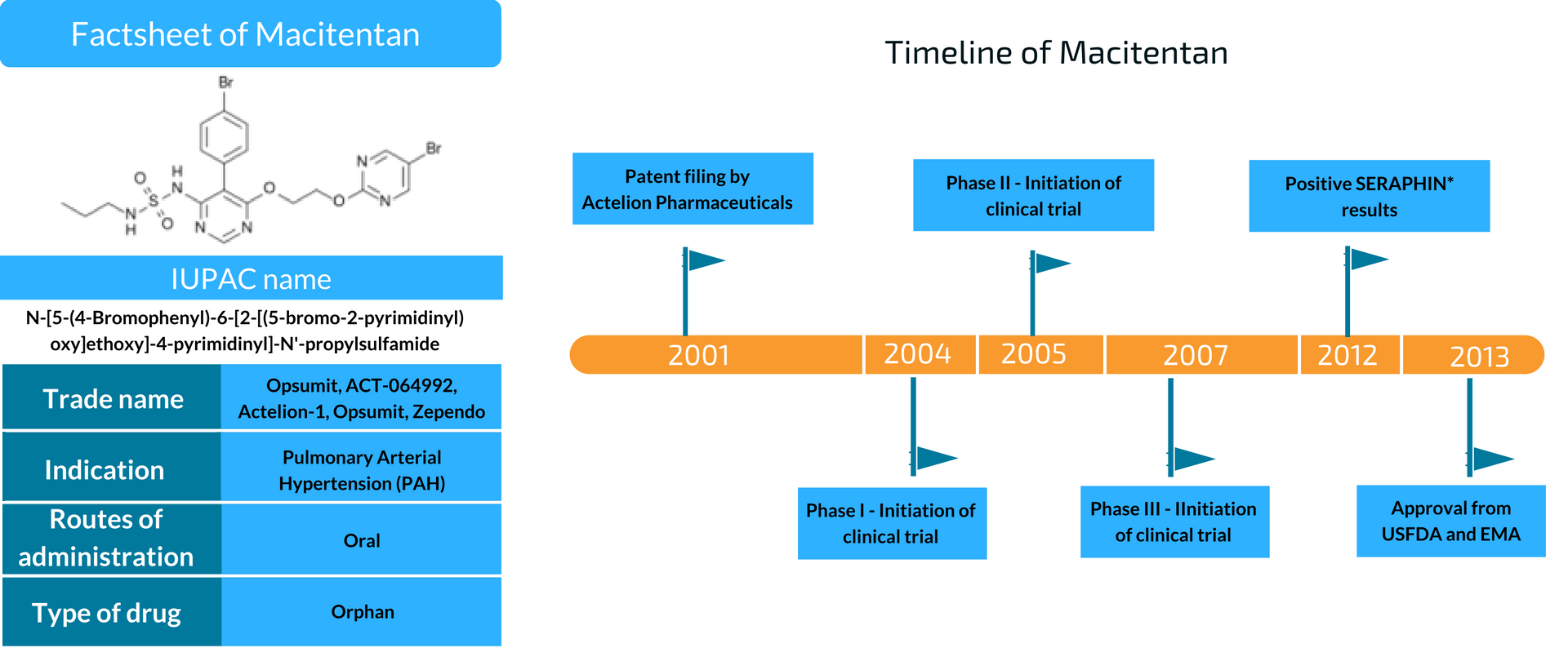

Macitentan is a drug by Actelion for treating Pulmonary Arterial Hypertension (PAH). It’s popularly known as Opsumit and delays the progression of PAH, which got approval from the FDA in Dec 2013. Since then, 35 other countries have given an affirmation for its usage.

After its approval, Opsumit has done great business for Actelion. In the first quarter of 2015, it touched the $99.5 million mark, which further rose to $390.2 million in the first half of 2016. Many drug makers, hence, want to ride in this large wave of opportunity by launching their own generic version of the drug.

