The IT industry is known for its fair share of mergers and acquisitions. From acquiring nascent start-ups with a small revenue stream to those with huge potential, the technology industry has seen it all. Be it WhatsApp’s $19 Billion acquisition or Nest for $3.2 Billion, the industry does only little not to surprise us.

Running up to an acquisition demands ascertaining available cash flow, culture fit and market sentiments, among others. Most importantly, however, the strategic fit in technology should make sense.

Salesforce has been quite in the limelight in 2015 since it hired financial advisors, possibly to discuss an acquisition. Though the company did not get acquired, at that point in time, we thought it would be a good idea to use the patent data to analyze the possible contenders and see if we can predict who has the maximum likelihood to acquire/partner with Salesforce.

Also, since the chances of Salesforce getting acquired have reduced to almost zero and it seems that they have bigger plans for their future (hinted by their recent acquisition of Tableau), there’s another company that is still open for acquisition – Twitter.

Since the overall value of Twitter will depend a lot on their patents too, we have tried to explore their portfolio in one of another analysis. Whether Twitter gets acquired or not, this analysis could give you different perspectives about how their patent portfolio might affect their overall value. Click here to read the analysis.

Salesforce Acquisition – Who would Benefit the most?

At present, it is unclear as to which company – among the top contenders – this acquisition will make a strategic fit. It is also unclear which company among the possible bidders will actually move forward to acquire Salesforce, even if an acquisition were to happen. However, given the patent portfolio and technological overlaps, for some companies, it makes more sense than for others. The top ones in line being Oracle, IBM, SAP, Microsoft, HP Enterprise, and Google.

While we see that the acquisition could give a boost to Microsoft, for Oracle the assimilation might be far easier. Google could still surprise us as it has been known to acquire companies not belonging to its palette. For IBM, the acquisition will be much out of its character.

The same applies to SAP, who does not seem to have any interest in acquiring Salesforce. Nevertheless, the comparison of the patent portfolios of these companies is an interesting one and it presents the whole scenario of the possible acquisition of Salesforce in a different light for the readers.

In the Run for Salesforce Acquisition

Judging from the online community’s reaction to the potential acquisition of Salesforce, the digital world is headed for a tailspin. Bloomberg recently reported that Salesforce, the enterprise cloud computing solutions company, has brought on financial advisers to consider an acquisition offer or perhaps to fend off one.

The Largest Acquisition of Technology Industry

Salesforce, which currently has a market cap of $48.1 Billion, holds a 16.1% market share of the global Customer Relationship Management (CRM) software market which stands at $20.4 Billion. It reported $5.3 Billion in revenue last year. If it were to go through, such an acquisition would be one of the largest acquisitions in the technology industry the world has ever seen, certainly dwarfing $22 Billion acquisition of WhatsApp by Facebook or the $10 billion takeovers of PeopleSoft by Oracle.

Analysts are of the view that such a deal could be financed by only a handful of the largest technology companies. The top contenders, as per Bloomberg and CRN, who have the finances and for whom the acquisition seems a better strategic fit, could be Oracle, IBM, SAP, Microsoft, HP Enterprise and Google.

While SAP and Oracle have made it clear that they will not be among the potential bidders, there are no clear indications from other giants like IBM, Microsoft or Google.

Salesforce Acquisition by IBM

For IBM, the acquisition of Salesforce would be outside its typical M&A strategy. When it comes to acquisitions, IBM has typically favored buying smaller companies. Its biggest acquisition was Cognos, Inc., a business intelligence software company, in 2007, for $4.5 billion.

Although purchasing Salesforce would give IBM an instant cloud revenue stream, but this acquisition would be out of ‘IBM’s character’, says Bloomberg.

Looking at this from the perspective of patents, IBM’s patent strategy is quite different than other companies, so weighing Salesforce’s patent portfolio seems irrelevant for them. We explored their patent strategy in one of our analyses and found that they have a huge patent abandonment ratio than any other company reaching almost 50%. Salesforce’s patent might not give them enough incentive to go forth with the acquisition. You can read about IBM’s patent abandonment strategy from here.

Salesforce Acquisition by Oracle

Oracle, on the other hand, has fairly valid reasons to acquire Salesforce. It probably would be simpler for Oracle to incorporate Salesforce into its product line since Salesforce is actually built on Oracle’s own database technology. Moreover, getting access to all the SME market through Salesforce would be an added benefit.

