Sudan supplies 70% of the world’s Arabic gum, a critical input for F&B companies like Coca-Cola and PepsiCo. However, since March 2025, RSF’s control over key harvesting regions has halted exports. This disruption, climate change, and price volatility have deepened supply chain risks for industries heavily reliant on this natural resin.

Companies are exploring alternative stabilizers to fix this dependency. Some reports suggest testing synthetic emulsifiers and plant-based alternatives, but no large-scale replacement has been confirmed yet. Also, the currently known gum arabic alternatives have a significant flaw – inconsistent quality.

Current Gum Arabic Alternatives aren’t Satisfactory

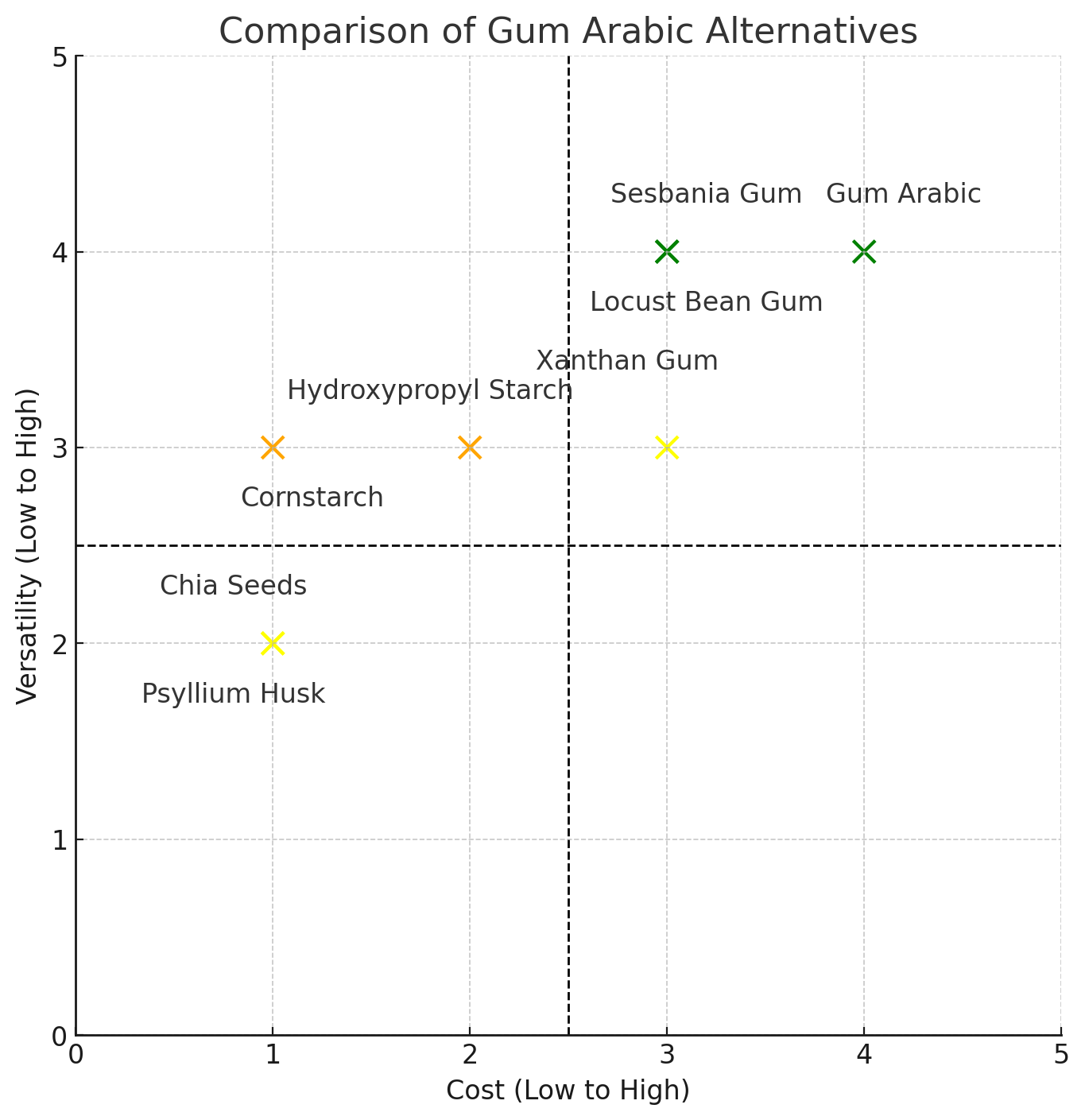

Many substitutes lack the versatility of gum arabic, particularly in applications that require high solubility and low viscosity. Others, such as Xanthan Gum and Locust Bean Gum, can cause off-flavors and are more expensive than gum arabic.

