85% of new CPG products fail within two years. For the survivors, each six-month delay can erase 15-35% of a product’s net present value, while competitors capture market share that may never be recovered.

Yet half of ingredient candidates still crash in late-stage feasibility—after months of bench work, procurement negotiations, and blown launch windows. The culprit isn’t lack of effort; it’s a discovery model built for screening, not prediction.

The traditional R&D playbook was never designed for today’s velocity.

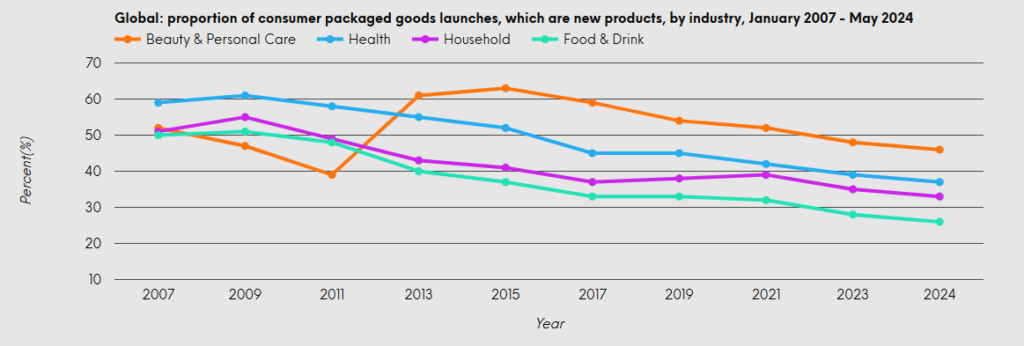

While legacy ingredient discovery cycles stretch to 18-24 months and testing sequential candidates through trial-and-error, CPG innovation has hit a 28-year low, with only 35% of 2024 launches offering genuinely new products.

Food and beverage experienced the steepest decline. Only 26% of launches were truly novel in early 2024, down from 50% in 2007.

The real bottleneck is a retrospective process that can’t predict functionality before synthesis.

However, that equation is shifting with AI.

AI platforms are compressing years-long discovery timelines into months by designing ingredients for specific functions rather than screening existing compounds and hoping they work.

Mondelez has accelerated recipe development by 4-5× using AI to generate formulations based on desired flavor, texture, and nutritional profiles. It helped them create over 70 new products, including Gluten-Free Golden Oreos.

NotCo’s Giuseppe platform explores vast ingredient combinations to optimize formulations in weeks rather than years, attracting partnerships with Mars, Nestlé, and Kraft Heinz.

This article examines how leading food companies are deploying AI, specifically in ingredient discovery, functionalization & formulation.

Getting this stage right determines everything downstream: formulation stability, sensory performance, shelf life, etc.

AI has applications across the food industry, but discovery & formulation are where it has a significant impact, e.g., predicting which ingredients will work rather than testing them one by one.

Why Traditional Discovery Methods Are Breaking Down

The traditional R&D playbook is slowing down.

Three forces converged to break it:

- Regulatory mandates like Nutri-Score and HFSS now require reformulation at a commercial scale

- Higher climate variability induces stress conditions that alter the properties of critical ingredients, including protein content, starch, and micronutrient levels in grains, as well as the chemical composition of plant-based ingredients.

- And launch windows have compressed while consumer demand for transparency has made every sourcing decision a potential brand risk.

Adding more trials doesn’t solve root causes when the problem is signal-to-noise ratio in a search space of millions of possible ingredient combinations.

AI fundamentally changes the equation by inverting the discovery process. Traditional methods screen known compounds and test for functionality, a retrospective approach limited by time, budget, and the size of existing databases.

Below are key challenges in discovery, functionalization & formulation that AI is actively addressing.

Expanding Search Space Beyond Known Compounds

Traditional ingredient screening tests 50 to 100 candidates sequentially over 12 to 18 months, limited by lab capacity and existing compound databases. Brightseed’s Forager inverts this: its AI analyzes over 2 million plant compounds in parallel, predicting bioactive properties and health benefits from molecular structure.

