Similar to previous Wi-Fi standards, there has been an influx of patent declarations for Wi-Fi 7, with over 4000 families related to WI-FI 7. Distinguishing between truly Standard Essential Patents (SEPs) and self-declared patents that may not actually meet essentiality criteria is increasingly difficult.

With so many patents declared as “essential” but lacking independent verification, conducting audits and legal reviews to assess their exposure is a time-consuming and costly process. This resource drain slows innovation and inflates product costs, creating bottlenecks at the intersection of IP management and R&D.

The challenges surrounding Wi-Fi 7 patent essentiality and ownership are not just theoretical. Our initial analysis of the sample set shows that nearly 50% of declared SEP claims may not actually be essential. This article examines the WI-FI 7 patent landscape across various key industry parameters, including Core SEPs, industry dominance, and jurisdiction. It highlights the role played by giants like LG, Huawei, Qualcomm, Samsung, MediaTek, and Apple, and examines the global patent race unfolding across China, the U.S., and Europe.

We clarify where the essential intellectual property lies by categorizing patents according to key technological innovations such as Multi-Link Operation and ultra-wide channels. This analysis was possible through our inhouse SEP team’s experience and the support of tools like GreyB’s Wi-Fi 7 SEP Dashboard.

How We Identified Truly Essential Wi-Fi 7 Patents

There are 4,216 patent families relevant to Wi-Fi 7 technologies, including both declared and undeclared patents, highlighting the expansive nature of global innovation in this space. To focus on patents that have true licensing potential, we filtered the dataset to include only active, granted, and enforceable patents as of March 31, 2025, narrowing the pool down to 1,697 patent families.

To ensure that the data was representative and statistically sound, we employed stratified random sampling using a proportion sample size formula, which reduced the dataset to 314 patent families.

While the sample set provides a clear direction regarding core SEP ownership, it’s important to acknowledge the inherent limitations of this approach. Given the large volume of patents in the Wi-Fi 7 space and the evolving nature of patent declarations, this sample may not capture every nuance. Specific trends may also shift as more patents are evaluated. Not all patents in the broader set will behave the same way as those in our sample, especially considering that new patents are continually being filed and granted.

Nonetheless, following a rigorous process of essentiality checks, we found that 47% of the sampled 314 patent families qualified as Core SEPs.

These patents include claims that are closely linked to key features of the Wi-Fi 7 standard, which will be crucial in licensing and legal disputes. This information provides a clearer and more accurate understanding of which Wi-Fi 7 patents are essential and identifies the key patent holders who are influencing the future of Wi-Fi 7 technology.

Global Distribution of Wi-Fi 7 Core SEPs: A Closer Look at National Ownership

The chart shows that U.S.-based companies lead the Wi-Fi 7 SEP landscape with 34.3% of core SEPs, followed by China at 28.9%, highlighting a concentrated dominance in next-gen wireless IP.

Industry-Wise Breakdown of Wi-Fi 7 Core SEPs

Data reveals that chipmakers and network providers are driving the Wi-Fi 7 revolution. Semiconductor firms hold 44% of core SEPs and 26% by telecom/networking players. In comparison, academia contributes only a marginal 1.3%.

As the semiconductor and telecom sectors lead the way, patent counsels should consider how these sectors might converge more in the future. In addition, as patents related to MLO and ultra-wide channels start being grouped together in patent pools, you should be prepared for changes in how these patents are licensed and shared.

These developments could lead to larger patent bundles or cross-licensing agreements, which may impact the pricing structure of royalties.

Ranking of Wi-Fi 7 Core SEP Holders

If you have seen any other essentially report in WiFi-6, 5G, or soon to come 6G, you will notice that few companies constantly top the chart. Intel, Huawei, and Qualcomm will always be there in top rankings.

Wi-Fi 7 charts don’t look so different either, with similar chip manufacturers and telecom giants taking top positions. Have a look here:

For deeper insights into Wi-Fi 7—including patent ownership trends, competitive analysis, and technology breakdowns—download GreyB’s comprehensive Wi-Fi 7 SEP report. WiFi 7 SEP report

Who Is This Report For?

This report serves a diverse range of professionals involved in the Wi-Fi 7 ecosystem:

- Patent owners and innovators who have contributed to the technology standards and want to understand their IP’s strategic position.

- Implementers and product developers seeking to commercialize Wi-Fi 7-enabled products while managing licensing risks related to SEPs.

- Policymakers and regulators tasked with fostering innovation while ensuring fair access to essential technologies.

- Legal professionals, judges, and courts require robust evidence of patent essentiality and transparent methodologies to resolve licensing disputes effectively.

Increasing Data Transparency in Wi-Fi 7

As Wi-Fi 7 adoption grows, the complexity of Standard Essential Patents presents significant challenges. The ecosystem faces a classic “tragedy of the commons,” where a lack of centralized, transparent information leads to duplicated efforts, inefficiencies, and costly disputes.

Greater transparency and structured access to SEP data can help address these issues. It allows innovators to secure fair royalties without diverting precious resources from core research and development into prolonged legal battles over patent essentiality.

