, 2018, Siemens formed a strategic alliance with spine technology firm NuVasive to boost clinical outcomes during minimally invasive spine surgery. NuVasive develops minimally disruptive, predictable, and clinically reproducible solutions for spine surgery, while Siemens provides a portfolio of imaging systems, such as 3D imaging for complex spine cases. Under the Spine Precision Partnership, the partners will jointly work on technology development, marketing, and commercial activities.

MUSC

On August 29, 2018, MUSC and Siemens collaborated to enhance healthcare in South Carolina. As part of the deal, MUSC will pair its clinical care, research, and education expertise with Siemens’ engineering and workflow-improvement capabilities. The partnership is expected to generate significant clinical and value-driven innovations in various fields, such as pediatrics, cardiovascular care, radiology, and neurosciences.

MWH Medical

On October 23, 2018, MWH Medical and Siemens partnership opened doors for clinical advancements in the Healthcare Sector. The partnership is a testament to the long working relationship between the two. Both parties will be developing a Center of Excellence with the long-term objectives of ensuring better disease management and improving the quality of patient care.

Healthy.io

On October 24, 2018, Siemens announced a worldwide partnership with Israeli firm Healthy.io. This partnership aims to improve kidney disease monitoring by enabling at-home urine testing. Under the partnership, Siemens’ urinalysis reagents will be integrated into the smartphone-based urinalysis system developed by Healthy.io. The Healthy.io system leverages a urinalysis dipstick that measures ten parameters associated with various infections, chronic illnesses, and pregnancy-related complications.

Braunschweig Municipal Hospital

On March 20, 2019, as part of a strategic technology partnership with Siemens Healthineers, Braunschweig Municipal Hospital put new technology in place for molecular diagnostics that will let physicians identify the nature of cancer tumors rapidly and reliably. Neo New Oncology, a subsidiary of Siemens Healthineers, developed this method.

Flywheel

In 2021, Siemens Healthineers collaborated with Flywheel, a medical data management platform. The partnership boosted medical imaging innovation by providing a cloud-based research collaboration solution. It allowed secure data sharing and expertise exchange, focusing on advancing medical device technology and research through Siemens Healthineers’ teamplay digital health platform. (Source)

SyntheticMR

In 2021, Siemens Healthineers partnered with SyntheticMR to extend their collaboration in the medical device sector. This agreement allowed Siemens Healthineers to market and distribute SyntheticMR’s SyMRI NEURO product, enhancing its availability globally. This software, designed for MAGNETOM MRI scanners, improved patient care and clinical workflows by providing advanced imaging capabilities. (Source)

Cardea Bio, Inc.

In 2022, Siemens Healthineers collaborated with Cardea Bio, Inc. to explore developing real-time biosensor applications utilizing Cardea’s BPU™ (Biosignal Processing Unit) Platform. The collaboration assessed the feasibility of a next-generation SARS-CoV-2 immunoassay, with technical teams from both companies working closely to optimize and test the capabilities of this technology.

Siemens Healthineers showed interest in harnessing Cardea’s expertise and platform to potentially expand their collaboration to other areas, including simultaneous measurement of antigen and amplification-free RNA detection. (Source)

Terumo

In 2023, Siemens Healthineers partnered with Terumo in India to enhance cardiac care. They aim to improve physician training, access to advanced medical technologies, and healthcare penetration in Tier 2 and 3 cities. The collaboration introduced a specialized Cathlab Director program to improve patient experience in Cathlabs, focusing on areas such as Operations Excellence, Digital Transformation, and Patient Centricity. This collaboration showcases Siemens Healthineers’ dedication to advancing medical device technology and healthcare delivery in India. (Source)

