Licensing teams rarely struggle because the technical work is incomplete. They struggle because the work arrives in pieces. SEP analysis is performed separately. Prior art studies follow a different methodology. Prosecution history reviews sit in another report. Global families appear in yet another spreadsheet.

The problem arises in how these inputs reach the licensing team, separately, in formats shaped by their own technical objectives rather than by the needs of negotiation.

A patent with moderate SEP alignment might also have significant prosecution weaknesses; another with strong technical coverage may offer little commercial relevance due to limited jurisdictional reach. These relationships matter for negotiation, yet they remain buried in separate documents, leaving counsel to infer portfolio strength rather than see it.

What’s needed is not more analysis, but a way to connect the analysis that already exists, so that the interaction between essentiality, prior art, prosecution depth, and enforceability becomes immediately visible. A view that lets you identify, at a glance, which patents shape the licensor’s position and which do not.

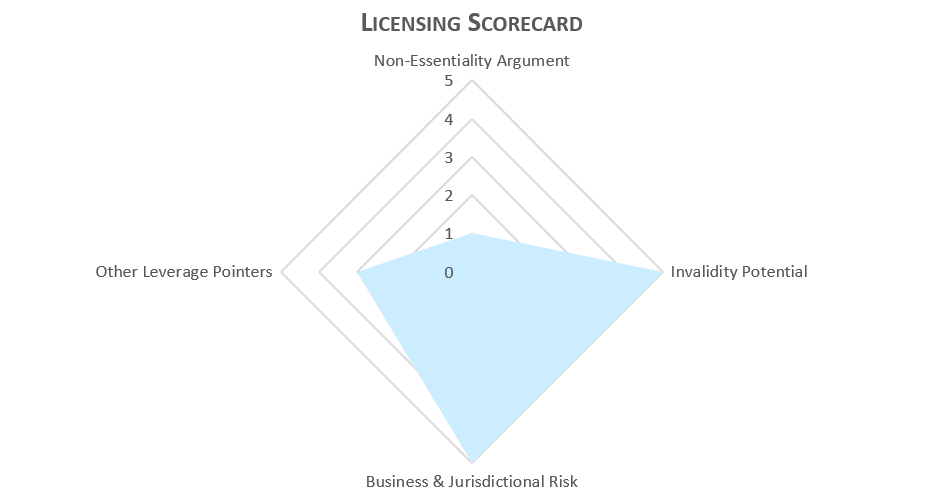

This is where the Licensing Scorecard becomes useful.

The Licensing Scorecard: The One View Licensing Teams Actually Need

In patent licensing negotiations, the real value lies in integrating technical, legal, and strategic insights into a clear, actionable format. The Licensing Scorecard does exactly that by consolidating SEP alignment, prior art evaluation, prosecution history, and global family relevance into a single unified view. It transforms fragmented analysis into strategic clarity, making it easier to prioritize patents based on their actual leverage in negotiations.

Much like the idea of a dashboard that visualizes patent portfolios to uncover patterns, timelines, and market trends, the Licensing Scorecard makes these insights visible and digestible. Instead of presenting isolated reports that require manual cross-referencing, it delivers a cohesive narrative that shows precisely how each patent contributes to the royalty request.

The scorecard is structured as a multi-dimensional assessment tool, evaluating each patent across several critical factors that influence licensing negotiations:

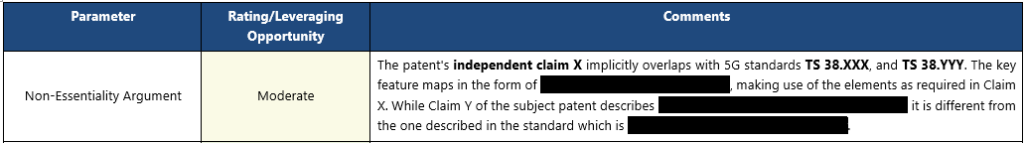

- Non-Essentiality Argument

This dimension evaluates how strong a patent’s claim of essentiality truly is. A high score here means the patent’s essentiality is solid, while a lower score signals potential weaknesses, such as optional dependencies or conditional overlaps. The Non-Essentiality Argument reveals where a licensor may be overestimating the patent’s value based on standards alignment. - Invalidity Potential

This factor assesses the risk of invalidity, including prior art hits and examination history. A higher score indicates that the patent is more vulnerable to invalidation, while a lower score suggests stronger, more defensible claims. The Invalidity Potential score helps counsel identify patents that might be challenged during negotiations, reducing the licensor’s leverage. - Business & Jurisdictional Risk

Here, the scorecard evaluates the geographic strength of the patent, considering where it is enforceable and relevant to the licensing discussion. A higher score suggests a patent is valuable across multiple jurisdictions, while a lower score indicates limited enforceability in key markets. This factor helps counsel separate patents that are globally relevant from those that may be overrepresented due to their geographical breadth. - Other Leverage Pointers

The scorecard also identifies other strategic aspects of a patent that could affect its value in negotiations. This includes factors such as patent blocking power, litigation history, and how well the patent aligns with broader industry trends. A higher score here reflects a patent’s additional negotiation leverage, potentially adding more weight to the licensor’s position.

