Key insights:

- Consumer interest is shifting towards natural alternatives to GLP-1 medications, driven by side effects like nausea and high costs.

- Premium pricing strategies dominate the market, but there’s room for scalable solutions targeting the broader consumer base.

- E-commerce is the fastest-growing distribution channel for GLP-1 food products, with a growing emphasis on direct-to-consumer models.

90% of GLP-1 users now express interest in food products that support their health goals, and this is reflected in their changing shopping habits. GLP-1 users are consuming 127% more high-protein foods and fewer sugary drinks. This shift has pushed the F&B industry to explore natural ingredients that simulate GLP-1 production.

Harleen Singh, industry expert at GreyB, explains the evolution of the GLP-1 market by highlighting emerging innovation trends and the strategic moves of leading companies. Harleen is interviewed by Shikhar Saini, the senior vice president at GreyB, where he leads strategy for R&D and open innovation in foodtech, with 16+ years of experience.

“As GLP-1 drug users face high discontinuation rates and side effects, the demand for food-based solutions that mimic drug benefits is skyrocketing.”

– Harleen Singh

Here are the key takeaways from the webinar, condensed for your quick reference.

Shikhar: With the rapid growth of GLP-1, can you tell us how big the market for GLP-1 foods is and what’s driving it?

Harleen: The GLP-1 receptor agonist market, which is currently at $62.86 billion in 2025, will reach $268.37 billion by 2034, expanding at a CAGR of 17.5%. Alongside this, the GLP-1 food market is also experiencing significant growth. The GLP-1 supporter market alone will grow from $13 billion to $50 billion by 2030. This growth is due to increasing demand for weight management and appetite control products, especially given the high costs and side effects associated with GLP-1 drugs.

Shikhar: You mentioned GLP-1 supporters and boosters. Can you explain the difference between these two categories?

Harleen: Sure! GLP-1 supporters are food products that specifically complement GLP-1 medications, helping users fulfill their nutritional needs. These include portion-controlled meals and ready-to-eat snacks designed to support weight management. On the other hand, GLP-1 boosters are an emerging category. They serve as natural alternatives to GLP-1 drugs, helping to stimulate the body’s own GLP-1 production without relying on prescription medications.

Shikhar: So, what’s driving the shift from GLP-1 drugs to food-based alternatives?

Harleen: The primary factors are the high discontinuation rates of GLP-1 drugs and the side effects, such as nausea and GI discomfort. Around 30% of people stop using GLP-1 medications within three months. Many users are looking for a more sustainable, natural way to maintain the benefits they got from the drugs without the side effects and at a lower cost. This creates an opportunity for companies to offer functional food products that mimic these benefits.

Shikhar: Let’s dive deeper into the ingredients being used in GLP-1 foods. What are the key ones to watch?

Harleen: Several interesting ingredients are being explored, including:

- Probiotics and prebiotics, including strains such as Lactobacillus plantarum and resistant starch, are beneficial for gut health and support GLP-1 production.

- Dairy-derived ingredients, including whey protein, milk protein hydrolysates, and microgels, are helpful for their potential to regulate blood sugar and enhance satiety.

- Plant extracts: Ingredients such as theobromine, quercetin, and mulberry extract are also being studied for their GLP-1-stimulating properties.

Shikhar: We’ve heard a lot about emerging technologies like microgels. Can you elaborate on how these are transforming GLP-1 foods?

Harleen: Absolutely! Microgel technology is an exciting development. It prevents whey protein from clumping when heated, allowing higher concentrations in beverages while maintaining a smooth texture. A clinical study showed that Nestlé’s microgel technology increased GLP-1 secretion by 66%, enhancing its potential for weight management and blood sugar regulation.

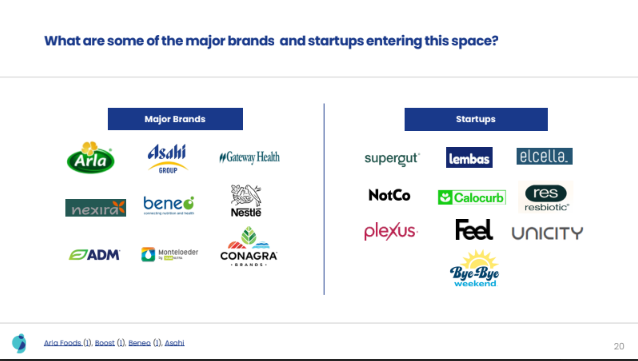

Shikhar: It’s incredible how much innovation is happening in this space. What companies are making strides in this sector?