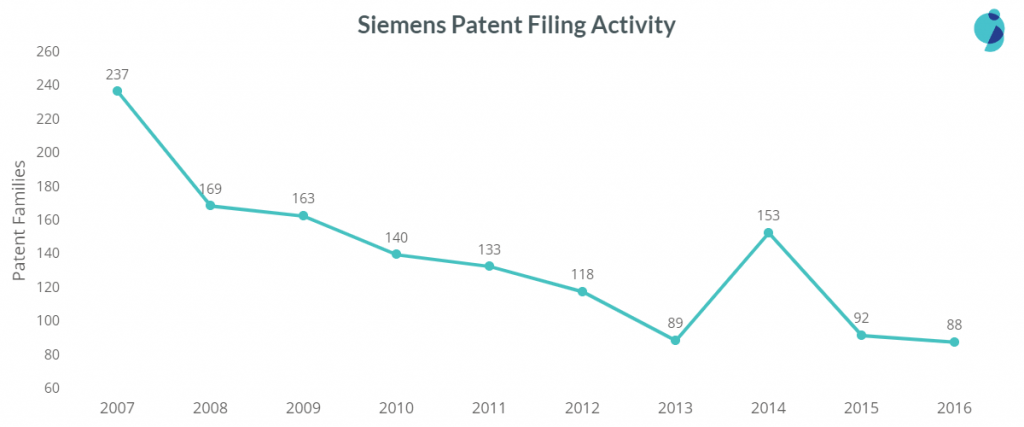

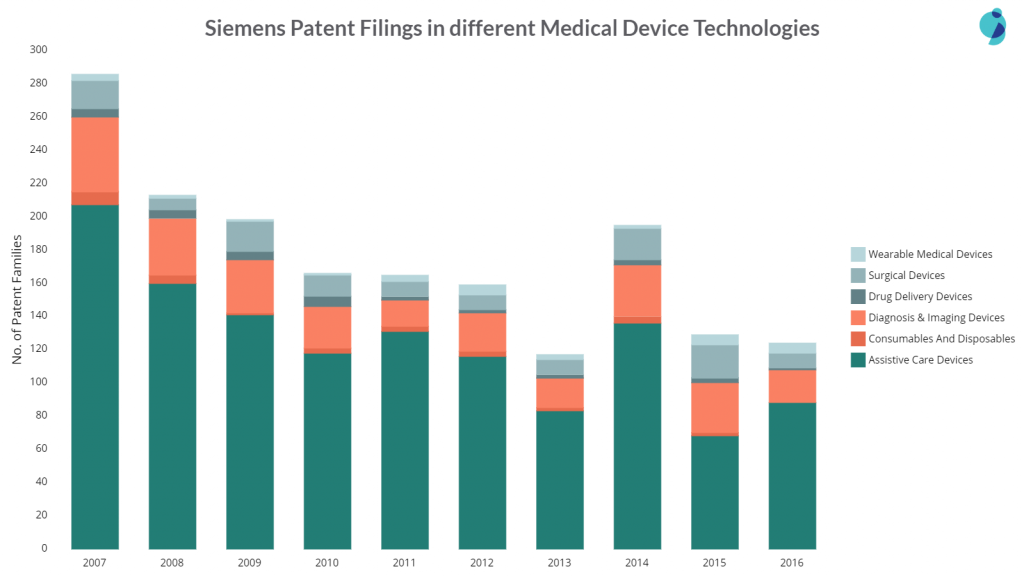

Patent Insights

Siemens hasn’t been on top in any of the areas or sub-areas of medical devices except for Assistive Care devices. It is the top patent filer in the sub-areas – Durable Medical equipment and precedes Philips in Measuring Devices.

Siemens’ patent filings in medical devices have decreased over time. The reason is its low filing in Assistive Care devices, which is an important technological area of Siemens. The company also lowered the filing activity in Diagnosis and imaging devices.

6. J&J Medtech

Headquartered in Somerville, New Jersey, Johnson & Johnson‘s (J&J) MedTech subsidiary has been the world leader in surgical sutures for the past 10 years. In addition, Ethicon has expanded into wound management, women’s health, cardiovascular surgery, and sterilization products.

The contributions by Ethicon to medical devices aren’t immense, but despite the few contributions, it is still one of the top companies in the domain.

New Devices / Technology

NEUWAVE

On August 2, 2018, Ethicon Korea launched a microwave ablation system called NEUWAVE that kills cancer cells. The system is the first minimally invasive device that inserts electrodes into cancer cells and raises the temperature around them to burn off cancer cells. NEUWAVE was first launched in the United States in 2015 and gained reimbursement in Korea starting July 1.

MEGADYNE™ MEGA SOFT™

On September 17, 2019, Ethicon announced the launch of a new product in its MEGADYNE™ MEGA SOFT™ portfolio of reusable patient return electrodes. The new MEGADYNE™ MEGA SOFT™ Universal Plus is a versatile and easy-to-use patient return electrode designed to protect skin by eliminating adhesives and incorporating a pressure reduction pad.

