The Covid-19 pandemic has affected several industries around the world. Businesses have taken a hit and most of them are adopting a myriad of approaches to combat these tough times. While retailers are shifting from Brick and Mortar to Online, some businesses are holding on to their assets and looking for investors to stay afloat through these tough times.

One of the most popular strategies to survive that emerged in these recent times is Mergers and Acquisitions. Companies are evaluating their assets and given the need of the situation, negotiating with other companies to sell their assets, IP or otherwise.

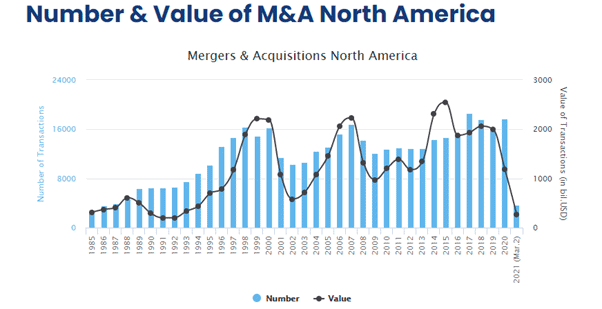

An interesting stat that emerged in 2020 resultantly was – the number of mergers and acquisitions in the US increased when compared to the previous year. However, the value of transactions dropped significantly. This indicates the obvious impact of COVID-19 which led to higher M&A, however, the distressed state of companies led to lowering the transaction value. The below chart can help paint a clearer picture.

(source)

The rise in M&A during Pandemic times

There are many reasons for M&A. Sometimes the acquisition might be for acquiring the talent, sometimes it may be for the technology, and sometimes the sole purpose is acquiring the customers.

For example, say company SensorForCars Limited is a small company that does innovation in IoT-based sensors and manufactures sensors for automobiles. This company also has a rich patent portfolio of ~500 patents, which is quite valuable for upcoming technologies in automotive. However, it is finding difficulty in manufacturing or selling these sensors and may reach a distressed state down the line.

Now consider another company, let’s call them BigCarManufacturer Corp – which is a huge player in the automotive sector – is planning to enhance IoT implementation in the vehicles. However, it lacks IP and does not want to invest in R&D given the cost and the need for immediate product implementation. So, the logical choice here would be patent acquisition, licensing, or acquisition of the companies which are working in the tech area.

BigCarManufacturer should look for soft targets like companies who are either in need of funding or small companies that can benefit from associating with these big brands.

However, the problem for companies like BigCarManufacturer is that they get to know about companies (like SensorForCars and their likes) pretty late unless they declare bankruptcy or their share takes a nose dive worth noticing.

What if big companies like BigCarManufacturer can get to know about companies like SensorForCars in time? They could do their due diligence, vet the resources SensorForCars has, and acquire the technology in time, with a proper plan in place to integrate them in their existing product line, and/or to absorb SensorForCars’ workforce in the right place.

How can Big companies find distressed companies to acquire?

While the slope of revenue is a well-known indication, in a recent study, we identified that patent data can also provide early indications of the distressed state of companies.

Yes, you read that right.

Let me describe how we use patent data to identify distressed companies (we call them Technologically Distressed companies) or the companies that may reach a distressed state in the coming years.

These patenting trends can help you identify technologically distressed companies

Patent filing

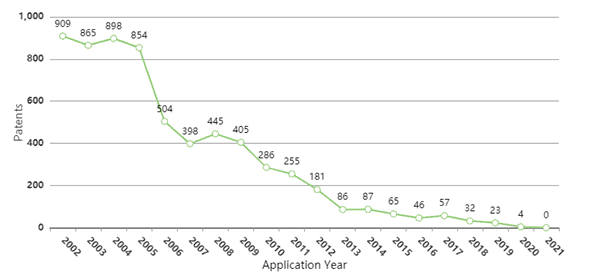

If the patent filing per year for a company has declined when compared to its past filing activity, it indicates a lack of innovation or availability of funds. To establish a proof of concept for this, we considered a few examples like Eastman Kodak, which filed for bankruptcy in 2012 and had shown a decline in its patent filing from 2006 onwards.

Kodak Eastman was one of the prominent companies which failed due to the lack of innovation. If you look at its patent application trends, it looks like this –

(source)

Similarly, there may be other signals that can indicate a company that may most likely go into distressed phase:

Patent renewal/maintenance fees

For a company, if a bunch of its patents is pending renewal and the company is letting them go, there is a high probability that they are probably cutting costs or not moving ahead with the specific technology.

Mortgaged patents

Recent events of patent mortgaging indicate that the company requires outside funds for development.

Recent licensing activity

A spike in the patent licensing may also indicate that the company is trying to generate a revenue stream using its IP (probably because revenue is going down). When Nokia’s handset business was going low it started licensing its valuable patent portfolio. Even when Nokia sold its handset business to Microsoft, it retained the patents for licensing (source).

There are various reasons why a company may decide to license its patents. We may never know the real reason but by closely studying the other factors probable factors can be deduced. For example, if most of the licenses are going to company in non-competing industries, it is probably the result of well thought IP strategy. Idea is observe closely and you would be able to figure out the reasons.

Shift in tech

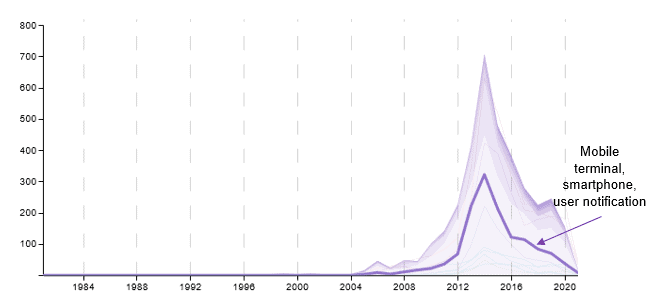

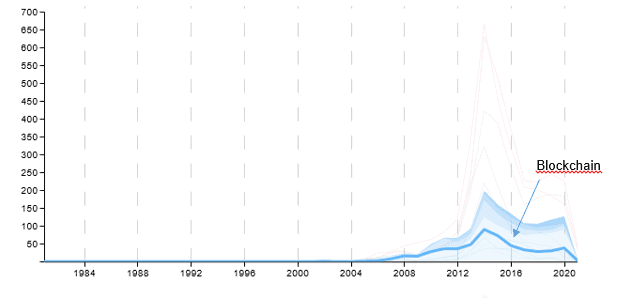

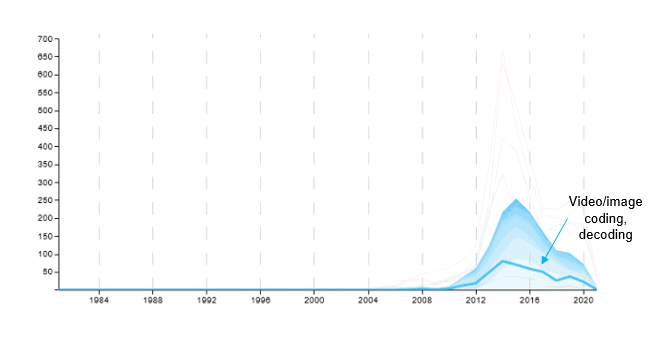

If the company, working in one particular technology, starts filing a bunch of patents in a different technology domain, it indicates either expanding or abandoning the previous tech. To substantiate it, we plotted Blackberry’s patent technologies filed over the years –

The purple line indicates the patents filed related to mobile terminals, smartphones, and user notification technology. There is a peak around 2013-14, after which the filing declined and consequently, Blackberry was out of the Smartphone business. However, filing in other technologies continued like Blockchain, video/image coding, decoding as shown by the trend below –

Of course, these patent-based indications are high-level and need to be supplemented with market data. However, these trends data is very useful for the buyer as it gives an overall state of the patents of a company that may reach a distressed state.

Concluding Notes

Identifying the technological state of the company can paint a clear picture about

- The innovation potential of the company

- Its capability to maintain the patent portfolio in a particular tech; and

- How quickly it can develop new technology.

Evaluating these factors can help you make a well-thought acquisition decision. Given the pandemic times, there are a lot of opportunities available for large companies to indulge in M&A and gain an advantage over their competitors by finding the right companies to acquire.

The question is, there are thousands of companies out there. How do I find out which company in my domain is in a distressed state and is a good candidate for acquisition?

This is where GreyB can help. Get in touch with us and we can help you find the best-suited company for acquisition according to your needs.

Authored by: Vincy Khandpur, Team lead, Infringement.