Further, if this happens, according to Gartner, the combined entity would make Oracle the largest CRM software company in the world. Oracle, however, is not willing to acquire Salesforce. It was made clear by Safra Catz, Co-Chief Executive Officer, Oracle, in a statement, that they are backing other companies, such as Microsoft, as it would create a lot disruption in the cloud market and which perhaps will be good for Oracle. However, we believe that this is just to keep the press away and internally this would have definitely been discussed in the board meeting.

Salesforce Acquisition by Microsoft

It could make more sense for Microsoft, who is looking to build a large cloud business and was seen informing analysts that the Company’s objective is to attain annual revenue of around $20 billion from the cloud business by mid-2018.

Both Microsoft CEO Satya Nadella and Salesforce CEO Marc Benioff have been lately seen interacting and possibly thinking around more alignment between the two companies. In May this year, reports of Nadella offering $55 Billion to Benioff for the acquisition surfaced. However, the terms could not be agreed upon as Marc Benioff insisted upon $70bn, says CNBC.

Microsoft, in fact, with $95.4 billion in cash and short-term investments has the actual gun powder to acquire Salesforce. It would be a better strategic fit too, given their enterprise software businesses. Also, it could prove as a boost to the proprietary Microsoft Dynamic CRM, a competitor to Salesforce.

On the other hand, it would be difficult for Salesforce to survive in this domain without Microsoft. Microsoft has the maximum number of patents in this area and it has a history of making money from its competitors. For example, Apple (for Mac) and Samsung (for Android) are paying huge royalties to Microsoft for its patents. It’s not going to be easy for a comparatively small company like Salesforce to fight Microsoft.

Predicting the Salesforce Acquisition through Patent Analysis

In the midst of the dilemma of who will acquire Salesforce and whether or not it’s even up for sale, we did a cross-company patent analysis to find if there are some technology overlaps and potential synergies which could lead to a more strategic fit between Salesforce and Microsoft, Oracle, IBM or Google.

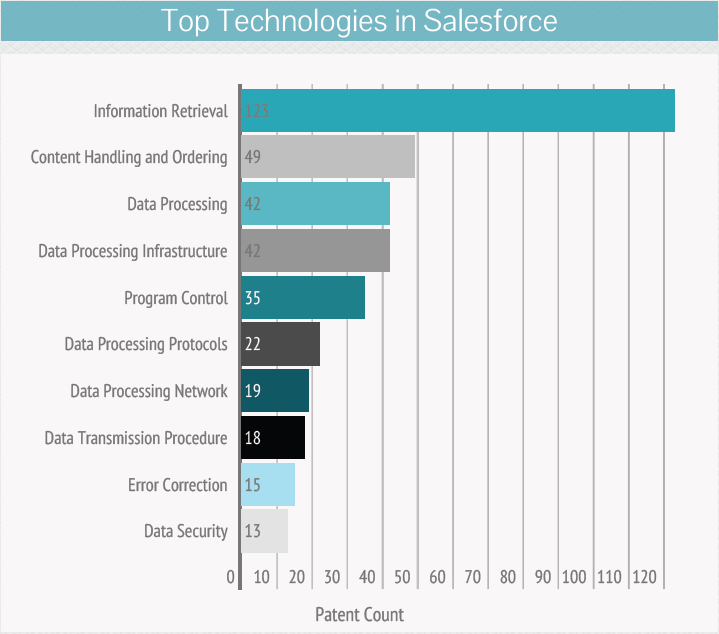

We looked at the total patent set of Salesforce and came up with the top 10 patent classes under which it has maximum patents (and/or applications) filed. Then we looked at the patents in those respective classes within each of the potential bidders: Google, Microsoft, Oracle, and SAP.

This chart shows the top technologies in the patent portfolio of Salesforce. This set of top 10 IPC class has been used as the base for comparison for the entire report.

All these classes mostly deal with digital computation, information retrieval, protocols, et cetera that relate to the record keeping and information manipulation offerings of Salesforce.

