The Research and Market Potential of Digital Oilfields Technology

The article provides insights of the countries with high R&D activities in digital oilfield technologies. The insights – driven from a patent landscape study on digital oil field technologies – also talks about the market potential of the field.

This article is the second post of the series “Digital Oilfield Study”. The first post “Innovation Timeline of Digital Oilfield“, served as a detailed introduction to the world of Digital Oil Fields and then reveals the way technology has evolved in the last two decades.

Update: We have covered the entire landscape of digital oilfield in four parts, covering innovation timeline, top companies, market and research potential, and future challenges and opportunities. For your ease, we combined all the four parts into one single PDF that you can download using this form below:

After plotting the innovation timeline, as the next step in our patent landscape analysis, we spotted the countries where the innovation has been taking place for 20 years.

A patent landscape analysis involves thousands of patents that make it difficult to identify the insights by just glancing over the report. We, therefore, convert the data into different visualizations to make insights emerge on the surface by itself.

After that, we use these visualizations to identify the existing and the probable up-coming markets of the domain.

Our objective, in a nutshell, is to help you get a holistic view of the happenings of the domain of the digital oil field. You, from the study, will get to know about the research trends, the marketing potential, and other business-savvy insights.

Let’s start with the countries which as of now are actively researching in this domain.

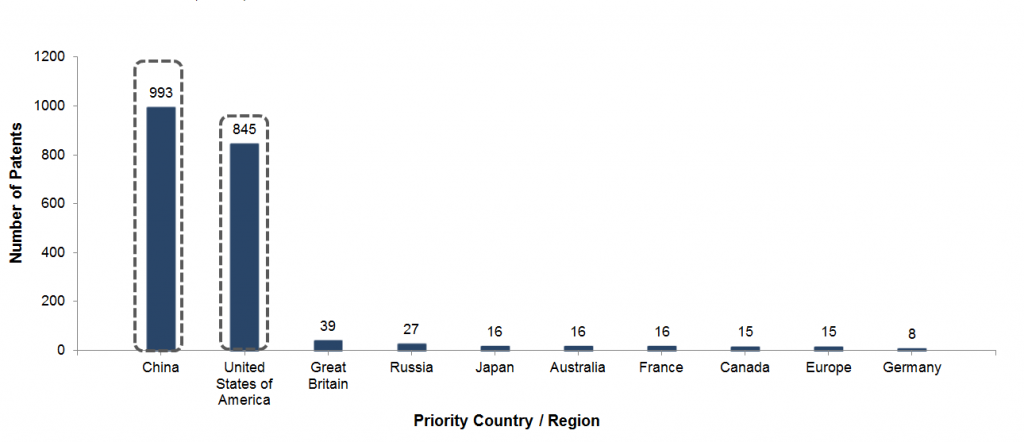

Countries with High R&D Activities

The above chart depicts high R&D activities in China followed by the USA. The global energy demands, by 2035, will increase by one-third. And China and India, being one of the fastest developing economies, will account for almost 50% of this growth.

Therefore, there seems notable ongoing research is going on in China that focuses on the modernization of the oil and gas sector to cater to this growing demand.

After China, USA tops the list where the juggernauts of the oil and gas industry like Schlumberger (190 patents), Halliburton (94 patents), Baker Hughes (61 patents), etc. are conducting continuous research in the field and filing for patent protection.

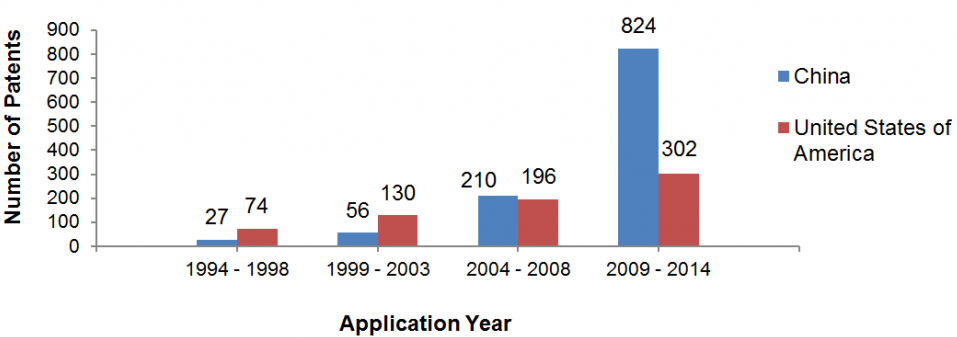

One noteworthy fact that piques curiosity in the above chart is the surge in Chinese R&D activities after 2008. 72.5% of the total patents on Digital oil field technologies, in China, are filed after 2008.

