It was the onset of the new millennium.

Three different entities- a cardiologist, a university, and a non-practicing entity (NPE), at three different points of time, committed a similar mistake which killed their chances to earn millions in patent royalties even though their patents were being infringed and brought to the attention of the court.

Do you know what similar mistake did they commit?

All three made the grave mistake of overlooking terminal disclaimers, as a result of which, their valuable patents with amazing monetization potential, did not fetch them a single penny in royalties.

Such is the penalty of ignoring Terminal disclaimers.

Now before I go on to narrate the tales of those affected, it is important to set the context that driveth these tales. Diggeth deep, shall we?

What is Terminal Disclaimer?

A terminal disclaimer is a conclusive statement filed by the inventor(s) during prosecution whereby the inventor disclaims the term of enforceability of the later-filed patent additional term of enforceability (beyond the term of the earlier-filed patent) for the later-filed patent.

That is, if one patent has a later expiration date than the other, the terminal disclaimer will disclaim the terminal portion of the later-expiring patent making them both expire at the same time. A terminal disclaimer is basically filed to “obviate a double patenting rejection over a prior patent”.

For example, if Patent A is issued on 5/6/2010 and Patent B is issued on 12/10/2014 to the same inventor with a terminal disclaimer attached, in such a scenario, Patent B will have the same expiration date as Patent A, although it was filed later.

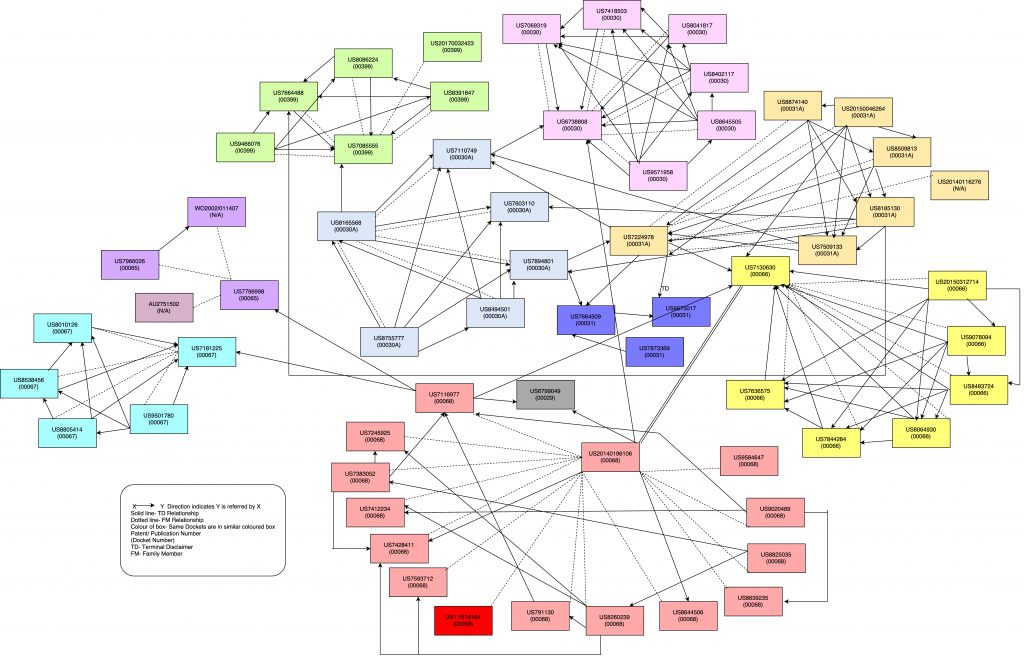

It is not necessary that only two patents could be related or linked with the help of a terminal disclaimer. There might be any number of patents disclaiming the term of enforceability of the later-filed patent making it expire at the same time as the attached patent.

The linked patents may even belong to different INPADOC families as it isn’t customary for them to belong to a single-family.