And finally, GreyB’s Recommendation (the “summary of the summary”)

By mapping all these factors visually, the scorecard transforms what would otherwise be a complex array of reports into a simple, actionable overview.

With over 50+ patents in a portfolio, we take it a step further by providing a dashboard that visually maps your entire portfolio. This heatmap highlights the patents that truly drive your licensing negotiations, making it easier to prioritize and act quickly. Want to see how it works for your next licensing negotiation?

Streamline your patent licensing negotiations

Turn complex patent data into actionable insights

Why This Approach Became Necessary

A global Fortune 500 company’s patent counsel recently approached us with a portfolio of 30 patents and a high royalty ask. What they wanted was:

“Which patents justify this ask, and which don’t?”

After the first call with the client, we recognized that the standard path would not address the core concern. An invalidation-driven search would overcorrect the problem; a surface-level essentiality check would undercorrect it. What was needed was something that sat firmly in the middle: analysis that questioned assumptions, highlighted inconsistencies, and revealed overextensions, without attacking the patent’s existence.

The focus shifted to identifying art that challenged valuation rather than claims, tracing how the technology evolved to contextualize the patent’s contribution, and spotlighting nuanced gaps, overstated essentiality, limited scope, and overlooked jurisdictions that influence leverage in a licensing setting. The result was an unconventional output specifically designed to meet these demands.

Here is how that transformed the analysis and why it mattered.

4 Ways to Shape the Licensing Negotiations for a Win

1. Exposing the SEP Reality Gap Reduced “Essential” Patents by 60%

Most SEP portfolios begin with claim charts that appear complete at first glance, features highlighted, standard clauses marked, and overlaps presented confidently. The portfolio in this case looked no different. To understand what those charts were really saying, the first task was to place each claim feature directly beside the exact sentence, condition, and sub-clause of the standard it was supposed to match.

That side-by-side placement changed the reading almost immediately.

For one patent, a feature labelled as “core” in the initial chart was traced down through the standard’s hierarchy: main clause → sub-clause → exception note. The mapping that had looked solid now depended entirely on a condition mentioned in a footnote at the bottom of the section. The feature only applied when a device operated in a specific mode—something the standard treated as optional and context-driven. Once that condition surfaced, the supposed “core” overlap shifted into a situational one.

The same method was repeated across every claim:

- Each feature was isolated.

- The exact standard language was retrieved, not the summary, not the high-level description.

- The smallest binding clause was identified.

- The feature was matched only at the level where the standard explicitly required it.

When applied across the entire portfolio:

- 8 patents showed direct overlap

- 5 relied on interpretation or optional conditions

- 2 were barely connected to the standard

This reclassification moved the negotiation from:

“You must license our entire SEP portfolio.”

to

“Let’s determine which patents actually comply with the standard.”

As a result, shifting the conversation from “You must license our SEP” to “Let’s discuss whether this patent truly qualifies as a standard essential patent.” This shift alone can reduce royalty demands or even eliminate licensing pressure altogether.