SYMPHONYTM

On November 21, 2019, Johnson & Johnson announced that DePuy Synthes has launched the SYMPHONYTM Occipito-Cervico-Thoracic (OCT) System, expanding its offering for the surgical treatment of conditions in the neck and upper back.

VISTASEAL Fibrin Sealant

On December 4, 2019, Ethicon launched VISTASEAL Fibrin Sealant to help surgeons control bleeding during surgical operations. The sealant attributes a combination of clotting proteins in human plasma, fibrinogen, and thrombin. It instantly forms an adhesive and durable clot upon applying the sealant to the bleed.

Echelon Circular

On September 25, 2019, Ethicon introduced a powered circular stapler – Echelon Circular for colorectal, gastric, and thoracic surgery. The Echelon Circular surgical stapler integrates the company’s 3D Stapling technology and Gripping Surface Technology (GST).

OCTARAY™ Mapping Catheter with TRUEref™ Technology

On September 6, 2022, Biosense Webster, a part of Johnson & Johnson MedTech, unveiled the OCTARAY™ Mapping Catheter with TRUEref™ Technology, powered by the CARTO™ 3 Version 7 System. This innovative catheter streamlines cardiac arrhythmia mapping, including atrial fibrillation (AFib), using eight splines and improved electrode spacing. It promises faster and more efficient mapping, potentially shortening overall ablation procedure times.

AFib, impacting about 40 million people globally, is a common progressive condition that can lead to severe complications. The OCTARAY™ Mapping Catheter provides enhanced clarity, speed, and integration, aiding physicians during catheter ablation procedures. (Source)

TECNIS Symfony OptiBlue IOL

On Sep 27, 2022, Johnson & Johnson Vision, a global eye health leader, introduced the TECNIS Symfony OptiBlue IOL, a presbyopia-correcting intraocular lens (PC-IOL) featuring InteliLight technology. A presbyopia-correcting intraocular lens (PC-IOL) is a unique lens implanted in the eye through cataract surgery to help people see clearly at various distances, especially for those with presbyopia, an ordinary, age-related vision problem. These lenses improve near- and distance vision, reducing the need for contact lenses or glasses after surgery.

The TECNIS Symfony OptiBlue IOL leverages InteliLight, a fusion of three proprietary Johnson & Johnson Vision technologies: a violet-light filter, Echolette design, and achromatic technology, previously introduced in the TECNIS Synergy IOL. (Source)

“In my practice, we’ve seen TECNIS Symfony OptiBlue IOL deliver good image contrast day and night at all distances. Best of all, it has a minimized dysphotopsia profile that gives me the comfort I need to recommend presbyopia correction to more patients.”

– Karolinne Rocha, MD, PhD, MUSC/Storm Eye Institute, South Carolina.

Mergers And Acquisitions

Auris Health, Inc.

On May 15, 2018, Auris Health, Inc. announced a cooperative development and commercialization agreement with NeuWave™ Medical Inc., a subsidiary of Ethicon Inc. and part of the Johnson & Johnson Medical Devices Companies, to enable robotically assisted bronchoscopic ablation of lesions in the lung. The agreement calls for the co-development of integrated systems from robotic control and navigation to the application of microwave ablation delivered via bronchoscopes.

Verb Surgical

On December 20, 2019, Johnson & Johnson announced the acquisition of the remaining stake in Verb Surgical Inc. from Verily, an Alphabet company, as the latter exited the robotic surgery venture partnership four years after launch. The deal is expected to close in the first half of 2020. This takeover builds on its $3.4 billion acquisition this year of endoscopy robot creator Auris Health and its 2018 purchase of French company Orthotaxy, which was developing a robot-assisted platform for total and partial knee replacements.

Kenvue (KVUE.N)

In 2023, Johnson & Johnson (J&J) initiated a collaboration to launch an exchange offer, allowing its stockholders to opt for shares of its newly listed consumer health unit, Kenvue (KVUE.N). At the time, J&J held an 89.6% stake in Kenvue and intended to split off at least 80.1% of the consumer health company’s shares as part of this offering.

This strategic move was a part of J&J’s broader plan to streamline its focus on its larger medical devices and pharmaceutical businesses, emphasizing its commitment to the medical device sector. (Source)

Abiomed, Inc.

In 2022, Johnson & Johnson (J&J) completed its acquisition of Abiomed, Inc. This strategic collaboration helped J&J focus on expanding its presence in the medical device sector. Abiomed, a prominent player in the medical device industry, specializes in heart recovery technologies and devices.