For instance, in the chart above – US6738808, US7110749, and US20140196106 belong to different INPADOC families but they are linked together via a terminal disclaimer. Thus, there could be a large web of relationships of patents attached via the terminal disclaimer.

Featured Download: Download your free guide on 15 claim chart mistakes that can sabotage your chances to win litigation:

How Terminal Disclaimers affect Enforcement of Patents?

Now that we covered the basics, onto understanding how Terminal disclaimers affect patents and your chances of enforcing them.

According to the patenting norms of the USPTO, to enforce patents a single corporate entity must own all the patents connected via terminal disclaimer.

Having different companies or even subsidiaries of a company’s own connected patents could make them unenforceable.

Overlooking terminal disclaimer might have some serious implications.

Give me an instance, you say?

I’ll give you three.

Below we have narrated three different cases, each resulting from one of the multiple implications of resulting Terminal Disclaimers. You can click on the hyperlinks to read individual cases or continue scrolling to gain knowledge on the implications of ignoring TDs in its entirety.

- When some patents attached to your asset are owned by some other company

- When one of the connected patents is owned solely by a company and others jointly with some other company/university

- When connected patents are owned by subsidiaries

3 Instances When Entities Axed their Feet by Ignoring Terminal Disclaimers

The Tale of Cardiologist- Voda vs Medtronic

Jan Voda filed a patent infringement suit against Medtronic Inc. in January 2009 for infringing on two of his patents on catheters- US 6083213 and US 6475195.

In court, Medtronic’s legal team argued that one of the counts in the complaint should be dismissed in light of the Terminal Disclaimer.

Terminal Disclaimer in the application stated that the patent 6,475,195 (‘195) shall be enforceable only for and during such period that it is commonly owned with the patent 6,083,213 (‘213) and 5,445,625 (‘625).

Although Voda owned all the three patents at one point in time, in 2008, he had assigned the rights of two of these patents (‘195 and ‘625) to Boston Scientific Corp.

In 2010, the company transferred the rights of the ‘195 patent back to Voda but it still owned the rights to patent ‘625.

Leveraging the opportunity, Medtronic contended that Voda could not enforce the patent. Voda attempted to claim royalties for the time period all the three patents in the suit were commonly owned.

But, the district court disagreed with Voda’s plea and ruled out that:

“The Terminal Disclaimers, however, do not speak in terms of ownership during times of infringement; rather, they require common ownership for enforceability. … To enforce the ‘195 patent, plaintiff must not only own all three patents for the period he seeks enforcement of the ‘195 patent, he must also own all three patents during the period he files suit to do so. As it is undisputed that plaintiff does not own the ‘625 patent, the ‘195 patent is unenforceable as a matter of law under the plain language of the Terminal Disclaimers.”

Jan Voda in nescience gave away the rights of a potential patent to Boston Scientific Corp. Though Voda won the overall case but overlooking terminal disclaimer made some of the claims in the patents unenforceable, costing him millions in royalties.

Had he paid attention to Terminal Disclaimers, he would have pocketed a lot more.

Lesson learned?

It is very important to have a deeper glance into the terminal disclaimer of each and every patent before being bought or sold.

Now you may ask, what if one of the related patents is solely owned by a company while others are joint with some other company? Or what if subsidiaries of a company own the related patents?

The below-mentioned cases would answer your queries.

University Anecdote- STC University of New Mexico (UNM) v. Intel Corporation

On November 2010, UNM sued Intel Corporation for infringement of U.S. patent, No. 6,042,998 (’998) which was terminally disclaimed to another U.S. patent, No. 5,705,321 (’321).

Although the patents had common inventors, UNM owned patent ’998 solely and patent ’321 commonly with Sandia Corporation. Intel Corp. argued that patent ‘998 was unenforceable as it was not commonly owned with patent ’321.

