“What the internet did for communications, blockchain will do for trusted transactions.”

– Ginni Rometty, CEO of IBM

30 years ago, when the internet came into public attention, nobody would have thought that it will become the backbone of modern-day communications. Built only for defense and research firms, the Internet quickly changed the way information was traveling and getting stored around the world.

Now we are again at a similar point where the future of financial transactions and public record-keeping is going to change. The innovation fueling this change is Blockchain technology.

10 years since the inception of Bitcoin and Blockchain, the technology landscape looks entirely different – Blockchain research has skyrocketed. Hundreds of companies have jumped in to incorporate Blockchain in their processes. Today more than 1500 Cryptocurrencies, each serving a different goal, are making global transactions more efficient and secure.

As the number of players in Blockchain tech is increasing at every blink, companies are interested in finding answers to questions like:

- How Blockchain can aid their business?

- What does the research landscape in Blockchain looks like?

- Which companies are testing the waters and which companies are diving deep?

In this short and crisp report, we have tried to answer these questions. Let’s dive right in to explore research trends, top companies, geographies, M&A, and the investment landscape of Blockchain technology.

What is Blockchain?

The blockchain is a way to keep records of transactions, blocks of data, and other records cryptographically in a way that anyone can access but can’t change. In its simplest form, Blockchain technology is a public ledger keeping records of data/transactions distributed over a network instead of a single place, making it impossible for a single entity to modify those records.

In case if you are not familiar, Blockchain is the technology powering all cryptocurrencies like Bitcoin, Ethereum, Ripple, etc. All the transaction records are kept on a cryptographically secure ledger, copies of which are kept on millions of computers (nodes). This decentralized nature of Blockchain is what makes cryptocurrencies secure as it makes it impossible for a hacker to modify that data while still keeping it accessible to everybody.

Applications of Blockchain Technology

Now, apart from fueling cryptocurrencies, which are already reaching a $170 billion market cap, applications of Blockchain are only bound to our imaginations. From shipment to telecommunications, from property ownership data to the production industry, almost every industry can benefit from Blockchain.

Recently, a $60,000 flat in Ukraine became the first-ever house to be bought on Blockchain. Developing countries like India are also planning to use Blockchain to prevent land ownership fraud.

Other than all of this, Blockchain could really aid in distributed cloud storage, giving users a secure way to store their data online without relying on any “trusted third party”. Just like I mentioned above, applications of blockchain technology are only bound to our imaginations.

Below are the applications of Blockchain Technology:

- Fintech

- Automotive

- Industrial IoT and Networking

- Smart Appliances

- Smart Sensors

- Healthcare

- Logistics

- Cloud Computing

- Stock Trading

- Crypto Exchange

- Retail

- Supply Chain Management

- Government and Public Records

- Human Resources

- Video Streaming

- Gaming

- Pharma

- Real Estate

- Accounting

- Construction

Who’s Innovating in Blockchain?

Such widespread applications of Blockchain Technology have resulted in a steep rise in startups and companies utilizing Blockchain in their business. According to a report published by CBInsights, in the past 3 years, more than 130 Blockchain startups have used ICOs to raise money.

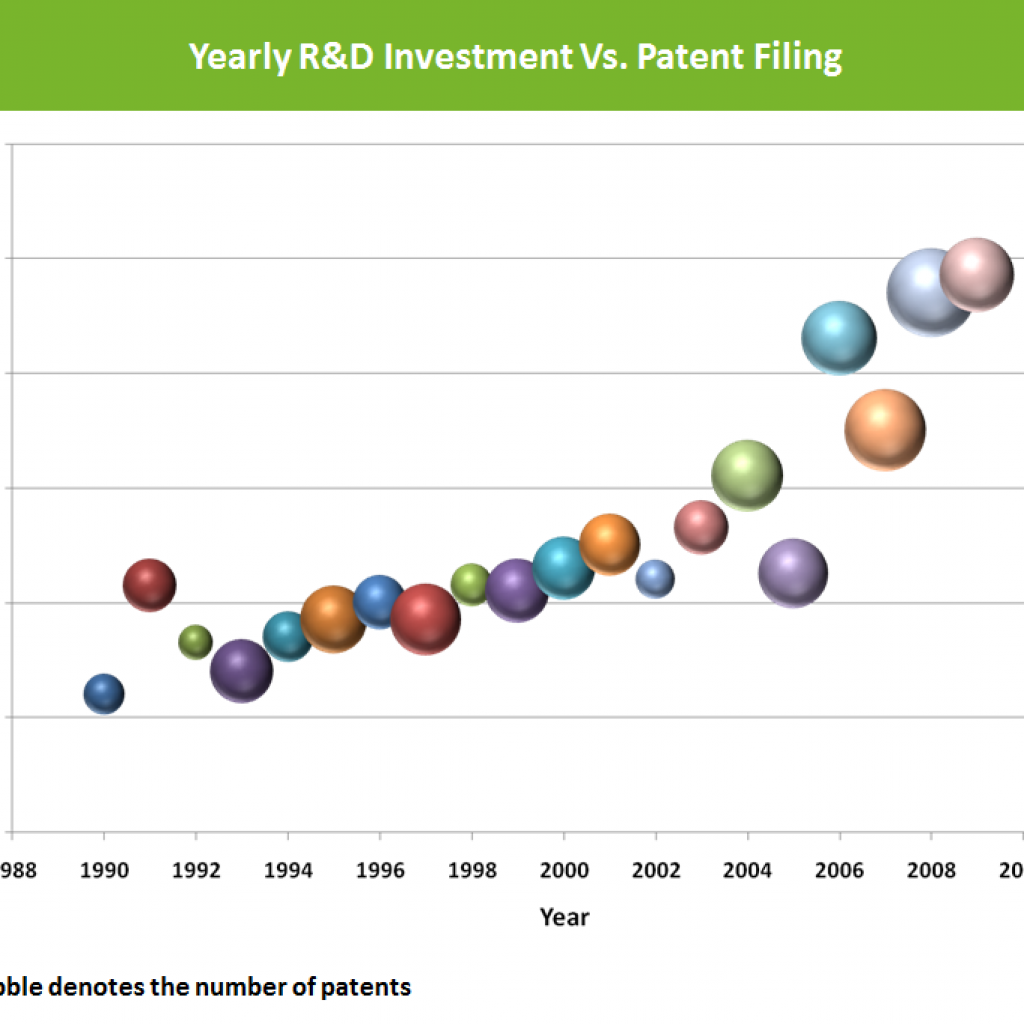

Apart from the growing interest of organizations in Blockchain, the research trend is also not left behind. IBM, being the most active patent filer across the globe is now pointing its research efforts towards Blockchain.

Companies Researching in Blockchain

Let’s zoom in and focus on the source of all the innovation happening in the countries across the globe. Even though governments and authorities are doing a lot to support Blockchain research, the efforts of individual companies are the reason behind the actual Blockchain innovation race.

From simplifying financial transactions to record-keeping, from taking the public library records to building a ledger-powered authentication system, these companies are innovating in each sector of their economy.

The most active and visible technology area where Blockchain has revolutionized a lot of things is the financial sector. Needless to say, cryptocurrencies are a part of it, but we are going to focus on things other than digital assets in this section.

The first most active company that we observed in this Blockchain application is:

Bank of America

Bank of America is one of the major research entities in the area of Blockchain. Even if you look at patent filings, BOA sits at the top of the list of top patent assignees in Blockchain. Its primary strategic focus is using Blockchain for verifying and recording transactions. Additionally, it intends to create a peer-to-peer payment system using Blockchain to ease foreign transfers.

In September 2016, BOA Merrill Lynch, and Microsoft collaborated to test and develop a Blockchain platform to help businesses power the exchanges between them and their clients using Blockchain. The company is using the Microsoft Azure platform and offering an automated corporate treasury operation.

BOA is also focusing on international collaborations to further expand its reach in Blockchain research and development. HSBC and Bank of America Merrill Lynch came together to build a hyperledger to record, digitize, and make trade finance deals more efficient than before using a series of smart contracts deployed over Blockchain. This reduces the back and forth communication between banks and parties namely exporters and exporters.

As a part of its growth strategy, BOA also made investments in startups in the Blockchain space. Along with other financial and tech giants: SBI Holdings Inc, HSBC Holdings Plc, Intel Corp and Temasek Holdings, BOA along with some other banks and tech firms invested in R3 CEV. The R3 CEV is developing a new operating system for the financial sector in the Blockchain space.

“The potential benefits of Blockchain will help drive meaningful supply chain efficiencies to the clients of both Microsoft and the bank. This project is another example of our continued commitment to introduce financial innovations for the betterment of global commerce.”

– Ather Williams, Head of Global Transaction Services at BOA Merrill Lynch

Mastercard

Like other financial sector firms, Mastercard understood the flaws and shortcomings of traditional payment services. Things like technical or manual error, data compromises, and manipulation are common in current payment systems. Seeing this, Mastercard has planned to utilize privacy, resistance to manipulation, and the decentralized nature of Blockchain in their core systems.

The company is eagerly working on payment solutions through the Blockchain platform to enable partner banks and merchants to make cross-border payments faster. After the successful testing and validation, Mastercard has introduced a B2B payment service called MasterCard Blockchain API with aim to simplify cross-border payments.

When it comes to partnership and collaboration, Mastercard has shaken hands with multiple startups in the Blockchain domain. To list one, the company has partnered with STACK which is a Canadian Blockchain startup to work on new chip-and-pin Mastercard payment cards. Using these cards, Mastercard and STACK aims to not just secure the current transactions but also widen the reach of this tech to the global network of retailers and ATMs.

Not just this, Mastercard is also actively filing a lot of Blockchain and cryptocurrency patents across the globe to secure their innovation and research.

Under this partnering, STACK will be offering a chip-and-pin Mastercard prepaid card to all STACK accounts providing secure point-of-sales access to worldwide retailers, global ATM networks, and Purchase Protection on every transaction.

Where does it stand in comparison to the competition? Financial services firms such as Bank of America, Coinbase, ShoCard, Nasdaq, and Goldman Sachs have filed numerous Blockchain and cryptocurrency-related patents over the past two years. However, Mastercard is one of the companies that intend to use Blockchain as a core system.

Other than Mastercard and Bank of America, a lot of other companies are also working on Blockchain application in the financial service sector. For instance, Visa has partnered with Union Bank of Philippines and Blockchain Tech Ltd to build Blockchain-based B2B payment systems. Few other names working in the domain include Paypal, NASDAQ, Goldman Sachs, TD Bank, American Express, Fidelity, et cetera.

IBM

“Blockchain will do for transactions what the internet did for information.”

– Ginni Rometty, CEO of IBM

IBM has been in the news from quite early with its research efforts in Blockchain tech. In order to integrate the IoT and Blockchain platform, IBM has invested $200 million in its Watson IoT headquarters in Munich, Germany. This investment aims to explore the opportunities of using Blockchain in the IoT sector.

One such opportunity is using Blockchain and the IoT to improve the logistics and transport industry using Blockchain and IBM Watson. IBM has partnered with a Canadian company, AOS, to automate quite a great part of this industry using connected devices, and thus reducing the error and manipulation chances all across.

IBM also collaborated with multiple tech companies with similar aims, to use Blockchain to build a new and better solution to industry-level problems. Apart from their partnership with AOS, IBM signed a contract with Bank of Tokyo-Mitsubishi UFJ to build a Blockchain service to handle and manage contracts between companies. Quite similar to smart contracts on Ethereum networks.

In the past, IBM had partnered with Samsung to develop ADEPT, a concept that tethers IoT and Blockchain technology. The primary objective was to test smart contracts with Ethereum and low-cost solutions to automate devices.

Similarly, Kouvola Innovation, a Finland-based company has also used the IBM Watson IoT platform to manage logistics and shipment data using Blockchain.

IBM’s partnership practices are spread in a wide range of industries. As a part of the international collaboration in the retail segment, recently in China, IBM partnered with Walmart, JD, and Tsinghua University to develop Blockchain technology in the food supply chain segment.

For using Blockchain in the healthcare industry, IBM’s Watson Health AI unit signed an agreement with the US FDA to use the technology to secure the exchange of medical data such as electronic patient records, clinical data, health information, etc.

The list can go on and on only to hint that IBM has all set to become the most innovative company in Blockchain tech regardless of the industry.

Intel

Intel, being an active tech giant in IoT and cloud computing is way into the waters when it comes to Blockchain research and collaboration.

Talking about joint ventures only at the moment, Intel and Microsoft have developed a new framework on Blockchain technology called Coco (Confidential Consortium) Framework. As part of this collaboration, Intel is providing hardware and software support. With this partnership, Intel aims to outpace IBM as the leader in Blockchain-as-a-Service (BaaS).

In October 2017, Intel partnered with Oracle to provide its Blockchain technology through the Oracle Cloud. Intel, according to their press release, has provided Oracle with specially optimized hardware support such as Intel Xeon processor.

Intel, along with JP Morgan, Microsoft, and 2 dozen other companies has formed a joint alliance named EEA (Ethereum Enterprise Alliance). This new venture will develop solutions to bring the capability of Ethereum Blockchain to a wide range of businesses.

Last year in February, Intel contributed a modular platform for Hyperledger, a contribution project of Linux foundation. Intel’s collaboration with the project resulted in the formation of Hyperledger Sawtooth which is now being used by many other tech giants like Huawei and T-Mobile.

In the healthcare sector, a healthcare API company named PokiDot, partnered with Intel to use their Hyperledger to build a healthcare Blockchain named DokChain.

Intel has a huge list of partnership projects. Some of those are AlphaPoint, a Blockchain as a service company, Tencent, a Chinese conglomerate, and Ledger, a France-based cryptocurrency company. This makes it evident that Intel, like many others, is racing to become the top innovator of Blockchain tech and is certainly on the right path.

VISA

Visa is also an active contributor to Blockchain research. Being a financial service giant and a direct competitor or MasterCard, Visa is just as active in partnership projects as the latter.

Visa is aiming to ease the cross-border payment process by providing direct payment services to financial institutions. The company developed the Blockchain-based platform with the help of a Blockchain startup Chain, that provides ledger as a service.

Other partners of Visa in these projects include U.S. based Commerce Bank, South Korea’s Shinhan Bank, the Union Bank of Philippines, and the United Overseas Bank. The objective of the service is to offer real-time or 24-hour fund transfer to businesses across the globe.

Visa’s other partnership projects are aimed at similar intentions, making current payment services more secure and robust with the help of Blockchain. However, in Visa’s case, they are being actively chased by competitors. Organizations like Blue, and the University of Sydney, are giving a tough competition to Visa.

A Blockchain version developed by the University of Sydney, named Red Belly Blockchain, outperforms Visa and many other financial tech giants in the market. According to reports, this system can process more than 660,000 transactions using just 300 machines while Visa’s system is capable to do 56,000 per second.

Major Countries Researching in Blockchain

Organizations in countries around the globe are channelizing resources into Blockchain research as it has the power to revolutionize the way information is stored and accessed digitally.

Be it hospital records management or automating financial contracts, Blockchain can solve problems of not just companies, but nations altogether. Below is an account of the major initiatives and research efforts being made in different countries:

European Countries

A flood of Blockchain startups and companies, along with the efforts made by the government, have surely put the EU on the path to become a global leader in Blockchain.

Talking about government interest, Andrus Ansip, Vice President of European Union, expressed his vision with Blockchain technology by saying “the European tech sector identifies AI and Blockchain as the areas where Europe is best positioned to play a leading role”, in his February speech.

Taking their efforts to support and promote Blockchain research a step forward, the European Commission, in partnership with the European Parliament, launched the EU Blockchain Observatory and forum. Here’s an excerpt from their press release stating the EU commission’s goals with this observatory and forum:

“The Blockchain Observatory and Forum will highlight key developments of the Blockchain technology, promote European actors and reinforce European engagement with multiple stakeholders involved in Blockchain activities.”

EU commission also announced increasing Blockchain research funding from $83 million to $340 million by the end of 2020.

European banks are also eager to make cross-border transactions a breeze. Last October, 9 European banks – Nordea Bank, KBC, Deutsche Bank, Natixis, Rabobank, HSBC, Societe Generale, Unicredit, and Banco Santander –jointly ventured to build a trading platform named we.trade focused on simplifying cross-border money exchanges.

Further, some banks have started their own initiatives to implement Blockchain in their process. Netherland’s ING bank, for example, completed the test of 27 proofs-of-concept in 6 different sectors—lending, identity, trade finance, working capital solutions, etc.

The list of research efforts in Europe is huge and is growing faster. If you would like to have an in-depth view, do let us know. Let’s move ahead to see what other countries are doing.

United States of America

The USA is the birthplace of most of the major Blockchain and cryptocurrency companies. Ripple by Ripple Labs, a digital currency intended to make cross-border transactions faster and cheaper, and Coinbase, the biggest cryptocurrency exchange is based out in America.

US government has also been funding and promoting Blockchain research for some time. Further, to gamify Blockchain research, various rewards for individuals or companies solving major or even minor problems in the country using Blockchain have also been announced.

Last year in September 2017, for example, the US government awarded $100 million to a group of researchers for digitalizing public library records using distributed ledger tech. US Senate also passed a $700 billion defense bill while mandating a portion of it to Blockchain research.

US State Department in collaboration with Coca-Cola, Blockchain Trust Accelerator, the Bitfury Group, and Emercoin started the program to prevent human trafficking, forced labor, and bring more transparency to the labor policies.

Not just companies, US universities are also actively taking part in researching new ways of utilizing Blockchain in various areas. MIT, for example, has developed a data consortium with business vanguards, named Trust to make data sharing easier while maintaining data security and privacy.

MIT, in April 2015, started the project DCI (Digital Currency Initiative) to promote research in cryptocurrencies and Blockchain. DCI has many other projects on its list, including MedRec, a system to efficiently manage patient health and medical records.

Other active US universities participating in Blockchain research include Georgetown University, Duke University, Arizona State University, and UC Berkeley, with their individual projects.

China

The Chinese government has shown some resistance to accept cryptocurrencies and ICOs. However, the authorities sure do know the potential of Blockchain. Recently, a government-backed research agency has launched Blockchain powered authentication and public identification records keeping service named BROP (Blockchain Registry Open Platform).

As another initiative to promote the research in Blockchain technology, the China Academy of Information and Communications Technology launched a new government-backed research lab named Trusted Blockchain Open Lab.

Recently in April 2018, Shenzhen – the Chinese metropolis – announced a new research budget of 500 million yuan ($79 million) for Blockchain technology. A similar investment initiative came into existence with a $1.6 billion budget allocation by a Chinese venture capital firm Tunlan investment, $400 million of which is provided by the Hangzhou city government.

Chinese companies are actively participating in innovation in Blockchain tech despite the ban on ICOs and cryptocurrencies. According to our analysis, China is second on the list with most Blockchain patents, slightly behind the US.

Canada

Canada in the past years has seen an increase in the number of blockchain startups. It is the birthplace of Ethereum, a billion-dollar Blockchain Company, and many others as well.

Initiatives like Blockchain Canada, Blockchain research institute, and Blockchain association make it evident how active the Blockchain research community in Canada is. Most of these research organizations are nonprofit and were formed by the collaboration of several other organizations.

Speaking of collaborations, The Blockchain Research Institute of Canada is also partnering with the National Association of Software and Services Companies (NASSCOM), a trade association firm of India, to build better Blockchain infrastructure in the latter nation.

Other than these leading geographies, South Korea, Japan, Germany, and the Gulf Cooperation Council are some of the most active countries in this domain.

Blockchain Market Share

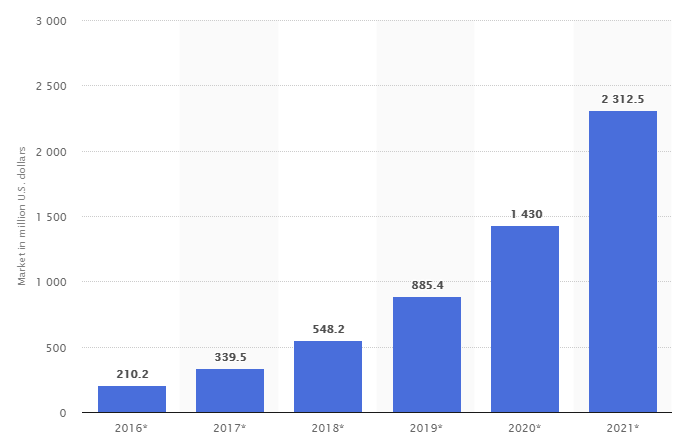

Aite estimated that capital markets spend on Blockchain development became twofold to $75 Million in 2015 when compared to 2014. According to their estimates, the number will reach $400 Million by 2019 as organizations look for cost savings and greater efficiency.

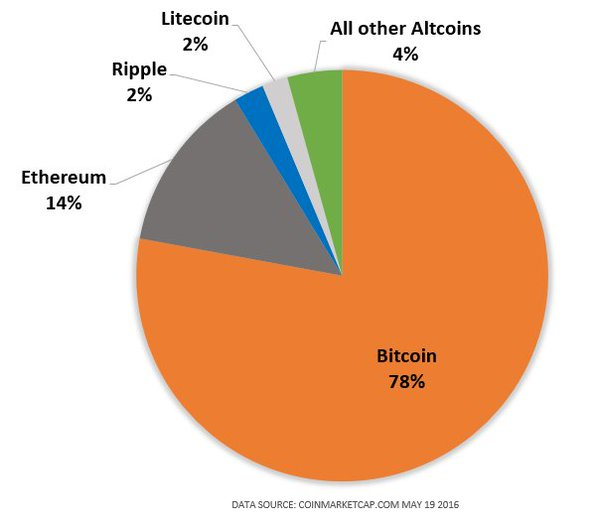

Over the years the number of cryptocurrencies rose to 900. Bitcoin is the largest Blockchain network as of June 2017, followed by Ethereum, Ripple, and NEM. The chart below gives a glimpse of the market share of major cryptocurrencies.

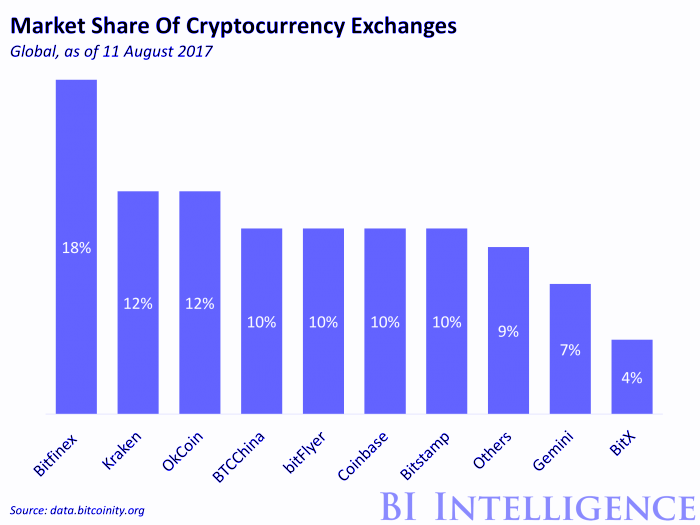

According to Business Insider, Bitfinex was the leading exchange as of August 2017 and held a share of 18% followed by Kraken, OkCoin, and BTCChina.