To improve the ecosystem, we advocate for objective indicators and standardized evaluation frameworks. These tools support informed and equitable decision-making among policymakers, innovators, device manufacturers, and legal stakeholders. While determining SEP essentiality involves subjective judgment and human error, centralizing technical assessments can accomplish approximately 80% of the work upfront. This lets stakeholders focus their efforts on the remaining 20%—the nuanced interpretation and final decisions.

Explore Deeper with GreyB’s Wi-Fi 7 SEP Dashboard

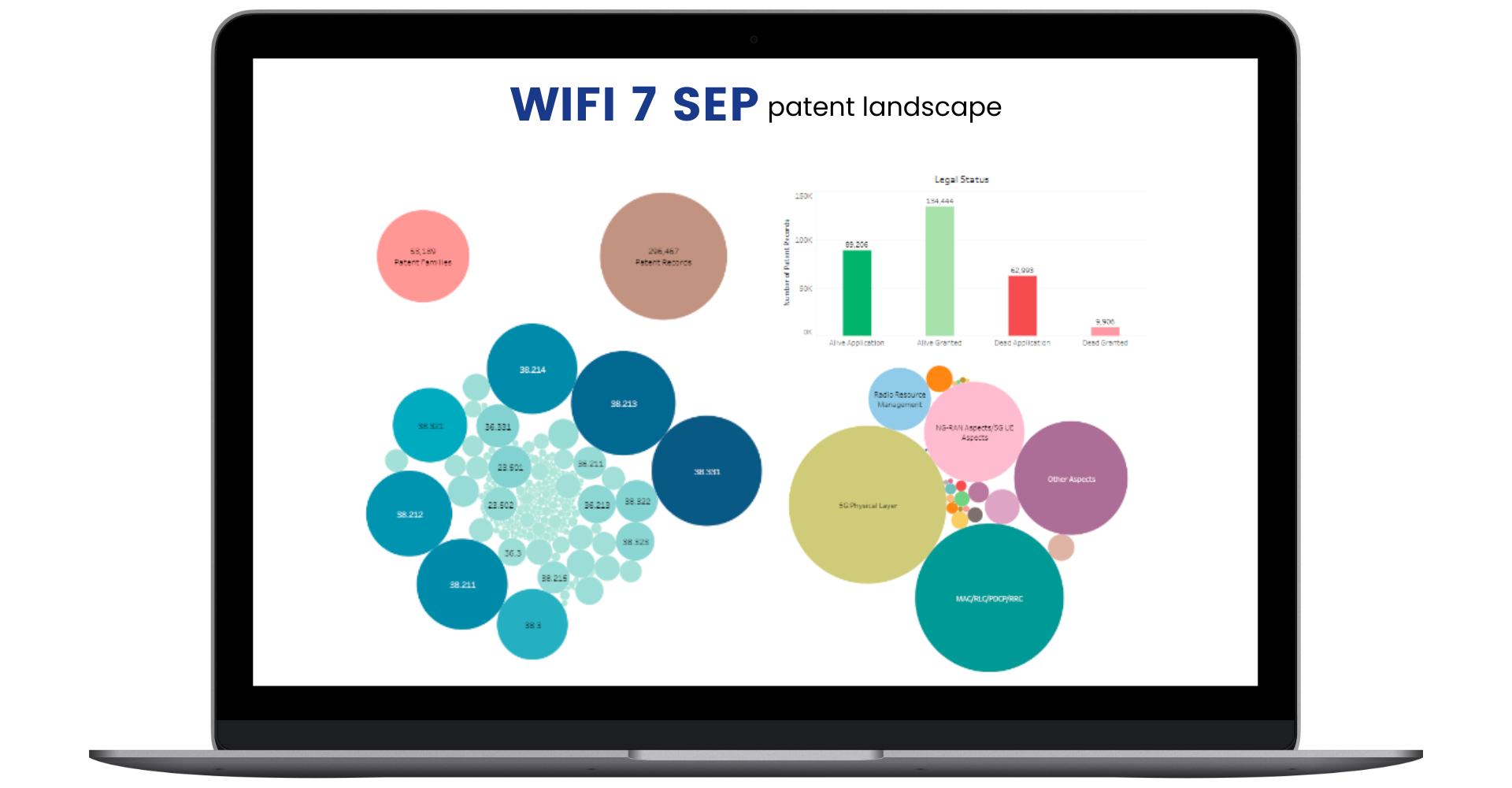

To complement this report, GreyB offers the Wi-Fi 7 SEP Dashboard, an interactive platform delivering real-time, dynamic analysis of Wi-Fi 7 SEPs.

While this report provides a statistically representative snapshot based on 314 patent families, the dashboard continuously updates to include new patent publications and essentiality assessments as they become available.

Key benefits include:

- Dynamic updates ensure access to the latest SEP data and market developments.

- Interactive tools for drilling down into specific companies, technologies, and regions.

- Geographic visualizations showing patent filing and granting activity worldwide.

- Insights into device applicability, highlighting licensing obligations across Access Points, Stations, Chips, and Modules.

Contact GreyB today to request a live demo of the Wi-Fi 7 SEP Dashboard