Other key insights

- Top Assignees – Companies like Petrochina Company (94.3% patents), China Petrochemical (81.2% patents), China National Petroleum (86.6% patents), China University of Petroleum (95.2% patents), etc. have filed more than 80% of their patents in China only after 2009. This is indicative of the strong interest of these companies in the area of digital oil fields in the last 5 years.

- Emerging Assignees – 329 new assignees have filed patents. The major among them are Weatherford Lamb (21 patents) and Saudi Arabian Oil (20 patents).

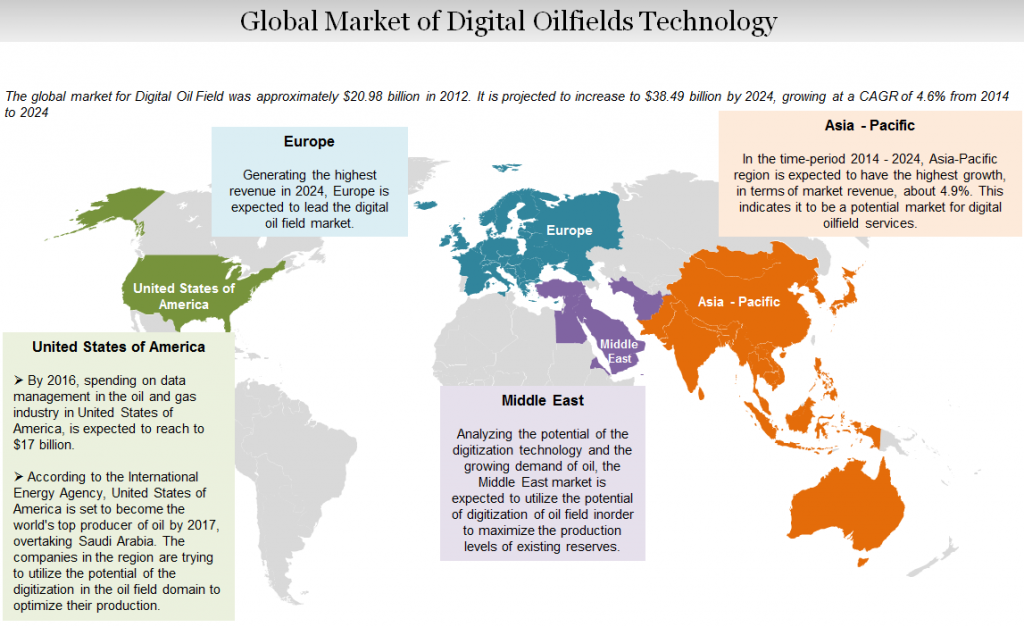

Global Market of Digital Oil Field Technology

Last year, the global market for Digital Oil Field was approximately $24.60 billion. This is estimated to reach $38.49 billion by 2024 with a CAGR of 4.6%, says a report by Markets and Markets.

Thought the R&D activities are prolific in China and the US only, the market potential for digital oilfield technology exists globally.

US

According to the International Energy Agency, in 2017, the USA is set to overtake Saudi Arabia to become the world’s top producer of oil. The companies of the region are already using digital oil field technologies to boost their oil production and this trend will continue in the future as well.

Apart from that, the USA, as we all know, is exploring avenues of unconventional energy of which unconventional gas production is one part. This exploration activity of unconventional reserves is another reason for the USA to be a potential region for the digital oil field technology market.

Middle East

The Middle East that houses 50% of the total global oil reserves and produces 30% of the global total has long been the center of the global oil market.

Albeit this, the Middle East market has shown a trend of slow adopter of the smart field technology.

However, now the Middle East is waking up and wants to boost its production figures in oil and gas. And for this expansion, digital oilfield technologies are going to be of critical importance, says a report.

Asia-Pacific

The Asia-Pacific region has witnessed the fastest economic growth of all regions of the world over the last decade. It also is a huge market for Oil and Gas exploration and is going to constitute 70% of the global oil demand in this decade, estimates the baker institute.