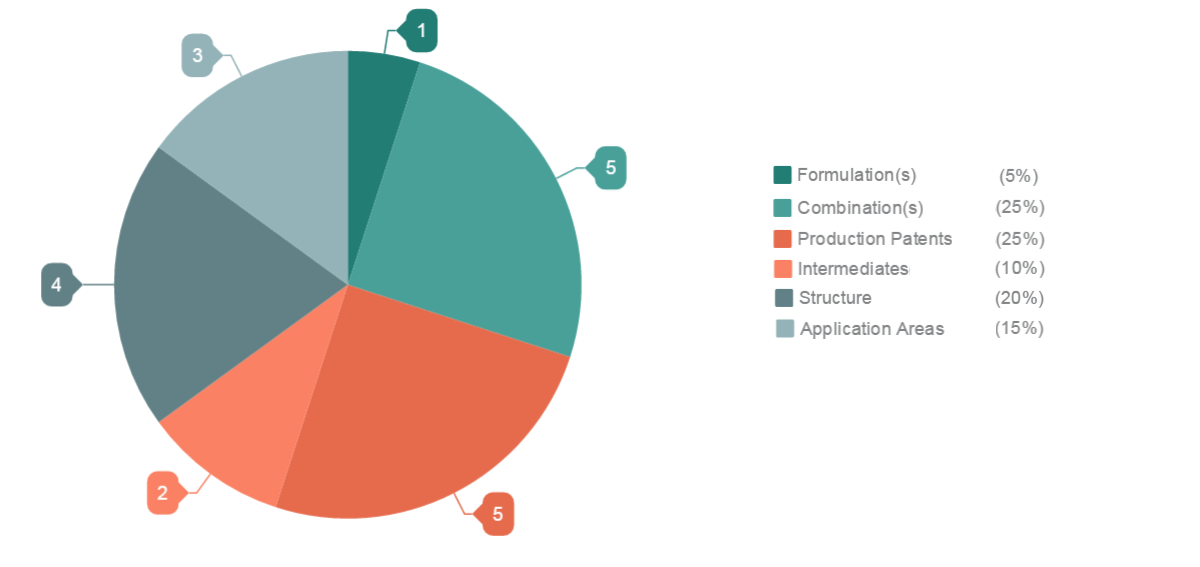

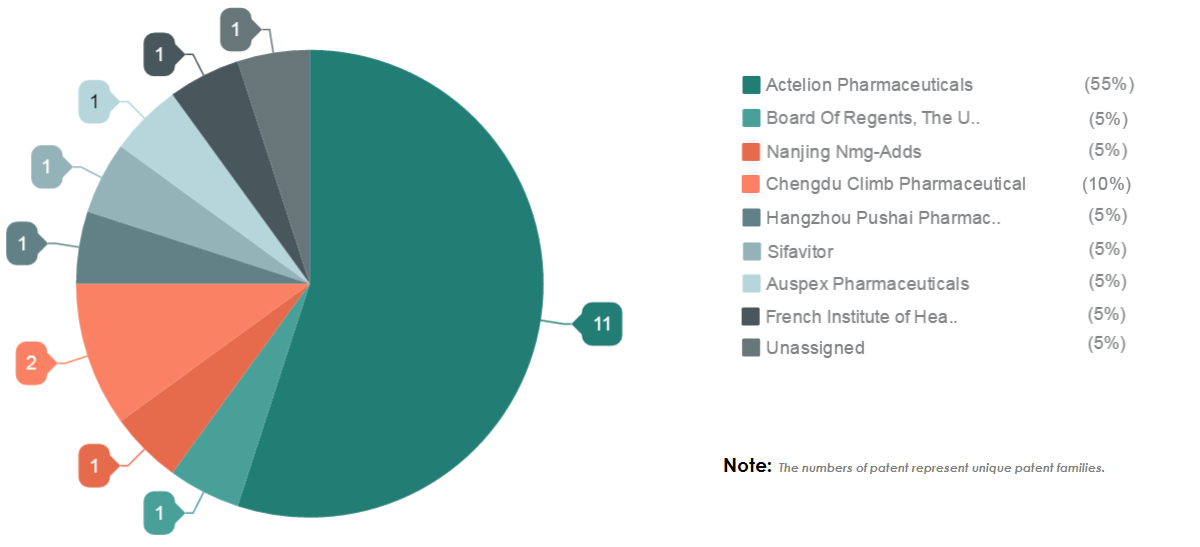

We studied patents filed on Macitentan which revealed this ride is not going to be smooth as Actelion owns 55% of the total patent for Macitentan (more on it later in the post). In this article, we have discussed how this strong patent portfolio of Actelion will bring challenges for generic drug makers.

Further, we have also discussed features that drug makers should avoid if they want to launch their generic version of Opsumit.

What is Macitentan, and how it’s exclusive?

Before the approval of Macitentan, Tracleer, and Letairis were the only two FDA-approved endothelin receptor antagonist ETRAs for oral PAH treatment. The problem with these two drugs was their adverse effect on the liver. Also, the phase-III clinical trials of the two drugs were primarily based on 6 minutes walking distance test. Macitentan’s phase-III clinical trial, on the other hand, was based on delaying disease progression.

The structure of Macitentan is derived from Tracleer, which has a dual ETA/ETB activity. ETA and ETB are endothelin receptors whose activation results in raising or lowering blood pressure. It has more affinity to bind to ETA, which increases blood pressure when endothelin binds to it. Also, ETA is responsible for curing PAH more as compared to ETB.

