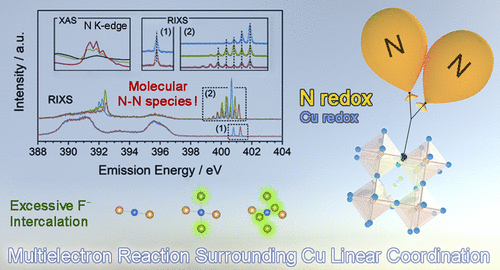

According to a report published in Jan 2025, researchers, in collaboration with Toyota, found that using a new type of cathode material, copper nitride (Cu₃N), for all-solid-state fluoride-ion batteries (FIBs), could increase the EV range by twofold.

Cu₃N exhibits a high reversible capacity of approximately 550 mAh/g, surpassing many conventional fluoride-ion cathodes. This material reportedly offers three times the capacity per volume and twice the capacity per weight compared to traditional lithium-ion batteries. The new cathode could potentially double the driving range of electric vehicles (EVs), from 372 miles (600 km) to 745 miles (1,200 km).

In September 2024, Toyota announced that the Japanese government had approved its plans to build cars with solid-state batteries. It plans to start production of its solid-state batteries by 2026 and to have solid-state battery-powered vehicles on the road by 2027.

The company has positioned itself at the forefront of electric vehicle innovation.

However, it took Toyota over 15 years to reach this point.

One and a Half Decades of Research and Development

In the mid-2000s, Toyota’s initial interest in lithium batteries was low, and the company claimed that they would eventually be superseded by fuel cells. While fuel cell work continues, battery activity surged drastically in the 2010s.

Toyota began researching solid-state batteries in 2010 and announced a four-layer all-solid-state battery in December of that year.

Toyota confirmed that the prototype all-solid-state battery can be used at 100°C. Existing lithium-ion rechargeable batteries with electrolytes cannot be used at this temperature because their electrolytes boil.

At the same time, Toyota was advancing Eco-Car Development With Electric and Hybrid vehicles. So, a safe and efficient battery was a challenge to overcome.

Toyota’s foresight in recognizing the potential of solid-state batteries to revolutionize electric vehicles (EVs) by offering higher energy densities and safety profiles than traditional lithium-ion batteries is truly impressive. The company’s aim to lead in this transformative area is a testament to its vision and commitment to innovation.

Toyota further sought partnerships with various research entities to accelerate the research and development of SSBs. Over the years, the company has overcome several challenges through successful partnerships, enabling it to reach SSB commercialization sooner.

After one year of development, Toyota and its research partners, involving Ryoji Kanno and his associate Masaaki Hirayama from Tokyo Tech, announced a breakthrough in SSBs.

They developed the world’s first lithium superionic conductor, Li10GeP2S12, which demonstrated the capability to conduct lithium ions at room temperature more effectively in the solid state than in liquid. This new material doubled the conductivity of existing lithium-ion conductors and surpassed the ionic conductivity of the organic solvents used in current lithium-ion batteries.

The company devised a plan to commercialize this technology between 2015 and 2020.

As the research intensified, the company made plans to expand its EV market.

Battery technology was even included on MIT’s list of the top 10 breakthrough technologies in 2011, further encouraging other players to join the race.

This was when many startups started to enter this technology to offer solutions to the challenges faced by Li-ion batteries.

In 2011, Toyota and Panasonic made a joint venture for battery development for EV and Hybrid cars.

Over the next two years, the company provided updates on refining its battery chemistry to enhance the performance of its hybrid vehicles.

In 2014, Toyota researchers announced the development of a new battery and showcased their intentions to research lithium-air batteries.

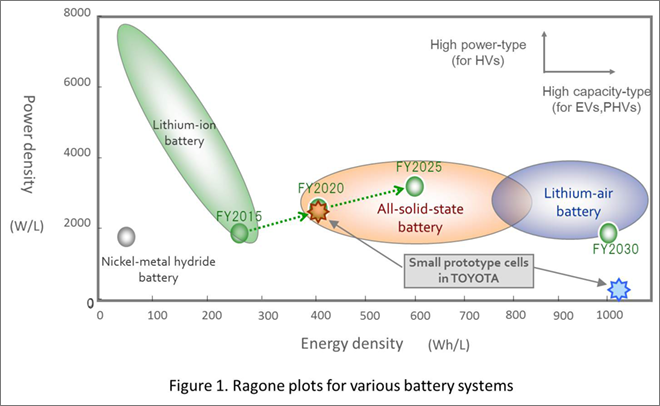

At the International Meeting on Lithium Batteries in Como, Italy, Dr. Hideki Iba from Toyota’s Battery Research Division and Dr. Chihiro Yada from Toyota Motor Europe’s Advanced Technology Group noted that, while lithium-air batteries may not be commercialized until 2030, solid-state batteries could be ready for the market as soon as 2020.