A report by Markets and Markets indicates Asia-Pacific to be a potential market of digital oil field technology. The region, during 2014-2024, will witness the highest growth rate (about 4.9%) in terms of market revenue.

Europe

Western Europe is going to dominate the global digital oil field market, forecasts Research and Market. The report also cites Norway and the UK as the leader of the segment that is going to have maximum developments in the digital oilfields market.

The Trend of Innovation in Digital Oilfields in Different Countries

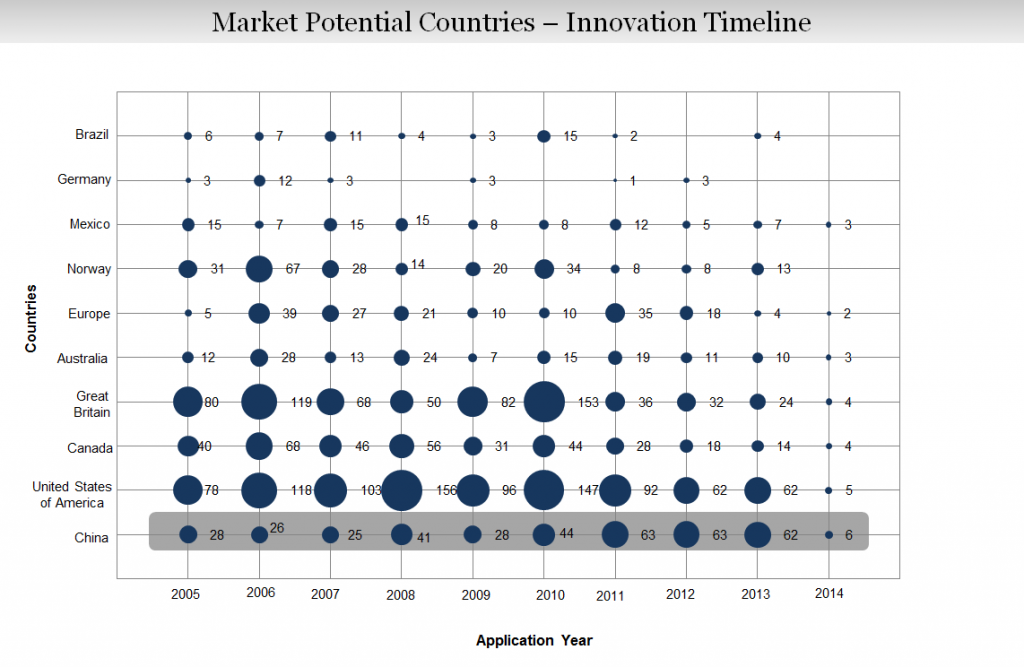

We thought it would be good to track the research performed in different countries over a period of time. The chart below unravels the research activity in different countries based on their patent filings.

Side note: in the below chart, the size of the bubble is directly proportional to the number of patents filed in the country.

Countries like Great Britain and the USA had shown a continuous year-by-year increase in their patent filing for a long, till 2011. However, thereafter there has been a decline in the number of patents filed by both countries.

China, which tops the R&D activities list, is lagging behind its competitors. But it has been making slow but steady progress over the last decade. In 2013, the number of patents filed in China equaled the patents filed there in the USA. The slow tortoise may win the race in case the rabbit sleeps off.

Brazil, Germany, and Mexico are a small but important part of the race. Though the patent filing activities of these nations are irregular and small however, they are going to stay in the field for a long time. These nations will be doing continuous incremental innovations in small but not negligible quantities.

The above chart discloses an impressive insight regarding Norway. Norway that only has a 2.7% share in the world’s oil production invests profoundly in innovation when compared to nations like Mexico (3.56% ) and Brazil (3.05%).

Australia, shares 0.70% of the world’s oil production and has five oil fields, believes innovation in the limited resources could open new doors. Though a large number of patents aren’t filed in Australia however, it’s trying hard to stay in the competition by innovating its limited resources.

Investing in technology is a way to thrive as labor is scarce and expensive in Australia.

Analysis Performed By: Deepika Kaushal, Manager, Patent Landscape

Read the Next Part of the Study: Competitive Intelligence- An Analysis of The Top Players

Access Any of the Four Parts: