From 2G through 4G, SEP declaration counts became the industry’s shorthand for power. Negotiation dynamics favored raw numbers, with counterparties conceding that more declared families meant broader coverage. Large licensors with huge SEP Portfolios reinforced the equation by filing across dozens of jurisdictions, turning global coverage into bargaining power. Pools too often rewarded contribution counts, entrenching the idea that scale equaled strength.

The 2025 5G Essentiality Report highlights a shift in this pattern. A distinct group of portfolio holders with fewer than 1,000 declared 5G families, including Panasonic, MediaTek, Kyocera, Fujitsu, and ETRI, is converting a higher share of their declared assets into truly essential patents than many of the largest players.

This ratio can translate into ROI per filing, higher recognition in pools, stronger bargaining positions in negotiations, and reduced annuity drag.

5G Essentiality Report 2025 (Updated Findings)

Read The Report*Note: The updated report was based on approximately 57,000 granted and active patent families as of December 2024. The patents are captured from 5G-unique patent families declared within ETSI declarations, with legal status published up to December 2024. A stratified sample of 574 families underwent manual review by SEP experts.

This article explores three subtle yet powerful signals that reveal the underlying strategy of due diligence, internal screening, and sharper portfolio curation of these mid-sized SEP portfolio holders.

Signal 1: Continuations as Proof of Due Diligence

In the U.S., where litigation payouts can reach hundreds of millions, continuations aren’t just legal maneuvers; they’re capital allocation decisions. Every additional continuation adds filing, prosecution, and maintenance costs. If a company invests in them, it signals one thing: they expect a return.

