Over the past decade, Netflix has seen a shift in the types of patent litigation it faces. It was predominantly litigated by Non-Practicing Entities (NPEs), but recently, there has been a rise in lawsuits from operating companies. This shift in litigation dynamics reflects the changing challenges that Netflix must address as it expands its technological and market footprint.

As these trends unfold, it’s crucial to examine how Netflix positions itself in response to these legal pressures, particularly in areas such as video coding technology.

Before these insights become widely recognized, our analysis of Netflix’s recent patent activities provides a comprehensive view of the company’s strategic interests and potential market impacts. This analysis draws on a detailed review of Netflix’s litigation trends, patent portfolio growth, and technology focus areas.

While this article is based on Netflix’s Patent Activity as of August 2024, subscribe to our newsletter for the latest updates on the patent strategies driving Netflix’s next big moves.

Netflix’s Litigation Trends

A Shift from NPEs to Operating Companies

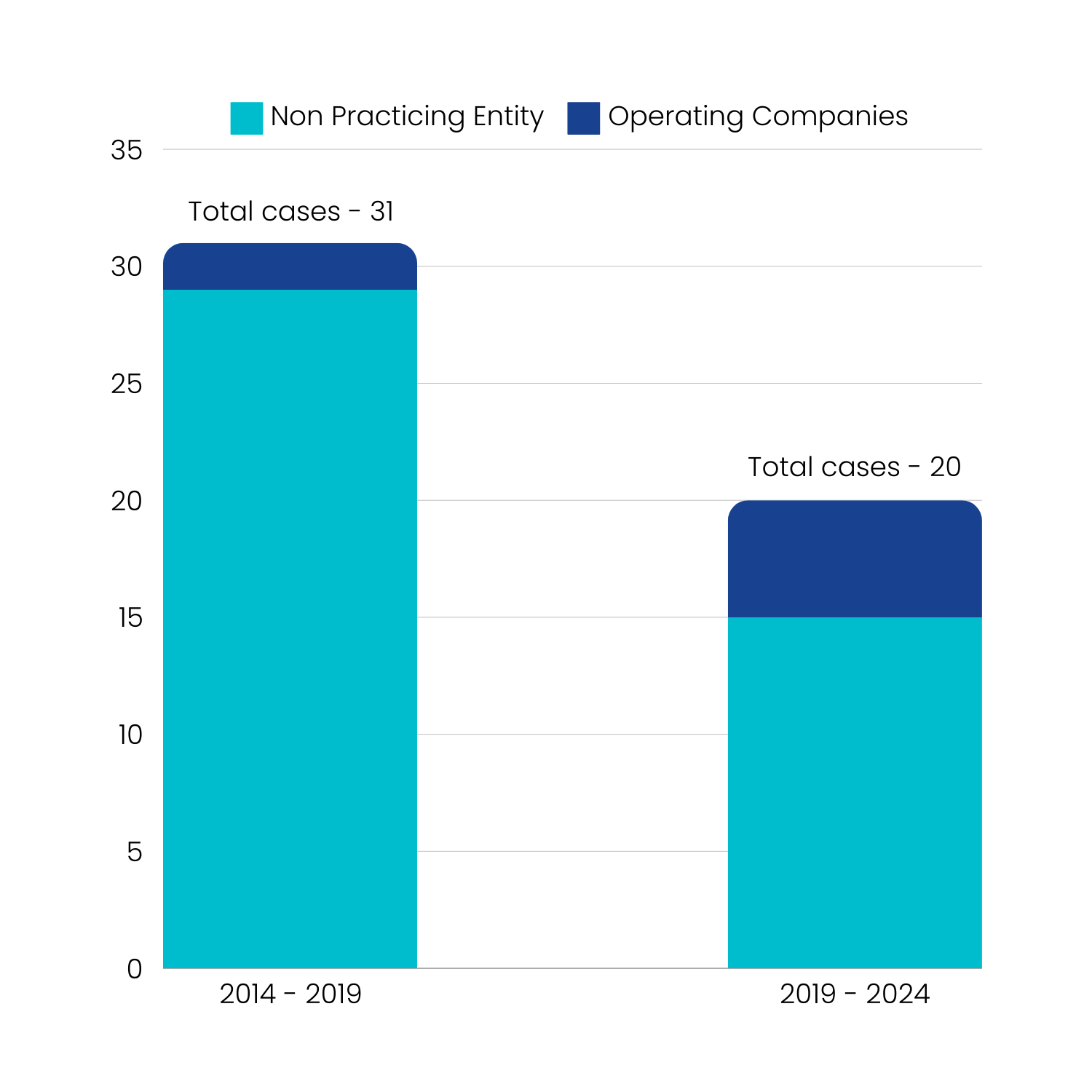

An in-depth analysis of litigation data over the past decade reveals a 50% decline in Non-Practicing Entity (NPE) activity against Netflix over the past five years, while litigations from operating companies have surged by 150% during the same period.