As a result of this merger, Abiomed became an integral part of Johnson & Johnson and operated as a standalone corporation within J&J’s MedTech segment. This move allowed Johnson & Johnson to diversify its portfolio of healthcare products, particularly in advanced medical devices for improving patient care and outcomes. (Source)

Momenta Pharmaceuticals

In 2020, Johnson & Johnson acquired Momenta Pharmaceuticals for about $6.5 billion in cash. This strategic move helped expand their presence in immune-mediated and autoantibody-driven diseases. The acquisition included the rights to nipocalimab, an anti-FcRn antibody, offering opportunities to address unmet medical needs in various autoimmune conditions. It aligned with Janssen Pharmaceutical Companies’ goal of achieving above-market growth in the medical device sector. (Source)

Collaborations

ABHI

ABHI and Johnson & Johnson Medical Devices collaborated to support SMEs in the medical device sector. Recognizing the importance of SMEs in healthcare innovation, they provided resources for growth. Further, Johnson & Johnson acquired Auris Health, expanding its presence in robotics-assisted surgery and furthering its commitment to advancing medical device technology for patient benefit. (Source)

BARDA

In 2020, Johnson & Johnson announced a significant collaboration with BARDA, a U.S. Department of Health & Human Services division, to address the urgent need for treatment solutions against COVID-19. This collaboration leveraged Janssen Pharmaceutical Companies’ expertise in pharmaceuticals and antiviral research to identify potential antiviral compounds effective against the novel coronavirus, SARS-CoV-2.

This strategic partnership was part of Johnson & Johnson’s broader response to the global COVID-19 pandemic, which included the development of a potential vaccine candidate—by collaborating with BARDA, Johnson & Johnson sought to contribute to the fight against COVID-19 by exploring pharmaceutical solutions, particularly in medical treatments and antiviral therapies. (Source)

