In the rapidly evolving world of unmanned aerial vehicles (UAVs) and connected devices, intellectual property stands as a critical pillar for market leadership. Few companies exemplify this strategic commitment better than Parrot, a pioneer renowned for its innovative drone technology. A deep dive into Parrot’s patent portfolio reveals not just a history of groundbreaking inventions but also a dynamic IP strategy that adapts to market shifts and competitive pressures.

Strategic IP Management in the Drone and Connected Device Sector: A Case Study on Parrot

Parrot has carved out a distinctive niche in both consumer and professional drone solutions, consistently pushing the boundaries of what these sophisticated devices can achieve. Its robust patent portfolio is a testament to its sustained investment in research and development, reflecting a targeted approach to protecting core innovations. This focus is evident across several key technological domains, including advanced navigation systems, critical communication technologies for UAVs, and design enhancements that boost drone performance. By strategically building its IP assets in these areas, Parrot underscores its commitment to solidifying its position as an industry frontrunner.

Evolving Litigation Risks and Strategic IP Defense

The competitive landscape of the technology sector often involves navigating patent litigation. Parrot’s recent patent litigation activity illustrates a strategic re-prioritization in its IP defense. Historically, the company observed a notable number of cases in its core transportation domain, with a range of 11 cases between 2015 and 2019. More recently, this number has seen a focused reduction to three cases from 2020 to 2023. This shift may signify a deliberate re-allocation of resources and a natural evolution of its technological focus.

Concurrently, there’s an emerging presence in the non-core networking domain, which saw no cases between 2015 and 2019 but initiated one case from 2020 to 2023. This new activity suggests Parrot’s growing interest in connected systems and IoT integration within its product offerings, signaling a forward-looking adaptation of its IP strategy to broader technological ecosystems.

Litigation Trends: From NPEs to Operating Companies

A closer look at the nature of the litigation Parrot has faced reveals a consistent pattern of challenges primarily driven by Non-Practicing Entities (NPEs). Between 2014 and 2019, Parrot encountered five cases, with a significant majority—approximately 80%—initiated by NPEs, and the remainder by operating companies. This trend persisted and even intensified in the subsequent period from 2019 to 2024, where out of eight cases, NPEs accounted for roughly 87.5% of the litigations.

This persistent focus from NPEs, including entities like Sapphire Dolphin LLC and Synergy Drone LLC, highlights a strategic landscape where IP defense against portfolio assertions is crucial. Operating companies such as Altair Logix LLC and Drone Technologies Inc. have also been involved, reflecting the broader competitive dynamics within the industry.

| Period | Total Cases | NPE Cases (%) | Operating Company Cases (%) | Key NPEs Involved | Key Operating Companies Involved |

|---|---|---|---|---|---|

| 2014-2019 | Around 5 | ~80% | ~20% | Sapphire Dolphin LLC, Synergy Drone LLC, Iron Bird LLC | Altair Logix LLC, Drone Technologies Inc. |

| 2019-2024 | Over 5 | ~87.5% | ~12.5% | Sapphire Dolphin LLC, Synergy Drone LLC, Iron Bird LLC | Altair Logix LLC, Drone Technologies Inc. |

The data indicates Parrot’s proactive posture in managing its IP exposure, effectively navigating the complexities of patent assertions while maintaining focus on its innovation roadmap.

Ramping Up Patent Filings Amidst Market Dynamics

Parrot’s strategic response to the evolving litigation environment and its commitment to innovation is evident in its patent filing activities. Over the decade spanning from 2010 to 2020, Parrot demonstrated a consistent increase in its U.S. patent filings. The number of patents filed rose from approximately 103 between 2010 and 2015 to around 126 from 2015 to 2020, marking an increase of over 20%. This steady growth underscores Parrot’s dedication to protecting its intellectual property in key markets and maintaining a competitive edge in the dynamic drone and consumer electronics sectors.