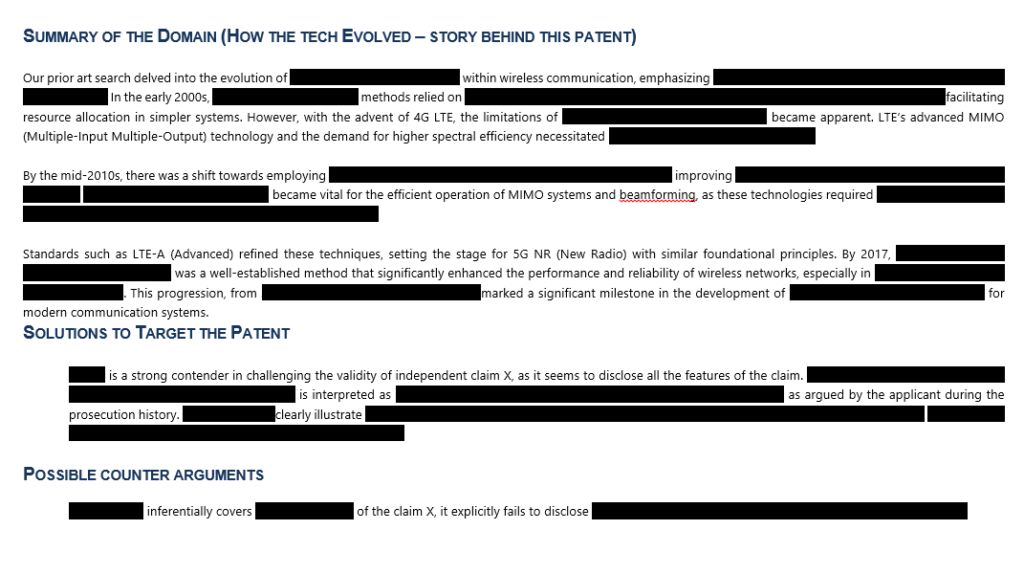

2. Novelty Destroying Prior-Art Identified for more than 75% patents in suit

The process began by isolating each claim’s core idea and tracing its presence across earlier literature, not just in terms of claim similarity, but also in problem framing, system behaviour, and architectural choices. Whenever a reference hinted at an earlier version of the same idea, it was pulled into a separate stack, even if the match wasn’t chartable.

This shifting of method revealed something useful.

For one patent, a publication predating the filing described the same signalling rationale but implemented differently. Another outlined the architecture that the patent later refined. A third, filed even earlier, discussed the same limitation the patent claimed to overcome, offering a window into how the concept evolved.

To make this visible, each reference was placed on a simple timeline:

- Foundational idea → early implementation → refinement → claimed invention

The claims remained valid, but their exclusivity felt more proportional. The field had clearly been walking toward the same solution long before the filing.

Your advantage: When patent holders face credible prior art challenges with a comprehensive study of the domain, they would prefer negotiating reasonable licensing terms rather than risking costly litigation or even invalidation proceedings. Licensing demands drop significantly when backed by solid prior art, and even more so when the prior art is supported by evolution and other background evidence.

At this point, we felt we had done enough. But, in the background, something felt amiss. Is a patent’s value only limited by the prior art and its standard overlap? We started thinking about other factors that could influence patent licensing. What else influences its strength? And Voila, we introduced two more factors to our analysis.

They are both interconnected in a way –

3. Prosecution History Revealed Examination Gaps Across ~40% of the Portfolio

Prosecution records may look routine, but when mapped against what the examiner actually searched versus what should have been searched, they become a powerful indicator of a patent’s true robustness.

In this portfolio, a deeper reconstruction of the examiner’s search strategy exposed patterns the client had never seen before. Several patents were examined only in narrow CPC classes, even though our technical mapping showed the invention extended into adjacent domains where stronger prior art already existed. In other cases, keywords that any standards-based search would naturally include were entirely missing from the examiner’s queries. These were not minor oversights; they suggested that key prior art may never have been considered during examination.

Once these patterns were layered across multiple jurisdictions, the picture sharpened further. Some examining bodies had run broad, multi-class searches; others had focused on a single class. A few patents looked “strong” only because the examiner covered less ground than the technology required.

Impact: When licensors position these patents as rigorously examined assets, the ability to demonstrate overlooked search areas immediately tempers valuation claims. Licensing teams can challenge premium royalty demands without escalating into aggressive invalidation by showing that the examination did not fully test the invention’s boundaries.

4. Global Patent Family Reality Check Exposed Inflated Perceptions of Coverage

Patent owners often present their portfolios as uniformly strong across regions, but a closer look at the global family tells a very different story. When we aligned prosecution outcomes, abandoned members, narrowed claims, and enforcement feasibility across jurisdictions, several “global” patents quickly lost their edge.

In this portfolio, a number of patents appeared impressive on paper but carried little practical weight in regions where the client actually operated. Some family members had lapsed quietly. Others had been granted only after significant claim narrowing, but the narrowing did not appear in the licensor’s presentation. A few patents were enforceable only in jurisdictions with minimal commercial relevance.

As the global map became clearer, the supposed worldwide strength condensed into a far smaller set of jurisdictions that truly mattered.

Impact: This reframing shifted the negotiation away from a global-rate justification. Instead of paying for a portfolio painted as internationally dominant, the client now negotiated based on where the patents were genuinely enforceable and where they weren’t. The result was a licensing position grounded in commercial reality, not inflated geographic claims.

Conclusion

In every major negotiation we’ve supported, the core challenge has been the same: companies walk in without a clear understanding of what the other side actually has, what those patents truly cover, and how much strength they genuinely bring to the table.

When timelines shrink to 10–15 days, teams cannot afford scattered reports, lengthy invalidation work, or high-level essentiality claims.

They need a fast, structured, negotiation-ready view of the portfolio, one that reveals leverage immediately.

Ready to see how this approach applies to your upcoming negotiation?

Fill out the form, and we’ll help you get the clarity you need, fast.

Streamline your patent licensing negotiations

Turn complex patent data into actionable insights