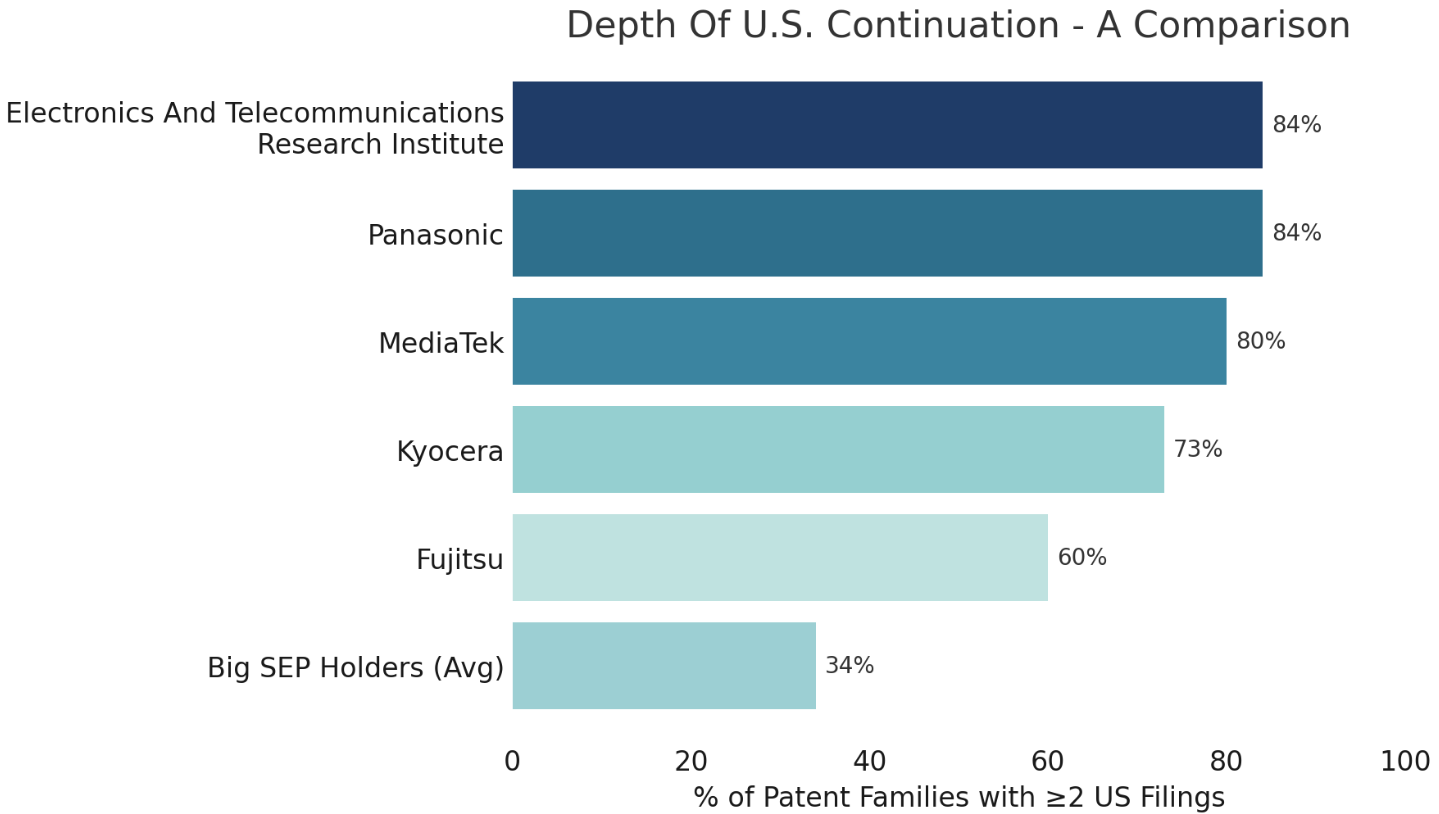

Our analysis shows a sharp divide. Panasonic and ETRI have layered continuations around 84% of their 5G families. By contrast, large filers average only 34%. This isn’t random.

It reflects a portfolio philosophy: mid-sized players double down only on patents they’ve already validated as essential. In contrast, large portfolios struggle to effectively ascertain the true essentiality across thousands of assets.

(Note: These are based on 5G-unique patent families declared within the ETSI as of December 2024, with the patent legal status published till December 2024.)

Why does this matter for licensing executives?

- Annuity ROI: Continuations deepen protection where value is proven, avoiding wasted spend on weak patents. For example, a portfolio with 500 families but 80% continuation coverage spends less on annuities than a 3,000-family portfolio, yet commands stronger design-around resistance.

- Negotiation leverage: Pools and counterparties recognize continuation depth as a proxy for claim differentiation. More layers mean a higher chance of having patents that cover critical design choices, pushing licensees toward settlement.

- Litigation readiness: Continuations provide multiple shots at enforcement. For a company facing potential infringement by a major OEM, this translates directly into stronger bargaining power as one patent family can sustain multiple enforcement campaigns.

The ROI takeaway: A mid-sized player filing 500 disciplined families with continuation depth could achieve licensing leverage comparable to a filer with 3–4 times as many declared assets, but at a fraction of the cost.