Unlike Tracleer, which requires two daily dosages, Macitentan requires only one. It also has enhanced oral efficacy and has less severe effects on the lives and bile salt transport system. Also, Macitentan is designated as an orphan drug. An orphan drug is used for the treatment of a rare disease.

Key Patents of Macitentan

The patent US7094781 titled Sulfamides And Their Use As Endothelin Receptor Antagonists by Actelion Pharmaceuticals is the key patent of Macitentan which claims its chemical structure. There are no limitations present in the patent, which leads to it having high infringement potential. In other words, the stakes are high if someone else generates a generic version of Macitentan.

- Twenty-one unique patent families are published based on Macitentan.

- Out of these twenty-one unique patent families, only one is the API (active pharmaceutical ingredient) patent, i.e., it claims only the structure of Macitentan.

Macitentan has 21 unique patent families, out of which one is the API (active pharmaceutical ingredient) patent. Actelion has protected Macitentan in 23 different countries, details of which are in the table below:

In Australia, the US, and Hungary, Macitentan patents have the expiry date of Dec 2026, Oct 2022, and Dec 2026, respectively. The longer expiration dates indicate that others will be inhibited longer from launching a generic drug version in these countries. However, in Luxembourg and Norway, Actelion’s patents on Macitentan have expired, thus opening the market for generic versions.