Source: Chargedevs

By 2014, the company had improved its battery technology 5X in power output compared to 2012. At that time, its solid-state battery had a power density of around 400 Wh/l (watt-hour per liter).

Meanwhile, Toyota also focused on hydrogen fuel cell technology and vehicles, launching the Mirai in Europe in 2015.

As the race for solid-state batteries heated up, patent filings increased yearly. Even companies like Apple filed patents on batteries.

2016 brought another breakthrough for Toyota and its research partners from the Tokyo Institute of Technology. The breakthrough was an improved design from its predecessor, which had proven to be expensive, and some models had exhibited problems with electrochemical stability.

The research highlighted lithium superionic conductors that exhibit exceptionally high conductivity (25 mS cm−1) and remarkable stability. These conductors, specifically Li9.54Si1.74P1.44S11.7Cl0.3, demonstrate near-zero voltage against lithium metal, indicating high stability.

In 2017, Toyota claimed to work on new battery types that could hold a higher charge. The improved battery technology would enable the development of smaller, lighter lithium-ion batteries for use in electric vehicles (EVs).

In May 2018, Toyota announced a new R&D program with Panasonic, Nissan, and Honda for the development of solid-state batteries. The aim was to develop batteries with a range of upto 500 miles. The Japanese government was also involved in this program.

Despite all this research, the journey wasn’t always fruitful. The company faced several challenges, including production hell and intense competition.

In 2018, Panasonic’s CEO stated that the anticipated battery would not be ready for production for another decade. This came from one of its partners and was a surprise.

Meanwhile, other automotive companies invested hundreds of millions in startups to gain a competitive advantage. For example, Volkswagen invested $100 million in Quantumspace, one of the top solid-state battery manufacturers.

In 2019, Toyota announced that it would debut its solid-state battery EV in the Tokyo Olympics, but COVID-19 dashed that plan.

In 2020, Toyota established Prime Planet Energy & Solutions, Inc., a joint venture with Panasonic to develop automotive prismatic batteries. The joint venture will supply batteries not only to Toyota but broadly to all customers.

By 2021, Toyota had a portfolio of over 1,000 patents in solid-state batteries alone and was leading the technology in terms of patent count.

Toyota further announced an investment of $13.5 billion by 2030 in batteries, including solid-state batteries. It aimed to reduce the cost of its batteries by 30% or more by improving the materials used and the cell structure.

“We are still searching for the best materials to use,” Chief Technology Officer Masahiko Maeda.