Researchers have experimented with more readily available options, such as psyllium husk, chia seeds, and cornstarch, to replace gum arabic. But these are unremarkable for the following reasons:

- Chia seeds’ gelling properties activate only after they are soaked and blended. This time-intensive process can yield inconsistent textures.

- Psyllium husk has a strong gelling effect, making it unsuitable for liquids. It can impart a gritty texture or earthy taste to solids, potentially impacting consumer satisfaction.

- Cornstarch is high in calories and lacks nutritional value. It does not provide the same emulsifying properties as gum arabic, limiting its versatility.

The emerging inventions below have enhanced thickness and resist freezing and lumping, making them more promising alternatives to gum arabic. These help companies achieve similar or other desirable results without any adverse effects.

Gum Arabic Vs. Emerging Alternative Formulations

| Material→ Criteria ↓ | Gum Arabic | Psyllium Husk | Chia Seeds | Cornstarch |

| Source | Acacia tree (primarily Sudan) | Plant-based (psyllium seeds) | Plant-based (chia seeds) | Plant-based (corn) |

| Common Applications | Beverages, confectionery, and pharmaceuticals | Foods, dietary supplements | Foods, beverages, cosmetics | Sauces, soups, and processed foods |

| Regulatory Status | Generally recognized as safe (GRAS) | GRAS (U.S.), EFSA (EU) | GRAS (U.S.), EFSA (EU) | GRAS (U.S.), EFSA (EU) |

| Consumer Acceptance | Widely accepted | Limited (can cause texture issues) | Limited (inconsistent texture) | Widely accepted, but less functional |

| Drawbacks | High cost, geopolitical instability | Strong gelling, not ideal for liquids | Time-consuming, inconsistent texture | High in calories, lacks emulsification |

Get the complete comparison table of all gum arabic alternatives, including key insights on functionality, cost, versatility, regulatory considerations, and scalability. Fill out the form below to request a comprehensive breakdown and find the right alternative for your product.

Gum Arabic Alternatives – Cost vs Versatility Comparison

New Formulation with Sesbania Gum Avoids Clumping and Speeds Up Dissolution

This patent, held by Qingdao Double Whale Pharmaceutical Co., introduces a soft capsule formulation that utilizes Sesbania gum as its primary ingredient. In addition to Sesbania gum, the composition includes pregelatinized starch, film-forming agents (such as sodium alginate), surfactants (like polysorbate 80), and plasticizers (such as glycerin or sorbitol).

This innovation enhances the material’s film-forming properties, flexibility, and toughness. It significantly reduces dissolution time to around 15-18 minutes, compared to the 2 hours required for raw gum Arabic. It also avoids issues like adhesion and insoluble powder clumping. These properties make it a safer and more efficient alternative to traditional gum Arabic and gelatin-based capsules.

Innovation, Sourcing, and Regulatory Considerations

Sesbania gum is sourced primarily from India and China and has a more stable supply chain than gum arabic. However, limited global production makes it harder for large industries to scale.

Even though many pharmaceutical formulations use sesbania gum, it is not as widely recognized as gum arabic in food applications. Some countries and regions may require additional safety evaluations before approving it for widespread use.

For instance, China regulates Sesbania gum as a food additive under GB 1886.188-2016 National Food Safety Standard. This imposes specific purity, molecular composition, and testing mandates for companies.

This thickener, made of xanthan and locust bean gum, resists freezing and lumping in liquids.

Cofco Nutrition & Health has developed a thickener primarily composed of hydroxypropyl distarch phosphate (a modified resistant starch), xanthan gum, locust bean gum, and sodium alginate derived from brown seaweed. This mixture exhibits improved thickening properties, retains more water, and resists freezing, making it more versatile than regular gum arabic.

This new approach offers significant benefits over traditional thickeners, enabling more flexible use in food products, particularly in liquid and semi-liquid seasonings, while maintaining the desired textures.