Signal 2: Jurisdictional Strategy – Choice vs. Forced Choices

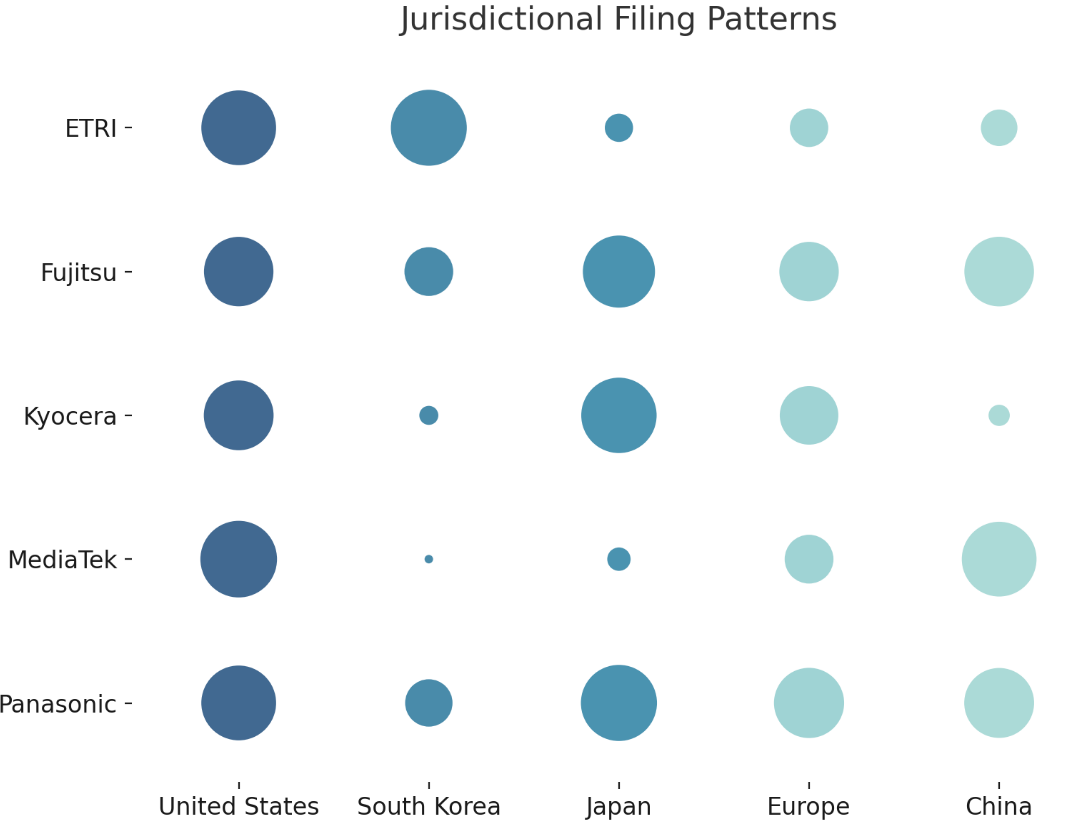

With leaner portfolios, Mid-sized portfolio holders can afford to be brutally selective. ETRI, for instance, targets only the highest-value markets; Panasonic and Fujitsu maintain broader coverage, but every jurisdictional filing is backed by a cost–benefit calculation.

For big players, the very scale of their portfolios becomes a constraint. With thousands of assets in motion, it is nearly impossible to know with clarity which patents are truly the most valuable. That uncertainty forces them into a defensive posture.

Instead of being selective, they default to blanket coverage, filing broadly across jurisdictions to avoid the risk of being left with no leverage at all.

Why does this matter for you?

- Direct annuity savings: A 3,000-family blanket portfolio can easily spend $30–40M more annually than a mid-sized, targeted filer. That is capital tied up in keeping weak patents alive instead of funding R&D or enforcement campaigns.

- Higher ROI per patent: Because every filing must justify itself, mid-sized portfolios avoid the dilution that plagues large ones. Each asset has a stronger chance of generating revenue through licensing or enforcement.

- Negotiation advantage: Selectivity signals confidence. When you walk into licensing talks with a portfolio concentrated in high-value jurisdictions, counterparties see you as precise and deliberate.

The ROI takeaway: Jurisdictional selectivity allows mid-sized players to save tens of millions annually while concentrating capital on patents that actually deliver licensing leverage.

Signal 3: Specification Declarations – Clarity vs. Broad Relevance

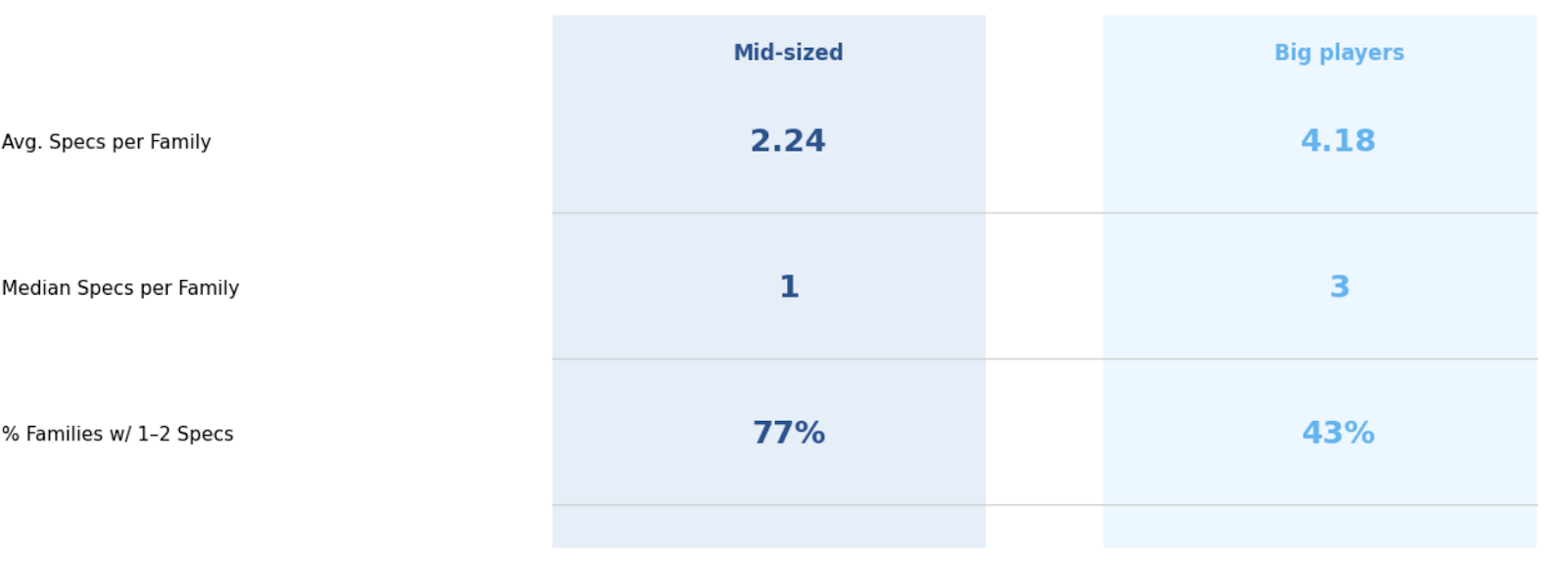

ETSI declaration data shows a striking divide between mid-sized and big players in how they link patents to specifications in their declarations.

Mid-sized SEP holders: Their families are mapped narrowly. On average, each family connects to just 2.24 specifications, with a median of 1. Nearly 77% of their families are declared against only 1-2 specs. This selective mapping indicates that they already know which patents are closely tied to the standard and declare them accordingly.

Big players: By contrast, their families average 4.18 specs each, with a median of 3, and only 43% of families mapped to 1-2 specs. This broad mapping reflects a more reflexive approach, linking patents across multiple specs to keep them “relevant,” but without the same clarity on which ones are truly essential.

Why does this matter for you?

- Pool scoring: Pools increasingly value clarity. Narrow declarations get recognized faster and more cleanly than broad hedges, which inflate numbers but dilute trust.

- Licensing efficiency: A licensee facing a portfolio mapped precisely to specific clauses of the standard has less room to argue relevance. This translates into faster, less contentious negotiations.

- Litigation readiness: Narrow declarations are easier to defend in court, as they align closely with specific standard features. Broad declarations, by contrast, risk being challenged as overreaching.

Conclusion

The next frontier is not to argue whether size or quality matters more, but to quantify the return each filing decision generates. That requires moving beyond portfolio numbers and into measurable benchmarks of essentiality, clarity, and enforceability.

The 2025 5G Essentiality Report shows, with data, that portfolios once dismissed as “too small” are now setting the standard for efficiency and leverage. The question is no longer who has the most patents, but who is converting their patents into the highest licensing yield.

If you’re preparing for licensing negotiations or pool participation, get in touch with our experts to see whether your portfolio is generating maximum ROI or bleeding value through inefficiencies.

Ready to maximize your 5G SEP ROI?

Fill the form for detailed essentiality analysis today