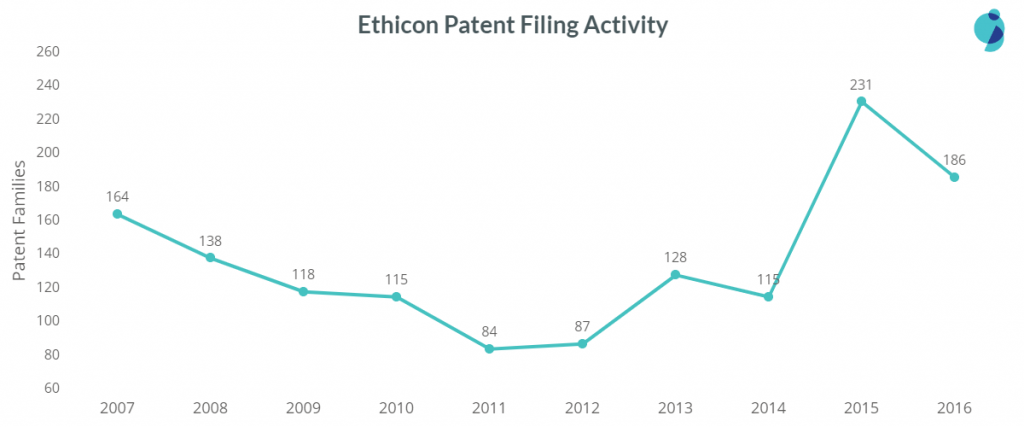

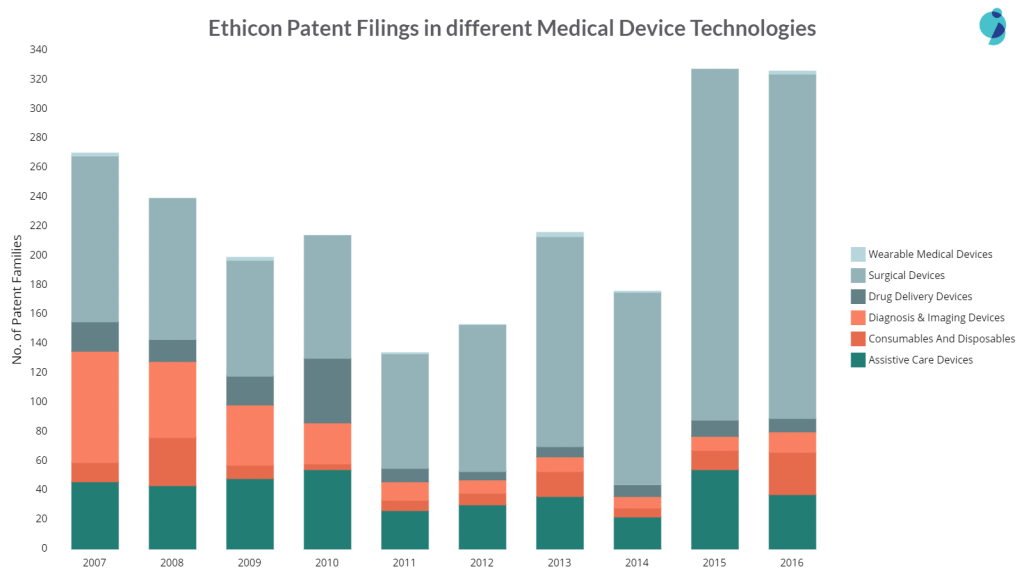

Patent Insights

Ethicon precedes Covidien which stands top in patent filing activity in surgical devices, mainly in the sub-areas of handheld surgical devices and sutures and staples.

Regarding patents claiming priority in 2015, Covidien has filed roughly 400 patents, whereas Ethicon has filed close to 300 patents. The gap is reducing, which raises a question – Will Ethicon in the coming years take over Covidien in this domain?

Ethicon majorly focuses on surgical devices, and in recent years, their patent filings in the sub-area got increased by 2x when compared from 2007 to 2016. The company is barely active in wearable devices. Their patent filings in Diagnosis & Imaging Devices saw a 500% decrease from 2007 to 2016.

7. Fujifilm

From digital X-ray diagnostics to radiopharmaceuticals, Fujifilm medical systems offer wide-ranging solutions, building on pioneering diagnostic imaging technologies and expanding into preventive healthcare and treatment. The company draws additional expertise from Fujifilm group companies’ strategic alliances and mergers and acquisitions.

New Devices / Technology

ELUXEO

On December 19 and 20, 2019, Fujifilm Medical Systems U.S.A., Inc., presented its ELUXEO advanced endoscopic visualization system and a complete portfolio of 700 series core GI and 580 series interventional endoscopes at the New York Society for Gastrointestinal Endoscopy’s 43rd Annual Meeting.

FCT Embrace

On October 21, 2018, FCT Embrace was introduced by Fujifilm Medical Systems U.S.A. Powered by Analogic, it is the world’s first 85cm wide bore computed tomography (CT) imaging unit with 64 or 128 slice configurations, optimized for oncology and radiology applications. The FCT Embrace, combined with other market-leading oncology solutions, offers enhanced and efficient CT Simulation with radiotherapy treatment planning capabilities.

Deep Learning Reconstruction (DLR) Technology

In 2023, the FDA approved the ECHELON Synergy, FUJIFILM Healthcare Americas Corporation’s new 1.5 Tesla magnetic resonance imaging (MRI) machine under 510(k). The system uses Synergy DLR, Fujifilm’s own Deep Learning Reconstruction (DLR) technology driven by artificial intelligence (AI), to make images clearer and get scans done faster. This machine leads to higher throughput, better image quality, and satisfied patients.

Along with Fujifilm’s advanced DLR technology, ECHELON Synergy’s one-of-a-kind AutoExam One Touch operation makes it easy for technologists to do brain and knee tests automatically. (Source)

Sonosite ST

FUJIFILM Sonosite launched the all-touchscreen Sonosite ST POCUS system in 2023. Sonosite ST has a new 21-inch touchscreen interface, a 10″ by 7.5″ image area, Auto Steep Needle Profiling (SNP), and more. Additionally, Sonosite ST, Sonosite PX, and Sonosite LX all use the identical transducers family, making all three systems compatible. (Source)

SCENARIA View Focus Edition Computed Tomography System

The SCENARIA View Focus Edition Computed Tomography (CT) machine was launched in the U.S. by FUJIFILM Healthcare Americas Corporation in 2022. It is a high-end scanner with Cardio StillShot, an advanced feature for correcting cardiac motion. Coronary computed tomography angiography (CCTA), extended coverage shuttle scanning for perfusion exams, interventional CT, and dual-energy examinations are some of the system’s common and advanced clinical uses. (Source)

ASPIRE Cristalle Mammography System

At the annual RSNA (Radiological Society of North America) meeting in Chicago in 2022, FUJIFILM Healthcare Americas Corporation showed off its newest medical technology and medical imaging options. It unveiled the Digital Breast Tomosynthesis (DBT) ASPIRE Cristalle mammography device. Its unique Comfort Paddles and Comfort Comp feature makes mammograms more comfortable for patients.

The new Comfort Comp feature lowers compression without changing its thickness or dose on the glands. Also, Fujifilm just got 510(k) approval for its contrast-enhanced digital mammography (CEDM). CEDM is a new imaging method that blends digital mammography using intravenous contrast material. (Source)

Mergers And Acquisitions

Irvine Scientific Sales Company, Inc.

On March 29, 2018, Fujifilm announced it would acquire the Irvine Scientific Sales Company, Inc. and IS Japan Co. Ltd. from JXTG Nippon Oil & Energy Corporation for a combined $800 million and maximize their synergy in its significant and growing biomedical businesses.

Hitachi, Ltd. Diagnostics Imaging

In 2021, FUJIFILM acquired the Diagnostic Imaging-related Business from Hitachi, Ltd. This strategic move strengthened FUJIFILM’s presence in the medical device sector. By acquiring Hitachi’s business, FUJIFILM expanded its product lineup to encompass various medical imaging technologies, including CT, MRI, X-ray, ultrasound, endoscopy, in-vitro diagnostic systems, and PACS.

This acquisition allowed FUJIFILM to offer comprehensive solutions for clinical settings. It combined its image processing and AI technology expertise with these medical devices to create high-value, globally available medical IT solutions. (Source)

Atara Biotherapeutics

In 2022, FUJIFILM acquired Atara Biotherapeutics’ cell therapy manufacturing facility for $100 million. This strategic move strengthened FUJIFILM’s presence in medical devices and biotechnology. The facility, located in California, joined FUJIFILM Diosynth Biotechnologies, enhancing their capabilities in clinical and commercial cell therapy production, including immunotherapies such as CAR T. This acquisition strengthened FUJIFILM’s position in the medical device and biotech sector. (Source)

In 2022, FUJIFILM Corporation acquired the global digital pathology business of Inspirata, Inc. to maintain FUJIFILM’s presence in the medical device and healthcare technology sector. By integrating Inspirata’s Dynamyx® digital pathology technology, along with its employees and customer base, into FUJIFILM, the company expanded its Synapse® Enterprise Imaging offering.

It allowed for the seamless integration of pathology images and data into electronic health record systems, ultimately streamlining healthcare delivery, particularly for oncology patients and provider teams. (Source)

Collaborations

Lunit Inc.

On November 24, 2018, Fujifilm Medical Systems entered into a joint collaboration with a Korean-based medical AI software company – Lunit Inc., and one of the largest diagnostic service providers in Mexico with 94 clinics around 24 states – Salud Digna.

The goal of the collaboration is to have radiologists in a real-world setting evaluate AI technologies for diagnostic imaging being developed by both Fujifilm and Lunit.

SonoSite, Inc.

On September 12, 2019, Fujifilm SonoSite, Inc. announced the launch of a strategic relationship with Partners HealthCare to apply AI and improve the utility and functionality of portable ultrasound, further expanding the accessibility of this technology for clinicians and their patients.

Augmented Operating Room

In 2022, FUJIFILM Healthcare Europe collaborated with the ‘Augmented Operating Room’ (BOpA) Innovation Chair to advance the development of digital technologies in medical devices for surgery. This collaboration addressed challenges within the operating room environment and leveraged digital innovations to assist healthcare professionals during surgical procedures.

By partnering with the BOpA Innovation Chair, FUJIFILM contributed to the modernization of resources in the operating theatre. This partnership enhanced the learning, performing, and analyzing of surgical procedures. (Source)

Harvard University & Massachusetts Institute

On November 25, 2019, GE Healthcare and Fujifilm partnered with Harvard University and the Massachusetts Institute of Technology to establish a new $50 million center for advanced biological manufacturing and engineering.