Geographic Patent Filing Trends: Parrot’s Global Innovation Footprint

Parrot’s patent portfolio highlights a well-defined global strategy, primarily focusing on major technological and commercial hubs. Its robust presence in key jurisdictions underscores a commitment to protecting its innovations where market opportunities are most significant.

| Jurisdiction | Number of Patents | Strategic Importance |

|---|---|---|

| United States | Over 260 | Forms the core of Parrot’s patent strategy, reflecting its commitment to protecting IP in one of the largest technology markets. |

| France | Around 250 | As a French company, this robust presence showcases strong local R&D efforts and innovation in its homeland. |

| European Patents | Over 235 | Emphasizes Parrot’s focus on the broader European market, reinforcing its leadership in the region. |

| China | Over 100 | Represents strong engagement with a major Asian market, known for technological advancements and increasing demand for drone technology. |

| Japan | Around 65 | Similar to China, signifies presence in another key Asian market for tech innovation. |

| WO – WIPO | Over 40 | Demonstrates Parrot’s interest in securing broad international IP protection for its innovations. |

| Austria | Over 10 | Reflects a strategic presence in specific European countries beyond the broad EP designation. |

| Australia | Over 10 | Highlights interest in the Asia-Pacific region beyond China and Japan. |

| Spain | Over 10 | Another targeted European country, indicating a nuanced market approach. |

| Canada | Over 5 | Indicates Parrot’s initial steps to secure patents in North America, complementing its strong U.S. presence. |

| Taiwan | Around 10 | Selective focus in a market known for electronics manufacturing. |

| South Korea | Over 2 | A targeted entry point into another advanced Asian market, possibly for niche applications or future expansion. |

While its filing activity in China experienced a slight adjustment from 17 patents between 2011 and 2015 to 15 from 2016 to 2020, and Hong Kong saw a decrease in filings from 7 to zero in the same periods, Parrot observed a modest increase in India, rising from two to three filings. This targeted approach to key regions, emphasizing quality over sheer volume, highlights Parrot’s strategic prioritization of markets that drive the adoption of drones and connected devices.