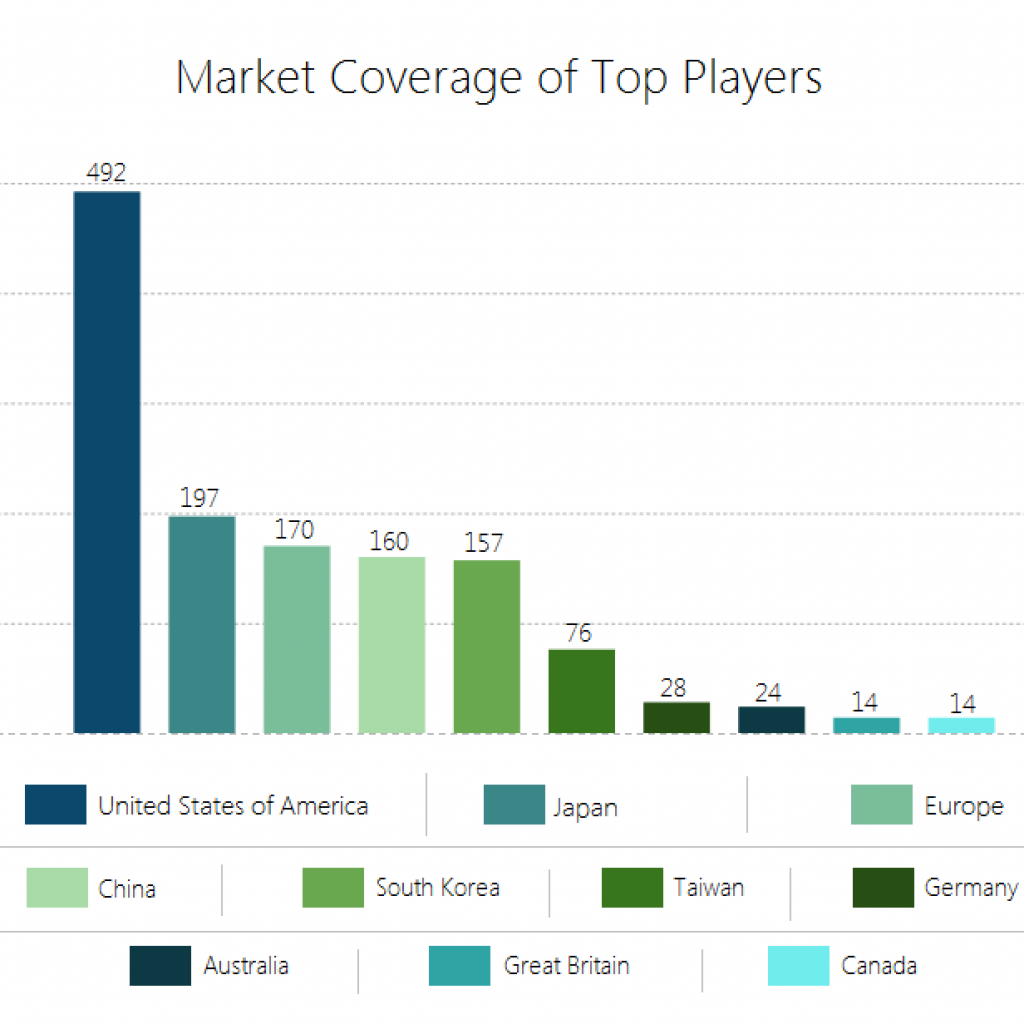

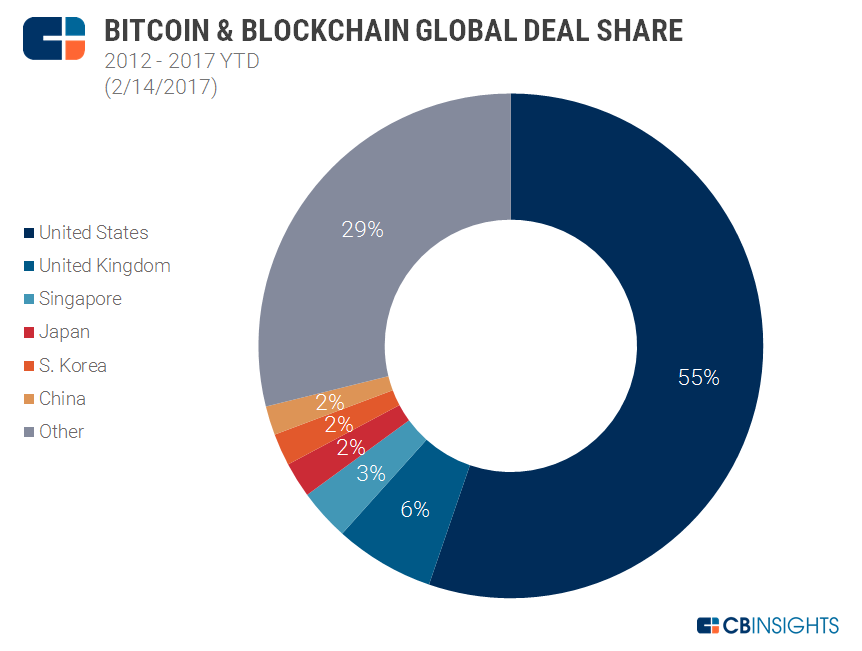

The Geographical share of the Blockchain market

Source: CB Insights

By geography, North America accounted for the largest share of the market in 2017 on account of the presence of leading players and growing investments for the development of this technology.

The Asia Pacific is expected to witness stupendous growth in the Blockchain technology market

The Middle East is fast adopting Blockchain technologies. UAE is the key country for Blockchain growth in the region.