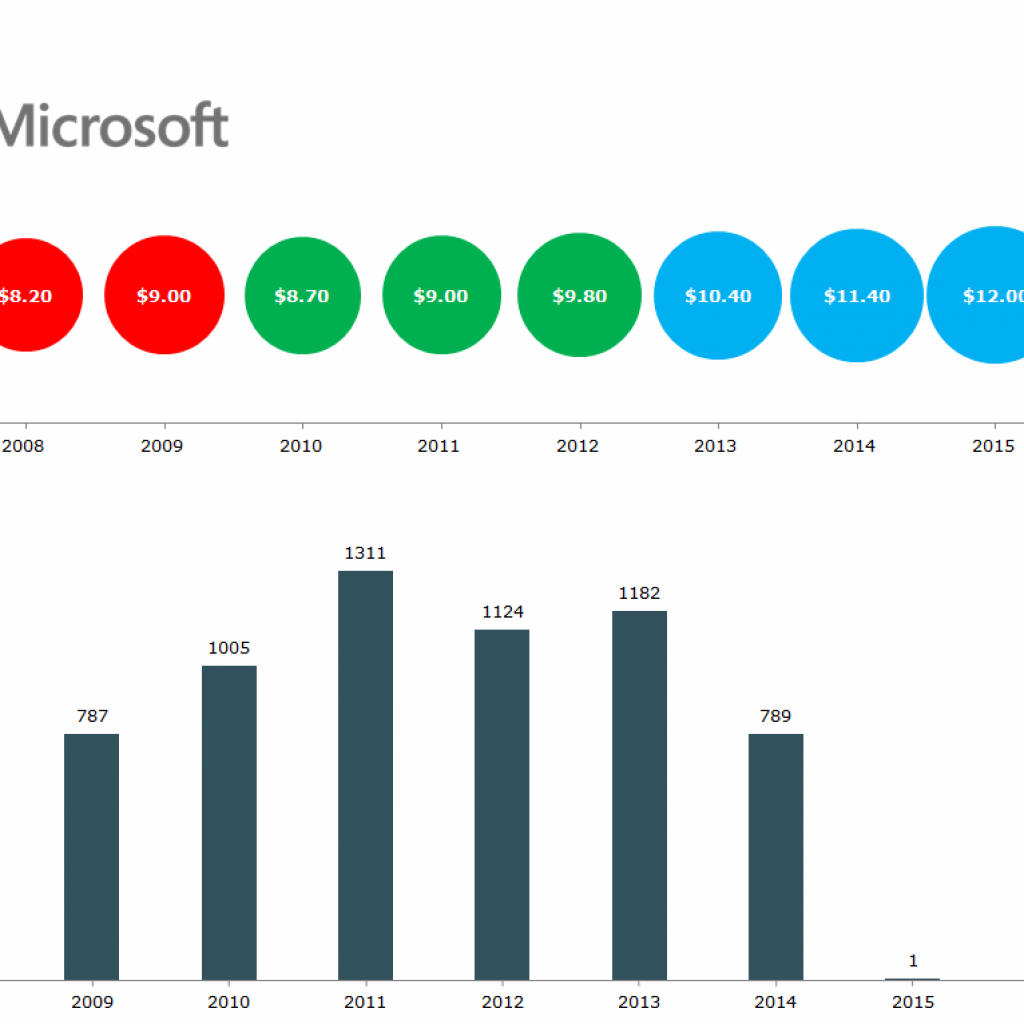

The above chart shows the number of granted patents vs. the number of published patent applications in the 5 target companies. The patents (granted and published applications) considered are from the top 10 technologies shown in the previous chart.

As can be seen, Microsoft leads the patent activity. It is also obvious as Microsoft is one of the oldest in this domain. However, from the strategic perspective, if someone wants to give a strong competition to Microsoft, any of the companies like Google, Oracle or SAP can gain an upper hand by the acquisition of Salesforce. Oracle and SAP do not seem to be overenthusiastic towards this acquisition at this point in time. It can then be Microsoft to gain an indomitable position in the market or Google who will then be comparable to Microsoft in the CRM domain.

There can, of course, be other players, but these companies seem to make the most eligible candidates to acquire the offerings of Salesforce.