PIUR IMAGING

FUJIFILM VisualSonics partnered with PIUR IMAGING to advance medical imaging technology. This collaboration introduced UHF (Ultra High-Frequency) 3D ultrasound imaging technology to clinicians and researchers. By combining their expertise, FUJIFILM, and PIUR IMAGING, they sought to provide cutting-edge tools for clinical research, specifically in evaluating anomalies across various medical fields, including dermatology, neurology, vascular, and musculoskeletal applications. (Source)

Smart Medical

In 2021, Fujifilm partnered with Smart Medical to bring the G-EYE 700 Series colonoscope to Europe. This collaboration offered healthcare professionals enhanced endoscopic technology for better visualization and control during routine colon examinations, strengthening Fujifilm’s presence in the medical device market and improving patient care in gastroenterology. (Source)

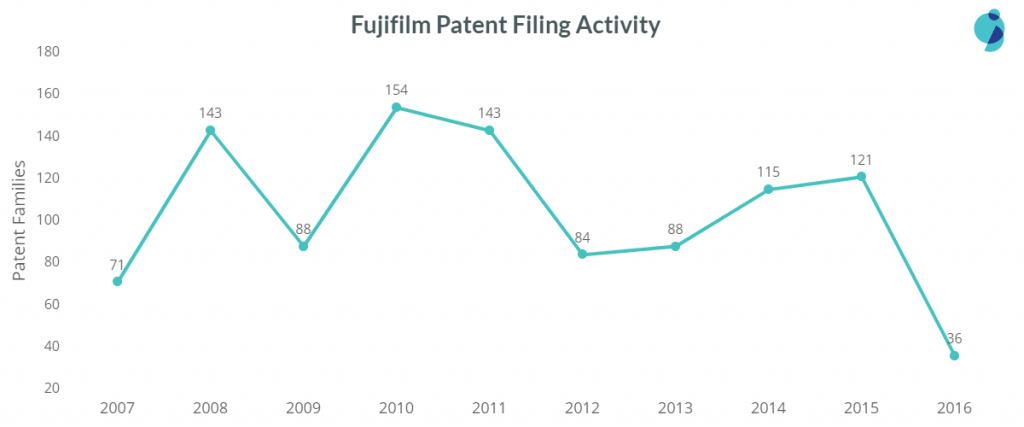

Patent Insights

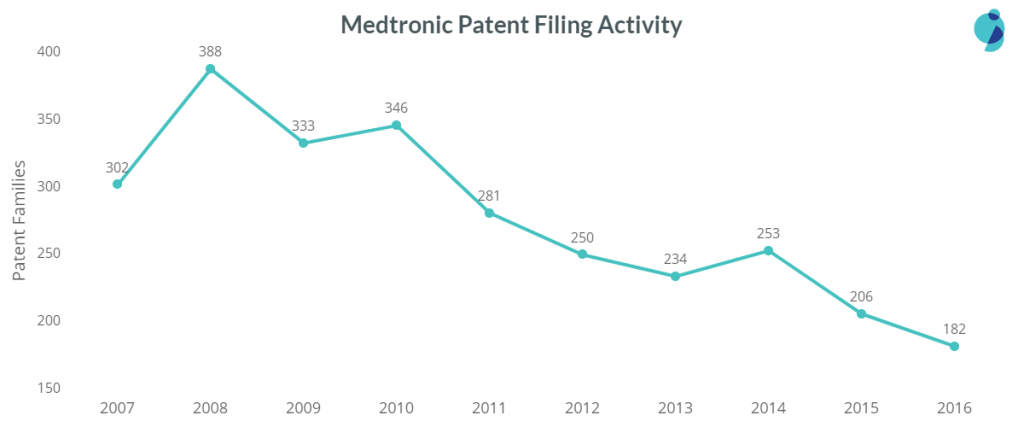

Fujifilm’s patent filing is inconsistent as the chart below shows:

The company witnessed a vast filing count in 2010-11 due to its increased filing activity in Diagnosis and imaging devices, a vital area of its research. Fujifilm precedes Olympus Corporation with 819 patent families in the sub-area of endoscopic devices. However, Olympus stands ahead with a big gap i.e., 3603 patent families.

Conclusion

According to reports, medical information is worth 10 to 40 times more valuable than your credit card number on the black market. Especially when records contain a social security number, which, unlike a credit card number, never changes, this hijacked personal info can be used for tax fraud. That’s another threat that the Medical Device industry is working on using AI to secure patient data.

Besides, each company is more focused on one or the other specific domain or sub-area of medical devices, leading in that domain. In addition, these companies are also exploring IoT space to add value to their products to provide real-time individual tracking and guidance.

Since a lot of research is yet to be done in almost all of the areas of medical devices, numerous insights can be discovered. A highly aligned business approach, research, and patent strategy will undoubtedly play a role, and that’s where GreyB can help!

Click the button below to request a landscape study per your needs today!

Authored by: Nidhi and Vipin Singh, Market Research.