Medtronic, a leading innovator in continuous glucose monitoring, is the second-largest patent filer in this domain, trailing behind only Abbott.

In terms of market share, it holds the third position, behind Abbott and Dexcom.

These three players dominate the entire CGM market (98% share), leaving only a small portion for the rest of the companies. Even Medtronic holds the 3rd position, but its share is only 6.88%, far less than Abbott’s (56%) and Dexcom’s (35%).

This disconnect between innovation and market performance presents both a challenge and an opportunity.

The company’s strong R&D foundation suggests untapped potential that could be unleashed through the right strategic approach.

Recognizing this gap, Medtronic has accelerated its efforts since 2023 to bridge the innovation-to-market divide. The company has been developing next-generation CGM devices and algorithms, while forming strategic partnerships and expanding its intellectual property portfolio, with a clear focus on market penetration rather than solely technological advancement.

This report examines Medtronic’s recent research activities in glucose monitoring, including new solutions and product upgrades, major collaborations and acquisitions, patent and publication activity, and a brief look at competitive positioning.

Advancements in Continuous Glucose Monitoring

MiniMed 780G adjusts insulin and provides corrective doses every 5 minutes

The 780G system has been available in Europe since 2020. It was touted as delivering the strongest clinical outcomes and best user experience to date among Medtronic’s pumps. In April 2023, Medtronic upgraded this system into the MiniMed 780G system.

This new FDA-approved CGM system has an advanced insulin pump paired with the Guardian 4 continuous glucose sensor. Its Meal Detection Technology automatically adjusts insulin and provides corrective doses every 5 minutes. This is a life-changing feature for users who occasionally forget mealtime boluses or miscalculate their carbohydrate intake.

“Mealtimes prove to be one of the biggest challenges for people living with type 1 diabetes, and now for the first time, the MiniMed 780G system addresses this unmet need with automatic, real-time insulin corrections,” Que Dallara, EVP and President of Medtronic Diabetes.

The MiniMed 780G is the first insulin pump system to offer real-time auto-corrections, addressing the challenge of post-meal glucose spikes in diabetes management.

The system also features one of the lowest glucose target settings (as low as 100 mg/dL) compared to other automated insulin pumps. It helps with precise control and keeping blood sugar levels in the normal range.

Crucially, the accompanying Guardian 4 sensor eliminated the need for routine fingerstick calibrations while in SmartGuard™ closed-loop mode.

This was a significant upgrade over Medtronic’s earlier sensors (which often required twice-daily calibrations) and brought the company’s CGM technology in line with competitors Dexcom and Abbott, which had already achieved calibration-free sensors.

Together, the 780G pump and Guardian 4 CGM represented a significant leap forward in ease of use and glycemic control efficiency, automating insulin delivery with minimal user input.

A study revealed the overall users’ reviews of this system, which were predominantly positive. The 780G seems to deliver on its promise compared to earlier/hybrid systems, with improvements in time in range, a lower risk of hypoglycemia, and high usage of its features (i.e., people stay in closed-loop mode most of the time), among other benefits.

There are even threads on the subreddit that show positive feedback among users.

Others who reviewed it showed that while they are happy with it, they would still consider Dexcom due to some features.

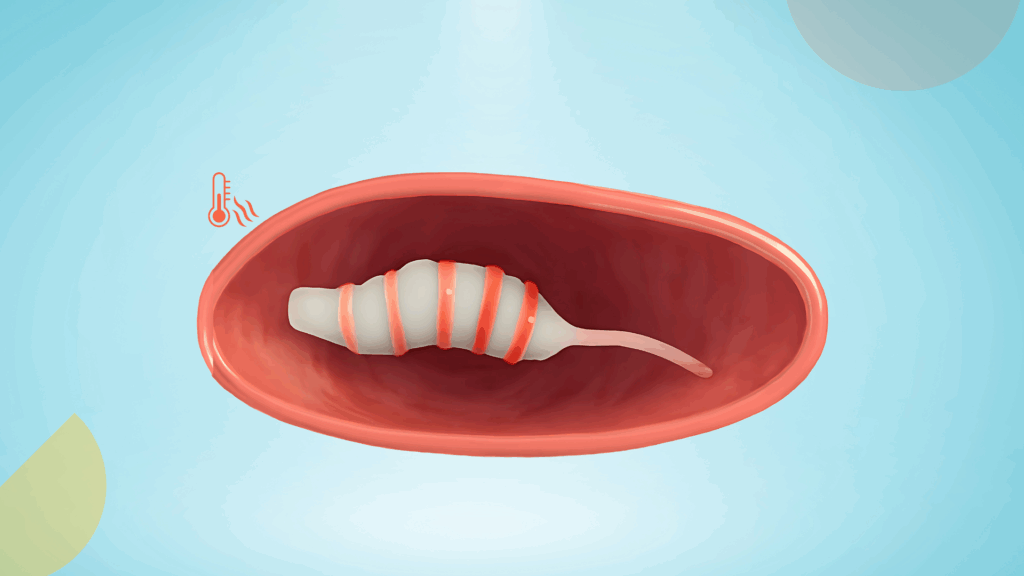

Simplera: All-in-one continuous glucose monitor

In late 2023, the company began previewing a new CGM platform called Simplera™. It’s Medtronic’s first fully disposable, all-in-one continuous glucose monitor.