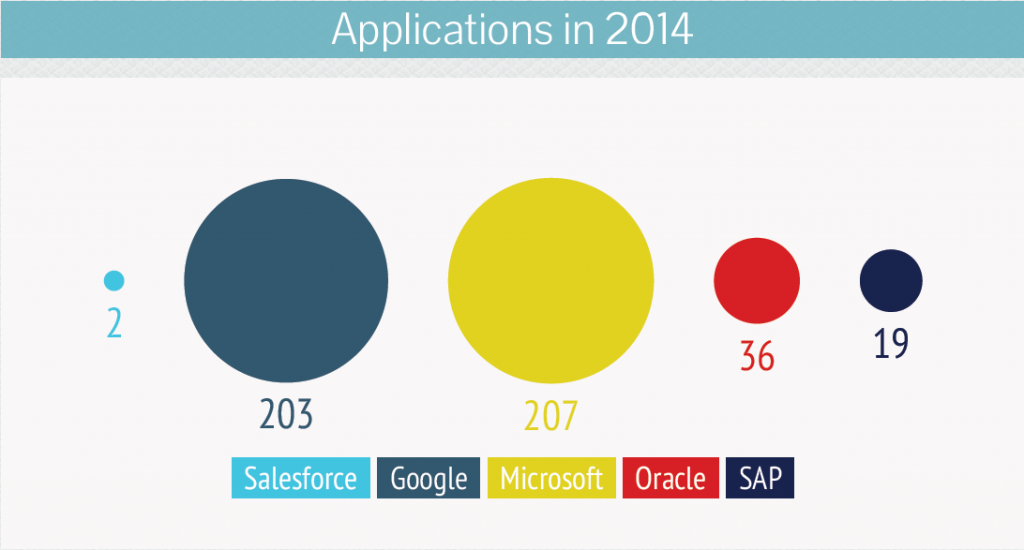

The above chart shows the number of new patent applications in 2014 filed by the target companies. Microsoft filed the maximum patent applications within the top 10 classes while Salesforce filed the least. These trends appear to be similar to the overall comparison of the patent portfolios of the five companies, showing that each has its own independent IP strategy.

Comparison of Top Technologies of Salesforce with Google, Microsoft, SAP, and Oracle

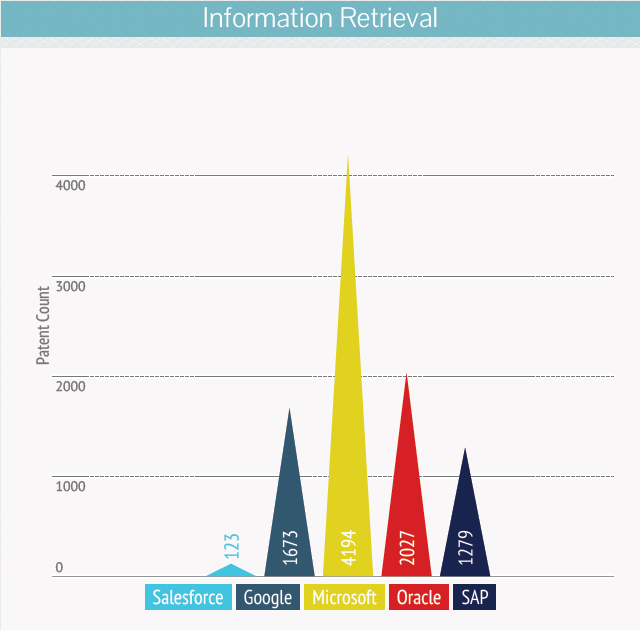

The chart compares the patents in the class ‘G06F 17/30’ of the target companies. Microsoft holds the maximum number of patents at 4194 while Oracle follows with 2017.

PS: G06F 17/30’ is a patent class for information retrieval.

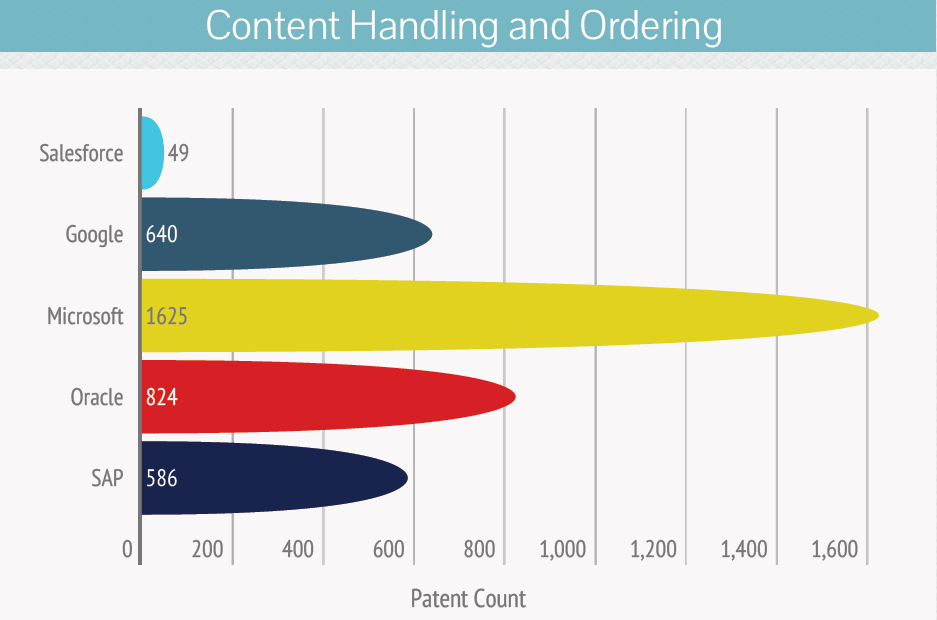

The chart compares patents in the class ‘G06F 7/00’, that is for Content Handling and Ordering, within the target companies. While Microsoft leads the group at 1625, Google and Oracle follow at 640 and 824 respectively.