This expanded the search space by 20-fold beyond published research and reduced discovery cycles from years to months for specific health-functional ingredients. The platform identified Bio-Quercetin, a novel bioactive now commercialized, by mapping plant compounds to human health pathways at scale, a task impossible through manual screening.

AI-driven analytics allow manufacturers to sift through millions of molecular, clinical, and consumer data points to identify promising new ingredients in a fraction of the time required by traditional methods.

By combining big data and machine learning, R&D teams can predict bioactivity and health benefits of novel compounds before physical testing, simulate interactions and safety profiles for custom formulations, and optimize ingredient selection based on efficacy, regulatory limits, and market trends.

Engineering Plant Proteins for Functional Performance

The alternative protein market is growing at 13.6% annually toward $47 billion by 2031, but functional performance remains the bottleneck. Plant proteins exhibit 30-40% variability in solubility, emulsification, and texture across growing regions, crop varieties, and processing methods, making it challenging to predict recipe performance.

NotCo’s Giuseppe platform addresses this by analyzing plant ingredient databases to identify unexpected functional matches; it discovered that pineapple enzymes could replicate milk fat mouthfeel—a combination no human formulator would test.

Traditional approaches would require 6 to 9 months of iterative formulation testing; AI-driven screening compresses this to 6 to 8 weeks by predicting ingredient interactions and sensory outcomes before lab trials. The platform was built by training it on massive datasets combining molecular structures, ingredient matrices, and sensory profiles, essentially turning messy, fragmented food data into actionable formulations.

Their ability to bridge data silos and extract insights across disciplines has been key to their success in replicating animal-based products with plant-based ingredients, and they have attracted partnerships with Mars, Nestlé, Mondelēz, and Kraft Heinz.

De-Risking Supply Chains Through Predictive Sourcing

A protein batch that performs well in pilot runs may behave differently in commercial production due to seasonal crop variations, processing differences, or supplier changes.

AI-powered supply chain platforms analyze global crop forecasts, climate data, and supplier quality metrics to predict availability, assess sustainability scores, and flag quality risks before procurement commitments.

This allows R&D teams to model “what if” scenarios: if Supplier A faces drought, which alternate sources match functional specifications? Companies using these tools have improved supply continuity during disruptions while ensuring ingredients meet environmental and social standards without compromising quality and consistency.

As sustainability becomes more important to consumers, sourcing ingredients that are both functional and sustainable is now a must, especially for products like plant proteins that are influenced by geopolitical shifts, seasonal weather changes, and supply chain disruptions.

Food Companies using AI for ingredient discovery and functionalization

Here are companies showing how AI is already shifting their innovation strategy, shortening iteration, and preventing any risks

1. Unilever x Microsoft: putting “model, then make” on the bench

It focuses on the classic dead-end loop (“looked great on paper, failed in matrix”) by moving risk out of the pilot plant and into quick simulations.

Unilever’s journey to innovative products starts with AI-driven ingredient discovery. The company uses AI models to predict which ingredients will have the best functional properties for food applications.

Instead of relying solely on traditional trial-and-error methods in the lab, Unilever is now utilizing AI platforms to rapidly and accurately screen potential candidates, thereby streamlining the discovery process.

Microsoft’s managed DFT service, built on innovations from Microsoft Research, enables researchers to perform calculations substantially faster than other DFT codes.

With Copilot and the advanced simulation capabilities of Azure Quantum Elements, Unilever can query scientific information using natural language, performing thousands of computational simulations in the time it would take to run tens of laboratory experiments.

Unilever scientists can use data gathered from these simulations to fine-tune models that screen tens of thousands of materials at high speed or to enable the exploration of intricate chemical reactions.

“It holds all our scientific experimental data. It’s built on an Azure platform. Microsoft’s cloud capabilities are absolutely critical to our successful delivery in this space. The tools in Azure enable us to screen millions of molecules, map out reaction pathways, simulate molecular mechanisms, and simulate molecular properties. This sort of discovery and exploration, a cost-effective and high rate, would’ve been unprecedented in our previous way of working in terms of time, resources, and patience.”, Unilever’s Digital R&D Director.

Unilever’s Catalyst for Food Supply Innovation

2. Danone x Brightseed: AI to mine plants for functional actives (at speed)

AI-driven shortlists cut through the noise of cluttered literature and inconsistent claims, allowing teams to focus on the most promising candidates.