By January 2024, Medtronic announced CE (Conformité Européenne)Mark approval in Europe for the MiniMed 780G system with the Simplera Sync™ sensor, a novel disposable CGM that integrates seamlessly with the pump.

The Simplera Sync represents a significant redesign, as it is approximately half the size of Medtronic’s previous sensors and features a simple, two-step insertion process that takes under 10 seconds to complete.

Unlike the Guardian series, Simplera is an all-in-one unit (the glucose sensor and transmitter are combined), so no separate reusable transmitter or overtaping is required.

This streamlined design enhances user comfort and simplifies setup. Simplera’s flat, low-profile shape (a square patch) and rounded edges also mean it’s less prone to snag on clothing or get bumped, a common complaint with older, bulkier sensors.

Like Guardian 4, the Simplera sensor requires no fingerstick calibration after its 2-hour warmup, yet maintains accuracy on par with the prior system.

Medtronic preserved key performance features (7-day wear duration and 5-minute readings) while vastly improving ergonomics. In short, Simplera was designed to usher in a “simple era” of CGM for Medtronic users – hence the name.

The Simplera CGM platform comprises two versions: the standard Simplera CGM, intended for standalone use with Medtronic’s InPen smart insulin pen (multiple daily injection therapy), and the Simplera Sync sensor, which pairs with the MiniMed 780G insulin pump in a hybrid closed-loop system.

Software/Algorithm

Beyond hardware, software, and algorithmic improvements have been integral to Medtronic’s research push. The 780G system’s SmartGuard™ algorithm not only automates insulin dosing but also includes predictive capabilities.

For example, the system can predict impending high or low glucose events up to 60 minutes in advance and alert the user, leveraging CGM data trends and AI-driven insights.

This proactive approach enables users to take action or allows the system to adjust automatically before glucose levels fall out of range.

Medtronic’s CGM data can be shared via smartphone apps: the MiniMed Mobile app (launched with the 780G in the US) displays real-time sensor readings and pump status on users’ phones.

In contrast, the CareLink Connect app enables care-partners to monitor glucose levels and receive notifications. These connectivity features, along with Bluetooth-enabled pump/CGM communication, were much-needed updates that brought Medtronic’s system up to parity with competing devices in the era of cloud-connected diabetes management.

Medtronic has indicated that data science and artificial intelligence will play a growing role in its R&D, stating it is “designing the future of diabetes management through next-generation sensors, intelligent dosing systems, and the power of data science and AI”.

Real-world Results of Smart MDI System

In March 2025, Medtronic shared the first real-world results from its new Smart MDI system, which combines a smart insulin pen (InPen™) with a small glucose sensor (Simplera™ CGM). This system is designed for people with diabetes who take insulin several times a day using injections rather than an insulin pump.

The results are encouraging: on average, users were able to keep their blood sugar in the healthy range about 56% of the time, which is already better than what most people achieve with injections and a regular glucose monitor.

The significant improvement came when people actually responded to the system’s helpful reminders. For example, if someone acted on alerts like “you missed a dose” or “your glucose is high, take a correction,” their time in range jumped to around 67–72%, which is close to the medical target of 70%.

Percentage of response by bolus to a Missed Dose alert

Percentage of response by bolus to a Correct High Glucose alert

The study also showed that more than half of all insulin doses were administered with the help of the pen’s built-in calculator, indicating that users were actively engaging with the tool.

Why does this matter?

People who use injections often struggle with missed doses or miscalculations, which can quickly lead to blood sugar problems. By providing timely reminders and expert guidance, Medtronic’s system helps individuals make informed decisions at the right time, reducing stress and enhancing overall health.

The system is already available in 16 countries across Europe, the Middle East, and Africa, and Medtronic plans to launch it in the U.S. soon, starting with a limited rollout.

Strategic Partnerships and Acquisitions in Diabetes Tech

Historic Partnership with Abbott

One of the most significant moves in recent years was Medtronic’s partnership with Abbott, announced in August 2024.

Under this global agreement, Abbott will supply Medtronic with a version of its advanced CGM sensors to be used exclusively with Medtronic’s insulin delivery devices and software.

In practice, this means future Medtronic insulin pumps and smart pens will have the option to use an Abbott-manufactured CGM (based on Abbott’s FreeStyle Libre platform) that is fully integrated into Medtronic’s ecosystem. Medtronic will OEM (rebrand and sell) this Abbott-based sensor alongside its own CGM offerings, providing patients with more choices within the Medtronic product line.

Abbott’s EVP, Jared Watkin, noted that it “pairs two global leaders” and combines Abbott’s strengths in sensor accuracy and simplicity with Medtronic’s strengths in insulin automation.