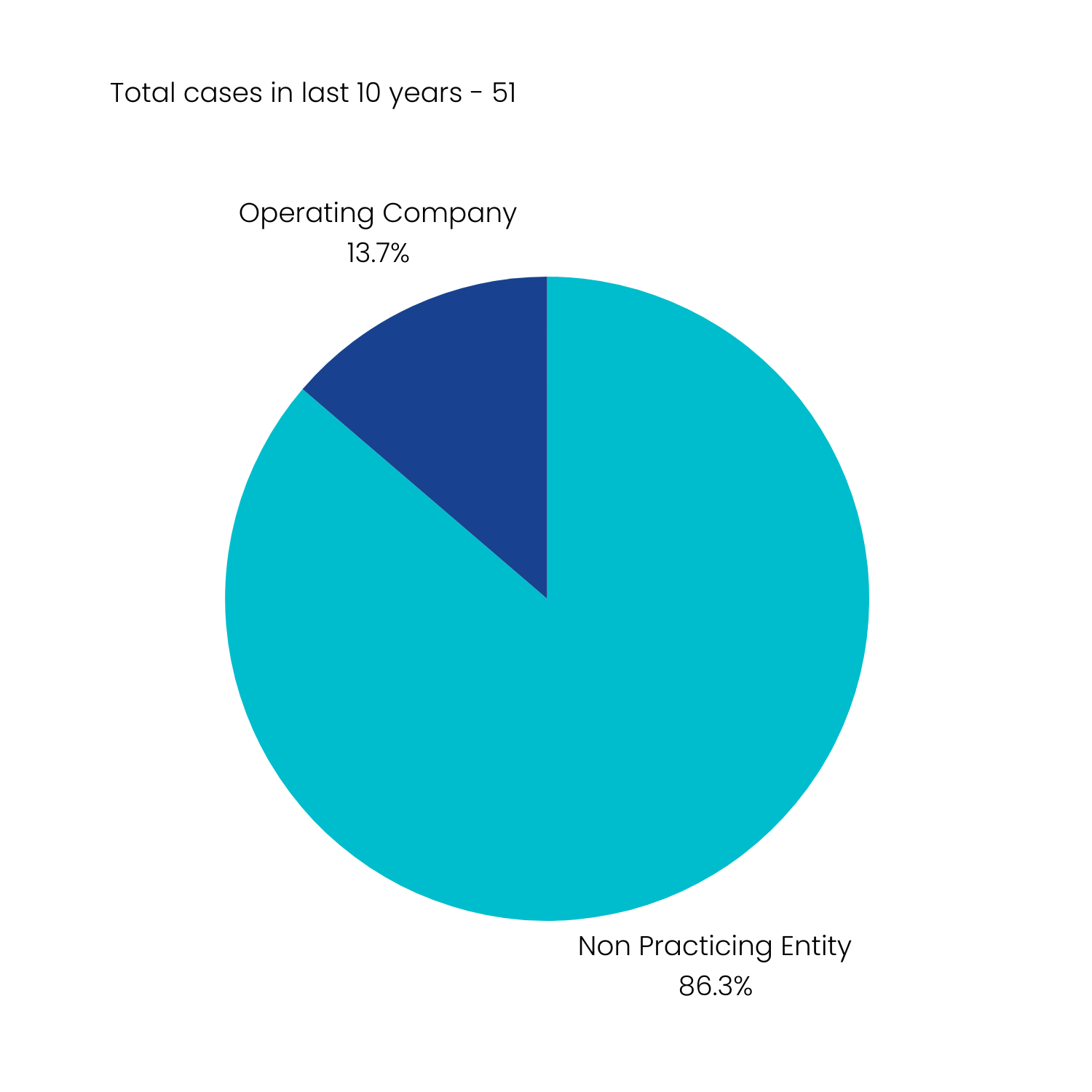

Historically, Netflix has been predominantly targeted by NPEs, accounting for 86.2% of all litigation initiated by these entities over the last decade.