Patents by Other Assignees on Macitentan

Patents by Other Assignees on Macitentan

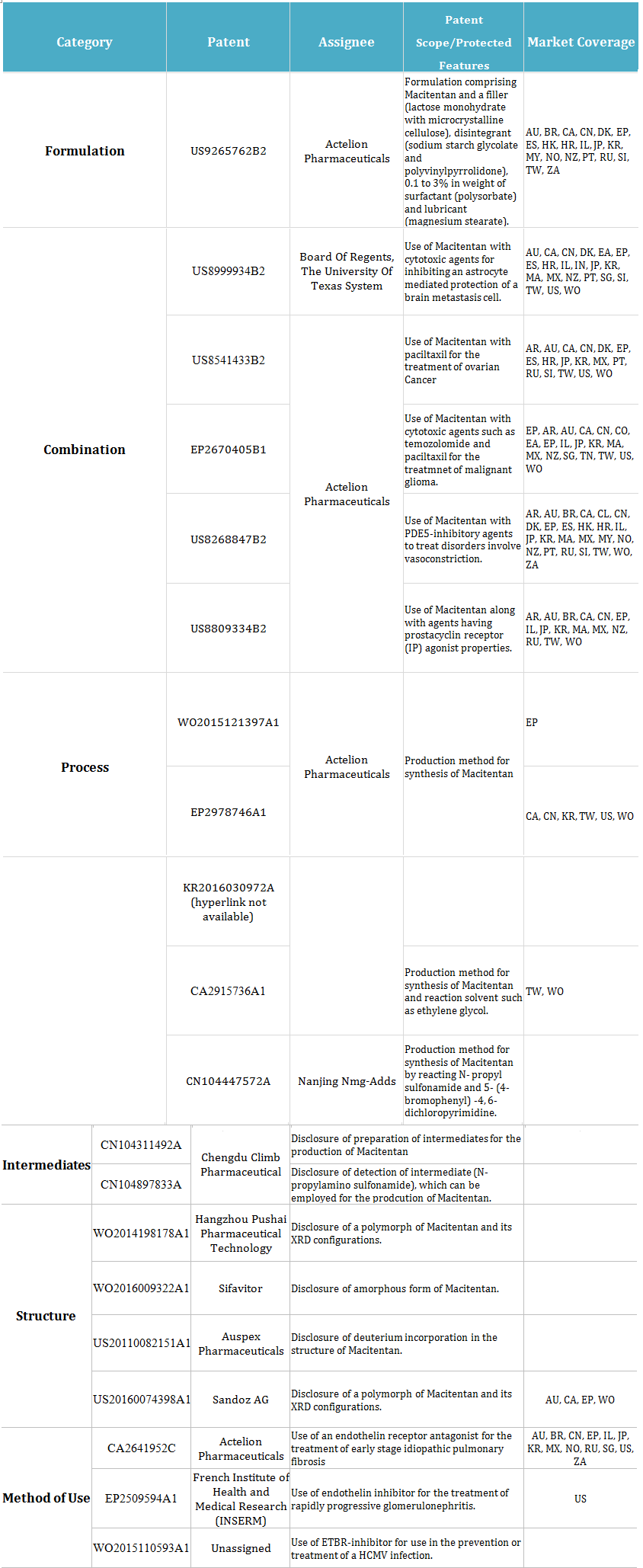

Other than Actelion, there are patents filed by other assignees on Macitentan that will be in effect even after the expiration of the key patent. The classification of these patents based on the features they are protecting is provided below.

Side Note: When you have to find what other assignees are doing in an area of a particular drug, a holistic competitive intelligence report plays a crucial role. Find out what elements you should add in such a report for better results: Elements you should add in a “Patent Monitoring Report” for holistic competitor monitoring

Distribution of Patents on the Basis of Features

At least 20 patents have been filed by assignees other than Actelion on Macitentan. Out of these 20, 1 patent is on formulation filed by INSERM of France.

Three patents are filed on methods of use. These patents disclose the development of Endothelin receptor antagonists in treating other diseases.

There are four patents related to structures in which companies have attempted to circumvent and develop technologies for the different crystalline or amorphous structures of Macitentan.

Sandoz, for example, has a patent application, US20160074398A1, that discloses a polymorph of Macitentan. There are fair chances of generic companies launching their drugs on polymorphs of Macitentan.

In the rest 12 patents, 5 are on combinations, 5 are in process, and 2 are on intermediates. The detail of these patents is as follows:

What are the features Companies Should Avoid when Launching a Generic version of Macitentan?

The table below provides the list of features that different patents protect in different jurisdictions, which a company that is trying to launch a generic drug of Macitentan should avoid.

Threats for Companies if they launch generic versions of Macitentan

Actelion, no doubt, is the most dominant player in the Macitentan drug segment. It owns 55% of the total patents filed on Macitentan, while the rest 45% are filed by different players.

There is one patent by Auspex, a company acquired by Teva that protects the Macitentan molecule. This could indicate Teva’s interest to launch a generic version of Macitentan. If this happens, Teva could give tough competition to Actelion and others in the future.

The chart below will help you understand the distribution of patents.

Authored by: Divya Goyal, Senior Research Analyst, Search Team