Harleen: Major companies like Nestlé and Arla, as well as startups like Supergut and Unicity, are leading the way in GLP-1 food innovation. These companies detected the surge in GLP-1 drug use, particularly for weight loss, and concerns about side effects like gastrointestinal discomfort from GLP-1 medications. Leveraging this data, some are already launching products targeted at GLP-1 support and stimulation. For example, Nestlé has invested heavily in whey protein microgels, and Arla is exploring combining whey protein with calcium minerals to stimulate GLP-1.

Shikhar: It seems like consumer feedback is playing a crucial role in shaping these products. What are consumers saying about GLP-1 food products?

Harleen: Consumers generally appreciate the satiety-inducing effects of GLP-1 boosters, particularly for controlling hunger and curbing cravings. However, there are some notable concerns about the flavor and texture. Many products have been criticized for their aftertaste and clumpy texture. This feedback presents an opportunity to innovate further and enhance the overall sensory experience while maintaining the desired health benefits.

Shikhar: And how are these products being priced in the market? Are there any trends?

Harleen: Interestingly, GLP-1 food products, especially those marketed as premium offerings, are priced higher than traditional weight management products. For instance, Nestlé’s Boost pre-meal drink costs $2 per 100ml, compared to conventional functional beverages like Ensure, which cost around $1 per 100ml. This price differentiation highlights the premium positioning of GLP-1 products for health-conscious consumers.

Shikhar: What’s next for companies looking to enter or expand in the GLP-1 food market?

Harleen: Companies must stay ahead by monitoring the emerging trends, ingredients, and technologies in the GLP-1 space. It’s essential to track competitor patents, product launches, and regulatory frameworks. Given the rapid growth and innovation potential, companies should explore their existing portfolios for relevant ingredients and consider partnerships with biotech and agri-tech firms to accelerate product development.

How food companies can embrace these GLP-1 trends?

As the GLP-1 food sector continues to evolve, companies in the food, nutraceutical, and pharma industries must stay ahead of the curve by leveraging emerging ingredients, delivery technologies, and consumer insights.

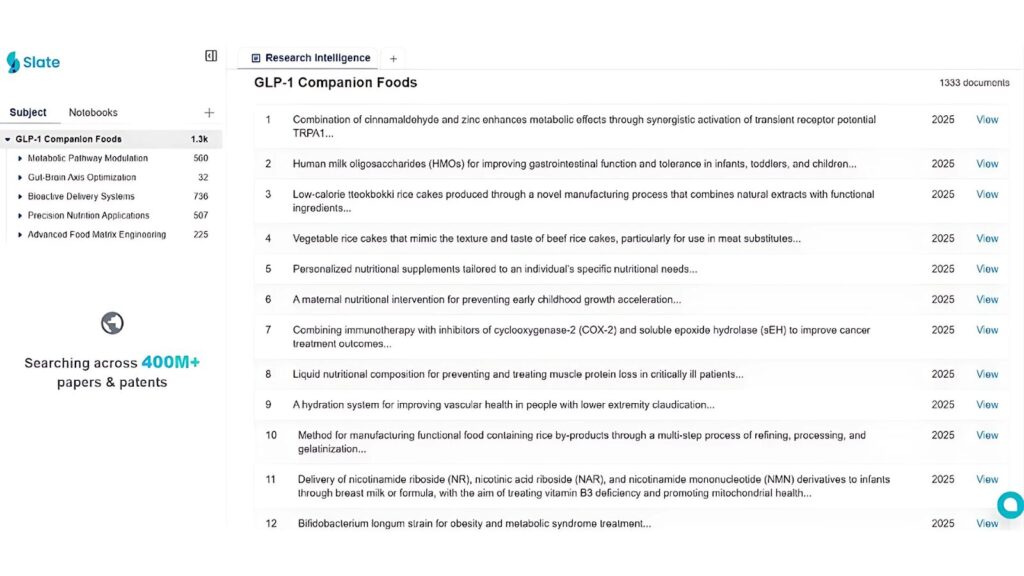

R&D departments should monitor ongoing innovations, patent filings, and competitor activity to track innovation. Manual research won’t work here, and agile R&D teams would need a platform that consolidates this research in one place. Hence, our experts have collated all ongoing research on GLP-1 at one place – Slate, our innovation discovery platform.

This proprietary platform is designed to help R&D teams identify external innovations more efficiently and effectively. This research can help you:

- Dive deeper into competitor research.

- Explore key areas like bioactive delivery systems, metabolic modulation, and more.

- Find formulations and ingredient levels solution.

The platform also allows you to ‘Ask and explore’ scientific research challenges and get answers from millions of research documents and patents.