Medtronic’s Diabetes President Que Dallara highlighted that using “the most widely used CGM in the world” (Abbott’s Libre) with Medtronic’s systems will help people spend less time managing diabetes and more time living life. This partnership is particularly remarkable because Medtronic historically developed its own CGMs and had not partnered with direct competitors in this domain.

The deal enables Medtronic to immediately expand its CGM portfolio and focus on its core strengths (closed-loop insulin delivery) without reinventing the wheel.

For patients and providers, the Medtronic–Abbott tie-up promises greater interoperability and flexibility. For example, a patient on a Medtronic 780G pump might in the future choose between using Medtronic’s Simplera sensor or an Abbott/Libre-based sensor, whichever suits their needs best, all while staying within the Medtronic system.

As of 2025, the Abbott-integrated Medtronic CGM is still in development (no product name or launch date announced publicly), but FDA submissions are anticipated once technical integration and trials are completed.

EOFlow Acquisition Attempt

A prominent example was Medtronic’s attempt to acquire EOFlow Co., a South Korean manufacturer of wearable insulin patch pumps. In May 2023, Medtronic announced a definitive agreement to buy EOFlow for approximately $738 million, with plans to incorporate EOFlow’s tubeless EOPatch pump into Medtronic’s product line.

The motive was clear: combine a disposable patch insulin pump with Medtronic’s CGM and proven algorithm, including the 780G’s meal detection and autocorrection features. It would create a compelling automated insulin delivery option for people with diabetes who prefer a patch pump format.

This would directly compete with Insulet’s popular OmniPod system. Medtronic touted the proposed acquisition as a way to reach more patients by offering “additional insulin delivery options”, integrating EOFlow’s wearable pump with Medtronic’s sensors and smart algorithms. However, the deal encountered obstacles and was ultimately called off by December 2023.

Companion Medical Acquisition

One notable 2020 acquisition was that of Companion Medical, the maker of the InPen™. By bringing InPen into its portfolio, Medtronic expanded beyond insulin pumps to also serve people on multiple daily injections (MDI).

This move laid the groundwork for what Medtronic now refers to as its “Smart MDI” system. In the Smart MDI setup, the InPen records insulin dosing and pairs with a CGM (originally the Guardian Connect and now the SimpliSafe CGM), along with a smartphone app that provides dosing decision support.

By combining InPen data and CGM readings, users gain features such as insulin-on-board tracking, dose reminders, and even algorithmic insulin titration advice – bringing some of the intelligence of a pump to injection therapy.

Medtronic’s recent product launches have reinforced this integrated vision. For instance, the new Simplera CGM was explicitly designed to work with both the 780G pump and the InPen for MDIs, reflecting Medtronic’s dual-pronged approach to diabetes technology.

Patent Portfolio and Research Publications

The continuous glucose monitoring field has seen a surge of patent activity over the past decade, and Medtronic is among the key players investing heavily in CGM-related IP.

The patent analyses indicate that over the last five years, there have been more than 5,000 CGM patent publications globally. Medtronic, along with Abbott and Dexcom, accounts for a large share of these filings.

Each company’s patent strategy is different.

Dexcom has recently pursued an especially aggressive filing cadence, focusing on both broad patent families and numerous individual patents (depth) to secure its technology.

Abbott has maintained a steady stream of high-value patents focused on core sensor innovations.

Medtronic, too, has been actively patenting in the CGM space, although analyses suggest its portfolio may have a slightly different profile. Medtronic holds a substantial number of patents, but on average, its CGM patent portfolio is “older” than those of Dexcom or Abbott.

In other words, Medtronic holds many foundational CGM patents from the 2000s and 2010s, whereas Dexcom’s significant patent expansion occurred primarily between 2015 and 2023.

Nonetheless, Medtronic continues to file new patents to protect recent advancements – such as sensor miniaturization and integration features seen in Simplera.

Broadly speaking, the focus areas of CGM innovation for which companies secure patents include sensor chemistry and materials, electronics and signal processing, calibration and accuracy algorithms, data analytics and alerts, and integration with insulin delivery systems.

Medtronic has IP in all these areas.

For instance, Medtronic holds patents on optional calibration methods (allowing a CGM to be used with or without user calibration), on adhesive patch designs that enhance wear, on algorithms that predict glucose trends and adjust insulin, and on systems that integrate pump, CGM, and dosing algorithms into a single loop.

Competitive Landscape and Outlook

It’s important to contextualize Medtronic’s glucose monitoring endeavors within the broader competitive landscape. The CGM market is a three-way race primarily between Medtronic and two leading rivals: Dexcom and Abbott.

These companies have all launched notable new CGM products in recent years. Medtronic is widely recognized as a leader in insulin pump systems, but in stand-alone CGMs, it has historically trailed the others in market share.

As of 2024, Medtronic’s CGMs accounted for roughly 20% of the global CGM market, compared to about 40% for Dexcom and 36% for Abbott. Dexcom has been especially dominant in the U.S., while Abbott’s Libre enjoys immense popularity globally, including in type 2 and lifestyle users due to its affordability.

How Can We Help You?

We support industry-leading R&D and Innovation professionals through complex problems. Describe your challenge, and let us bring clarity and expertise.