Parrot’s Innovation Core: Key Technologies and Talent

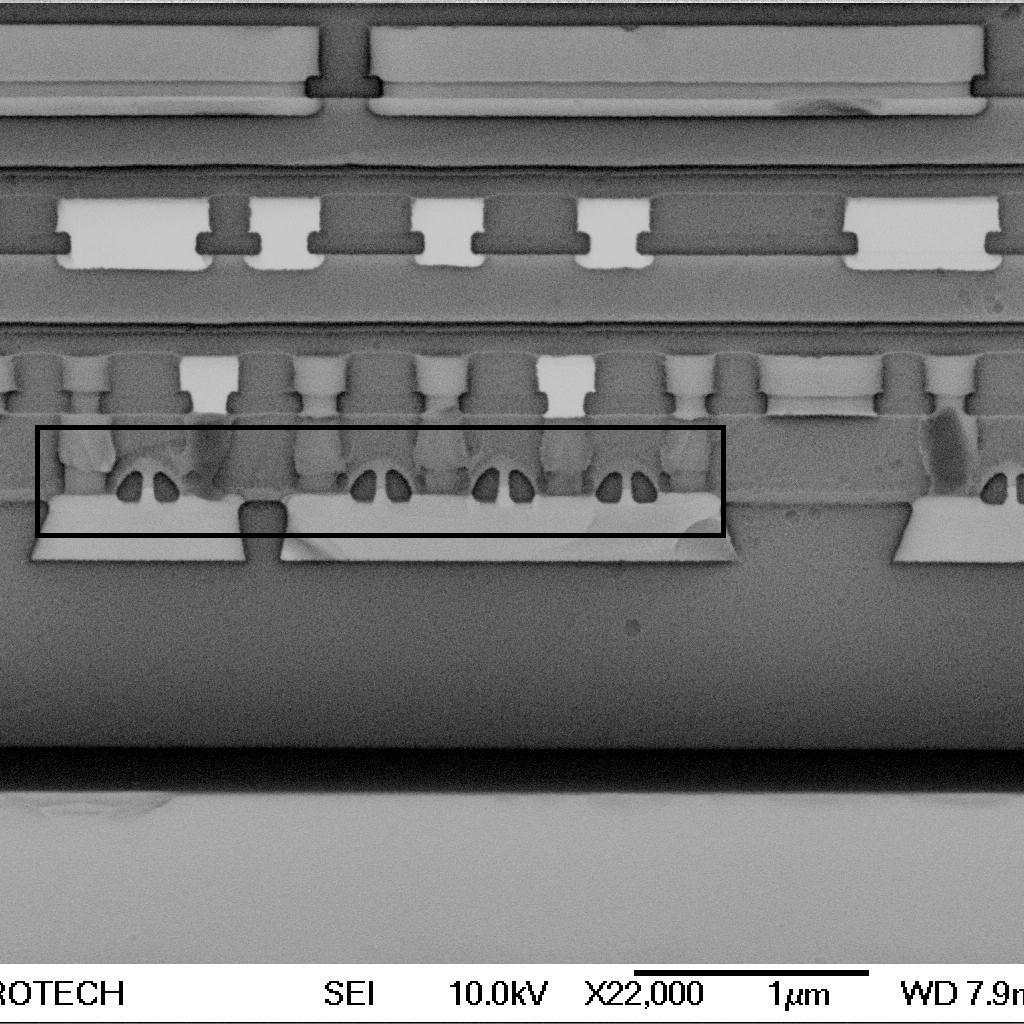

Parrot’s patent portfolio clearly illustrates its strategic commitment to advancing drone and UAV innovation. Its efforts are predominantly focused on:

- Advanced navigation and autopilot systems: Essential for optimizing drone flight paths and ensuring reliable operation.

- Communication technologies: Enhancing data transmission and connectivity in UAVs, crucial for real-time control and data streaming.

- Design improvements for drones: Focused on boosting performance, versatility, and user experience.

- Development of toys integrated with advanced technology: Reflecting a broader vision for interactive and immersive experiences beyond traditional professional applications.

- Precision control systems: Aimed at improving the responsiveness and accuracy of unmanned vehicles.

This concentration in key technological areas positions Parrot at the forefront of drone evolution. The company also strategically leverages global talent to drive its technological progress. While a significant portion of its innovation originates from inventors in France, Parrot also draws on expertise from the United States, Japan, and Singapore, fostering a diverse and robust intellectual capital base. Notably, pioneers such as Morra, Flavien; Seydoux, Henri; Caubel, Christine; Lebon, Jacquy; and Logel, Valère have been instrumental in shaping Parrot’s patent portfolio, contributing significantly to its approximately 172 INPADOC patent families.

Competitive Dynamics and Industry Influence

Parrot’s focused IP strategy in core drone and connected device technologies inherently establishes its influence within the competitive landscape. By concentrating its patenting efforts on foundational elements like navigation, communication, and design, Parrot’s innovations become essential benchmarks. This strategic depth means that other companies operating in similar technological domains must continually assess Parrot’s developments. While specific instances of competitive patent rejections or modifications due to Parrot’s patents were not detailed, the company’s significant presence in critical CPC classifications implies a strong capacity to shape innovation trajectories and encourage independent invention.

Strategic Focus and Future Outlook

Parrot’s intellectual property strategy is characterized by a deliberate, quality-focused approach, ensuring its innovations are well-protected in key global markets. By aligning its patenting efforts with evolving market demands and technological advancements, Parrot maintains a formidable position in the drone and connected device industry. Its ability to adapt its litigation posture and expand its innovation footprint into emerging areas like networking demonstrates a forward-thinking IP management system designed to support long-term growth and leadership.

Want regular updates on how your competitors are using patents to gain an edge?

Subscribe to our Inside IP newsletter for insights into patent filings, litigation shifts, licensing opportunities, and strategy breakdowns across tech and innovation-driven sectors.

Track your Competitor’s Strategy

Subscribe for Updates