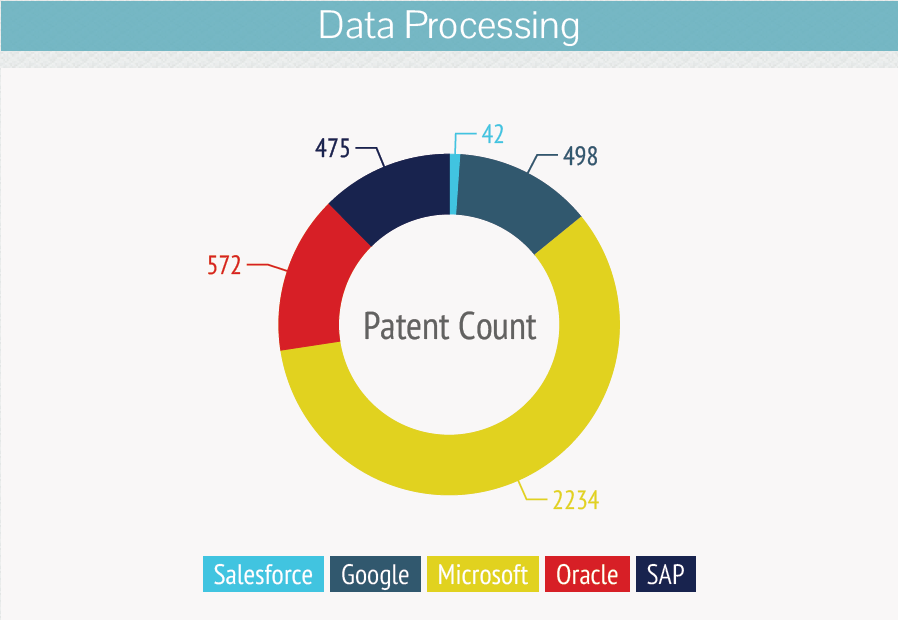

The chart shows patents in the class ‘G06F17/00’ that lists patents for data processing. Microsoft leads the group while Google, Oracle and SAP are close to each other at 498, 572 and 475 respectively.

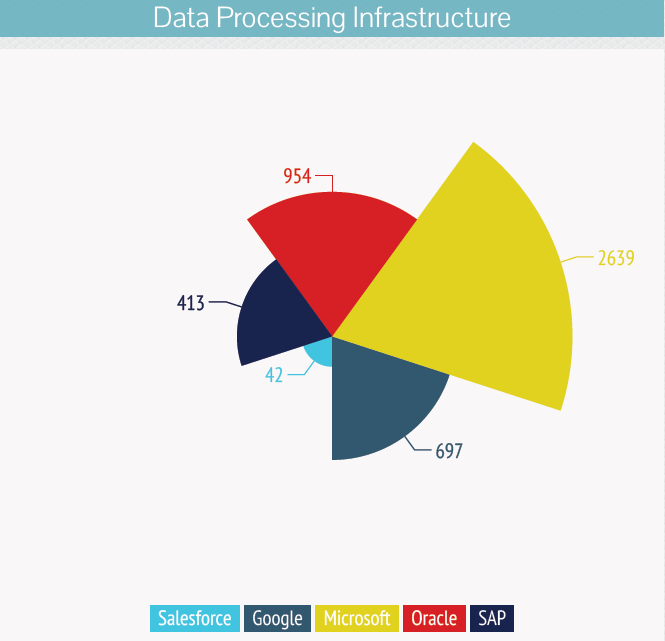

The chart compares the number of granted patents in the class ‘G06F 15/16’ in the target companies. Being a newbie, Salesforce has the least number of patents at 42, while Microsoft leads the group at 2639. G06F 15/16 classifies patents that are on data processing infrastructure.