This reduces wasted time and resources spent on non-viable options, which helps R&D move faster toward products that are both functional and scalable.

Danone works on an evidence-led shortlist of plant inputs to take into formulation.

- For Discovery, this raises hit rates among candidates with plausible functional and nutritional value.

- For Functionalization, it narrows screening to inputs most likely to behave in real food matrices.

Currently, less than 1% of bioactive compounds in plants are known to science, and only 12 plants — such as corn, rice, wheat, soy, and oats — account for approximately 75% of the global food system.

Danone has been using Brightseed’s AI to identify new biological connections between the bioactives in these plant sources and human health, enabling exploration of new territories for plant-based innovation and mining their untapped potential.

This expanded partnership with Brightseed came at a pivotal time for Danone. It is when the company announced it would revamp its plant-based platform and introduce new “dairy-like technology” that will improve the taste and texture of its Silk, So Delicious, and Alpro dairy alternative lines.

It also plans to grow its sales of plant-based yogurt, ice cream, cheese, and creamers. Having an AI-enabled fast track will only further accelerate innovation for Danone.

3. Givaudan x Nuritas: Leveraging AI to Accelerate Functional Ingredient Discovery and Optimization

Developing plant-based products requires extensive, costly, and time-consuming testing to identify functional proteins. Companies often waste materials before arriving at a functional product ready to sell.

AI-driven functional peptide discovery addresses this bottleneck.

Givaudan aims to discover new natural peptides for its functional innovations, which not only advance flavor and taste innovations but also meet consumers’ short-term demands.

This is where the partnership between Givaudan and Nuritas comes into play. Nuritas, known for its AI-driven platform for discovering bioactive peptides, has partnered with Givaudan, a leader in flavors and fragrances, to accelerate the discovery of functional ingredients that offer not only taste and flavor but also health benefits.

Nuritas’ Magnifier AI analyzes billions of natural peptides to predict health benefits, combining multi-omics, machine learning, and in-house labs for rapid validation. By focusing only on the most promising candidates, it accelerates the path from discovery to clinically proven ingredients with known functionality, achieving higher success rates than conventional methods.

Nuritas set out to reduce the early risks of development, and its Magnifier AI now achieves a 64% success rate in identifying peptide networks with targeted functions.

4. Mars x PIPA Platform: Bring New Ingredients to Market Faster

Mars entered a multiyear partnership with PIPA (Process Integration & Predictive Analytics), a University of California, Davis spinoff, to accelerate ingredient discovery using artificial intelligence. The collaboration leverages PIPA’s proprietary LEAP AI platform to bring new ingredients to market faster for both human and pet foods.

The LEAP platform employs advanced bioinformatics that aggregates data from over 22 million published papers, more than 60 knowledge bases and semantic networks, cross-referencing this information against 16,000 diseases and conditions to identify novel ingredient solutions.

Beyond botanical ingredient discovery, the platform offers multiple capabilities, including flavor prediction, fermentation process customization, and personalized nutrition recommendations.

This partnership aligns with Mars’ established track record in ingredient research, exemplified by its extensive work on cocoa flavanols sold under the CocoaVia supplement brand.

Conclusion

The role of AI-powered tools in ingredient discovery and functionalization is transforming how food manufacturers innovate. These tools help speed up development cycles, reduce trial-and-error testing, and ensure that ingredients meet both functional and nutritional requirements.

From Brightseed’s Forager® to Tandoor AI, these tools allow R&D teams to predict ingredient behavior, optimize recipes, and discover new bioactives in ways that weren’t possible before.

As companies increasingly seek to meet consumer demand for healthier, more sustainable, and functional food products, these AI tools will continue to play a crucial role. By accelerating innovation, reducing costs, and ensuring the production of better-quality products, AI-driven platforms are enabling companies to bring new products to market faster and more efficiently.

The future of food innovation lies in AI, and those who embrace it will lead the way in shaping sustainable, health-conscious, and functional food products for tomorrow’s consumers.

How Can We Help You?

We support industry-leading R&D and Innovation professionals through complex problems. Describe your challenge, and let us bring clarity and expertise.