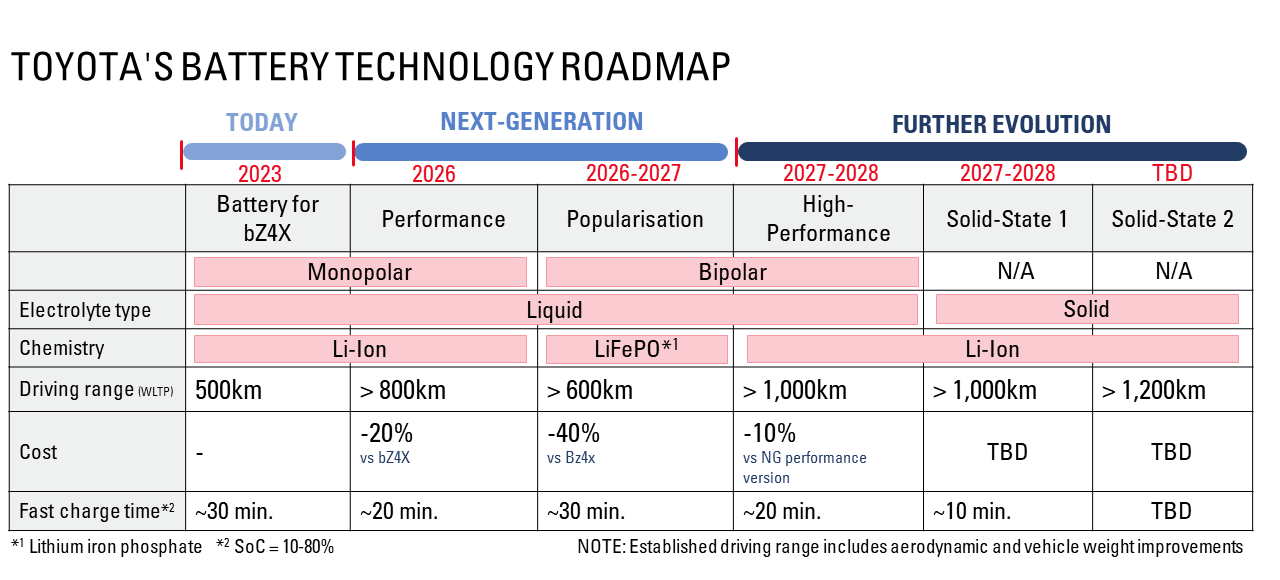

In 2023, Toyota released its battery technology roadmap, which showcases that it won’t be able to release solid-state batteries before 2027.

Source: Toyota

The company further clarified that they will use these batteries in a hybrid vehicle first.

It plans to sell 3.5 million EVs annually across 30 different Toyota and Lexus model lines by 2030. Long-range battery packs will provide up to 500 miles of range by 2026 and 620 miles by 2027.

Toyota aims to introduce solid-state batteries in 2027 that are capable of ultra-fast 10-minute recharge times from 10 to 80 percent state of charge.

Major Challenges in Solid-State Batteries

Toyota’s pursuit of solid-state battery technology represents a significant advancement in the electric vehicle (EV) sector, but it is not without its challenges. Solid-state batteries possess several critical issues that must be addressed to ensure their practical application in automotive settings.

One of the primary challenges facing solid-state batteries is the interfacial stability between the solid electrolyte and the electrodes. High interfacial impedance is a significant barrier to the commercialization of SSBs, as it can lead to inefficient ion transport and reduced battery performance (Feng, 2024; Wang et al., 2020).

The solid-solid contact necessary for effective ion conduction often increases resistance, severely limiting the battery’s efficiency. This interfacial challenge is compounded by the mechanical and chemical instabilities that can occur at the electrode/electrolyte interface, leading to rapid capacity decay and battery failure (Liu, 2023; Chen et al., 2019).

Moreover, the mechanical properties of solid electrolytes present another hurdle. While solid electrolytes are generally more stable than their liquid counterparts, they can be brittle and susceptible to cracking under stress. This brittleness can lead to the formation of voids and cracks, further exacerbating interfacial issues and potentially causing dendrite growth, which can result in short circuits. Developing flexible and mechanically robust solid electrolytes is essential to mitigate these risks and improve the overall durability of solid-state batteries (Liu et al., 2020; Yang et al., 2021; Chen et al., 2019).

Temperature sensitivity is another significant concern for solid-state batteries. Polymer-based solid electrolytes, while offering some advantages, can suffer from performance degradation at elevated temperatures due to shrinkage and deformation. This sensitivity limits the operational temperature range of solid-state batteries, which is critical for automotive applications that require reliable performance across varying environmental conditions (Hu, 2024; Wang et al., 2020).

Toyota Patents on Solid-State Battery

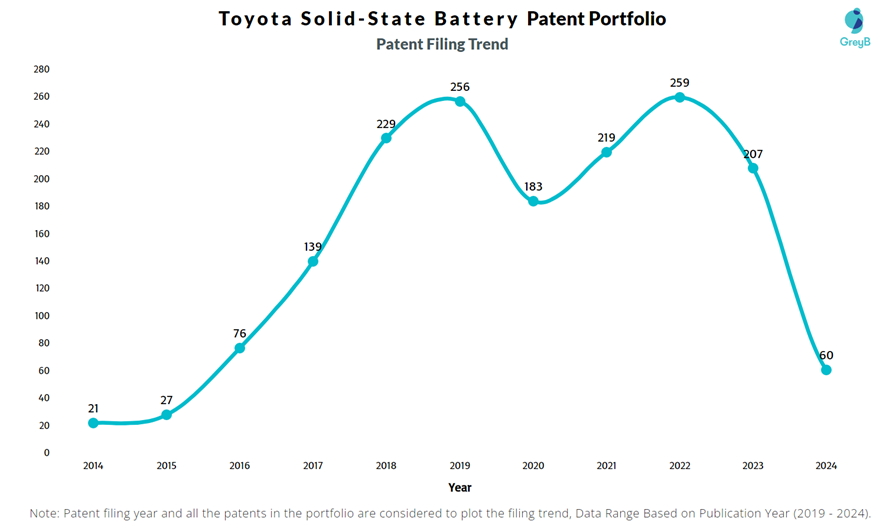

In the last 10 years, Toyota has filed nearly 2000 patents on solid-state batteries. Although the company claims to have 1,000 patents, the analysis reveals that the actual number is much higher.