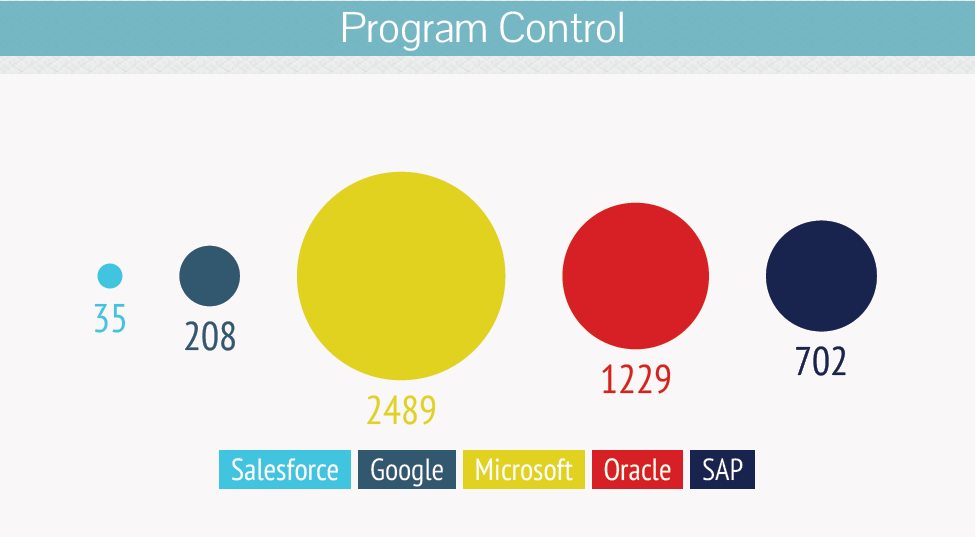

The chart depicts the patent count for the class ‘G06F 9/44’ (for program control) in the target companies. Microsoft nearly has double the number of patents than those of Oracle in this class.

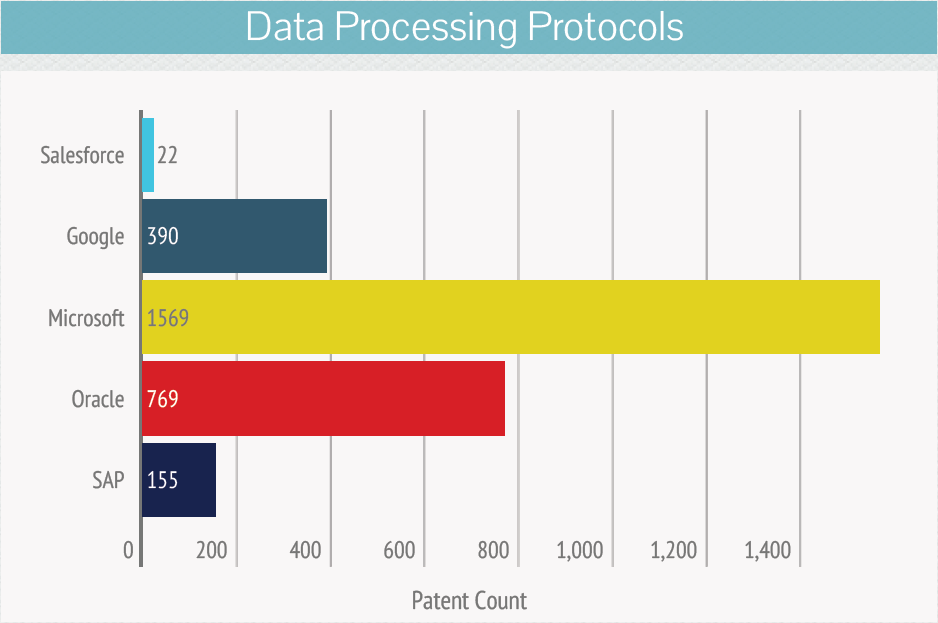

The chart shows the patent count in the class ‘H04L 29/06’ (a class for data processing protocol) in the target companies. Salesforce has the least patents while Microsoft has the highest number of patents in this class.