UNM realized this and tried to solve this problem by assigning an undivided interest in patent ’998 to Sandia. They did this to ensure that both the patents were commonly owned by Sandia and UNM, rendering the ’998 patent enforceable.

To UNM’s ill fortune, Sandia refused to join the suit, therefore the district court dismissed the case ruling that the Plaintiff lacked standing. Thus, even though UNM fixed the problem of common-ownership to enforce patent ’998, it still could not enforce patent ’998 as co-owner Sandia refused to join the suit.

Owning one patent solely and others commonly with some other company or in this case university could make them unenforceable. So, either there should be joint ownership of all the related patents or all should be solely owned.

That answered one of your questions.

Wondering about entities that have the same parent company?

Time for the tale of an NPE.

The Anecdote of an NPE- Email Link Corp Vs Treasure Island

When it comes to wholly-owned subsidiaries of a company, the case between Email Link Corp Vs Treasure Island is an ideal example to pull off the curtains.

Email Link Corp (in 2012) filed litigation against Treasure Island and 7 other companies for Infringement over one of their patents 7,840, 176 (’176).

In the patent ‘176 there was a terminal disclaimer attached linking it to an earlier patent 7, 508, 789 (‘789) which was assigned to Online News Link.

Both the companies ‘Email Link and Online News Link’ were the wholly-owned subsidiaries of Acacia Global Acquisition LLC. Treasure Island argued that the patents are not commonly owned by Email Link and therefore are unenforceable.

The judge ruled out the decision that the patent ‘176 was not enforceable as the earlier patent ‘789 was not assigned under the same entity.

Although both the entities Email Link and Online News were wholly owned by Acacia Global Acquisition LLC; the parent company had no entitlement over the patents of its subsidiaries. That is the subjected patent had a different assignee than the earlier patent ‘789 and thus, leaving the subject patent unenforceable thereby dismissing the whole case.

Which means, having even wholly-owned subsidiaries own the related patents could make them unenforceable. The patents need to be commonly owned by one company, even wholly-owned subsidiaries owning related patents could end up making the patents unenforceable.

How to Keep Track of Terminal Disclaimers?

To find the patents linked via terminal disclaimer, you need to dig very deep into the patent data to work out the relationships. For companies with a portfolio of thousands of patents, this could be a very difficult task. It could consume a lot of time and take a toll on the company’s resources.

For such tasks, a robust system that could help companies keep a track of terminal disclaimers is a dire need.

Realizing the situation, we took a step to optimize this problem.

We built a program to efficiently monitor different patents to determine the terminal disclaimer.

Intuitive and interactive, this program provides a definite set of patents (linked via a terminal disclaimer), making it easier to assess which patent(s) needs to be included in the sales bundle.

Here are some of the many advantages of this program:

- It saves a lot of time and provides the needed set of patents without having to beat your head through file histories of all the patents in the portfolio.

- It makes negotiation very clear and easy

- Knowing the exact patents to be included in your sales bundle, you could expand the customer base accordingly.

- Once you know the exact sales bundle to sell, you can set the right asking price.

This will not only help save your time and resources, but also millions of dollars which would otherwise have gone wasted only because of one small mistake.

If you’d like to know more about the program and how we could help manage your portfolio:

Conclusion

In the lights of Terminal Disclaimer, it becomes very important that a company commonly or solely owns all the related patents. The terminal disclaimer has got some serious implications and ignoring it (willfully or even unknowingly) could cost you “millions”.

It is important to have a check on the TD quotient before preparing your next sales bundle. You never know, how many millions you or the buyer would end losing patents that come with Terminal Disclaimer tag attached.

Behold ‘ere thou leap.

Authored by: Gaurav Sharma, Associate, IP solutions and Abhinav Aneja, Team Lead, IP Solutions

Next Step: Find out How Filing Patent Continuation Applications Can Enhance Value of Your Patent Portfolio?

Disclaimer: The content of this article does not constitute legal advice. Consult an attorney of your choice for any legal matter or document.