Over the past 10 years, Netflix has faced 44 lawsuits from NPEs, compared to just 7 from operating companies. Notable companies that have filed patent infringement lawsuits against Netflix include Broadcom Corp., Gotv Streaming LLC, CA Inc., OpenTV Inc., and Avago Technologies.

From 2014 to 2019, Netflix was involved in 29 NPE lawsuits, compared with only 2 from operating companies. However, the trend has shifted significantly over the last five years (2019-2024), with a reduction in NPE-related cases to 15 and a notable increase in operating company litigation to 5 instances.

This marked shift suggests that while NPE threats are declining, Netflix is facing increasing scrutiny and legal challenges from operating companies, potentially requiring it to reevaluate its IP defense strategies.

Patent Litigations of Netflix

Netflix Bounding its Vulnerability in the Video Coding Technology

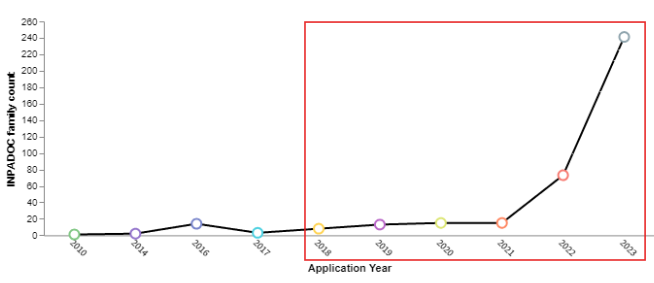

Netflix recently faced a significant legal setback when a German court found the streaming giant had infringed Broadcom’s video coding patent, which is crucial to streaming Ultra-HD content. This decision has highlighted the vulnerabilities in Netflix’s technology portfolio and the intense scrutiny it faces in the competitive streaming industry.

Following litigation in 2018, when Netflix had filed only 8 video coding patents, the company has significantly ramped up its patent filings. In 2023 alone, Netflix filed over 240 patents, marking a substantial increase.

This rise indicates a strategic effort to fortify its intellectual property assets, protect its innovations, and reduce future legal risks. By expanding its patent portfolio, Netflix is positioning itself to defend its technologies better and maintain a competitive edge in the market.

*Note: The numbers for 2023 and 2024 may increase over time as some of the recent filings might not be publicly available.

Netflix’s Recent Patent Acquisition

Focus on Content Over Patents

Netflix maintains a patent portfolio comprising approximately 371 patent families and 2106 patents (including applications). Despite Netflix’s acquisitions of several smaller companies in animation, visual effects, video game development, and book publishing, these deals did not involve significant patent reassignments to Netflix.

One exception is Animal Logic, an Australian animation and visual effects studio that Netflix acquired in 2022, which brought with it two patent applications related to image composition. Animal Logic is renowned for producing visual effects and animation for major films such as “The Lego Movie,” “Marvel Studios’ Captain Marvel,” and “The Great Gatsby.”

Another notable acquisition in the visual effects domain was Scanline VFX, acquired in 2021, a studio recognized for its work on popular TV series and movies like “Stranger Things 3,” “Game of Thrones,” and “Godzilla vs. Kong.”

In recent years, Netflix has also been expanding into the video game market, acquiring companies such as Next Games, Night School Studio, Boss Fight Entertainment, and Spry Fox. However, these acquisitions have not involved significant patent reassignments, suggesting that Netflix is not primarily focused on acquiring companies for their patent portfolios. Instead, these acquisitions reflect a strategy to diversify and enhance its platform’s content offerings.

It will be interesting to observe whether Netflix will shift its strategy in the future by focusing more on acquiring companies with substantial patent portfolios or if it continues to prioritize content and creative capabilities over patent accumulation.

Want to Keep an Eye on Netflix and Other Leading Companies?

GreyB’s “Business Behind Patents” series will help you learn the business strategies behind industry leaders’ patent activities.

Subscribe to our newsletter to monitor their latest moves and analyze patents and trends before they make headlines.

Analysis by: Rohit Sood, Shrey Mehra & Rahul Mahajan