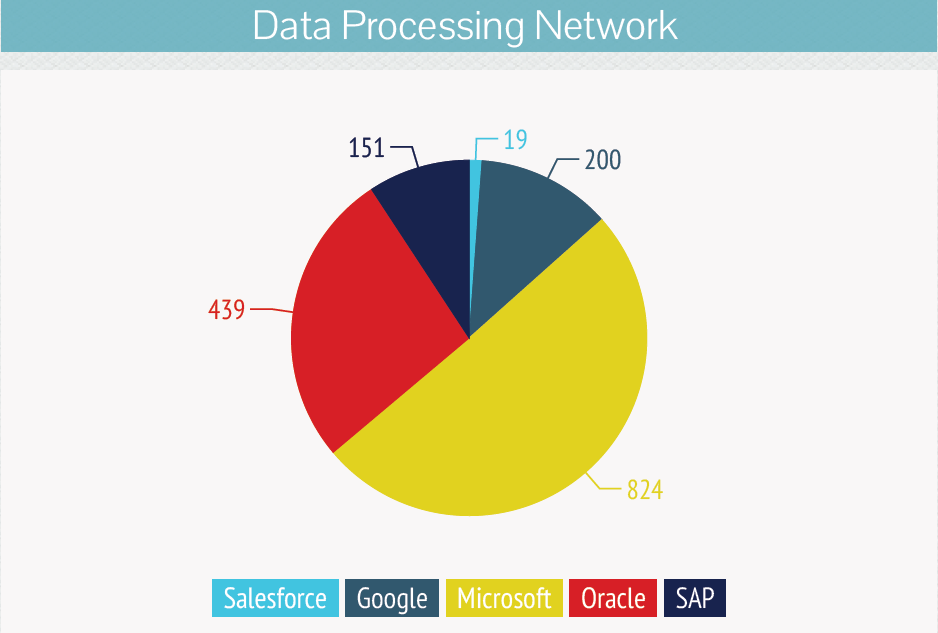

The chart depicts the patent count in the class ‘G06F 15/173’ (for data processing network) in the target companies. Microsoft leads the group while Google and SAP have a comparable number of patents.

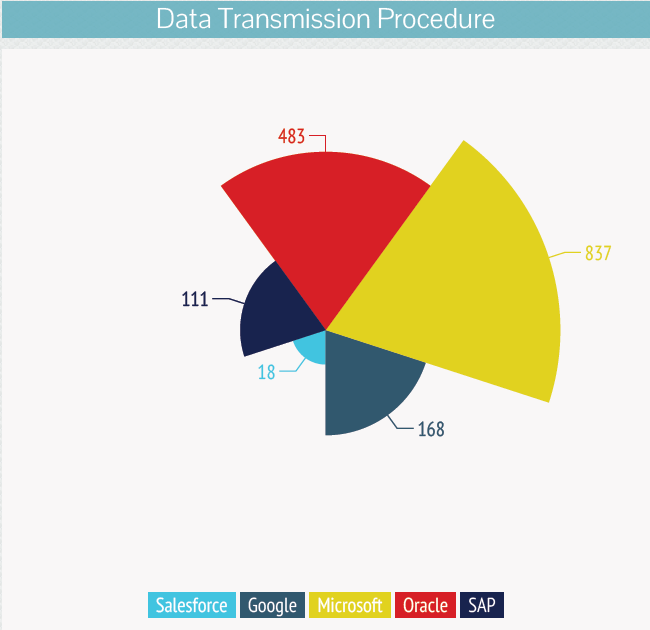

The chart shows the patent count in the class ‘H04L 29/08’ within the target companies. The class H04L 29/08 classifies patent filed for data transmission procedure.

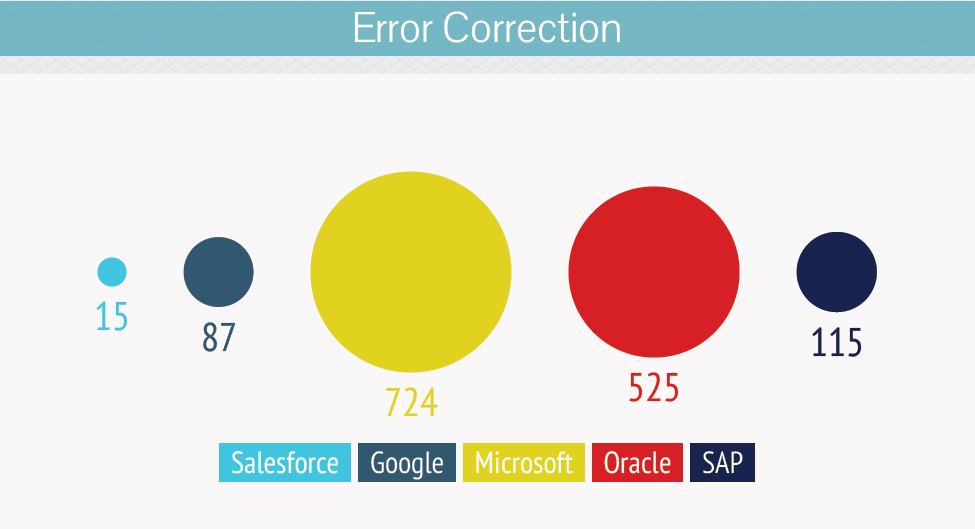

The chart shows the patent count in the class ‘G06F 11/00’ for each of the target companies. The class contains patent for error correction.