Below is the patent filing trend of Toyota’s patents in SSBs:

The filing chart indicates that the surge in filings occurred in 2016.

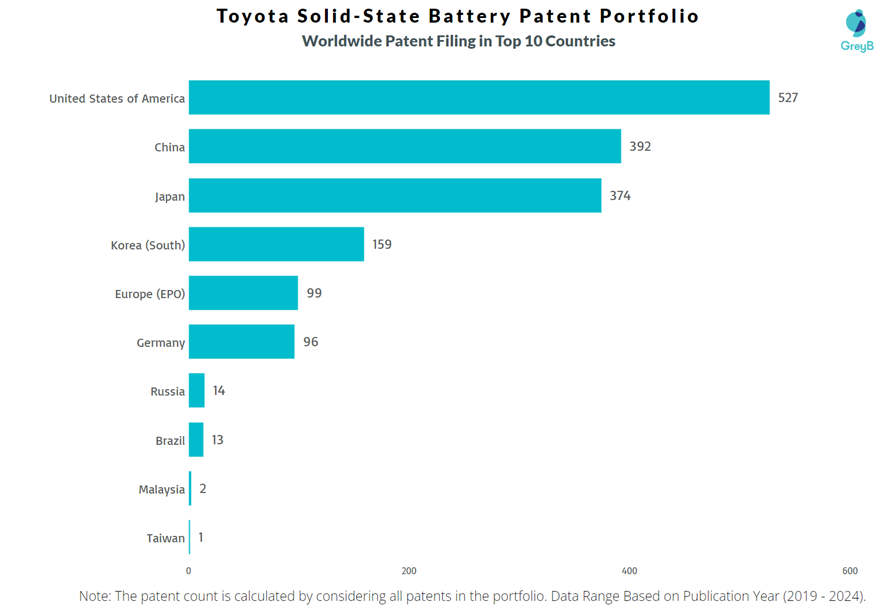

The US received the most patent filings, followed by China, the biggest market for EV batteries.

This significant patent count on solid-state batteries demonstrates Toyota’s intense focus on the technology. These patents address issues in solid-state batteries, including increasing charging speed, enhancing battery life, improving energy density, and ensuring safety.

Below are some recent patent examples of how the company solves these issues.

Advantages of Toyota’s Solid State Battery

Toyota focuses on addressing fundamental issues that EVs struggle with and aims to provide advantages such as faster charging speeds, improved battery life, and enhanced battery density.

Increase Charging Speed

One of Toyota’s inventions (US20230387412A1) utilizes graphite particles with a specific crystalline structure and a sulfide solid electrolyte to enhance charging. Experimental results show reduced ion transport resistance and better charging capabilities.

In another patent (US20240021797A1), Toyota discusses a composite particle with a fluorine-based coating film for all-solid-state batteries to reduce resistance increment, especially under high voltage. This technology enhances charging speed by minimizing resistance, with the composite particle produced through a mixture of coating liquid and active material particles. The coating comprises fluorine, phosphorus, and a glass network former, with optional metallic elements for further reducing resistance.

Enhance Battery Life

Toyota’s patent (US20240038972A1) discusses an electrode material for all-solid-state batteries that reduces resistance degradation during cycling. The electrode uses a composite particle structure with alternating fluoride and sulfide electrolyte layers, minimizing resistance increment over time. This innovation improves battery longevity by decreasing post-endurance resistance.

This patent (US20230343961A1) describes a method for reducing resistance in all-solid-state batteries by coating positive electrode particles with a phosphorus-containing film, thereby enhancing adhesion and ion conductivity. The process involves spray drying a coating mixture of active particles and a solution with a lithium-phosphorus ratio. The coated electrode is then formed and rolled at 170°C or higher, achieving a filling rate of 90% or higher, which improves battery longevity and performance.