Combining xanthan gum with metal salts and carbohydrates to increase viscosity

Similarly, Taiyo Kagaku Co. has patented a new thickening composition with xanthan gum modified by binding metal salts to its surface. This composition enables rapid viscosity development when added to water-containing substances, making it particularly suitable for sauces, dressings, and therapeutic foods for patients with swallowing difficulties.

The metal salts, such as monopotassium citrate and calcium lactate, enhance the dispersion and dissolution of xanthan gum. They prevent lump formation and achieve at least 90% of the peak viscosity within 2 minutes. This innovation offers significant advantages over traditional gum Arabic by speeding up processing times, improving solubility, and enhancing ease of use, all without requiring specialized equipment.

Fusing carbohydrates into guar and xanthan gum for enhanced stability

Another patent held by Shandong Ruoyao Fsmp Food Co. introduces a liquid thickening composition that combines carbohydrates with gum of guar, acacia, gellan, xanthan, and pectin in specific weight ratios (10-55 parts carbohydrates to 45-90 parts thickener). This composition enhances viscosity, dispersion, and stability while minimizing nutritional interference in food products. Compared to traditional Gum Arabic, this alternative offers improved adaptability to varying pH and temperature conditions, reduced dosage requirements, and enhanced performance in food applications.

Innovation, Sourcing, and Regulatory Considerations

Xanthan gum is produced through bacterial fermentation, delivering a consistent supply. Major producers include China and the US. However, locust bean gum is derived from carob trees with limited production regions (Mediterranean, Portugal, Spain). Supply fluctuations are plausible due to climate change.

Both are well regarded as “safe” regulatory-wise. The FDA (U.S.), EFSA (EU), and JECFA (WHO) have approved Xanthan gum for food applications. It is already widely used in gluten-free products and processed foods. Locust bean gum is often used in dairy products, sauces, and bakery items, meaning it’s well-accepted by manufacturers and consumers.

As the search for viable alternatives intensifies, gaining access to the latest developments in ingredient innovations is essential. With a simple query like “What are the latest developments in gum arabic alternatives? ” Slate, an AI-powered research and analysis tool, sifts through hundreds of research papers and patents, compiling a list of relevant results to explore.

Save the hours spent going through the overwhelming number of Google search results. Find the perfect gum arabic alternative for your application with Slate in minutes! Try it out using this simple form:

These edible coatings, free of gum arabic, dry faster and appear whiter for confectionery use.

Tic Gums, Inc. has developed several gum arabic replacement or extender compositions, targeting food, pharmaceutical, and industrial applications. Their methods involve selecting a potent film-forming agent from natural or modified polysaccharides, such as cellulose gum, methylcellulose, and hydroxypropyl methylcellulose (HPMC). The composition also includes a low-viscosity enhancing agent (like oligosaccharides) and a sticking modifier (starch, guar gum), along with a quick-crystallizing agent (inulin, erythritol).

The resulting formulations exhibit improved functionalities compared to traditional gum arabic, including faster drying times, enhanced barrier properties against oxidation, and a whiter appearance. This makes them suitable for sugar and sugarless confectionery, dragee-making, and other applications.

This innovation addresses the supply instability of gum arabic, offering a cost-effective alternative that maintains or enhances its performance characteristics. Tic Gums has emphasized that this product reduces the need for multiple shell layers in panned confections, saving time and money without compromising quality or performance.

The company already has a product named TicaPAN Quick Crunch. It is an alternative to gum arabic in various applications, such as edible coatings and films. The above innovation will further enhance this product’s versatility.

Using linseed gum with starch and seaweed compounds for improved elasticity

Similarly, the Chinese Academy of Sciences has created a composition for edible plant plasma membranes using linseed gum, modified starch (specifically hydroxypropyl starch), carrageenan, and a plasticizer (preferably glycerin). The composition enhances the elasticity and toughness of edible packaging films and soft capsules.

Seaweed-based polysaccharides, such as fucoidan and carrageenan, are emerging as key ingredients for edible, health-conscious gels that replace gum arabic.

Fucoidan is found in brown seaweed and is known for its health benefits. It exhibits antioxidant, anti-inflammatory, and antiviral properties, making it popular in pharmaceuticals and functional foods. Extracted from red seaweed, carrageenan is widely used as a thickener, stabilizer, and emulsifier. It is commonly found in ice cream, yogurt, and plant-based milk products. These compounds are generally more affordable than gum arabic.

For instance, prices for carrageenan are typically around $3.50 per kilogram, depending on the grade and source. In contrast, gum arabic prices average around $11.42 per kilogram and can go higher.

This innovation offers advantages over traditional Gum Arabic, including improved mechanical properties, better water retention, and enhanced processability. It results in a more cost-effective and versatile solution for edible packaging and soft capsules.

Dalian Polytechnic University has developed a hybrid gel that combines these two. The resulting gel has high transparency and elasticity, enhancing the functional properties of fucoidan in the food industry. It offers advantages over traditional gum Arabic, including improved gel strength and health benefits associated with fucoidan, such as immune regulation and anti-inflammatory properties.

Supply Chain and Regulatory Considerations

The FDA has approved ingredients like cellulose gum, methylcellulose, and HPMC for food applications. They are also EFSA (EU) and JECFA (WHO) compliant. On the other hand, linseed gum, modified starch, carrageenan, and glycerin fall under generally considered safe (GRAS) but may require specific purity standards in China and the EU.

While modified starch and carrageenan have established global supply chains, linseed gum is not as widely sourced. Limited commercial production may cause scaling challenges.

New hydrocolloid formulation enhances the textures of meat alternatives

The alternative meats industry commonly uses gum arabic to improve the texture and consistency of plant-based meat products. However, the scarcity of gum arabic will make alternative meat unappealing to consumers due to its reduced mouthfeel. Fortunately, innovators are working to create plant-based alternatives.

For instance, Dupont Nutrition USA has created an alternative to traditional gum arabic, comprising 90% plant protein and 10% hydrocolloid (such as alginate, pectin, agar, or methylcellulose). This formulation enables the creation of textured meat analogs that replicate the irregular shapes and structures of natural analogs, enhancing their sensory appeal.

Hydrocolloids, such as alginate, enhance the texture while providing gelling properties. This is advantageous over gum arabic, particularly in achieving a more natural appearance and mouthfeel. The composition also allows customization in protein sources (e.g., soy, pea) and hydrocolloid types, offering flexibility in product development.

On the other hand, Dow Global Technologies has created a replacement for gum arabic as a binding agent for consumers who prefer traditional meat sausages. Their patent describes an edible composition for use in sausage production. This composition comprises konjac gum, carrageenan, cellulose ether, and optional water.

Combining these components significantly enhances the textural and sensory properties of sausages. It improves smoothness, emulsion stability, chewiness, and cohesiveness without increasing production costs. It also locks in moisture and stabilizes the protein matrix, offering a promising alternative to Gum Arabic with superior performance in meat products.

Innovation, Sourcing, and Regulatory Considerations

The plant protein and hydrocolloid blend (alginate, pectin, agar, methylcellulose) is FDA-approved for food applications and is widely available, ensuring stable sourcing.

Konjac gum, carrageenan, and cellulose ether fall under GRAS classification by the FDA and EFSA. Sourcing-wise, konjac gum and carrageenan have established global supply chains, but cellulose ether production is more limited.

Conclusion

The current geopolitical instability and environmental challenges surrounding gum arabic have prompted industries to seek viable alternatives. Recent innovations in plant-based formulations, polysaccharides, and hydrocolloids are beginning to fill this gap, offering promising solutions that could help industries break free from their reliance on gum arabic.

The ongoing research into alternatives such as Sesbania gum, seaweed-based gels, and modified starch compositions creates more sustainable, cost-effective, and versatile options. These formulations address the functional properties of gum-arabic-like film formation, emulsification, and texture, but also introduce new benefits, such as faster drying times, enhanced gel strength, and better water retention.

Researchers exploring these alternatives for commercial adoption will face numerous challenges, such as:

- Finding the options with specific emulsifying and stabilizing properties,

- Understanding how these new alternatives will affect product texture, shelf life, and taste,

- Ensuring the chosen alternatives can be easily scaled for large-scale production without issues,

GreyB’s experts can help you save time and prevent costly mistakes in this ingredient hunt. Get a head start on exploring the feasibility, accessibility, and ideal suppliers of a particular ingredient. Simply fill out the form below, and our research experts will get back to you.

Get in touch

Please share your query below