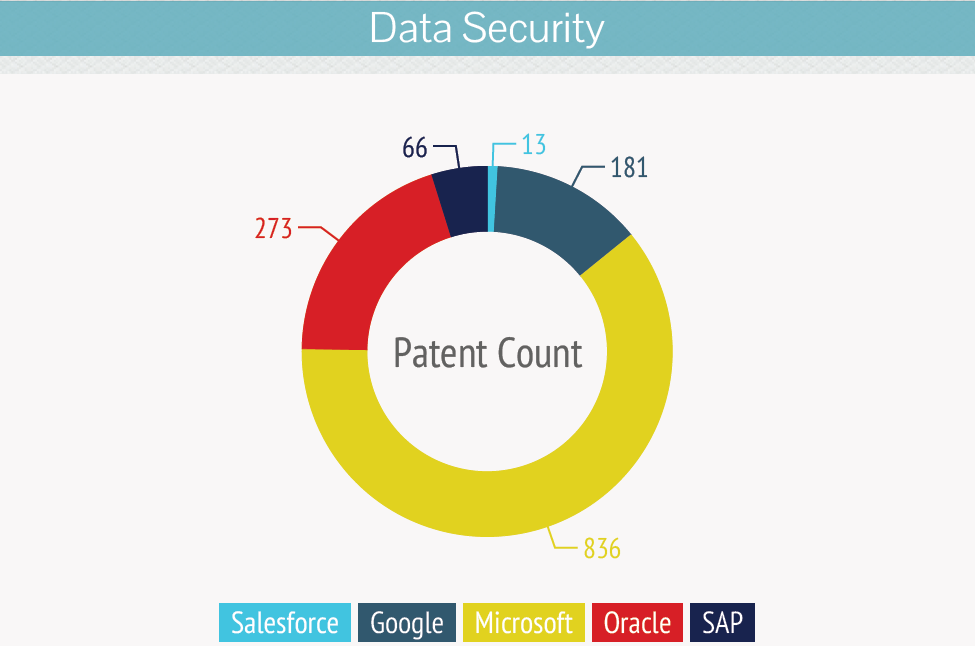

The charts compares the patent count in the class ‘G06F 21/00’ within the target companies. Microsoft leads the group at 836 followed by Oracle at 273. G06F 21/00 classifies patents related to data security.

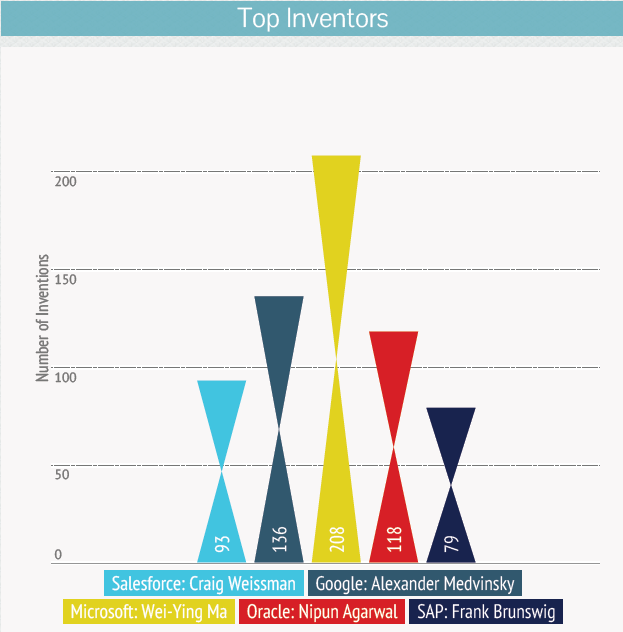

Top Inventors in Salesforce, Google, SAP, Microsoft, and Oracle

The above chart depicts the top inventors at each of the target companies. For the patent classes, we have considered the top 10 technologies. Wei-Ying Ma from Microsoft has maximum patents within the top 10 technologies while Google’s Alexander Medvinsky occupies the second spot.

Conclusion

It is certainly difficult to ascertain as to which direction the possible acquisition would move. The cross-company patent analysis on Salesforce acquisition though definitely puts the technological perspective on the table. Moreover, one might be inclined to one or other company based on it.

However, an acquisition has more than few variables. Though technological fit will be an important one but whether or not it will make sense practically and the market reaction, financial perspectives, competitive regulations, etc. make the equation quite complex. It would be interesting to see how the possibility of acquisition of Salesforce pans out.

Read next: Who will acquire Twitter and is it worth it?