Improve Energy Density

Toyota’s patent (US20230299337A1) discusses a solid-state battery design with low restraining pressure, enhancing energy density. The positive electrode layer utilizes composite particles coated with a sulfide solid electrolyte, thereby preventing contact failure at pressures of 0.5 MPa or less. Critical factors, such as particle composition and peel strength, play a crucial role in maintaining battery performance, as evidenced by tests that show reduced resistance during cycling.

This patent (US20220328815A1) discusses a solid-state battery design with a Si-based anode to reduce resistance increase during cycling. The design strikes a balance between energy density and resistance by optimizing the anode capacity ratio and fill factor. The Si-based anode prevents cracking during volume expansion, with specific ratios allowing expansion without fracturing. This innovation enhances battery performance by mitigating anode expansion and reducing contact resistance.

Another patent application (US20220200057A1) showcased a method to enhance energy density by enclosing the battery laminate in a metal case and welding the protruding current collector layers to the folded margin parts. This design eliminates the need for welding clearance, resulting in a more compact battery. The method involves folding the welded parts inside the case and sealing them with resin, resulting in a more efficient and compact battery design. The battery can utilize various materials, such as sulfide solid electrolytes and carbon, to improve energy density in both bipolar and monopolar types.

Market Growth

According to Markets and Markets, the global solid-state battery market is expected to grow from $85 million in 2023 to $963 million in 2030, with a CAGR of 41.5%.

EVs are one of the biggest reasons the SSB market will explode shortly. Therefore, it is not surprising that major automotive companies, such as Toyota or Volkswagen, are striving to perfect this battery technology.

Besides Toyota, other companies are also leading in solid-state battery manufacturing. Most of them are startups that attract attention and funds from VCs and EV companies. As a result, specialized startups such as QuantumScape, BrightVolt, and Solid Power are now big manufacturers of SSBs.

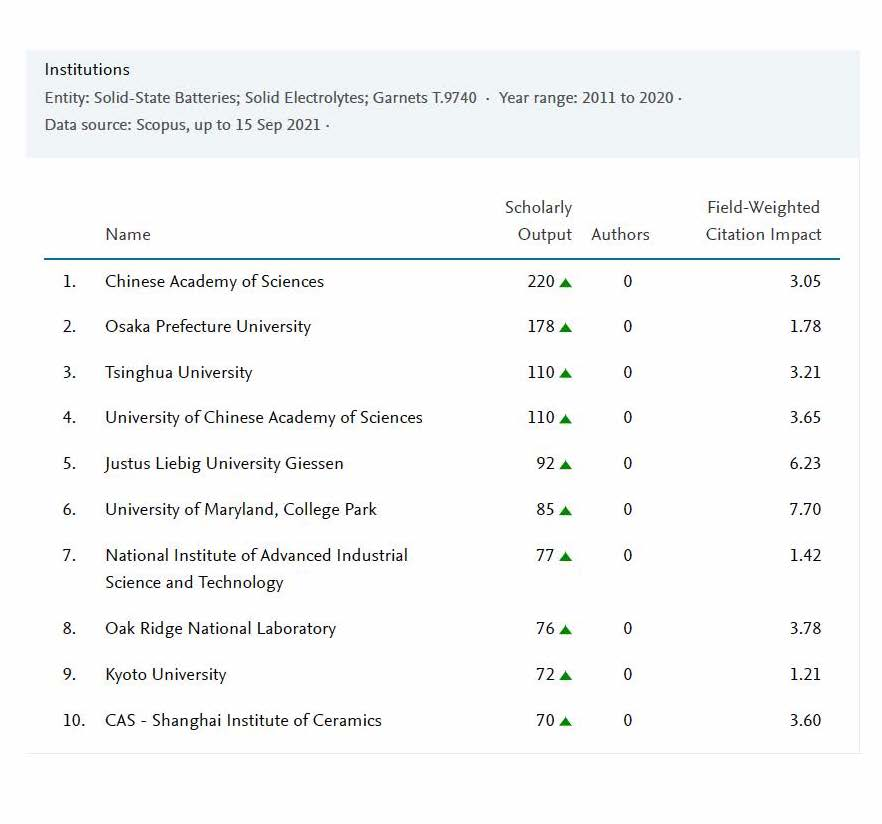

Universities and Research institutes are participating vigorously in this technology to make it efficient.

A report by Elsevier shows the top universities with the most research papers on solid-state batteries published between 2011 and 2020. In 2011, 66 publications were on solid-state battery technology, but by 2020, the number had increased to 722 papers.

Many startups are born from these institutes, including Ion Storage Systems, founded by Eric Wachsman, the director of the Maryland Energy Innovation Institute.

Further, Toyota isn’t the only automaker planning to put solid-state batteries in cars to reap all their benefits. SAIC-owned MG says it will launch its first solid-state-powered production vehicle in 2025. Another SAIC brand, IM Motor, has already revealed the L6, which features a 133 kWh semi-solid-state battery that promises a range of up to 673 miles on the Chinese CLTC test cycle. Charging it for just 12 minutes adds 249 miles of range.

Toyota’s Partnerships to Develop SSBs

Toyota, a longstanding pioneer in hybrid technology, has strategically positioned itself as a leader in the SSB domain. Recognizing the potential of SSBs to revolutionize the automotive sector, Toyota has been proactive in forming alliances and fostering collaborations.

Toyota’s collaborations span industries and borders, including ties with Panasonic to develop and scale battery production and a notable partnership with Idemitsu. These partnerships leverage mutual strengths in materials science, manufacturing processes, and technological innovation.

Partnership with Tokyo Institute of Technology

Toyota partnered with the Tokyo Institute of Technology before 2010 to research and develop solid-state batteries. Together, they announced a breakthrough in 2011.

A New R&D Program, Libtec

In 2018, Toyota, Honda, Nissan, and Panasonic, along with the Japanese Government, announced a new R&D program, Libtec, for the development of solid-state batteries. The aim was to develop batteries with a range of upto 500 miles.

Joint Venture with Panasonic

In 2020, Toyota and Panasonic announced a joint venture, Prime Planet Energy & Solutions, Inc., specializing in automotive prismatic batteries. Toyota holds a 51% ownership stake in this venture, while Panasonic owns the remaining 49%. The number of employees is 5100, including 2400 at a subsidiary in China.

Partnership with Idemitsu

In October 2023, Toyota partnered with Idemitsu, a petroleum company that develops elemental technologies for all-solid-state batteries. They agreed to collaborate on developing a mass-production technology for solid electrolytes. This will enable both companies to enhance productivity and establish a supply chain for mass-producing all-solid-state batteries for battery electric vehicles (BEVs).

How will the Success of SSBs impact Toyota?

The successful commercialization of solid-state batteries (SSBs) could be a game-changer for Toyota, altering the company’s market dynamics in several ways.

Enhanced Vehicle Performance

Toyota’s entry into EVs is inevitable now, so it is crucial to have a superior electric vehicle compared to companies with big market shares in EVs.

Toyota’s SSB prototype showcased a record range and charging time. For instance, Toyota has suggested that its SSB technology could enable electric vehicles to charge from zero to full in just 10 minutes.

This enhancement meets another crucial consumer demand—reducing downtime due to battery charging, which currently hampers the practicality of EVs for long-distance travel and quick usage turnaround.

Market Share Growth

By leading in SSB technology, Toyota positions itself at the forefront of the next wave of EV innovation, which could enable it to capture a larger share of the burgeoning EV market.

Toyota’s early adoption and potential mastery of SSB technology could attract a broad customer base, ranging from eco-conscious individuals to tech enthusiasts and mainstream consumers seeking reliable, advanced, and efficient vehicles.

Competitive Edge

The shift to SSBs could provide Toyota with a significant competitive advantage. While other automakers may be hesitant or slower to move away from the more mature lithium-ion technology, Toyota’s commitment to SSBs could make it a leader in a crucial area of automotive technology.

Toyota enhances its brand reputation by establishing itself as a leader in SSB technology. It sets a high standard for competitors, potentially leading to a scenario where Toyota’s innovations become the benchmark against which other vehicles are measured.

What’s next?

The impact of these dynamics is multifaceted. For Toyota, it could mean stronger sales, a more robust market position, and the influence to shape future industry standards. It could also translate into access to more advanced, reliable, and sustainable consumer vehicles.

Collectively, these factors could dramatically reshape the automotive market, placing Toyota at the vanguard of the next major shift in automotive technology.

This analysis provides an overview of Toyota’s Battery Innovation efforts. However, the in-depth study of its patent portfolio and market research provides a broader view of its research strategy.

How Can We Help You?

We support industry-leading R&D and Innovation professionals through complex problems. Describe your challenge, and let us bring clarity and expertise.