According to a plan by the Smart Dubai Office (DSO), Blockchain technology will be used for all government documents by 2020. As a result, businesses are adapting fast, and many startups and big companies are shifting to accommodate the government, or relocating to Dubai. This is particularly important for the real estate sector.

Dubai is attracting involvement from companies including IBM, Cisco, SAP, and a dozen or more others who are part of a Global Blockchain Council or are working on Blockchain applications in Dubai. Dubai is already home to a bitcoin exchange, BitOasis, and other start-ups, and accelerators devoted to Blockchain are springing up as well.

IBM and ConSensys have both been named advisors to the government’s effort.

Blockchain Investment Landscape

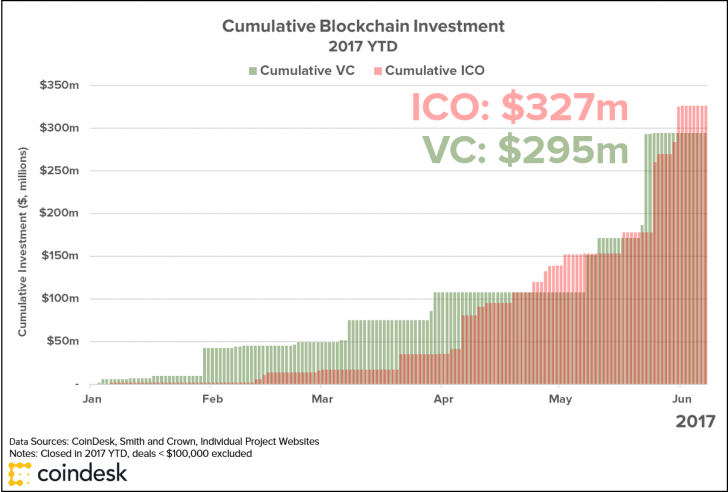

According to CoinDesk, during the first half of 2017, Blockchain entrepreneurs have raised $327m through ICO offerings, a figure that exceeded the $295m raised through VC funding.

An analysis shows that the development was spurred by big gains in Q2, as entrepreneurs raised $291m through ICOs, compared to just $187m in traditional funding over the same period.

Overall, the totals are a far cry from 2016, when the nascent funding mechanism accounted for less than half of the nearly $500m of venture capital invested into startups. In the first quarter of 2017, for example, ICOs raised to just under a third of entities seeking VC funding.

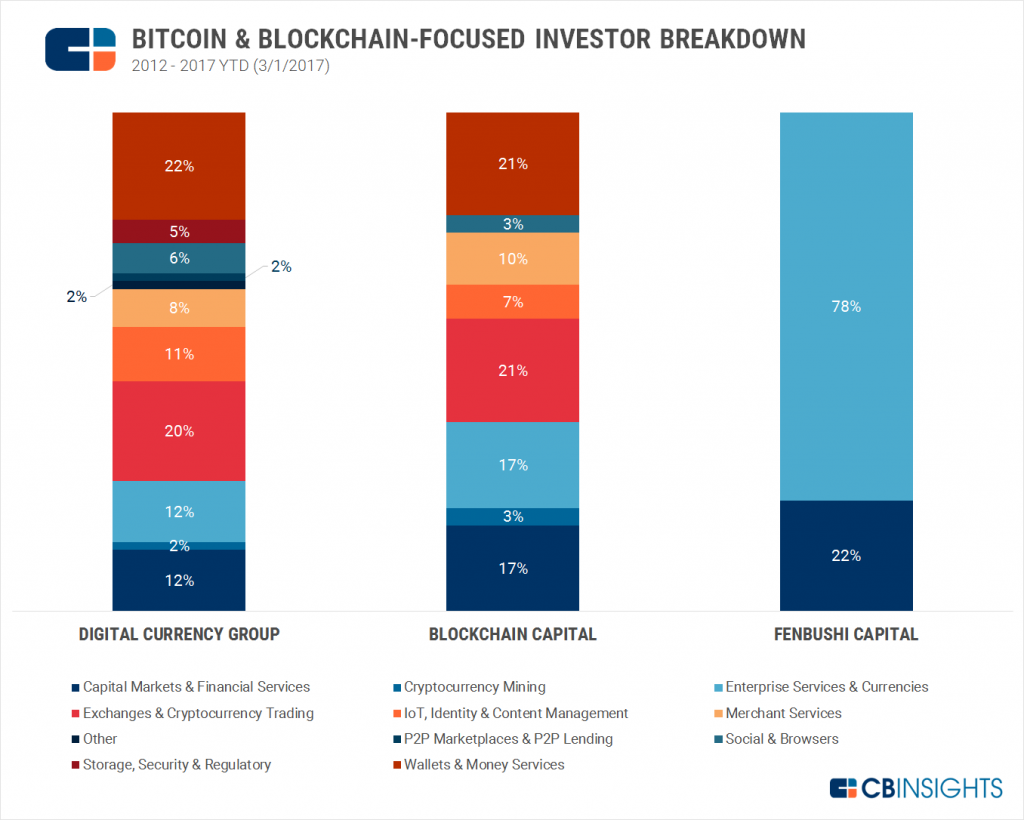

Analysis conducted by CBinsights revealed that Digital Currency Group is the top investor in the Blockchain domain. Their investment portfolio is filled with Blockchain startups and leading companies including the top five (Ripple, Circle, Coinbase, etc.)

Here’s a chart showing the entire breakdown of the top 3 investors in this domain:

Blockchain M&A

The Blockchain M&A market is certainly in its infancy averaging only five transactions per quarter since mid-2015.

Also signaling its early stage, 83% of all transactions have occurred between two companies that were both engaged in developing early-stage Blockchain-related technology and products; what we’re referring to as “Intra-Sector Transactions.” Many represented a low-value asset, intellectual property or team acquisitions.

Let’s have a look at the notable M&A:

Spotify

Spotify acquired MediaChian on 04/26/17 to improve the music licensing management of their platform.

MediaChain has developed an open media library that persistently links media to its creator and manages important metadata about such content. The company allows registering, identifying, tracking, and offering properly referenced and licensed the use of digital creative works online.

Spotify acquired MediaChain to initially help solve its challenges with music attribution and licensing. MediaChain raised $1.5mm from Andreessen Horowitz and Union Square Ventures. Founded in 2016 by Denis Nazarov and Jesse Walden, based in Brooklyn, NY

Daimler Financial Services

Daimler acquired Pay cash on 01/16/17. Even though the business models of the two organizations are quite different, Daimler has plans to implement mobile payment systems into the automobile industry.

PayCash offers a payment platform that includes a mobile payment solution, an e-money management solution, a cryptocurrency solution to implement virtual currencies into existing payment infrastructure, and a voucher and loyalty solution to provide targeted offerings to customers.

Daimler will be creating an electronic payment service named MercedesPay to allow car-based mobile payments, of which cryptocurrency payments are an option. Founded in 2012 by Jürgen Wolff and Jan Reinhardt, based in Luxembourg. Employs roughly a dozen people.

Rakuten

The acquisition took place on 8/18/16 when Rakuten acquired Bitnet. Bitnet built an e-commerce platform enabling enterprise merchants to accept bitcoin payments. Rakuten acquired Bitnet’s Blockchain IP assets and hired CTO Stephen McNamara to build Rakuten Blockchain Lab and explore new Blockchain capabilities. Two other executives, John McDonnell, and Jiri Novak joined Uphold as executives.

Bitnet raised $14.5mm from Highland Capital Partners, Digital Currency Group, Blockchain Capital, Rakuten, and others. Founded in 2013 by Stephen McNamara and John McDonnell, based in San Francisco, CA

Airbnb

Airbnb acquired ChangeCoin on 4/12/16. ChangeCoin is an online micropayment infrastructure that built ChangeTip, which allowed users to send tiny amounts of money over social networks including Twitter and Reddit. Airbnb acqui-hired the core team. ChangeCoin raised $4.7mm from Pantera Capital, 500 Startups, Digital Currency Group, and others. Founded in 2014 by Nick Sullivan, based in San Francisco, CA.

Palantir Technologies

Palantir Technologies acquired Kimono to empower its data analytics platform. Kimono allows users to extract data from websites. Kimono also builds a bitcoin correlator that allows users to correlate data from anywhere on the Web with the price of bitcoin. Kimono’s collective expertise will expand Palantir’s data analytics platform and the existing commercial product will be shut down. Kimono raised $5mm from CrunchFund, Cowboy Ventures, SV Angel, and others. Founded in 2014 by Pratap Ranade and Ryan Rowe, based in San Francisco, CA.

Conclusion

This rise in research is what pulled our interest towards Blockchain Technology and we thought to do a patent analysis on blockchain technology.

The analysis revealed a ton of interesting insights like:

- Which companies are leading the Bitcoin research?

- Startups that are making their way up in Blockchain technology?

The presentation above has half of the insights from our analysis. If you want the full analysis to consider filling the form below:

Below is the list of additional insights you will get by downloading the presentation.

Research Status of Blockchain

- The technological evolution of Blockchain – what does the research trend look like?

- Top countries from where the research is originating.

- Which companies hold a maximum number of patents in Blockchain technology?

- Top universities taking part in the research in Blockchain Technology

- Companies having a maximum number of patents based on geographies

- Asia

- Europe

- America

Challenges and Solutions of Blockchain

- Major challenges that Blockchain technology may face

- Major companies/banks working on solutions to these problems?

- What solutions are they proposing to tackle these challenges?

Funding & Investment Activity in Blockchain

- Major funding entities in Blockchain

- Major funding events and projects

The full report will also help you explore the countries having a high potential for future markets of Blockchain Technology. This could help startups as well as existing companies in business expansion. You can get the full report along with all the above-listed insights from the form below:

Contributors – Priya Vashishth, Sushant Kumar, and Shikhar Sahni